Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Peter Thiel-backed Bullish has confidentially filed for an IPO with the SEC, seeking to leverage renewed interest in digital assets under a more crypto-friendly U.S. administration....

The US and China capped two days of high-stakes trade talks with a plan to revive the flow of sensitive goods — a framework now awaiting the blessing of Donald Trump and Xi Jinping.

After some 20 hours of negotiations in London, US Commerce Secretary Howard Lutnick said both sides had established a framework for implementing the Geneva consensus that last month brought down tariffs. “First we had to get sort of the negativity out,” he said. “Now we can go forward to try to do positive trade, growing trade.”

Capping a marathon round of haggling that stretched over 12 hours on Tuesday, Lutnick said the Chinese had pledged to speed up shipments of rare earth metals critical to US auto and defence firms, while Washington would ease some of its own export controls — suggesting progress was made on two of the thorniest issues in bilateral ties.

The US and Chinese delegations will take that proposal back to their respective leaders, according to China’s chief trade negotiator Li Chenggang. Negotiations were “in-depth and candid”, he told reporters in brief remarks before midnight outside Lancaster House, a Georgian-era mansion near Buckingham Palace that served as this week’s meeting site.

While the positive tone should reassure investors worried about a decoupling of the world’s largest economies, details were scarce and the deal could still be nixed by top leaders. The discussions also did little to fix issues such as China’s massive trade surplus with the US and a belief in Washington that Beijing is dumping goods on its markets.

Initial market reaction to the announcement was muted, with US equity futures edging lower and the offshore yuan little changed. The Chinese onshore benchmark stock gauge was up 0.9% on Wednesday morning, on track for the biggest increase since May 14, shortly after the Geneva agreement.

“Markets will likely welcome the shift from confrontation to coordination,” said Charu Chanana, chief investment strategist at Saxo Markets. “We’re not out of the woods yet — it’s up to Trump and Xi to approve and enforce the deal.”

The Chinese Foreign Ministry and Commerce Ministry didn’t respond to requests for comment.

The London meetings came together at short notice after Trump last week spoke to Xi for the first time since taking office, in a bid to stop ties spiralling over claims both sides had reneged on the Geneva accord. US officials accused China of stalling magnet exports while Trump officials angered Beijing with new controls on chip design software, jet engines and student visas.

That spat showcased the growing role of export controls in modern trade warfare, where access to rare metals or tiny microchips can give one economy leverage over a rival. European trade officials and global carmakers also sounded the alarm in recent weeks on disruption of supplies from China that are critical for fighter jets and electric vehicles.

Lutnick suggested they’d found a way to overcome the deadlock.

“There were a number of measures the United States of America put on when those rare earths were not coming,” he added. “You should expect those to come off — sort of, as President Trump said, in a balanced way.”

Allowing technology that’s critical to Beijing’s military advancement to become a bargaining chip would mark a major departure for Washington, which has justified such export controls with national security concerns. It would also open the door for China to use its dominance of rare earths to put a lid on further limits on cutting-edge chips.

The US relenting on export controls is “unprecedented”, Wendy Cutler, a former senior US trade negotiator now at the Asia Society Policy Institute, wrote on LinkedIn, while pointing to the fragility of the current arrangement.

It took two days, three US Cabinet members and one Chinese vice premier to get back to upholding the Geneva accord, she added. That’s “a preview” for the next 60 days, she said, when US and Chinese officials have to hammer out agreements on excess capacity, unfair trade practices and the flow of fentanyl as part of a broader trade agreement.

US Trade Representative Jamieson Greer said the issue of fentanyl, which the Trump administration cited as a rationale for imposing a 20% tariff on China, was a priority for the US president. “We would expect to see progress from the Chinese on that issue in a major way,” he added.

Greer said there are no other meetings scheduled, adding that both sides talk frequently. Striking a similar tone, China’s Li said: “We hope the progress we made will be conducive to building trust.”

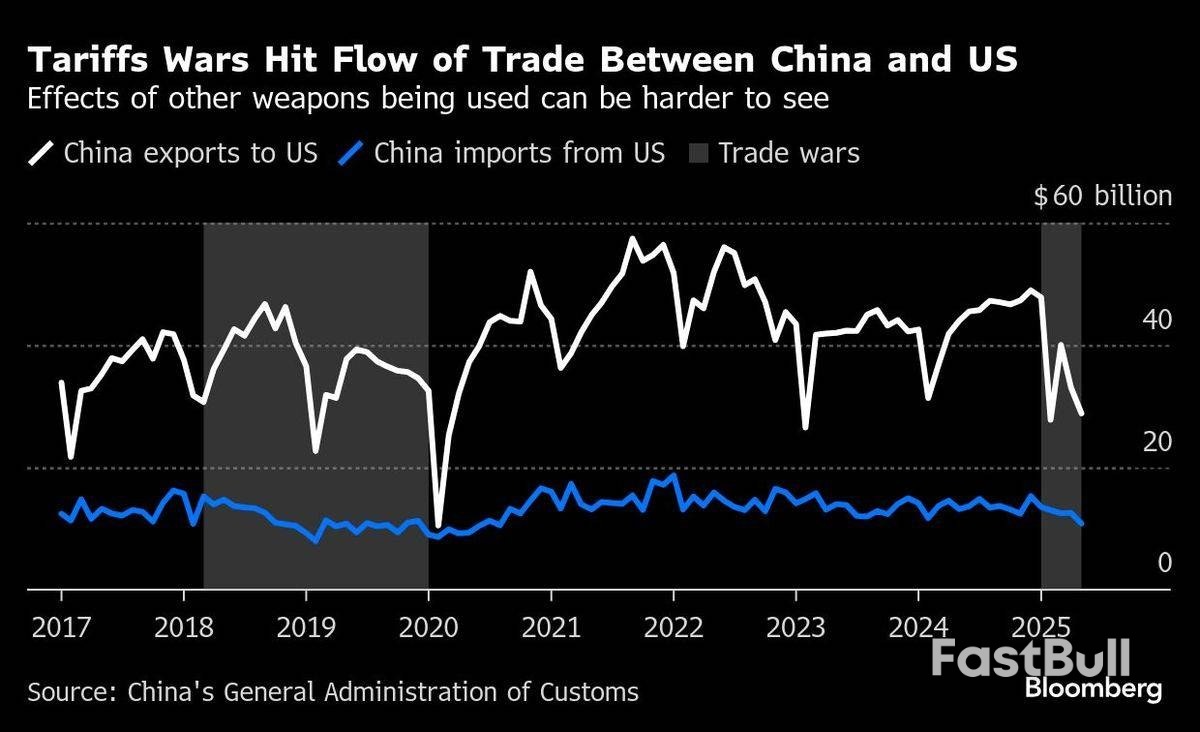

The US and China are about a third of the way through a 90-day reprieve on the crippling tit-for-tat tariffs imposed on each other through April. Though the Geneva settlement dramatically reduced duties, trade remains disrupted — China’s exports to the US fell in May by the most since early 2020 when the pandemic shut down the Chinese economy.

The trade war’s biggest casualty hasn’t been lost sales but lost trust, according to Josef Gregory Mahoney, a professor of international relations at Shanghai’s East China Normal University.

“We’ve heard a lot about agreements on frameworks for talks,” he added. “But the fundamental issue remains: Chips vs rare earths. Everything else is a peacock dance.”

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up