Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The European Central Bank slashed interest rates at its latest policy meeting on Thursday as expected, bringing...

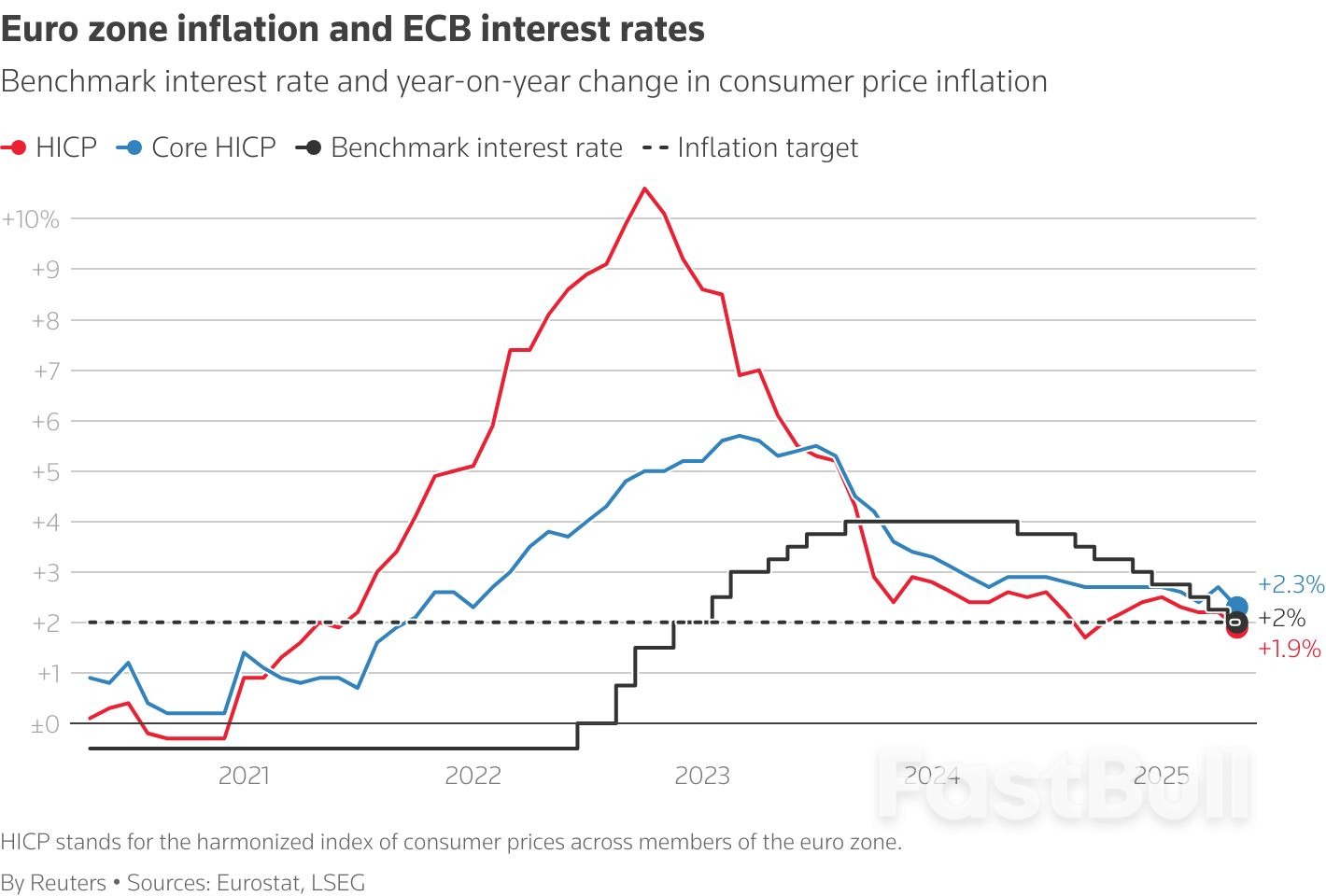

The European Central Bank slashed interest rates at its latest policy meeting on Thursday as expected, bringing its key deposit rate down by 25 basis points to 2.0%, although officials did not provide outright guidance for changes later this year.

In a statement, the ECB said its decision to lower borrowing costs for the eighth time since last June comes as the euro area economy faces waning inflation but persistent uncertainty around the impact of global trade tensions.

Thursday’s cut was widely anticipated by markets, meaning that much of the debate among analysts heading into the announcement swirled around the central bank’s plans for rates over the rest of the year. Particularly with inflation easing back down to the ECB’s 2% target, some investors have bet that policymakers will push pause on the rate-reduction cycle in July and potentially roll out one more drawdown before the end of 2025.

"We forecast one more rate cut in the second half of the year with risks skewed towards deeper cuts," said Jack Allen-Reynolds, Deputy Chief Euro Zone Economist at Capital Economics, in a note following the decision.

Officials did not provide any specific rate guidance in their statement, but ratcheted down their expectations for future price gains. Estimates for headline inflation in 2025 and 2026 were lowered to 2.0% and 1.6%, respectively, a drop of 0.3 percentage points compared to the ECB’s projections in March. Inflation is seen returning to 2.0% in 2027.

Speaking at a press conference, ECB President Christine Lagarde added that the ECB is "not pre-committing to a particular rate path".

Consumer price inflation in the 20 countries using the euro eased to 1.9% in May, thanks to sliding energy prices and declining services costs. In the prior month, the figure came in at 2.2%. So-called "core" inflation, which strips out volatile items like food and fuel, decelerated to 2.3% from 2.7%, data from Eurostat, the European Union’s statistics agency, found.

The ECB also left its growth projections for 2025 unchanged, anticipating average gross domestic product expansion of 0.9%. While the first quarter was stronger than expected, the central bank flagged that the euro zone’s prospects for the remainder of the year are "weaker".

Murkiness is also surrounding the impact of U.S. President Donald Trump’s tariff plans. The White House has especially targeted the European Union -- which includes several euro zone countries -- with elevated so-called "reciprocal" levies. The ECB warned that the uncertainty may weigh on business investment and exports in the short term, although medium-term growth is tipped to be bolstered by increased government spending on defense and infrastructure.

"Inflationary pressures in the euro zone are receding faster than expected. Not only did [...] Trump make the European economy great again -- for one quarter, as frontloading of exports and industrial production boosted economic activity -- he also made inflation almost disappear," said Carsten Brzeski, Global Head of Macro at ING, in a note.

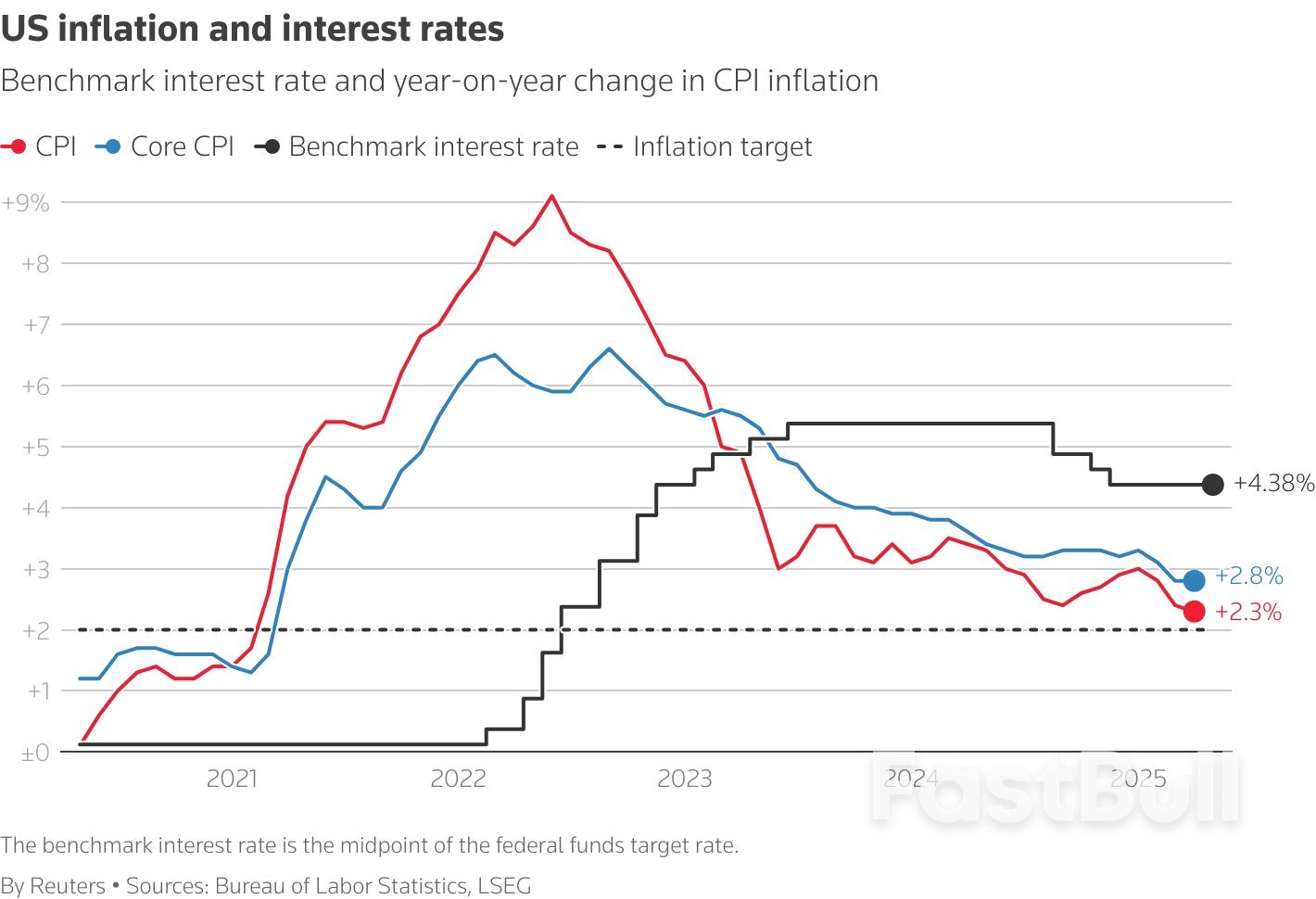

Trump referenced the ECB’s rate-cutting campaign earlier this week in a social media post urging Federal Reserve Chair Jerome Powell to bring borrowing costs down at a faster pace. The Fed drew down rates by one percentage point in 2024, but has left them unchanged since December, noting that the tariff turmoil could place renewed upward pressure on inflation in the U.S.

Canada's trade deficit in April widened to an all-time high of a whopping C$7.1 billion ($5.2 billion), data showed on Thursday, as tariffs imposed by President Donald Trump sucked out demand for Canadian goods from the United States.

Its exports to the rest of the world rose, but could not compensate for the drop in exports to the U.S., data from Statistics Canada showed.Exports to the U.S. shrank by 15.7%, a third consecutive monthly decline, Statscan said, adding that exports south of the border have fallen by over 26% since the peak seen in January.Analysts polled by Reuters had expected the trade deficit to widen to C$1.5 billion for April. Statistics Canada also made a big revision to the trade deficit recorded in March to C$2.3 billion from C$506 million.

Canada shipped 76% of its total exports to the U.S. last year and the trade between the two countries exceeded a trillion Canadian dollars for a third consecutive year in 2024.

But a barrage of tariffs from Trump on Canada and its C$90 billion worth of retaliatory tariffs on U.S. imports have started disrupting trade between the two.

Total exports in April plunged by 10.8% to C$60.4 billion, the lowest level seen in almost two years, Statscan said. This was the third consecutive monthly decline and the strongest percentage decrease in five years, it said.While exports to the U.S. led the drop, lower crude oil prices and a stronger Canadian dollar also contributed.

The Canadian dollar was trading up 0.17% to 1.3651 to the U.S. dollar, or 73.25 U.S. cents. Yields on the two-year government bonds were down 0.4 basis points to 2.613%.

Exports to the rest of the world were up 2.9% and in volume terms total exports registered a big decline of 9.1% in April.

The biggest drop in exports came from motor vehicles and parts which lost 17.4% of trade in April from March and was almost entirely attributable to exports of passenger cars and light trucks, which fell 22.9% in April, Statscan said.

Imports were down 3.5% in April to C$67.58 billion, but were partly offset by imports of unwrought gold.

Due to the sharp decline in exports to the U.S., Canada's merchandise trade surplus with the United States narrowed to C$3.6 billion, the smallest surplus since December 2020, the statistics agency said.

The deficit with rest of the world marginally increased to C$10.7 billion in April from C$9 billion in March.

The Nasdaq compositeended Wednesday up for a third-straight day at 19,460.49. The prevailing trend has the tech-laden index aiming for key chart hurdles, including its record highs.

Indeed, thanks to a resurgence in tech, the composite has now advanced 27.5% from its April 8 close, and as much as 32% from its April 7 intraday low. This puts the IXIC in positive territory for the year, up about 0.8%, and up 12.5% quarter-to-date.

With this, it's now down just 3.54% from its December 16 record closing high, and 3.68% from its December 16 record intraday high.

Of note, tech is the best performing S&P 500 indexsector so far this quarter, up about 15.5%. Chipsare doing even better with a 17.9% QTD rise. The NYSE FANG+ index, which provides exposure to 10 of today's highly traded tech giants, (including six of the Mag 7 stocks), has surged 22.3% QTD.

In fact, this week, NYFANG has completely erased its February-April collapse, and is hitting fresh record highs.

Meanwhile, the composite is now nearing the resistance line from its record intraday high, which now resides around 19,820, and presents a tough hurdle in itself:

The early 2025 highs were at 20,110.12 and 20,118.61. The December 16 record close was at 20,173.89 and the record intraday high was at 20,204.58.

Significant support resides in the 18,599.69-18,068.90 area. This zone includes the May 23 low at 18,599.69, the 200-day moving average (DMA) and the Fibonacci-based 233-DMA, which now reside in the 18,495-18,365 area. The March 25 high was at 18,281.13, and the May 12 weekly gap requires a fall to 18,096 for a fill (and 18,068.90 daily basis).

On weakness, bulls would look for this zone to provide fertile ground for a resumption of the advance. The rising 50-DMA ended Wednesday around 17,768.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up