Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

China’s smartphone shipments declined by 2.4% in Q2 2025, with Huawei gaining significant ground, growing 17.6% year-on-year, while Apple experienced a slight contraction amid growing domestic competition....

Oil prices edged down on Tuesday as concerns the brewing trade war between major crude consumers the U.S. and the European Union will curb fuel demand growth by lowering economic activity weighed on investor sentiment.

Brent crude futures fell 24 cents, or 0.35%, to $68.97 a barrel by 0055 GMT after settling 0.1% lower on Monday.

U.S. West Texas Intermediate crude was at $66.99 a barrel, down 21 cents, or 0.31%, following a 0.2% loss in the previous session.

The August WTI contract expires on Tuesday and the more active September contract was down 23 cents, or 0.35%, to $65.72 a barrel.

Still, the oil market has struggled to find any direction since the ceasefire on June 24 ending the conflict between Israel and Iran removed concerns about major supply disruptions in the key Middle East producing region.

Since then, Brent has traded in a range of $5.19 and WTI in a range of $5.65 as supply concerns have been alleviated by major producers raising output and investors are increasingly worried about the global economy amid U.S. trade policy changes. However, a weaker U.S. dollar has provided some backing for crude as buyers using other currencies are paying relatively less.

Prices have slipped "as trade war concerns offset the support by a softer (U.S. dollar)," IG market analyst Tony Sycamore wrote in a note.

Sycamore also pointed to the possibility of an escalation in the trade dispute between the U.S. and the EU over tariffs.

The EU is exploring a broader set of possible counter-measures against the United States as prospects for an acceptable trade agreement with Washington fade, according to EU diplomats. The U.S. has threatened to impose a 30% tariff on EU imports on August 1 if a deal is not reached.

There are also signs rising supply has entered the market as the Organization of the Petroleum Exporting Countries and their allies unwind output cuts.

Saudi Arabia's crude oil exports in May rose to their highest in three months, data from the Joint Organizations Data Initiative (JODI) showed on Monday.

Brazil’s Finance Minister Fernando Hadad admitted on Monday that trade negotiations between his country and America could fail to be resolved before an Aug. 1 deadline. That is when President Donald Trump’s administration intends to impose 50% tariffs on various Brazilian exports.

“That can happen,” Haddad said in an interview with local radio station CBN. But he said the giant of South America is still waiting for an official response from Washington to a package of trade proposals that the government presented in May.

President Trump announced the tariffs earlier this month, saying they were in response to what he described as political persecution of former President Bolsonaro, who is currently on trial for conspiracy to commit a coup. Trump also criticized the country for what he described as “unfair” trade practices.

Not only was the announcement a bolt from the blue, but the trade relationship has been relatively stable. The United States has long been an important export market, particularly for commodities like crude oil, semi-finished steel, coffee, orange juice, and airplanes. Still, the US holds a trade surplus with Brazil, which Brazilian officials have argued makes the new tariffs politically motivated and economically unjustified.

Haddad said the giant of South America had contingency plans if Washington imposed the tariffs. One of those plans is to expand export markets and lessen reliance on US trade.

The minister said that if we can find other buyers, we could export more than half of our current exports. “But that would take time.”

Industries across the state are preparing for impact. Among the most at risk is Embraer, the world’s third-largest commercial aircraft manufacturer, which depends heavily on America for sales and partnerships. The steel industry, which sells raw and semi-processed materials to American buyers, would also see major disruption.

Haddad said that although government support could be extended to some industries most affected by the tariffs, the efforts would remain fiscally prudent. He emphasized that they would not “blow up the base” and added that any assistance would be strategic and targeted.

The Brazilian private sector is on edge, too. Business leaders worry about how quickly new trade routes and buyers can be secured, especially for highly spatially regulated products such as aircraft or processed foods. Some of the crisis’s next steps could depend on how effectively Soybean Brazil’s diplomatic strategy can ramp up contacts with the US in the next days to prevent a trade conflict.

The Brazilian President Lula Da Silva made it clear with a firm, down-to-earth sense. He warned that the country would retaliate if the tariffs were imposed, but he also said he did not want to start fights where they were unnecessary.

Lula repeated last week at a public event in São Paulo that the state’s sovereignty and economy must be preserved. Should the other side enforce tariffs, he warned, the country will react — but it will always do so in a manner loyal to its values and relationships across the globe.

His new finance minister repeated President Haddad’s statement that Brazil would not attack US businesses operating on its territory.

He also stressed that Brazil’s policy would be based on principle and not provocation; for Brazil, it is not retaliation that it seeks or wants, but fair trade.

Now the Aug. 1 deadline looms heavily. Brazil has a lot on the line. Should discussions continue at an impasse, Latin America’s largest economy must adapt at a corporate level to a new trade landscape that might ravage its commercial alliances and industrial strategies months from now.

Brazil is holding the line, waiting, watching, and preparing for now.

Key Points:

On July 22, the White House plans to submit its first crypto policy report, as per cryptocurrency reporter Eleanor Terrett in a statement to PANews. The report is anticipated for public release by the end of July.

The report carries significance as it marks a pivot in U.S. regulations, potentially introducing measures such as the establishment of a Strategic Bitcoin Reserve and easing banking restrictions for crypto firms.

The White House Digital Asset Markets Working Group, under David Sacks, excludes traditional banking regulators, reflecting a notably different oversight approach. Potential policy highlights include the formation of a Strategic Bitcoin Reserve and the conclusion of Operation Chokepoint 2.0, which previously restricted crypto banking services.

Immediate effects could see bolstered institutional confidence in Bitcoin, increased liquidity for crypto firms, and shifts towards compliance for U.S.-based exchanges. This environment might attract more capital inflows to BTC and responsive positioning by blue-chip assets.

Did you know? The proposed U.S. Strategic Bitcoin Reserve could parallel El Salvador's 2021 BTC treasury, which sparked widespread debate over Bitcoin's role as a sovereign asset.

Bitcoin, as of the latest data from CoinMarketCap, shows a market dominance of 59.64%, with a current price of $117,425.27. The market cap stands at 2.34 trillion dollars, with a 24-hour trading volume increase of 21.63%. Over the last 90 days, BTC's value has risen by 25.41%.

Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 23:49 UTC on July 21, 2025. Source: CoinMarketCap

Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 23:49 UTC on July 21, 2025. Source: CoinMarketCapInsights from Coincu's research team emphasize the potential for the report to enhance institutional participation and positively impact long-term market stability. The anticipated U.S. Bitcoin Reserve may influence global perceptions of crypto assets, aligning with previous trendshifting regulatory moments where clarity drove surges in asset interest.

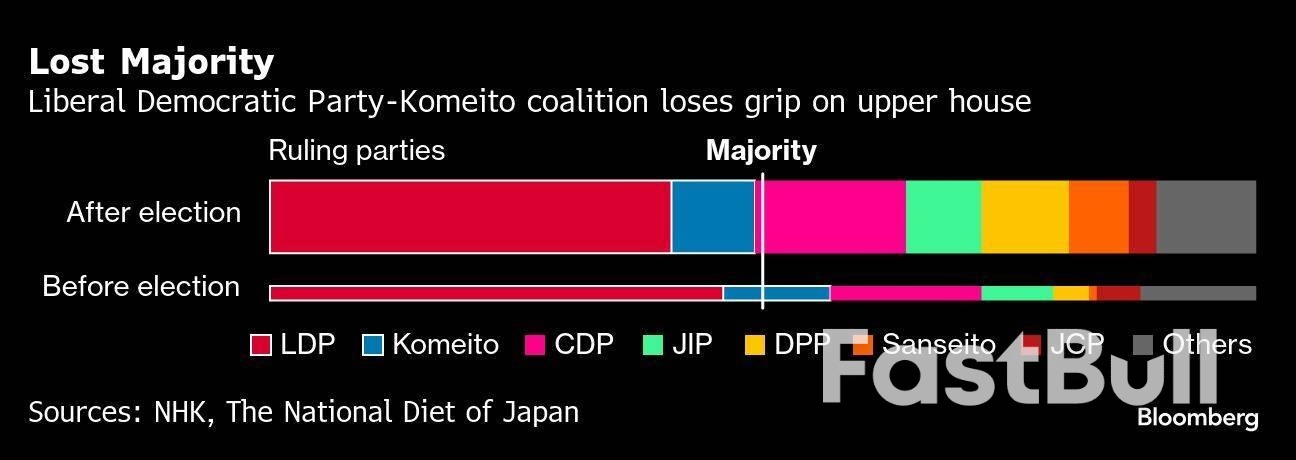

Japanese Prime Minister Shigeru Ishiba sought to buy time in office following a second election setback in less than a year. But whether he stays days, weeks or even months, Sunday’s vote made clear that his Liberal Democratic Party needs an overhaul to stay relevant.

Ishiba on Monday vowed to remain in his job even though his LDP-led coalition finished Sunday running a government without a majority in both chambers of parliament for the first time since the party’s founding seven decades ago. While it has ruled Japan for most of that period, younger voters are increasingly turning toward populist smaller parties as rising prices fuel discontent.

“The LDP is a fatigued party and it has a brand problem,” said David Boling, director at the Eurasia Group covering Japan and Asia Trade, former negotiator at the USTR. “To be blunt I think many Japanese and many Japanese voters see it as a party of old men who are out of touch.”

Although the outcome on Sunday wasn’t as bad as some of the early exit polls suggested, Ishiba still failed to clear the low bar he set of retaining a majority in the upper house. That leaves him at risk of becoming yet another footnote in the revolving door of Japanese prime ministers that only managed to last for a year or so.

For now, Ishiba can lean into the fact that he needs to stay on to negotiate a trade deal with the US to help Japan avoid a steep increase in tariffs from Donald Trump’s administration. He cited those talks and other pressing issues at his briefing on Monday.

“I plan to put all of my efforts into finding a solution to the urgent issues we face, including the US tariffs, inflation, natural disasters, and the most complex and severe security environment since the war,” Ishiba said.

Still, it looks like his days are numbered — even if he has no obvious successor right now and anyone who takes over will face the same problems of getting anything done without control of parliament. Japan’s stocks rose while 10-year government bond futures were down slightly on Tuesday as investors weighed the impact of the vote.

“We’ll see in the next day or two if the dissenters are able to gather enough people to push him out, but this can’t go on,” said Tobias Harris, founder of Japan Foresight, adding that none of the opposition parties want to join a coalition with him. “It all looks like you’ve got a political crisis.”

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up