Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The dollar’s rally faded after a U.S. court blocked Trump’s broad tariff plans, reviving fiscal and trade concerns. Market sentiment remains cautious amid ongoing uncertainty and reduced Fed rate cut expectations.

Bitcoin continues to hold around the $108,000 mark, consolidating within a narrow range after a sharp rally from April lows. Price action suggests strength, but momentum has cooled slightly, setting the stage for a critical few days ahead.

The Daily Chart

On the daily chart, BTC remains above both the 100-day and 200-day moving averages, which are located in the $90,000 – $96,000 range, and have also crossed bullishly in recent weeks. The RSI sits around 63, showing that the rally isn’t yet overheated but is nearing the upper range.

A healthy consolidation around the $108,000 level could serve as a base for another leg up, provided bullish momentum holds and volume supports a breakout.

The 4-Hour Chart

The 4-hour chart shows a rising channel structure, and despite a recent breakdown of the lower trendline, the price has convincingly defended the horizontal support level at $106,000. This area has now become an intraday support zone.

The RSI is around the neutral 50 level, suggesting balanced momentum after a brief correction. A clean break and close above $109,000 and a return inside the channel could trigger a push towards the $112,000–115,000 range, while any breakdown below $106,000 might open the door for a short-term pullback toward the $102,000–$100,000 region.

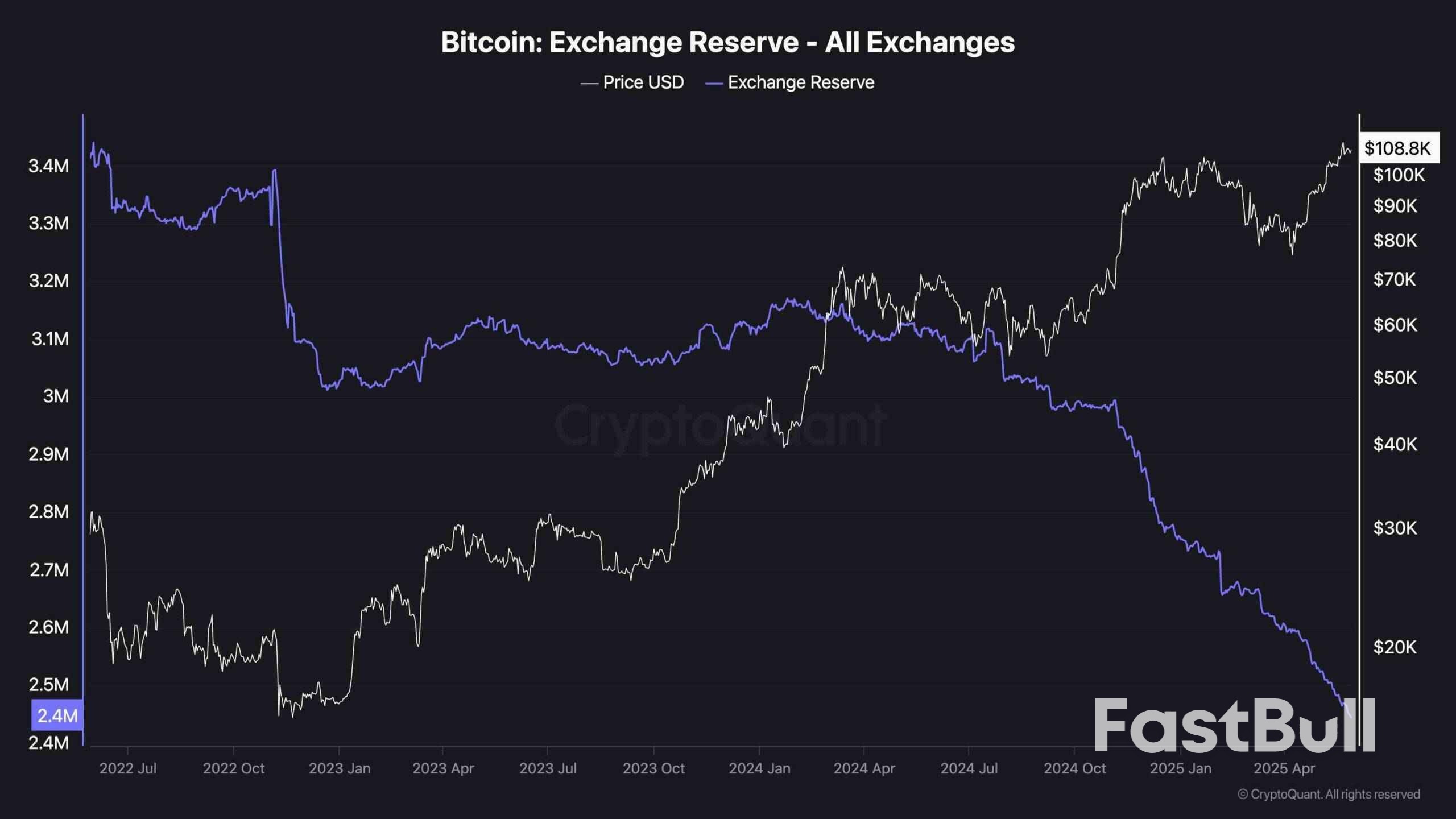

Exchange Reserve

On-chain data continues to support a bullish bias. Exchange reserves are at their lowest level in years, now sitting around 2.4 million BTC. This sustained and aggressive decline reinforces the idea that investors are moving BTC off exchanges, likely for long-term storage, reducing sell-side liquidity.

With supply tightening and price climbing, the conditions remain ripe for higher valuations, especially if macro conditions stay favorable and demand from institutional channels remains strong.

White House economic adviser Kevin Hassett said on Thursday three trade deals were nearly done and he expected more despite a trade court ruling that blocked most of President Donald Trump's tariffs.

"There are many, many deals coming. And there were three that basically look like they're done," Hassett said in an interview with Fox Business Network.

Hassett dismissed a U.S. trade court ruling on Wednesday that blocked most tariffs and found Trump had overstepped his authority as the work of "activist judges". He said he was confident the administration would win on appeal.

The administration's view is that numerous countries will open up their markets to American products in the next month or two, Hassett said.

"If there are little hiccups here or there because of decisions that activist judges make, then it shouldn't just concern you at all, and it's certainly not going to affect the negotiations," Hassett said.

There were three deals ready for Trump's review at the end of last week, Hassett said.

The number of Americans who filed for unemployment insurance for the first time last week, known as initial jobless claims, has seen a significant increase. The actual number of initial jobless claims came in at 240K, marking a substantial rise from the previous week and surpassing the forecasted figure.

The forecasted figure for initial jobless claims was set at 229K, indicating that the actual figure exceeded the forecast by 11K. This unexpected rise in jobless claims is a bearish sign for the U.S. dollar, as it suggests that the labor market may be experiencing some turbulence.

When compared to the previous week’s figure, the actual number of initial jobless claims has also increased. The previous number was 226K, meaning that there has been an increase of 14K in the number of individuals filing for unemployment insurance for the first time.

Initial jobless claims represent the earliest U.S. economic data available, and their impact on the market varies from week to week. However, a higher than expected reading is generally considered negative or bearish for the USD. Conversely, a lower than expected reading is viewed as positive or bullish for the USD.

The importance of these figures is underscored by their three-star rating. This means they are considered significant and are closely watched by analysts and investors alike.

While the increase in initial jobless claims may be a cause for concern, it is important to remember that these figures can fluctuate from week to week. Therefore, while this increase is notable, it does not necessarily indicate a long-term trend. Nonetheless, the financial markets will be closely monitoring future reports to see if this increase is a one-off event or the start of a new trend.

In conclusion, the rise in initial jobless claims is a surprising development that has exceeded both forecasted and previous figures. It will be critical to monitor these figures in the coming weeks to gain a clearer understanding of the state of the U.S. labor market.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up