Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Chinese tech giants, including Alibaba and ByteDance, are reportedly relocating AI model training to Southeast Asia to access Nvidia chips and sidestep U.S. export controls on advanced semiconductors, according to the Financial Times....

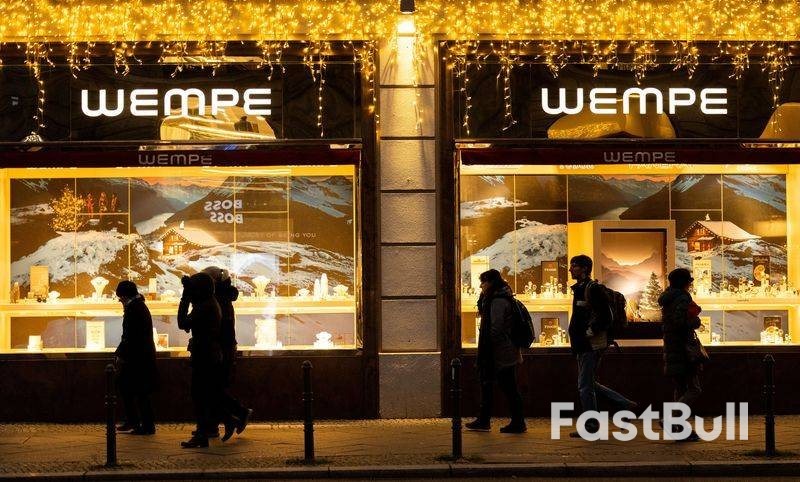

Consumer sentiment in Germany is set to improve slightly in December as households show more willingness to spend money ahead of the holiday season, though less rosy income prospects are preventing a stronger recovery, a survey showed on Thursday.

The consumer sentiment index, published by the GfK market research institute and the Nuremberg Institute for Market Decisions (NIM), rose to -23.2 points for December from -24.1 points the month before, in line with analysts' expectations.

Overall sentiment was boosted by a 3.3-point rise in consumers' willingness to buy for a second month in a row, bringing it to the same level as a year earlier at -6.0 points.

A 2.1-point dip in their readiness to save also helped.

"Consumer sentiment is currently at almost exactly the same level as last year. This is good news for retailers with an eye to year-end business: The data points to stable Christmas sales," said Rolf Buerkl, head of consumer climate at NIM.

"On one hand this shows a certain stability in consumer sentiment but on the other hand, it shows that consumers do not expect a drastic recovery in the short term," he added.

Households' economic expectations for the next 12 months fell nearly 2 points month on month, to -1.1 points, but were still 2.5 points higher compared with last year's level.

Germany's economy is expected to grow by only 0.2% in 2025 after two years of contraction as Chancellor Friedrich Merz's spending measures need time to translate into better conditions.

DEC NOV DEC

2025 2025 2024

Consumer climate -23.2 -24.1 -23.1

Consumer climate components

NOV OCT NOV

2025 2025 2024

- economic expectations -1.1 0.8 -3.6

- income expectations -0.1 2.3 -3.5

- willingness to buy -6.0 -9.3 -6.0

- willingness to save 13.7 15.8 11.9

The survey period was from October 30 to November 10, 2025.

An indicator reading above zero signals year-on-year growth in private consumption. A value below zero indicates a drop compared with the same period a year earlier.

According to GfK, a one-point change in the indicator corresponds to a year-on-year change of 0.1% in private consumption.

The "willingness to buy" indicator represents the balance between positive and negative responses to the question: "Do you think now is a good time to buy major items?"

The income expectations sub-index reflects expectations about the development of household finances in the coming 12 months.

The economic expectations index reflects respondents' assessment of the general economic situation over the next 12 months.

($1 = 0.8618 euros)

The USD/JPY pair fell to 156.13 on Thursday, with the Japanese yen recouping recent losses as markets remain on high alert for potential intervention by Japanese authorities.

Traders are speculating that the US Thanksgiving holiday, which typically sees lower liquidity and thinner market conditions, could provide a strategic "window" for regulators to intervene and support the yen. Notably, the mere risk of intervention is already acting as a deterrent, effectively capping the currency's recent decline.

Fundamentally, sentiment is also shifting as investors reassess the Bank of Japan's (BoJ) policy trajectory. Recent media reports suggest the central bank is actively preparing for a potential rate hike as early as next month. This shift is driven by persistent inflationary pressures, the pass-through effects of a weak yen, and a perceived easing of political pressure to maintain ultra-loose monetary settings.

Externally, the yen has found additional support from a broadly weaker US dollar. Markets have increased bets on further Fed easing, weighing on the greenback across the board.

H4 Chart:

On the H4 chart, USD/JPY is forming a consolidation range around 156.40. We anticipate a near-term decline to 154.90, which is likely to be followed by a technical rebound to retest the 156.40 level. A decisive upward breakout above this resistance would open the path for a more significant rally towards 158.47. However, following such a move, we would expect the formation of a new lower high and the start of a fresh downward impulse, targeting 154.00 and potentially extending the correction to 153.30. The MACD indicator supports this bearish medium-term bias. Its signal line is below zero, pointing downward, confirming that selling momentum remains strong.

H1 Chart:

On the H1 chart, the pair is developing a clear downward wave structure with an initial target at 154.90. We expect this target to be reached, after which a corrective wave of growth should emerge, retesting the 156.40 level from below. The Stochastic oscillator corroborates this near-term bearish view. Its signal line is below 50 and falling towards 20, indicating that short-term downward momentum remains intact for now.

The yen is strengthening on a confluence of intervention threats and a fundamental reassessment of BoJ policy. Technically, USD/JPY is in a corrective phase with an immediate target at 154.90. While a rebound to 156.40 is expected thereafter, the broader risk is tilted to the downside. A break above 158.47 would be required to invalidate the current bearish corrective structure. Traders should remain vigilant for intervention-driven volatility, particularly during periods of low liquidity.

Gold softened in early European trading as improving risk sentiment and rising expectations of a December Federal Reserve rate cut pulled investors away from haven assets. Recent remarks from senior Fed officials signaled growing support for policy easing, prompting markets to reassess the US rate outlook.

New York Fed President John Williams called policy "modestly restrictive" and said rate adjustments remain possible if inflation keeps easing. Governor Christopher Waller added that labor-market cooling provides room for a cut, while former Fed official Stephen Miran argued that weakening economic conditions warrant "a quicker shift toward neutral."

Rate expectations moved sharply. Futures markets now assign an added 85% probability to a quarter-point cut next month, up from roughly 50% a week earlier. The shift pushed the US Dollar to a one-week low, though stronger risk appetite limited gold's upside.

US economic figures delivered a mixed signal. Durable goods orders rose 0.5%, beating forecasts but slowing from the prior month, while unemployment claims fell to 216,000, the lowest in seven months. However, the Chicago PMI dropped to 36.3, its deepest contraction in months, highlighting ongoing business weakness.

Despite the divergence, traders focused more on the Fed's dovish tone than the data itself, keeping pressure on gold and silver as markets rotated into risk assets.

Silver eased alongside gold, with sentiment supported by signs of progress in geopolitical negotiations and firming global equities. As an industrial-linked metal, silver remains particularly sensitive to shifting growth expectations, and the improved risk backdrop tempered haven demand.

For now, both metals remain anchored to the Fed's policy trajectory. With markets heavily pricing in a December cut, upcoming inflation data and scheduled Fed speeches will likely guide the next move.

Gold may range between $4,122–$4,179 as traders await a breakout from the triangle, while silver holds a bullish bias above $52.26, eyeing $53.46–$54.44 if momentum strengthens.

Gold – Chart

Gold – ChartGold is consolidating near $4,146, trading inside a tightening symmetrical triangle that has been developing through November. The metal continues to respect its rising trendline from the November 13 low, while the upper boundary near $4,180 remains firm resistance. Price is holding above the 50-EMA and 200-EMA, signaling underlying support even as upside momentum slows.

The RSI sits around 56, reflecting steady but controlled buying interest. A breakout above $4,179 would expose $4,245, while a close below $4,122 threatens a move back toward $4,067 and the triangle's lower trendline.

Gold remains at an inflection point, with traders watching for a decisive break before positioning for the next directional move.

Silver – Chart

Silver – ChartSilver is consolidating near $52.89, holding firmly above the key support at $52.26 after a strong recovery from the $49.70 region. Price continues to trade above the 50-EMA and 200-EMA, signaling a stable bullish bias while respecting the broader ascending trendline from late October. The RSI sits around 63, showing improving momentum without overextended conditions.

Immediate resistance is positioned at $53.46, a level that capped the previous rally. A decisive break above this zone could open a continuation move toward $54.44.

If sellers return, support at $52.26 and $51.00 becomes the first downside cushion. Silver remains in a constructive structure, with traders watching for a clean breakout before confirming the next direction.

New Zealand Dollar's broad-based rally extended through today's Asian session as a run of solid domestic data continued to bolster confidence in the country's recovery. Strong retail sales in Q3 suggested the rebound is already underway, while the surge in business confidence and activity pointed to a more durable upturn. Together, the indicators painted a picture of improving real-side momentum rather than a temporary sentiment bounce.

The optimism was reinforced by outgoing RBNZ Governor Christian Hawkesby, who made clear that the hurdle for further rate cuts is now very high. Hawkesby emphasized that only a significant deterioration in the outlook would justify a shift away from the central bank's current projection of holding rates through next year. His comments reinforce the perception that the easing phase has ended and that policy is likely to remain on hold for an extended period.

Aussie also traded strongly, buoyed by shifting expectations around the RBA outlook. Some economists have flipped their calls and now argue the next move may in fact be a rate hike rather than a cut. NAB said that if growth accelerates and the labor market tightens, a hike as early as the first half of 2026 is possible. Some others have taken an even more hawkish view, penciling in increases in both May and August next year.

Dollar, by contrast, stayed broadly weak. Markets are firming expectations that the Fed will deliver another risk-management cut before year-end. At the same time, risk appetite has returned to U.S. equities, while 10-year Treasury yield has slipped back below the 4% mark. These factors are interconnected, reinforcing downward pressure on the greenback as investors rotate toward higher-beta currencies.

Taken together, the macro backdrop has encouraged further selling in the Dollar while supporting the antipodeans, particularly Kiwi. Risk-sensitive FX is benefitting from the combination of solid domestic fundamentals and a friendlier global risk tone.

For the week so far, Kiwi remains at the top, followed by Aussie and then Sterling, which emerged from the UK Autumn Budget without major damage. At the bottom end, Dollar sits as the weakest performer, trailed by Yen and then Loonie. Euro and Swiss Franc are hovering in the middle of the pack.

In Asia, at the time of writing, Nikkei is up 1.24%. Hong Kong HSI is up 0.53%. China Shanghai SSE is up 0.59%. Singapore Strait Times is up 0.44%. Japan 10-year JGB yield is down -0.02 at 1.799. Overnight, DOW rose 0.67%. S&P 500 rose 0.69%. NASDAQ rose 0.82%. 10-year yield fell -0.004 to 3.998.

BoJ board member Asahi Noguchi said today that the central bank could resume interest rate hikes once U.S. tariff risks recede, but emphasized that any tightening must "measured, step-by-step".

He warned that maintaining very low real interest rates for too long risks undermining the economy by pushing Yen lower and stoking undesirable inflation. A weaker currency, he said, lifts prices through import costs and boosts exports in a way that can overheat the economy .

Noguchi highlighted that Yen depreciation was once a tailwind during Japan's deflation era, supporting exporters and helping revive demand. However, "as supply constraints intensify, the positive effects eventually disappear and are replaced by negative effects that merely push inflation higher than needed," he added.<

New Zealand's ANZ Business Confidence index jumped from 58.1 to 67.1 in November, the strongest reading in 11 years. The survey's own-activity outlook also surged from 44.6 to 53.1, marking the highest level since 2014 and signaling a material improvement in real economic momentum rather than sentiment alone. ANZ noted that "green shoots are looking well established", with recent gains increasingly rooted in actual activity.

Inflation signals were more mixed. The share of firms planning to raise prices over the next three months climbed from 44% to 51%, the highest since March. However, expected cost increases eased slightly from 76% to 74%, and one-year-ahead inflation expectations were steady at 2.7%. The combination points to stabilizing inflation pressures, but not yet disinflation strong enough to encourage fresh easing from the RBNZ.

ANZ said the underlying improvement in conditions offers reassurance that the pickup is likely to be sustained. With the recovery underway and CPI sitting at the top of the target band, the bank sees little reason for further OCR cuts "barring unexpected developments."

New Zealand retail sales delivered a strong upside surprise in Q3, rising 1.9% qoq versus expectations of 0.6%. Ex-auto sales also beat forecasts, up 1.2% qoq compared with 0.8% consensus.

Statistics New Zealand said this was the largest quarterly increase in retail activity since late 2021, with broad-based gains across the sector. Most industries recorded growth during the September.

The details showed particularly strong demand in motor vehicles and electrical and electronic goods retailing, which posted the biggest increases. Eight of the 15 retail industries reported higher volumes compared with Q2.

The Fed's Beige Book indicated an economy that has largely stalled, with activity "little changed" across Districts. Consumer spending declined again, while manufacturing posted slight improvement despite the drag from tariffs and uncertainty around their future path. Outlooks were broadly unchanged, though several contacts flagged "increased risk of slower activity in coming months.

The labor market showed clearer signs of easing, with employment slipping "slightly" and around half of Districts reporting "weaker labor demand". Wage gains were generally "modest", consistent with a gradual loosening in labor conditions.

Price growth remained moderate but continued to reflect tariff-related pressures on input costs, especially in manufacturing and retail. Firms reported uneven ability to pass these higher costs through, with outcomes shaped by competition, consumer sensitivity, and client resistance. While businesses expect cost pressures to persist, "plans to raise prices in the near term were mixed," suggesting a more uneven path for inflation heading into early 2026.

ECB chief economist Philip Lane said overnight that while headline inflation has hovered near target for most of the year, the picture is still flattered by energy deflation. Non-energy inflation remains "well above 2%," and Lane stressed that a further slowdown is required to ensure inflation is sustainably anchored at target. Nevertheless, he added "We're confident that's going to happen because everything we look at tells us wage dynamics are set to decelerate further."

Lane also addressed concerns around U.S. tariffs and Europe's export exposure. He argued the hit may be smaller than feared, as the AI-driven expansion and high U.S. government spending are supporting American demand. Under these conditions, firms still have room to pass through tariff-related costs to U.S. importers and consumers. While the U.S. is an important partner, Lane underlined that it is "not the predominant driver of the European economy."

However, he warned that tariffs are reshaping global trade flows in meaningful ways, particularly in Asia. China is exporting more to Southeast Asia, Southeast Asia is exporting more to the U.S., and China is simultaneously increasing its footprint in Europe and other markets. Lane called this a "very big reconfiguration" of the global system, one that intensifies competitive pressure on European firms even at home.

Daily Pivots: (S1) 0.6482; (P) 0.6501; (R1) 0.6538;

AUD/USD's rise from 0.6420 accelerates higher today and intraday bias remains on the upside for 0.6579 resistance. Decisive break there should confirm that whole fall from 0.6706 has completed as a three wave correction. Stronger rally should then be seen back to retest 0.6706. On the downside, below 0.6483 minor support will turn intraday bias neutral first.

In the bigger picture, there is no clear sign that down trend from 0.8006 (2021 high) has completed. Rebound from 0.5913 is seen as a corrective move. Outlook will remain bearish as long as 38.2% retracement of 0.8006 to 0.5913 at 0.6713 holds. Break of 0.6413 support will suggest rejection by 0.6713 and solidify this bearish case. Nevertheless, considering bullish convergence condition in W MACD, sustained break of 0.6713 will be a strong sign of bullish trend reversal, and pave the way to 0.6941 structural resistance for confirmation.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up