Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Mexico Central Bank Governor Rodriguez: Helicoide Detention Center To Be Converted To Social, Sports Center

[Guterres: UN Faces Financial Collapse, Funds May Run Out By July] On January 30, Local Time, UN Secretary-General António Guterres Warned That The UN's Funds May Run Out By July Due To The Accumulating Unpaid Dues, And The Global Organization Is Facing An "imminent Financial Collapse." In A Letter To Permanent Representatives Of Member States To The UN, Guterres Wrote: "This Crisis Is Deepening, Threatening Project Implementation And Risking Financial Collapse. And The Situation Will Worsen Further In The Near Future." Guterres Pointed Out In The Letter That Either All Member States Must Fully And Timely Fulfill Their Dues Obligations, Or Member States Must Fundamentally Reform Their Financial Rules To Prevent The Imminent Financial Collapse

Hong Kong Port Operator Violated Panama's Constitution, Failed To Serve Public Interest, Panama Court Ruled

South Korea Signs Deal With Norway To Supply Multiple Launch Rocket System Valued At 1.3 Trillion Won -South Korea Presidential Chief Of Staff

[Arctic Cold Wave Hits: Florida Citrus Industry At Risk Of Frost] The Southeastern United States Is Bracing For A Powerful Storm, Potentially Bringing Devastating Frost To Florida's Citrus Belt And Heavy Snowfall To The Carolinas. The Wind Chill In Central Florida's Orange-growing Regions Could Drop To Single Digits (Fahrenheit); Much Of Polk County Is Expected To Experience Sub-zero Temperatures, Threatening The Statewide Citrus Harvest. The Storm Is Also Expected To Bring Strong Winds And Coastal Flooding To The East Coast. Approximately 1,000 Flights Have Already Been Canceled Across The U.S. This Weekend, With Half Of Them Concentrated At Hartsfield-Jackson Atlanta International Airport

[Former Goldman Sachs Executive: Warsh's Fed Chairship Could Reduce Risk Of Massive Sell-Off Of US Assets] Fulcrum Asset Management Stated That Nominating Kevin Warsh As The Next Federal Reserve Chairman Reduces The Risk Of A Massive Sell-off Of US Assets Because The New Leader Is Expected To Take Measures To Address Inflation. "The Market Will Breathe A Huge Sigh Of Relief, And So Will The Dollar Market," Said Gavyn Davies, Co-founder And Chairman Of The London-based Firm, In A Video Released On The Fulcrum Website. He Added That Choosing Warsh Reduces The Risk Of A "crisis-laden 'sell America' Trade."

MSCI Emerging Markets Benchmark Equity Index Fell 1.7%, Its Worst Single-day Performance Since November 2025, Narrowing Its January Gain To Approximately 9%, Still Its Best Monthly Performance Since 2012. The Emerging Markets Currency Index Fell About 0.3%, Narrowing Its January Gain To 0.6%. On Friday, The South African Rand Fell 2.6% Against The US Dollar, Its Worst Performance Since April

Pentagon - USA State Department Approves Sales Of Joint Light Tactical Vehicles To Israel For $1.98 Billion

Federal Reserve Governor Bowman: I Look Forward To Working With Kevin Warsh, President Trump's Nominee For Federal Reserve Chairman

On Friday (January 30), At The Close Of Trading In New York (05:59 Beijing Time On Saturday), The Offshore Yuan (CNH) Was Quoted At 6.9584 Against The US Dollar, Down 137 Points From The Close Of Trading In New York On Thursday, Trading Within A Range Of 6.9437-6.9612 During The Day. In January, The Offshore Yuan Generally Continued To Rise, Trading Within A Range Of 6.9959-6.9313

House Speaker Boris Johnson Told House Republicans That He Hopes To Vote On The Senate's Draft Bill On Government Funding Next Monday

Fed Governor Bowman: Absent A 'Clear And Sustained' Improvement In Job Market, We Should Be Ready To Adjust Policy To Bring It Closer To Neutral

U.K. M4 Money Supply (SA) (Dec)

U.K. M4 Money Supply (SA) (Dec)A:--

F: --

U.K. M4 Money Supply YoY (Dec)

U.K. M4 Money Supply YoY (Dec)A:--

F: --

P: --

U.K. M4 Money Supply MoM (Dec)

U.K. M4 Money Supply MoM (Dec)A:--

F: --

P: --

U.K. Mortgage Lending (Dec)

U.K. Mortgage Lending (Dec)A:--

F: --

U.K. Mortgage Approvals (Dec)

U.K. Mortgage Approvals (Dec)A:--

F: --

Italy Unemployment Rate (SA) (Dec)

Italy Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Euro Zone Unemployment Rate (Dec)

Euro Zone Unemployment Rate (Dec)A:--

F: --

P: --

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Euro Zone GDP Prelim YoY (SA) (Q4)

Euro Zone GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)A:--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)A:--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)A:--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)A:--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)A:--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)A:--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)A:--

F: --

P: --

U.S. Core PPI YoY (Dec)

U.S. Core PPI YoY (Dec)A:--

F: --

U.S. Core PPI MoM (SA) (Dec)

U.S. Core PPI MoM (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Dec)

U.S. PPI YoY (Dec)A:--

F: --

P: --

U.S. PPI MoM (SA) (Dec)

U.S. PPI MoM (SA) (Dec)A:--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)A:--

F: --

P: --

Canada GDP YoY (Nov)

Canada GDP YoY (Nov)A:--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)A:--

F: --

P: --

U.S. Chicago PMI (Jan)

U.S. Chicago PMI (Jan)A:--

F: --

Canada Federal Government Budget Balance (Nov)

Canada Federal Government Budget Balance (Nov)A:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Jan)

China, Mainland NBS Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Composite PMI (Jan)

China, Mainland Composite PMI (Jan)--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

This week, the U.S. Treasury Department announced a $20 billion currency swap bailout for Argentina, as the country struggles with surging inflation, rising unemployment, deepening poverty, and a severe shortage of U.S.

This week, the U.S. Treasury Department announced a $20 billion currency swap bailout for Argentina, as the country struggles with surging inflation, rising unemployment, deepening poverty, and a severe shortage of U.S. dollars as the peso devalues. The rescue package is the largest U.S. intervention in Argentina’s economy in decades, offering temporary relief in dire times.President Javier Milei has branded himself as one of Washington’s most loyal allies in Latin America, especially under President Donald Trump, whose own populist brand of right-wing politics he has wed to a radically libertarian economic policy.

Yet, despite initial rhetoric promising to end Argentina’s ties to “communist countries” and to align itself with the West, Milei’s administration has quietly strengthened Argentina’s engagement with China, illustrating a broader pattern in which multipolar pragmatism wins out in a region long dominated by American power. As Eduardo Porter of the Washington Post wrote recently, “Trump can’t beat China in Latin America by being a bully” anymore.

Across Latin America, governments increasingly treat Beijing and Washington (and even Moscow, Brussels, and New Delhi) as partners of equal standing, hedging between powers while pursuing their own economic needs.As a case in point, last week, the Chinese automaker BYD officially launched EV sales in Argentina, seizing the opportunity created by the government’s decision to lift import tariffs on electric and hybrid vehicles. The policy allows up to 50,000 vehicles to enter the country tariff-free in 2026. BYD, the world’s leading EV manufacturer, has moved swiftly to dominate that space.

Its new models, the Yuan Pro electric SUV, the Song Pro plug-in hybrid, and the Dolphin Mini, are priced at under $16,000, less than half the cost of comparable U.S. electric vehicles such as Teslas and Ford EVs.Even compared to locally produced combustion cars, BYD’s vehicles are significantly cheaper. With oil prices fluctuating and the peso under pressure, affordability could make this launch an overwhelming success.Out of the 50,000 EVs and hybrids allowed under the new measure, roughly 40,000 are expected to come from China. The remaining quota appears designed to appease U.S. investors and political figures in Washington. In practice, if sales continue along current trends, Chinese firms like BYD could easily dominate the entire allocation.

Stephen Deng, BYD’s country manager in Argentina, noted that the company currently holds an import allocation of about 7,800 electric and hybrid cars, calling the government’s policy a “tremendous opportunity” for expanding electromobility in Argentina.Argentina is the second-largest automobile market in South America after Brazil, but has the region’s lowest penetration of EVs. Between January and August 2025, only 486 electric cars were sold out of 421,000 total sales. For years, importers were constrained by unfavorable exchange rates and steep tariffs, which kept most consumers reliant on locally-built gasoline cars.

With the tariff exemption and China’s entry into the market, that dynamic may shift quickly.

BYD’s launch also reflects China’s growing industrial strategy in South America. To ease political and labor concerns, the company plans to invest directly in Argentina, potentially opening a manufacturing plant similar to the one it just inaugurated in Brazil.That Brazilian facility, BYD’s largest investment outside Asia, was endorsed by President Lula da Silva, signaling how deeply Chinese firms are embedding themselves in Latin America’s green-industrial landscape.

Milei’s government cut tariffs on EVs in April, marking an abrupt reversal from its earlier rhetoric. Milei has previously called Xi Jinping a “murderer” and a “thief,” and berated China’s economic and political system when he was running for president. Yet at the G-20 summit in November 2024, Milei met with Xi, effectively abandoning that position. The meeting marked Argentina’s continued integration with China.China’s presence in Argentina already extends far beyond electric vehicles. Chinese banks now operate across the country, and Argentina can now do trade and foreign exchange using the yuan. China has also quietly become a key source of credit and investment for Argentine infrastructure, energy, and transportation projects.

As China’s capital, technology, and labor expand visibly deeper into Argentina’s economy, Washington’s bailout may buy time, but is unlikely to buy loyalty in this new era of great power competition, no matter how much Trump may want it.This sale will continue defining Argentina and Latin America’s broader trend towards pragmatic engagement with great powers, where business is guided by whoever can offer the best terms, rather than what is the most politically expedient choice.

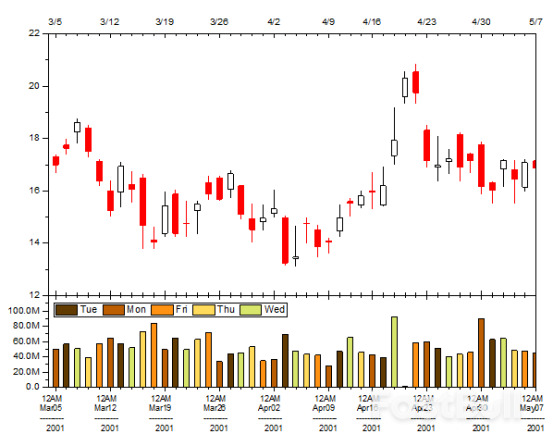

Understanding how to read forex charts is the foundation of every successful trading and investing decision. Forex charts visually show how currency prices move over time, helping investors identify market trends, spot entry and exit points, and measure volatility. Whether you’re analyzing short-term movements or long-term trends, learning to interpret chart patterns builds confidence and turns raw market data into actionable insight.

A forex chart is a visual record of a currency pair’s price over time. Along the x-axis you see time (e.g., 1 minute, 1 hour, 1 day), and along the y-axis you see price. Each plotted point or bar summarizes what happened to price during that period—at minimum the close, and often the open, high, and low. By compressing thousands of trades into a compact picture, charts let investors grasp trend, momentum, volatility, and key levels at a glance.

Prices move because expectations change. Charts show those changing expectations in real time, letting investors respond with discipline rather than headlines alone.

Understanding how to read forex charts starts with knowing the main chart styles used in trading. Each type displays price data differently, helping investors interpret market direction, momentum, and volatility.

A line chart connects closing prices over a specific period with a continuous line. It gives a clear, simplified view of the overall market trend—ideal for spotting long-term direction without distractions from intraday noise.

Use line chart for:

Limitations:

A bar chart (Open-High-Low-Close, or OHLC) adds more detail than a line chart. Each vertical bar shows the highest and lowest prices for the period, while small horizontal ticks indicate the opening (left) and closing (right) prices.

Use A bar chart for:

Limitations:

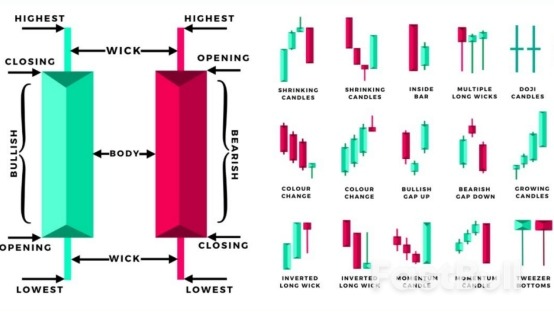

A candlestick chart conveys the same data as a bar chart but in a more visual way. Each candle shows the open, high, low, and close, but the body color (usually green for bullish and red for bearish) makes it easier to spot momentum and reversal signals.

Use A candlestick chart for:

Limitations:

Tip:

Most traders start with candlestick charts for their clarity but combine them with line charts for long-term trends and bar charts for volatility analysis.

Learning how to read forex charts helps investors transform price data into meaningful insights. The process combines technical observation, time analysis, and confirmation using reliable tools. Follow these five steps to understand how to read chart in forex trading and make better investment decisions.

Start by selecting your chart format—line, bar, or candlestick—based on your trading objective.

A line chart highlights long-term trends, a bar chart shows volatility and price range, and a candlestick chart reveals market psychology.

Next, set your timeframe: shorter charts (1m–1h) reveal intraday movement, while longer ones (1D–1W) show broader direction.

Choosing the right view is the foundation of how to read forex trading charts effectively.

Look for higher highs and higher lows in an uptrend, or lower highs and lower lows in a downtrend. Draw trendlines or use moving averages to confirm direction. Understanding structure prevents you from trading against momentum and helps you spot early reversals. This step trains your eye to read the rhythm of the market, not just isolated candles.

Pay attention to candle length and bar height—large ranges mean strong market activity. Watch how price reacts around support and resistance zones to gauge buying or selling pressure. When reading forex charts, always link price action with market sentiment—calm markets compress, volatile ones expand. This helps you detect strength, weakness, or potential breakout conditions.

Use chart formations like breakouts, double tops/bottoms, or reversal candles to time entries and exits. But don’t rely on visuals alone—combine technical patterns with macroeconomic context, such as inflation data, policy changes, or geopolitical events. Charts show market expectations; fundamentals explain why they change.

To apply these concepts, use FastBull’s live forex charting tools. You can compare chart types instantly, analyze multiple timeframes, and overlay indicators like RSI or Moving Averages for confirmation.

FastBull also integrates economic calendars and news updates—so you can read forex charts, follow market events, and react confidently in real time. This hands-on approach makes learning how to read a forex chart more practical and data-driven.

It’s a trading discipline method: focus on 5 currency pairs, 3 trading strategies, and 1 specific trading time each day. It helps traders stay consistent and avoid overtrading.

It refers to a micro lot, equal to 1,000 units of a currency. This allows beginners to trade smaller positions and control risk while learning how to read forex charts effectively.

Through leverage, consistent strategy, and risk control. Use small lot sizes, follow clear chart signals, and manage stop-losses—never rely on luck or over-leverage.

It took nearly two years of war, relentless protests demanding the release of hostages, and one energetic and determined American president to achieve what had seemed unachievable. President Donald Trump secured support from key Arab and Muslim countries, including Qatar and Turkey, and then forced an end to the war on both Israel and Hamas. Within days, the IDF withdrew most of its forces from Gaza and all 20 living Israeli hostages were released from captivity. International leaders then headed to a peace summit in Sharm al-Sheikh.

Netanyahu hadn’t been invited to the Sharm summit until he spoke with Egyptian President Abdel Fattah al-Sisi in Trump’s presence. For a second, Netanyahu actually considered sitting at the same table with Palestinian President Mahmoud Abbas to discuss peace, Gaza’s reconstruction, and what now appears to be the inevitable participation of the Palestinian Authority (PA) in this process (though he ultimately decided against attending). Watching these fast-paced events unfold was as surreal as witnessing Netanyahu’s public apology to Qatari leadership last month – with Trump watching carefully.

The prime minister’s position has changed dramatically. But how likely is it that he loses his grip on power?

Just weeks ago, Netanyahu angrily dismissed anyone who suggested the war should end with a deal, insisting instead on ‘total victory’ – the promise he’d made from the first days of the Gaza war. He rejected the idea that Hamas’s disarmament should be deferred to the future, to allow the release of the hostages. He said ‘no’ to any PA involvement in Gaza’s reconstruction. And he insisted on providing only limited humanitarian aid through the Israeli-backed GHF, a failed project that has since been dismantled.

Those positions helped sustain the support of his far-right coalition partners, including Bezalel Smotrich and Itamar Ben-Gvir. But they have threatened to quit over Trump’s peace deal and voted against the first stage. The second stage – which includes Hamas disarmament, Gaza reconstruction, the PA’s return to Gaza, and a path toward Palestinian sovereignty – has not even been voted on yet.

In his recent speech, Netanyahu defended and even praised the deal, claiming Israel had received everything it wanted. That may well be true, but this deal also contradicts everything Netanyahu has preached for many years. Within days, the Rafah crossing between Gaza and Egypt will reopen, secured by Palestinian policemen trained in Egypt, according to Palestinian sources. This represents a de facto return of the PA to Gaza and marks the beginning of reunification between Gaza and the West Bank.

Since the early 2010s, Netanyahu’s strategy has been ‘divide and rule’ – preventing any opportunity for negotiations and any prospect of Palestinian statehood. This included weakening the PA in the West Bank while keeping Hamas alive in Gaza. Every single move – the pro-settlement policy in the West Bank and the Qatari suitcases of US dollars delivered to Hamas with Israel’s approval – served this goal.

For some time, Netanyahu genuinely believed he could have it all: lucrative peace deals with Arab states while ‘managing the conflict’ with Palestinians. This strategy disintegrated during the 7 October massacres, when 1,200 Israelis, mostly civilians, were slaughtered by Hamas.

The prolonged war that followed and the acute humanitarian crisis and human tragedy it created in Gaza caused the world to turn away from Netanyahu. Indeed, Saudi officials interviewed by Israeli media in recent days made clear that Saudi Arabia will not join the Abraham Accords as long as Netanyahu remains in power.

Ultimately, Netanyahu decided not to participate in the Sharm al-Sheikh peace summit. Nonetheless, the decisions made there will bind him and his government. His coalition members currently prefer to emphasize only the part of the agreement that returned the hostages. But there is clearly much more at stake, as detailed in Trump’s 21-point plan.

It remains to be seen how Netanyahu’s coalition partners will react to unfolding events in Gaza. The PA’s influence looks set to grow. The timeline for Hamas disarmament is delayed and indefinite. And the path to Palestinian statehood is now clearly backed by a decisive majority of the international community.

If Bezalel Smotrich and Itamar Ben-Gvir do not resign over these issues, Netanyahu’s government could still survive for several months: elections are scheduled by law for late 2026. However, demands for a committee to investigate the security failures that led to 7 October will loom over the government, especially since the prime minister confirmed such a committee can only be formed after the war ends. Advancing a conscription bill, in order to ensure that the Ultraorthodox men will not serve in the army, will also pose problems in a country that has just lost 915 soldiers – men and women – in combat.

The chances of early elections are significant, though not certain. According to polls, Netanyahu’s Likud party would be unable to form a coalition, even accounting for its recent slight growth in support.

This means the prime minister may try to delay elections until he believes his chances of winning have improved. Prior to Trump’s visit to Israel, Netanyahu had threatened that Israel would return to fighting to eliminate Hamas, if any terms of the deal were violated. It seems now that even his far right wing partners understand that will be impossible for the time being, in light of Trump’s determination to end the war.

Netanyahu’s policies have collapsed, one by one. But the camp of those who still support them remains significant. Also, there is a lot of uncertainty about what will happen next in the West Bank. It is unclear whether the far-right wing partners of Netanyahu will get a free hand there to expand settlements and build new ones.

It is also unclear whether the Israeli opposition – weak and fragmented – will find the courage to call the prime minister’s bluff and offer the nation a different path: one of peace and reconciliation. Only then will the course of Israeli politics, and Israel’s fate, change dramatically – away from endless wars and illusions of ‘total victory’, to dialogue, cooperation and peace.

US customs authorities began collecting fees from Chinese-built and -operated merchant ships bringing goods into American ports on Tuesday, one more move in a series aimed at curbing China’s economic dominance.

The Trump administration has said the revenue collected would be used to support US shipbuilding resurgence, though there’s no mechanism in place yet for funding the industrial policy. The plan had become one of several points of contention in the US-China trade war, and at the end of last week Beijing announced its own retaliatory proposal to charge vessels with more than 25% US-ownership or control a hefty fee upon entry to Chinese ports.

That announcement — along with China’s threat of further curbs on critical mineral exports among other provocations — saw President Donald Trump kick off the weekend with a threat to slap an additional 100% import duty on goods from China as well as export controls on “any and all critical software” beginning Nov. 1.

The shock announcements sent markets into turmoil, as maritime analysts and commodities traders attempted to parse the implications for the flow of global raw materials and the shipping industry.

While there aren’t many US-headquartered shipping companies left, “there’s a substantial amount of American capital embedded throughout the industry,” said James Lightbourn, founder of Cavalier Shipping.

China’s proposal had the potential to raise prices much more so than the US plan is expected to because most companies have already redeployed any Chinese-made vessels in their fleets to avoid the US — and the fees, said Lightbourn.

“China, on the other hand, is such a major destination for bulk commodity exports — such as crude oil and iron ore — that this type of geographical reshuffling would have been much less of a realistic tactic for US-linked shipping companies,” Lightbourn said in an email to Bloomberg.

The Ministry of Transport has since exempted US-owned ships that were built in China, which Lightbourn called a “clever touch,” he said.

The ship fees are latest in the tit-for-tat, unpredictable trade war of Trump’s second term. And while it’s still early to see the fallout from the highest US tariffs in nearly a century and supply chain uncertainty abounds, data show so far that global trade has held up better than many expected.

A new edition of DHL’s Global Connectedness Tracker, released Tuesday with New York University’s Stern School of Business, shows international flows of trade and capital investment has remained surprisingly resilient despite the quickly changing policy coming out of Trump’s second term.

Among the takeaways: In the first half of the year, global goods trade grew faster than any other half-year since 2010, with the exception of the volatile pandemic period. U.S. imports surged earlier in the year as cargo owners frontloaded purchases ahead of tariff hikes. At the same time, China’s export growth remained positive despite steep declines in shipments to the US.

“A key factor behind the expected resilience of trade growth is the relatively modest role the US plays in global trade — accounting for just 13% of global goods imports and 9% of exports in 2024 — and the fact that other countries have not followed the US on its current path of across-the-board tariff increases,” wrote the DHL-NYU study authors.

The tariff impact on consumer prices has also been relatively muted so far, though according to a new analysis from Goldman Sachs, that may be about to change.

US consumers will likely shoulder 55% of tariff costs by the end of the year, with American companies taking on 22%, Goldman Sachs analysts wrote in a note to clients this week. Foreign exporters would absorb 18% by cutting prices for goods, while 5% would be evaded, they wrote. (See Katia Dmitrieva’s full story here.)

Goldman’s latest report doesn’t include Trump’s most recent threats. “We are not assuming any changes to tariff rates on imports from China, but events in recent days suggest large risks,” the analysts wrote.

Indeed, US tariffs on imported timber, lumber, kitchen cabinets, bathroom vanities and upholstered furniture also kicked in on Tuesday, and USTR investigations expected to result in duties on sectors ranging from industrial robots, to semiconductors to medical devices are underway.

Just minutes after the ship fees took effect, Beijing announced curbs on five US units of Hanwha Ocean — one of South Korea’s biggest shipbuilders —in response to the probes of Chinese maritime industries. Meanwhile, the Ministry of Transport also said it was probing the USTR’s investigation into China’s maritime sector and may implement retaliatory measures.

Gold has staged a dramatic rally this year as Russia’s war in Ukraine and the US Trump administration’s unorthodox economic policies sent investors and central banks reaching for safe-haven assets. Right now, however, it’s silver that’s stealing the spotlight.A squeeze in supply of the precious metal has catapulted it to a 70% gain on the London market this year, compared with a 55% increase for gold as of mid-October. Both have been experiencing a surge in demand from investors, who value their price stability through periods of political instability, inflation and currency weakness.

Unlike gold, silver isn’t just scarce and beautiful: It also has useful real-world properties that make it a valuable component in a range of products. With inventories at their lowest in years and investors still scrambling for more, there’s a risk of supply shortages that could impact multiple industries.Political and fiscal uncertainty this year in major economies including the US, France and Japan is putting pressure on their currencies, and investors have been hedging their exposure to US dollars, euros and yen by acquiring assets like gold and silver in what’s been termed the “debasement trade.”

Silver is an excellent electrical conductor that’s used in circuit boards and switches, electric vehicles, batteries and solar panels. It’s also used in coatings for medical devices. And like gold, it’s still a popular ingredient for making jewelry and coins. As a tradable asset, it’s cheaper than gold per ounce, making it more accessible to retail investors, and its price tends to move more sharply during precious metal rallies.China and India remain the top buyers of silver, thanks to their vast industrial bases, large populations and the important role that silver jewelry continues to play as a store of value passed down the generations.

Governments and mints also consume large quantities of silver to produce bullion coins and other products.

Silver’s varied uses mean its market price is influenced by a wide array of events including shifts in manufacturing cycles and interest rates and even renewable energy policy. When the global economy accelerates, industrial demand tends to push silver higher. When recessions loom, investors often step in as alternative buyers.The market is thinner than with gold. Daily turnover is smaller, inventories are tighter and liquidity can evaporate quickly. That isn’t because there is less silver than gold available for trading. In fact, it’s the opposite: There are about 790 million ounces of silver in vaults overseen by the London Bullion Market Association, compared with 284 million ounces of gold. But silver is far less valuable per weight. The silver stored in London is worth about $40 billion, while the gold is worth $1.1 trillion.

LBMA data show silver inventories in London — the backbone of the global trade — have dropped by roughly a third since mid-2021, leaving less metal available for lending or delivery. Global demand for silver has outpaced the output from mines for four consecutive years, eroding the supply buffer once held in London. Meanwhile, silver-backed exchange-traded funds have drawn in new investment, forcing custodians to secure physical bars just as available supply was dwindling.

A proposed US tariff on certain imported metals earlier this year added fuel to the fire, spurring speculative buying and depleting inventories even further. Spot prices in London are trading at multi-year premiums to futures in New York.

The result has been strained liquidity and a scramble to secure silver bars.

The country’s festive season, culminating in Diwali on Oct. 20, is traditionally a peak period for precious metal buying. Silver imports have nearly doubled from last year as jewelers rushed to restock amid soaring bullion prices.Indian buyers are now paying premiums of 10% or more over global benchmark prices, underscoring how tight physical supply has become. That demand has siphoned off even more metal from Western vaults, worsening the squeeze.

Some traders have been booking space on transatlantic cargo flights for bulky silver bars — an expensive transport method typically reserved for gold — to capture price differentials between London and New York.For sectors like solar panel manufacturing, in which silver paste is a critical ingredient, sustained high prices could begin to erode profitability and spur efforts to substitute silver components for other metals.

Global mine production has been constrained by declining ore grades and limited new project development. Mexico, Peru, and China — the top three producers — have all faced setbacks ranging from regulatory hurdles to environmental restrictions. Reshuffling inventory from New York to London might solve the immediate crisis, but it won’t fix persistent supply deficits.

Whether the market finds a balance — or faces another bout of panic buying — will depend on how quickly new supply can reach the vaults.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up