Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

China has quietly started to exempt some US goods from tariffs that likely cover around US$40 billion (RM170.64 billion) worth of imports, in what looks like an effort to soften the blow of the trade war on its own economy.

China has quietly started to exempt some US goods from tariffs that likely cover around US$40 billion (RM170.64 billion) worth of imports, in what looks like an effort to soften the blow of the trade war on its own economy.

A list of exempted US products covering 131 items like pharmaceuticals and industrial chemicals has been circulating among traders and businesses over the past week. Some of these products were previously reported by Bloomberg News.

It’s unclear where the list came from and it hasn’t been officially confirmed, but at least half a dozen companies in China have been able to bring in goods from the list without paying tariffs, according to people familiar with the matter, who asked not to be identified discussing confidential information.

The 131 items are worth about US$40 billion, or around 24% of Chinese imports from the US in 2024, Bloomberg calculations based on China customs data show.

The move echoes steps taken by the Trump administration to exempt smartphones and other electronics from its own “reciprocal” tariffs, including the 145% levies on China. Those US exemptions apply to about US$102 billion, or roughly 22% of US imports from China last year, according to estimates by Gerard DiPippo, associate director of the RAND China Research Center.

The notion that China’s exemptions largely mirror the US ones suggests this is more of a strategic move to match Washington’s actions rather than purely a goodwill gesture. It also points to Beijing’s priority of shielding its own economy from the fallout of the trade war.

“China is likely trying to mitigate damage to its economy by avoiding a collapse in key imports,” DiPippo said. “The exemptions shouldn’t be interpreted as a signal to the US, as China has been quiet about its exemptions, working through business channels and avoiding public statements.”

There are tentative signs the US-China trade standoff could be shifting. The Chinese Commerce Ministry said on Friday it’s assessing the possibility of trade talks with the US, giving a lift to equity markets.

“The US has recently sent messages to China through relevant parties, hoping to start talks with China,” the ministry said in a statement released during a mainland holiday. “China is currently evaluating this.”

Chinese officials began asking foreign companies as early as the second week of April to name the US imports that are essential to their operations and can’t easily be replaced, said the people. Since then, some of those items have received waivers from China’s 125% tariffs on the US goods.

The list of exemptions is said to be dynamic and will be continuously adjusted depending on China’s needs, according to people familiar with the matter. More products may be added, while some could be removed if China manages to find substitutes, said one of the people.

China’s General Administration of Customs didn’t respond to a faxed request for comment during a Chinese holiday.

Bloomberg reported last week that the Chinese government is considering lifting levies for certain medical devices and industrial chemicals like ethane. Officials are also discussing waiving the tariff on aircraft leasing.

While the US imports far more from China than the other way around, the exemptions highlight areas where Beijing still relies on American products. For example, China is the world’s largest plastics manufacturer but some of its factories depend on ethane — a feedstock mainly imported from the US.

China has already granted exemptions to two domestic plastic producers that depend heavily on US ethane, according to analytics firm Vortexa.

The trade war has hit both economies hard. China’s factory activity slipped into its sharpest contraction since December 2023, an early sign of the strain from the tariffs. Major banks including UBS Group AG and Goldman Sachs Group Inc have cut their forecasts for China’s full-year growth to around 4% or lower — well below Beijing’s official target of around 5%.

Wu Xinbo, director at Fudan University’s Center for American Studies in Shanghai, said while he couldn’t confirm the exemptions, they wouldn’t be surprising. “Tariffs are a kind of self-inflicted thing,” he said. “And we want to control the damage as much as we can.”

US job growth was robust in April and the unemployment rate held steady, suggesting uncertainty over President Donald Trump’s trade policy has yet to have a material impact on hiring plans.

Nonfarm payrolls increased 177,000 last month after the prior two months’ advances were revised lower, according to Bureau of Labor Statistics data out Friday. The unemployment rate was unchanged at 4.2%.

US stock futures and Treasury yields rose following the release, while the dollar pared losses.

The report suggests the labor market continues to cool gradually, a sign that businesses facing heightened uncertainty around tariffs and turmoil in financial markets didn’t significantly alter their hiring plans. Most economists anticipate the brunt of the impact from punishing levies will be seen in coming months.

Federal Reserve officials have indicated they’re in no rush to cut rates until they get further clarity on the impact the administration’s policies will have on the economy, and are widely expected to leave their benchmark unchanged when they next meet May 6-7. While the US central bank is an independent institution, Trump has been pressuring it to ease borrowing costs.

Payroll gains in April were broad based, led by the health care and transportation and warehousing sectors. Manufacturing shed jobs as the sector saw the steepest contraction in output since 2020.

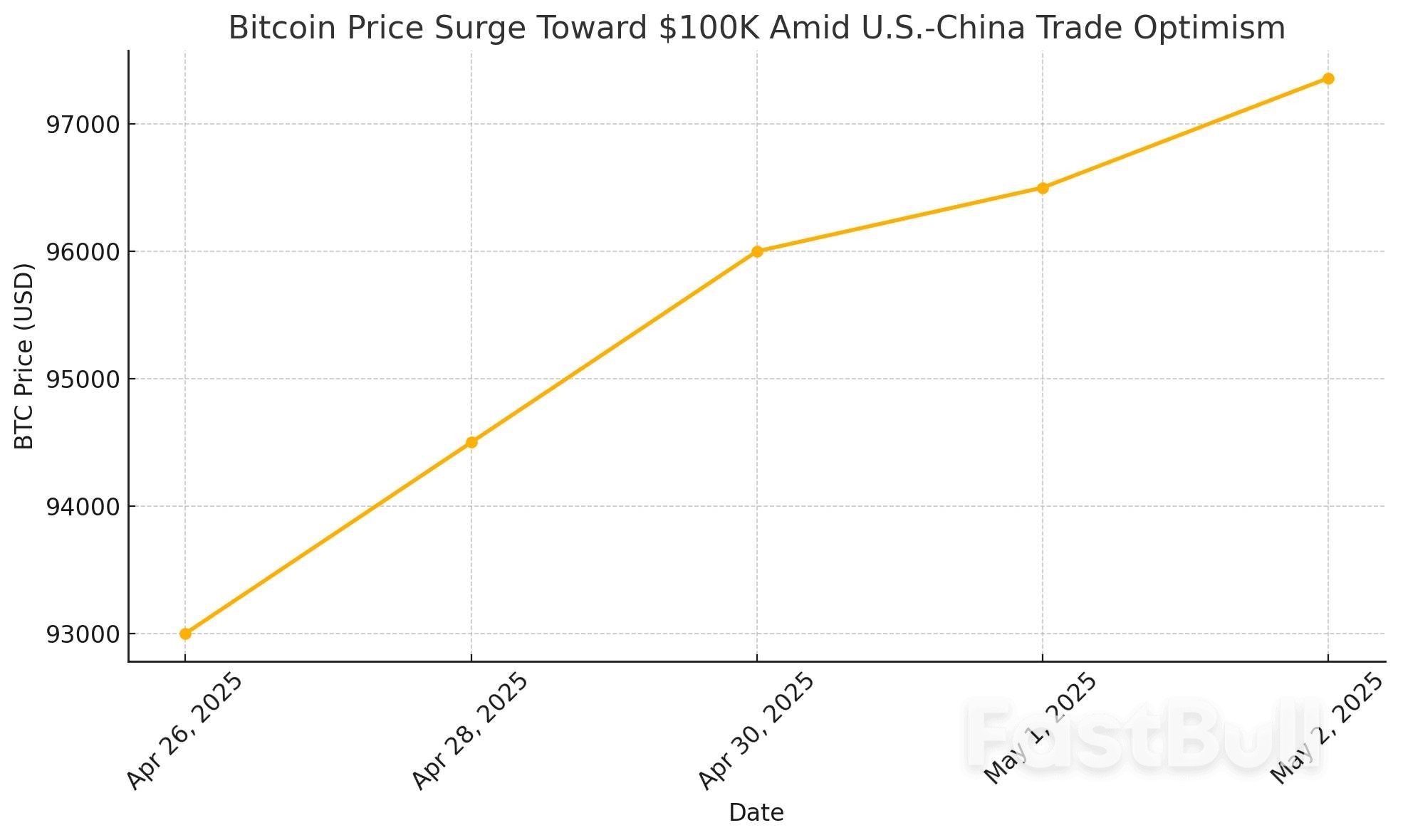

Bitcoin surges on geopolitical optimism as it has officially broken above $97,000, reaching its highest level in weeks, as optimism around a potential U.S.-China trade breakthrough fuels global risk-on sentiment. The world’s largest cryptocurrency is riding the wave of macroeconomic momentum, institutional inflows, and strategic demand in emerging markets.

“Bitcoin has become a geopolitical barometer,” said analyst Joe Burnett. “When tensions ease or cooperation increases, Bitcoin typically benefits from increased market confidence.”

Bitcoin is now just a few percentage points away from the psychological $100,000 level — a threshold traders believe could trigger a fresh round of institutional inflows.

The recent surge is largely driven by speculation that the United States and China may be approaching renewed trade negotiations. Markets reacted positively to reports that diplomatic teams are exploring a potential “framework agreement” by June.

Although Polymarket odds place a full deal at just 20%, the possibility of eased tariffs and restored cross-border economic flow is enough to bolster investor confidence across risk assets — Bitcoin included.

“Crypto is a beneficiary of global stability,” said CoinMetrics’ Kyle Waters. “The more predictable the macro backdrop, the more capital is allocated to assets like BTC.”

It’s not just Bitcoin that’s booming. Altcoins and AI tokens are gaining significant traction, highlighting broader market confidence.

Kava Labs surpassed 100,000 users on its decentralized AI platform, drawing institutional interest in transparent AI infrastructure.

ETH, SOL, and TON all posted 3–6% gains in the past 24 hours.

Meanwhile, BlackRock and Fidelity have reportedly expanded BTC holdings across ETF and trust products, confirming the growing appetite from traditional finance players.

While Bitcoin’s uptrend is strong, some risks remain:

A collapse in trade negotiations could trigger a pullback.

U.S. macro data (jobs, CPI) due next week could sway Fed policy expectations.

Short-term overbought signals may cause profit-taking around $100K.

“It’s not a straight line to $100K,” warned Alex Krüger. “But we’re entering the stage where dips are getting bought aggressively.”

Can Bitcoin Hit $100K This Month?

The short answer: yes, but cautiously.

With BTC climbing above resistance, macro winds at its back, and ETF inflows rising, the setup is there. What’s missing is a final catalyst — possibly the announcement of a tangible U.S.-China trade agreement or a breakout in altcoin dominance to spread liquidity across the ecosystem.

Bitcoin’s latest surge past $97K shows that geopolitics and crypto markets are more intertwined than ever. As global leaders navigate trade diplomacy, Bitcoin remains an asset reflecting investor hope and market uncertainty.

If optimism continues to build, and no black swan events disrupt momentum, Bitcoin at $100K may not just be a dream, but a near-term reality.

Why did Bitcoin jump above $97K?

The surge was fueled by optimism around potential U.S.-China trade negotiations, institutional inflows, and macroeconomic stability.

What is the significance of a $100K Bitcoin?

$100,000 is a psychological and technical milestone. Reaching it could attract more institutional investors and reinforce Bitcoin’s status as digital gold.

Are there any risks to Bitcoin’s rally?

Yes. Breakdown in trade talks, unexpected Fed moves, or profit-taking near $100K could cause short-term pullbacks.

What altcoins are also rising?

ETH, SOL, TON, and AI-related tokens like those on Kava Labs’ platform have seen significant gains alongside BTC.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up