Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

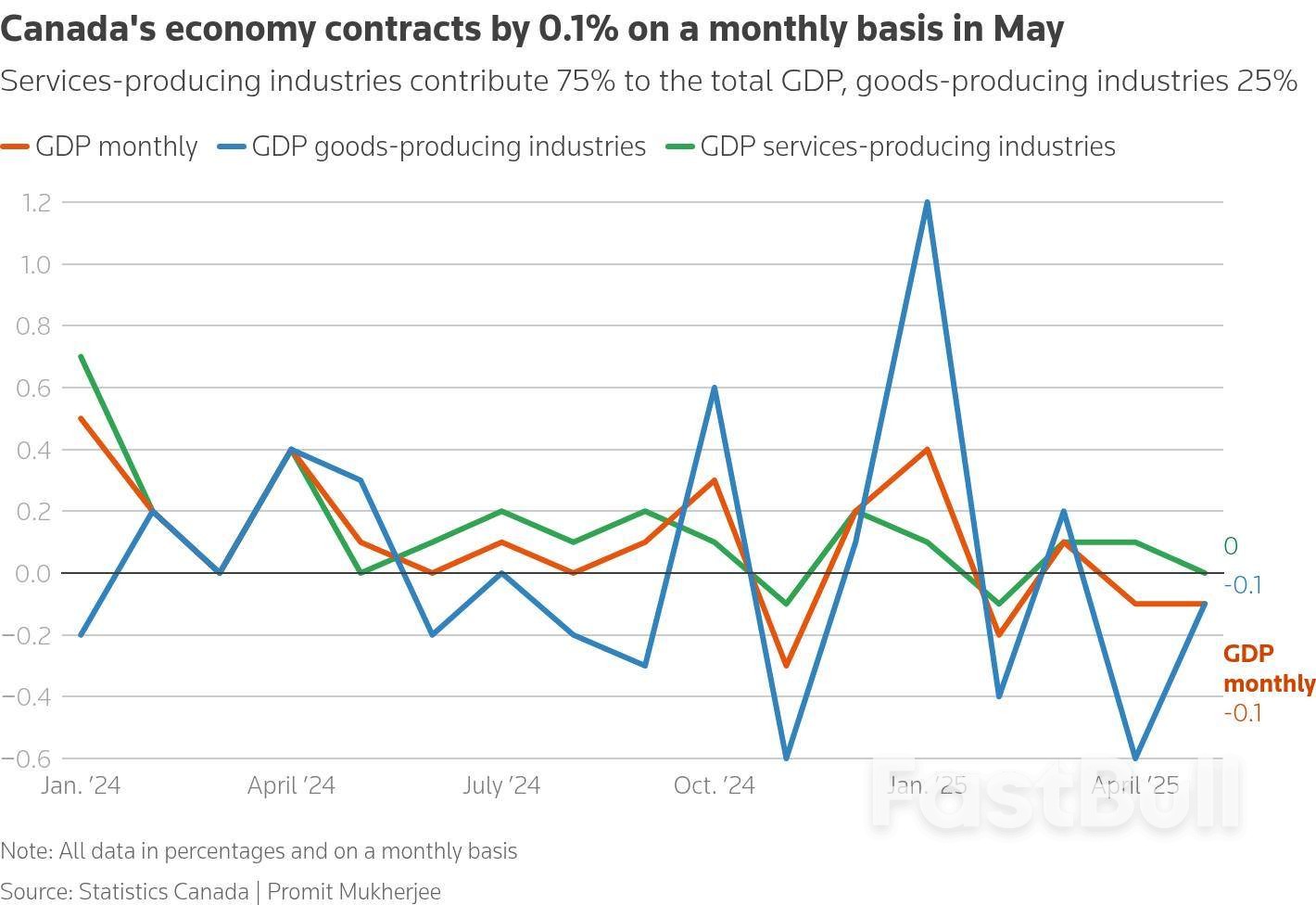

Canada's Gross Domestic Product shrank 0.1% in May on a monthly basis as expected but is likely to regain the lost ground in June as some sectors rebound, data showed on Thursday.

Canada's Gross Domestic Product shrank 0.1% in May on a monthly basis as expected but is likely to regain the lost ground in June as some sectors rebound, data showed on Thursday.

An advanced estimate showed GDP is likely to have expanded by 0.1% in June, and on an annualized basis it could also post growth of 0.1% for the second quarter, Statistics Canada said.

That is in contrast to the more widely held expectation for a second-quarter contraction, and could change when the final June numbers are released next month.

In May, the biggest hit to growth came from the retail trade sector which contracted 1.2%, StatsCan said, adding that activity across seven subsectors out of 12 shrank.

Retail trade is part of the larger services-producing industries that contribute up to 75% of total GDP. Overall, output from the services-producing group was flat in May as the drop in retail trade was offset by real estate and transportation.

Amongst goods-producing industries, which account for 25% of GDP, the mining, quarrying, and oil and gas extraction sector was the main laggard with activity shrinking 1% in the month.

Manufacturing expanded 0.7% on a monthly basis, after a 1.8% decline in April, largely as a result of higher inventory accumulation, the statistics agency said.

Canada's first quarter GDP expanded 2.2% on an annualized basis as exporters advanced their sales to the United States to beat a barrage of incoming tariffs. But as tariffs took effect from March, exports and industrial output took a hit.

The Bank of Canada, after announcing that it would keep rates on hold at 2.75% on Wednesday, said that it expected the economy to contract by 1.5% in the second quarter due to a 25% drop in exports.

StatsCan's forecast of even slim Q2 growth could take away the incentive for a rate cut in September, though data on inflation and job growth before the BoC's next meeting will be crucial.

Economists expressed doubt on a prospective growth in the second quarter as the data is calculated based on expenditure and income of people, unlike monthly GDP which is based on industry output.

"We will need to wait and see next month's quarterly GDP release to know whether the economy is really outperforming the Bank's expectations," Andrew Grantham, senior economist at CIBC Capital Markets wrote in a note.

Royce Mendes, head of macro strategy for Desjardins Group noted that there was lingering uncertainty about trade policy and domestic headwinds, which will continue to weigh on activity, forcing the central bank to restart cutting rates by September.

Money markets are betting around an 89% chance of the BoC holding rates on September 17, up three percentage points from before the GDP data was released .

The Canadian dollar dropped 0.11% to 1.3842 to the U.S. dollar, or 72.24 U.S. cents.

The U.S. and Canada are currently locked in negotiations to hash out a trade deal by Friday in a bid to reduce tariffs, but negotiators have admitted that it may not happen by the deadline.

The GBP/USD currency pair continues to move within the framework of a downward trend and the beginning of a head and shoulders reversal pattern. At the time of publication, the pound-dollar exchange rate on Forex is 1.3206. Moving averages indicate a short-term bearish trend. Prices have broken through the area between the signal lines downwards, indicating pressure from sellers of the currency pair and a potential continuation of the instrument’s decline. At the moment, we can expect an attempt at a bullish correction of the British pound against the US dollar and a test of the resistance area near the 1.3275 level. From there, we can again expect the pair to rebound downward and continue to fall against the US dollar. The target for the pair’s decline, according to the Forex forecast, is the area at 1.3005.

An additional signal in favor of a decline in the currency pair will be a test of the trend line on the relative strength index (RSI). The second signal in favor of a decline will be a rebound from the upper border of the bearish channel. A strong rise and a breakout of the resistance area with the price consolidating above 1.3405 will cancel the scenario of a decline in the GBP/USD currency pair. This will indicate a breakout of the resistance level and a continuation of the GBP/USD pair’s growth to the area at 1.3665. Confirmation of the pair’s decline should be expected with a breakout of the support area and the price closing below the level of 1.3265.

GBP/USD Forecast and Analysis for August 1, 2025 suggests an attempt to develop growth and test the resistance area near the 1.3275 level. Then, the quotes will continue to fall with a target near the 1.3005 level. An additional signal in favor of a decline in the British pound will be a test of the resistance line on the relative strength index (RSI). A strong rise in the British pound against the US dollar and a breakout of the 1.3405 area will cancel the decline scenario. This will indicate a continuation of the rise in the Forex pair with a potential target above the 1.3665 level.

Key Points:

Germany's EU-harmonised inflation decreased to 1.8% in July 2025, surpassing market expectations amidst stagnant economic growth.

The lower-than-expected inflation may influence future European Central Bank policies, affecting EUR and potentially impacting major cryptocurrencies like BTC and ETH.

Germany's recent inflation data reveals a decline in the EU-harmonised rate to 1.8% for July 2025, surpassing market expectations. Meanwhile, national inflation remains stable at 2%, set against stagnant economic growth as reported by Destatis.

Destatis, the Federal Statistical Office, reported the inflation figures, serving as the central authority for macroeconomic data releases in Germany. The agency indicated the consistent national inflation at 2%, aligning with expectations.

The reduction in inflation highlights potential impacts on macroeconomic strategy in Europe, particularly concerning fiscal policy adjustments. There are expectations of shifts in ECB policies, though no definitive changes were announced following the data release.

Macroeconomic assets, including the EUR and European bonds, could experience volatility as markets respond to evolving inflationary trends. Despite the absence of direct impacts on cryptocurrency markets, indirect effects may influence investor sentiment toward risk assets.

Historical data suggests German inflation surprises often affect market dynamics, notably in foreign exchange movements and crypto fluctuations. Stability in EU economic indicators could encourage steady approaches by financial regulators, amidst ongoing monetary policy evaluations by the ECB.

Potential outcomes could include adjustments in ECB rate expectations to align with regional inflation data, impacting interest rates across Europe.

Key points:

Asian shares fell on Friday after the U.S. slapped dozens of trading partners with steep tariffs, while investors anxiously await U.S. jobs data that could make or break the case for a Fed rate cut next month.Late on Thursday, President Donald Trump signed an executive order imposing tariffs ranging from 10% to 41% on U.S. imports from dozens of countries and foreign locations. Rates were set at 25% for India's U.S.-bound exports, 20% for Taiwan's, 19% for Thailand's and 15% for South Korea's.

He also increased duties on Canadian goods to 35% from 25% for all products not covered by the U.S.-Mexico-Canada trade agreement, but gave Mexico a 90-day reprieve from higher tariffs to negotiate a broader trade deal."At this point, the reaction in markets has been modest, and I think part of the reason for that is the recent trade deals with the EU, Japan, and South Korea have certainly helped to cushion the impact," said Tony Sycamore, analyst at IG.

"After being obviously caught on the wrong foot in April, the market now, I think, has probably taken the view that these trade tariff levels can be renegotiated, can be walked lower over the course of time."MSCI's broadest index of Asia-Pacific shares outside Japan (.MIAPJ0000PUS) fell 0.4%, bringing the total loss this week to 1.5%. South Korea's KOSPItumbled 1.6% while Japan's Nikkeidropped 0.6%.EUROSTOXX 50 futuresdropped 0.5%. Nasdaq futuresfell 0.5% while S&P 500 futuresslipped 0.3% after earnings from Amazonfailed to live up to lofty expectations, sending its shares tumbling 6.6% after hours.

Apple , meanwhile, forecast revenue well above Wall Street’s estimates, following strong June-quarter results supported by customers buying iPhones early to avoid tariffs. Its shares were up 2.4% after hours.Overnight, Wall Street failed to hold onto an earlier rally. Data showed inflation picked up in June, with new tariffs pushing prices higher and stoking expectations that price pressures could intensify, while weekly initial jobless claims signalled the labour market remained on a stable footing.Fed funds futures imply just a 39% chance of a rate cut in September, compared with 65% before the Federal Reserve held rates steady on Wednesday, according to the CME's FedWatch.

Much now will depend on the U.S. jobs data due later in the day and any upside surprise could lower the chance for a cut next month. Forecasts are centred on a rise of 110,000 in July, while the jobless rate likely ticked up to 4.2% from 4.1%.The greenback has found support from fading prospects of imminent U.S. rate cuts, with the dollar index up 2.4% this week against its peersto 100, the highest level in two months. That is its biggest weekly rise since late 2022.The Canadian dollarwas little impacted by the tariff news, having already fallen about 1% this week to a 10-week low.

The yenwas the biggest loser overnight, with the dollar up 0.8% to 150.7 yen, the highest since late March. The Bank of Japan held interest rates steady on Thursday and revised up its near-term inflation expectation but Governor Kazuo Ueda sounded a little dovish.Treasuries were largely steady on Friday. Benchmark 10-year U.S. Treasury yieldsticked up 1 basis point to 4.374%, after slipping 2 bps overnight.

In commodity markets, oil prices were steady after falling 1% overnight. U.S. cruderose 0.1% to $69.36 per barrel, while Brentwas at $71.84 per barrel, up 0.2%.Spot gold priceswere steady at $3,288 an ounce.

Key points:

The day after the Federal Reserve's non-unanimous decision to stand pat on interest rates, a cavalcade of economic indicators appears to suggest not moving was the right move.

The PCE price index, Powell & Co's pet inflation yardstick, showed inflation gathering some heat.

Headline and core (ex. food and energy) prices both rose by 0.3% last month, hitting the consensus nail on the head. Both marked a slight acceleration from May's 0.2% increases.

But prices rose 2.6% year-over-year, and the core figure posted an annual gain of 2.8%. Both were 10 basis points hotter than expected.

But stripping away volatile food and energy prices, core PCE rose on monthly and annual bases by 0.2% and 2.7%, respectively. Both numbers were 0.1 percentage points hotter than expected.

Taken together, they appear to justify the Fed's holding pattern as prices, increasingly waylaid by tariffs, struggle to bridge that troublesome last mile to the Fed's average 2% inflation target.

"The Fed is unlikely to welcome the inflation dynamics currently taking hold," writes Olu Sonola, head of economic research at Fitch Ratings. "Rather than converging toward target, inflation is now clearly diverging from it."

"This trajectory is likely to complicate current expectations for a rate cut in September or October," Sonola adds.

Elsewhere in the report, personal income rose by 0.3%, stronger than the 0.2% analysts expected and marking a partial bounce-back from May's 0.4% decrease.

Consumer spending, the tent pole of the U.S. economy, increased by 0.3%, weaker than the 0.4% gain economists predicted. And even then, the increase reflects price increases, particularly with respect to gasoline.

"Consumer spending rose decently in June, but that mostly just kept spending in line with price increases," says Bill Adams, chief economist at Comerica Bank. "After a larger decline in May, consumer spending in June was below April’s level."

Drilling down, consumers continued to rein in their expenditures on durable goods, which dipped 0.5%, while spending on non-durables and services increased by 0.4% and 0.1%, respectively.

Disposable income was unchanged, which helped hold the saving rate - or the unspent portion of disposable income - at 4.5%.

The saving rate is often viewed as a barometer of consumer anxiety.

Last week, 218,000 U.S. workers joined the queue outside the unemployment office USJOB=ECI, or 1,000 more than the previous week and 2.7% shy of consensus.

The underlying trend, as expressed by the four-week moving average of initial claims, now has a slight downward bias, suggesting that layoffs are on the wane.

But don't tell that to Challenger, Gray & Christmas (CGC). The executive outplacement firm's planned layoffs report USCHAL=ECI showed that in July, corporate America announced it would lay off 62,075 workers, or a 29.3% increase from June and 140% more than a year ago.

From January through July, 806,383 job cuts have been announced. That's 75% more than the 460,530 announced in the first five months of last year.

So far this year, the government - largely as a result of billionaire Elon Musk's DOGE efforts - has cut 292,294 jobs. That's 36.2% of total year-to-date layoffs.

"We are seeing the Federal budget cuts implemented by DOGE impact non-profits and healthcare in addition to the government," says Andrew Challenger, labor expert at CGC. "AI was cited for over 10,000 cuts last month, and tariff concerns have impacted nearly 6,000 jobs this year."

Ongoing jobless claims USJOBN=ECI, reported on a one-week lag, essentially held firm at 1.946 million, or 9,000 fewer than analysts expected. The number remains elevated and supports recent consumer survey data suggesting laid off workers are finding it increasingly difficult to find a replacement gig.

"Continued claims are still elevated, signaling unemployed workers are finding it difficult to find new jobs, but are showing signs of leveling off," says Nancy Vanden Houten, lead economist at Oxford Economics.

Separately, the Labor Department released its employment cost index USEMPC=ECI, which rose by 0.9% in the second quarter on a quarterly annualized basis, hotter than the 0.8% analysts anticipated and a repeat of the Q1 growth rate.

All of which is prologue to the Labor Department's July employment report due on Friday, which is expected to show the U.S. economy added 110,000 jobs this month, with the unemployment rate creeping up to 4.2% from 4.1%.

Finally, Midwest factory activity has continued to contract in July, but at a shallower-than-expected pace.

MNI Indicators' Chicago purchasing managers' index (PMI) USCPMI=ECI delivered a reading of 47.1, a 6.7-point improvement over June and not quite as gloomy as the 42.0 analysts anticipated.

Still, a PMI reading south of 50 indicates monthly contraction.

Market participants will get a clearer picture of the state of U.S. manufacturing on Friday, when the Institute for Supply Management (ISM) releases its nationwide PMI.

Analysts see that report improving to a barely-contractive but much healthier 49.5.

Japan's manufacturing activity shrank in July after briefly stabilising in the previous month as weak demand pulled production back into contraction, a private sector survey showed on Friday.

The S&P Global Japan manufacturing purchasing managers' index (PMI) fell to 48.9 in July from 50.1 in June, dropping below the 50.0 threshold that separates growth from contraction. The PMI was little changed from the flash reading of 48.8.

Most of the survey data was collected before the announcement of a Japan-U.S. trade agreement last week, which lowers tariffs imposed on Japan to 15% from a previously threatened 25%.

As the trade deal with Washington kicks in, "it will be important to see if this will translate into greater client confidence and improved sales in the months ahead," said Annabel Fiddes, economics associate director at S&P Global Market Intelligence, which compiles the survey.

The key sub-index of output fell back into contraction and at the sharpest pace since March. Companies widely reported reducing production due to lower volumes of new business, according to the survey.

New orders shrank again in July, though at a slightly slower pace than in June.

Despite falling production and orders, manufacturers continued to increase staffing in July, though the pace of job creation slowed to a three-month low.

On the price front, input cost inflation eased to its lowest in four-and-a-half years, while output prices rose at the fastest rate in a year as firms passed on higher costs to customers.

Business confidence improved to a six-month high in July, with firms expecting improved demand conditions and reduced trade-related uncertainty to support growth over the next year.

South Korea's factory activity contracted for the sixth straight month in July, as uncertainty over U.S. tariffs weighed on output and orders, a business survey showed on Friday.

The Purchasing Managers Index (PMI) for manufacturers in Asia's fourth-largest economy, released by S&P Global, fell to 48.0 in July, from 48.7 in June.

The index has stayed below the 50-mark, which separates expansion from contraction, since February.

"July PMI data signalled that the South Korean manufacturing sector experienced a stronger deterioration in operating conditions," said Usamah Bhatti, economist at S&P Global Market Intelligence.

"Both production volumes and new orders fell at a steeper rate than that in June, with anecdotal evidence indicating that weakness in the domestic economy was compounded by the impacts of U.S. tariff policy."

The survey was conducted from July 10 to July 23, before South Korea reached on Wednesday a trade deal with the U.S. lowering tariffs to 15% from a threatened 25%.

In July, output and new orders fell at steeper rates than the month before, although the decline in new export orders contracted at the mildest rate in four months, sub-indexes showed.

Anecdotal evidence pointed to declining export order volumes in the U.S. and Japan in particular, according to the survey.

South Korean manufacturers turned pessimistic about the outlook for the year ahead for the first time in three months, citing concerns over the timing of a domestic economic recovery and ongoing uncertainty surrounding U.S. tariff policy.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up