Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Britain is more likely to see lower rather than higher inflation as a result of U.S. President Donald Trump's tariffs, Bank of England policymaker Megan Greene said on Tuesday.

Britain is more likely to see lower rather than higher inflation as a result of U.S. President Donald Trump's tariffs, Bank of England policymaker Megan Greene said on Tuesday.

Greene, who has sounded more worried about the persistence of inflation pressure than some of her other colleagues on the Monetary Policy Committee, said Britain's decision not to levy reciprocal tariffs meant it was likely to become a destination for cheaper goods from Asia and the European Union.

"The tariffs actually represent more of a disinflationary risk than an inflationary risk," Greene told Bloomberg TV.

However, she said she remained concerned about domestic inflation pressures in Britain due to a lack of supply capacity, which informed the "cautious" approach to rate cuts she has taken so far.

The BoE's next interest rate announcement comes on May 8. Financial markets on Tuesday priced in a 100% chance of a rate cut, with recession fears rising sharply in the wake of Trump's imposition of tariffs.

Asked about investors' worries over the independence of the U.S. Federal Reserve after Trump criticised its chair Jerome Powell, Greene said: "Credibility is the currency of central banks and I think independence is quite an important piece of that."

The USD/JPY pair dropped to 140.13 on Tuesday, marking yet another seven-month low.

The yen’s rally is gaining momentum amid rising global trade risks. Additionally, investors are growing increasingly wary of US assets.

Last week’s tentative market optimism has now faded, with sentiment deteriorating following remarks from US President Donald Trump regarding the potential dismissal of Federal Reserve Chair Jerome Powell. Trump has expressed dissatisfaction with the Fed’s pace of decision-making, with the White House believing progress is too slow.

Domestically, Japanese investors are closely watching the upcoming Bank of Japan (BoJ) meeting on 1 May. While the key interest rate is expected to remain steady at 0.50% per annum, the central bank may revise its economic growth forecasts—prompted by mounting external risks, including the impact of US tariffs on Japanese exports.

The yen continues to perform strongly as a safe-haven asset. However, an excessively strong JPY also carries risks.

H4 Chart

On the H4 chart, USD/JPY has broken below the 141.55 level, extending its downward wave towards 138.88. This is a near-term target, and upon reaching it, a corrective rebound towards 143.55 is possible. Beyond that, further downside towards 136.22 may be considered. This scenario is supported by the MACD indicator, with its signal line firmly below zero and pointing sharply downward.

H1 Chart

On the H1 chart, the pair continues to develop the third wave of its downtrend. The immediate target of 140.00 has been met, and a temporary rebound to 141.55 (testing from below) could occur today. Subsequently, another decline towards 138.88 may follow. This outlook is corroborated by the Stochastic oscillator, whose signal line is below 20 but turning upward towards 80.

While the yen’s strength reflects its defensive appeal, excessive appreciation could prove detrimental. Traders should monitor both fundamental developments and technical signals for further guidance.

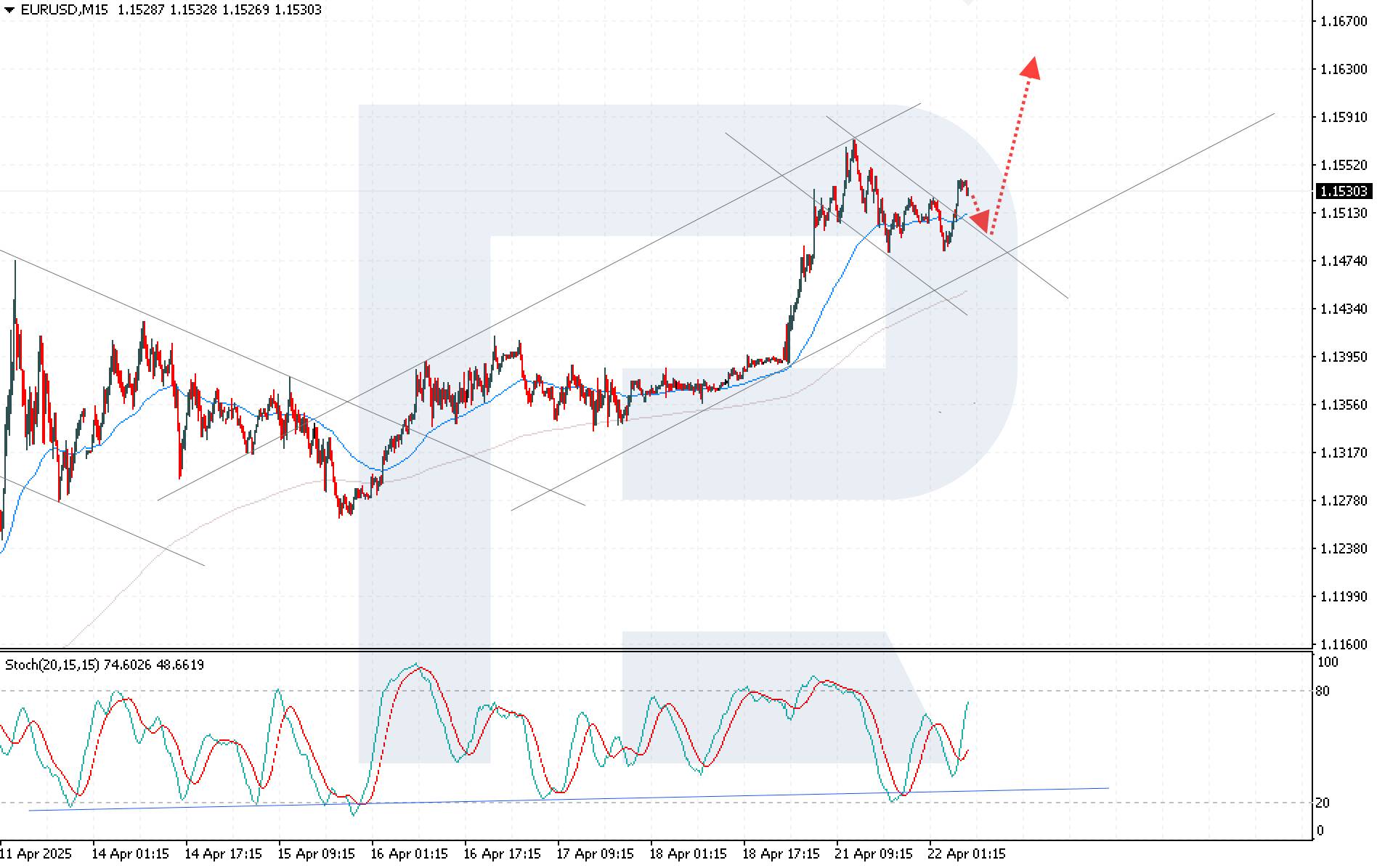

Increased pressure on the Fed and rising geopolitical tensions continue to undermine the US dollar, supporting the EURUSD rally. The EURUSD technical analysis points to strong upside potential, with the next target at 1.1630.

The EURUSD rate is gaining for the third consecutive trading session, currently trading at 1.1530. Find out more in our analysis for 22 April 2025.

The EURUSD rate continues to rally after rebounding from the 1.1475 support level. Pressure on the US dollar has increased following fresh verbal attacks by President Donald Trump on Federal Reserve Chairman Jerome Powell. On Monday, Trump escalated his calls for immediate rate cuts.

Market participants are increasingly concerned about the rising tension between the White House and the Fed. Trump’s actions could be perceived as an attempt to pressure the Fed’s independence, with speculation around a possible replacement of Powell adding to uncertainty and fear in the market, undermining confidence in the US dollar.

Additional support for the EURUSD rally came from investor disappointment over stalled US-China trade negotiations. Beijing accused Washington of misusing tariffs and warned other nations about entering trade deals with the US, which has increased tensions and further weighed on the US dollar.

The EURUSD rate is on the rise after breaking above the upper boundary of the descending corrective channel. Today’s EURUSD forecast points to a continued bullish wave targeting 1.1630. Technical indicators support the bullish scenario, with Moving Averages maintaining their upward direction and the Stochastic Oscillator rising confidently from oversold territory, showing a bullish crossover between the %K and %D lines. Consolidation above the local resistance at 1.1555 will confirm the bullish scenario.

It’s the turnaround point of a previous trend shift — $1.3430 could be a double-top pattern and bears are on the watch. Also, sterling is up a whopping 11% since mid-January.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up