Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

[Speaker Of The U.S. House Of Representatives: Confident Of Sufficient Votes To End Partial Government Shutdown By Tuesday] February 1st, According To Nbc News, U.S. House Speaker Johnson Said He Is Confident That There Will Be Enough Votes By At Least Tuesday To End The Partial Government Shutdown

Iranian Official Tells Reuters: Media Reports Of Plans For Revolutionary Guards To Hold Military Exercise In Strait Of Hormuz Are Wrong

Ukraine's Defence Minister Says Kyiv And Spacex Working On System To Ensure Only Authorized Starlink Terminals Work In Ukraine

Russian Security Committee's Vice Chairman Medvedev: Europe Has Failed To Defeat Russia In Ukraine

Russian Security Committee's Vice Chairman Medvedev: We Never Found The Two Nuclear Submarines Trump Spoke Of Deploying Closer To Russia

Russian Security Committee's Vice Chairman Medvedev: Victory Will Come 'Soon' In Ukraine But Equally Important To Think Of How To Prevent New Conflicts

Russian Security Committee's Vice Chairman Medvedev: Trump Is An Effective Leader Who Seeks Peace

Russian Security Committee's Vice Chairman Medvedev: Behind The So Called 'Chaos' Of Trump, He Is An Effective And Original USA Leader

Russian Defence Ministry: Russia Gains Control Over Two Villages In Ukraine's Kharkiv And Donetsk Regions

U.K. M4 Money Supply (SA) (Dec)

U.K. M4 Money Supply (SA) (Dec)A:--

F: --

Italy Unemployment Rate (SA) (Dec)

Italy Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Euro Zone Unemployment Rate (Dec)

Euro Zone Unemployment Rate (Dec)A:--

F: --

P: --

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Euro Zone GDP Prelim YoY (SA) (Q4)

Euro Zone GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)A:--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)A:--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)A:--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)A:--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)A:--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)A:--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)A:--

F: --

P: --

U.S. Core PPI YoY (Dec)

U.S. Core PPI YoY (Dec)A:--

F: --

U.S. Core PPI MoM (SA) (Dec)

U.S. Core PPI MoM (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Dec)

U.S. PPI YoY (Dec)A:--

F: --

P: --

U.S. PPI MoM (SA) (Dec)

U.S. PPI MoM (SA) (Dec)A:--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)A:--

F: --

P: --

Canada GDP YoY (Nov)

Canada GDP YoY (Nov)A:--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)A:--

F: --

P: --

U.S. Chicago PMI (Jan)

U.S. Chicago PMI (Jan)A:--

F: --

Canada Federal Government Budget Balance (Nov)

Canada Federal Government Budget Balance (Nov)A:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Jan)

China, Mainland NBS Manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland Composite PMI (Jan)

China, Mainland Composite PMI (Jan)A:--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)A:--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)--

F: --

P: --

South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)--

F: --

P: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)--

F: --

P: --

Envious of Trump, who can freely control gold prices.

Envious of Trump, who can freely control gold prices.

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Galaxy Digital executed a $9 billion Bitcoin sale for a Satoshi-era investor in July 2025, one of the largest crypto exits to date. This event signals a new era, as early Bitcoin adopters distribute coins to meet rising institutional demand without disrupting the market.

This ongoing shift marks Bitcoin’s transition into a more mature and stable market. Institutional capital now dominates, as on-chain data shows dormant wallets reactivating throughout 2025. The asset’s evolution from speculative play to global financial infrastructure continues to accelerate.

The Mechanics of Bitcoin’s Distribution Phase

Bitcoin’s current consolidation resembles the post-IPO stages in traditional equities, where early backers gradually exit as institutions enter.

In a Subtack post, Jeff Park, an advisor at Bitwise, describes this as a “silent IPO,” which lets original holders distribute Bitcoin through ETF infrastructure. Unlike previous downturns shaped by regulation or failures, today’s distribution happens under strong macro conditions and growing institutional interest.

On-chain data reflects the trend. Dormant wallets that were inactive for years began moving coins in mid-2025. For example, in October 2025, a wallet that had been inactive for three years transferred $694 million in Bitcoin, highlighting broader wallet reactivations during the year.

Blockchain analytics firm Bitquery also tracked numerous wallets that had been dormant for over a decade, becoming active in 2024 and 2025.

Crucially, this distribution is patient, not panic-driven. Sellers target high-liquidity windows and institutional partners to minimize price impact.

The Galaxy Digital transaction demonstrates this approach, where over 80,000 Bitcoin were moved during estate planning for an early investor, all without destabilizing the market.

Historically, such consolidation phases in traditional finance last six to 18 months. Companies like Amazon and Google experienced similar periods after their IPOs, as founders and venture investors made room for long-term institutional investors.

Bitcoin’s ongoing consolidation since early 2025 signals a comparable shift from retail pioneers to professional asset managers.

Institutional Adoption Accelerates as Early Holders Exit

This handoff from early holders to institutions relies heavily on the expansion of ETF infrastructure. Since the launch of spot Bitcoin ETFs in early 2024, institutional inflows have surged.

CoinShares research reported that as of Q4 2024, investors managing over $100 million collectively held $27.4 billion in Bitcoin ETFs, a 114% quarterly gain. Institutional investors accounted for 26.3% of Bitcoin ETF assets, up from 21.1% the prior quarter.

North American crypto adoption increased by 49% in 2025, driven primarily by institutional demand and the introduction of new ETF products, according to Chainalysis. This growth ties directly to the accessibility of spot ETFs, a familiar option for cautious investors.

Still, market penetration remains early. River’s Bitcoin Adoption Report reveals that only 225 of over 30,000 global hedge funds held Bitcoin ETFs in early 2025, with an average allocation of just 0.2%.

This gap between interest and allocation demonstrates how institutional integration is just beginning. Still, the trend remains upward. Galaxy Digital ended Q2 2025 with roughly $9 billion in combined assets under management and stake, a 27% quarterly increase—thanks in part to rising crypto prices and the record-setting Bitcoin sale. Its digital assets division delivered $318 million in adjusted gross profit, and trading volumes jumped 140%, as detailed in Galaxy’s Q2 2025 financial results.

The crypto lending ecosystem also expanded. According to Galaxy’s leverage research, Q2 2025 saw $11.43 billion in growth, bringing total crypto-collateralized lending to $53.09 billion.

This 27.44% quarterly rise signals strong demand for institutional-grade infrastructure that supports large transactions and wealth strategies.

Psychological De-Risking and the New Bitcoin Holder Profile

The logic behind early holder exits goes beyond profit-taking. Hunter Horsley, CEO of Bitwise, highlights that early Bitcoin investors remain bullish but prioritize psychological risk management after life-changing gains.

Strategies include swapping spot Bitcoin for ETFs to gain custodial peace of mind, or borrowing from private banks without selling.

Others write call options for income and set price targets for partial liquidations. These approaches signal smart wealth management and continued potential upside, not pessimism.

Bloomberg ETF analyst Eric Balchunas confirmed on X that original holders are selling actual Bitcoin, not just ETF shares. He likened these early risk-takers to “The Big Short” investors, who were first to spot opportunities and are now reaping the rewards.

As institutional ownership expands, Bitcoin’s volatility is projected to decrease, thanks to a broader distribution across pension funds and investment advisors.

This supports greater market stability and draws additional conservative capital. As a result, Bitcoin continues to shift from a speculative asset to a foundational monetary tool in global finance.

The European Commission is exploring plans to bring stock and cryptocurrency exchanges under central supervision as part of a broader effort to make the bloc’s capital markets more competitive with those in the US.

The incoming proposal would expand the European Securities and Markets Authority’s (ESMA) jurisdiction to include stock and crypto exchanges, as well as crypto asset service providers and other trading infrastructure, the Financial Times reported on Saturday.

The EU's current landscape comprises numerous national and regional regulatory agencies, which significantly raises the cost of cross-border trade, hindering startup development in the region.

Empowering a single supervisory body akin to the US Securities and Exchange Commission (SEC) may be the next step for the EU's “capital markets union,” which is also backed by European Central Bank (ECB) President Christine Lagarde.

“Creating a European SEC, for example, by extending the powers of ESMA, could be the answer. It would need a broad mandate, including direct supervision, to mitigate systemic risks posed by large cross-border firms,” Lagarde said at the European Banking Congress in November 2023.

The commission is set to publish a draft in December, according to people familiar with the matter who spoke with the FT.

The proposal would also enable ESMA to have the final say in disputes between asset managers, issuing binding decisions without direct supervision.

France considers blocking license “passporting,” raising MiCA concerns

The EU’s single supervision model may address the concerns related to crypto service providers seeking licenses under more lenient regulatory jurisdictions.

In September, France's securities regulator threatened to ban crypto license “passporting” under the Markets in Crypto-Assets Regulation (MiCA) regime, raising concerns about enforcement gaps in the EU-wide regulatory framework.

France also became the third country to call for the Paris-based ESMA to take over supervision of major crypto companies, after Austria and Italy.

Under MiCA, which took effect for crypto-asset service providers in December 2024, companies authorized in one member state can use that license as a “passport” to operate across the 27-nation bloc.

Verena Ross, ESMA chair, also confirmed the commission’s plans to transfer financial sector oversight from national regulators to ESMA in October.

Ross said the proposal aims to address “continued fragmentation in markets” and move closer to a unified capital market across Europe.

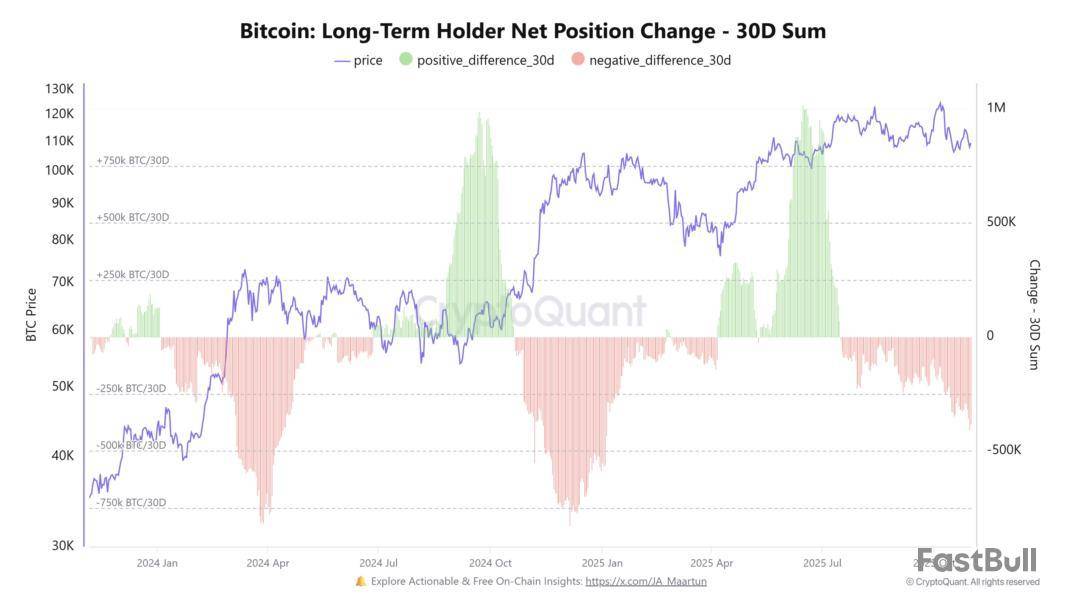

Recent on-chain data shows that a relevant class of Bitcoin investors known as long-term holders has continued to move out of their market positions.

LTHs Actively Switching To Distribution

In a November 1st post on social media platform X, popular on-chain analyst Burak Kesmeci shared an insight into the prevalent structural bias among Bitcoin’s long-term holders. Kesmeci’s analysis hinges on the Long-Term Holder Net Position Change metric, which tracks the net buying or selling behavior of Bitcoin’s long-term investors over a period of 30 days.

Related Reading: Bitcoin At A ‘Do-Or-Die’ Level As Cycle Faces First Real Test: Analyst

A positive reading is usually interpreted as a sign that the LTHs are in a net accumulation phase, as there are more market participants within this investor class buying Bitcoin than those who are selling. On the flipside, when the Long-Term Holder Net Position Change metric is negative, it means that the LTHs are in a distribution phase.

Kesmeci explained in his post that there has been an increasing amount of momentum towards the sell side of the metric. In the highlighted chart, around 400,000 BTC appears to have been sold off in the past 30 days. Interestingly, the LTHs don’t seem to be easing off on their sales — a behavior which stands equally as a source of concern.

In a case where Bitcoin’s long-term investors do desist from selling their holdings, Bitcoin could put in a local price bottom, as this typically indicates renewed interest and ‘smart money’ positioning for the next cycle. However, if this distribution momentum continues to grow, the premier cryptocurrency could continue towards the downside, as its long-term holders continue to inject more bearish pressure.

LTH 2.2% Supply Drop Relatively Modest — Analyst

In another X post, crypto pundit Darkfost shed light on the implications of Bitcoin’s LTH behavior shift. According to the analyst, the 2.2% “modest reduction” of Bitcoin LTH supply in October is not much to worry about, especially when compared to the levels seen in 2024.

As of March 2024, Bitcoin’s LTH supply dropped by approximately 5.05%. In December, there was an even higher decline of about 5.2%. Darkfost implied that the present distribution the market is seeing could therefore be a result of early profit taking, where the market could soon see a rebound of the Bitcoin price.

Nonetheless, the long-term holder net position’s trend is one that should be monitored, as a move back towards neutral readings could signal the start of an accumulation phase and subsequent price reversal to the upside.

As of this writing, BTC is valued at approximately $110,750, with no significant movement in the past 24 hours.

The European Commission is planning to introduce a proposal in December to centralize regulation of stock exchanges, crypto exchanges, and clearing houses under one entity, modeled after the U.S. Securities and Exchange Commission (SEC), according to a recent FT report.

The move towards a "capital markets union" is intended to make it easier for small finance startups to scale across borders, without having to gain approval from a litany of regional and national regulators. The commission is planning to introduce proposals in December, the report states.

One idea is to expand the powers of the existing European Securities and Markets Authority to cover significant cross-border financial entities, such as stock exchanges, crypto firms, and other post-trading infrastructure, though this idea is "contentious," according to the report. ECB President Christine Lagarde supports the move, along with her predecessor Mario Draghi. Lagarde also backed Germany's call for a single European stock exchange, Reuters recently reported.

The commission told the FT it was "still exploring the potential of EU level supervision in relation to some critical infrastructures, such as central counterparties, central securities depositories and trading venues, as well as in relation to big cross-border entities such as asset managers."

Luxembourg and Dublin reportedly "balked" at the prospect of a single supervisor, expressing skepticism that the EU will act in the best interests of smaller nations with finance hubs.

The European Commission and European Union finance ministers have made several moves towards centralizing oversight of key areas of crypto, from stablecoins to exchanges, in recent months. Lagarde and EU finance ministers recently agreed on a roadmap for issuing a digital euro Central Bank Digital Currency (CBDC), and the Commission is also planning proposals for December that deal with real-world asset tokenization, The Block previously reported.

If the Commission presents the package in December, it would begin the ordinary legislative process with the European Parliament and Council, including amendments and trilogue negotiations that could extend into 2026.

Disclaimer: The Block is an independent media outlet that delivers news, research, and data. As of November 2023, Foresight Ventures is a majority investor of The Block. Foresight Ventures invests in other companies in the crypto space. Crypto exchange Bitget is an anchor LP for Foresight Ventures. The Block continues to operate independently to deliver objective, impactful, and timely information about the crypto industry. Here are our current financial disclosures.

© 2025 The Block. All Rights Reserved. This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.

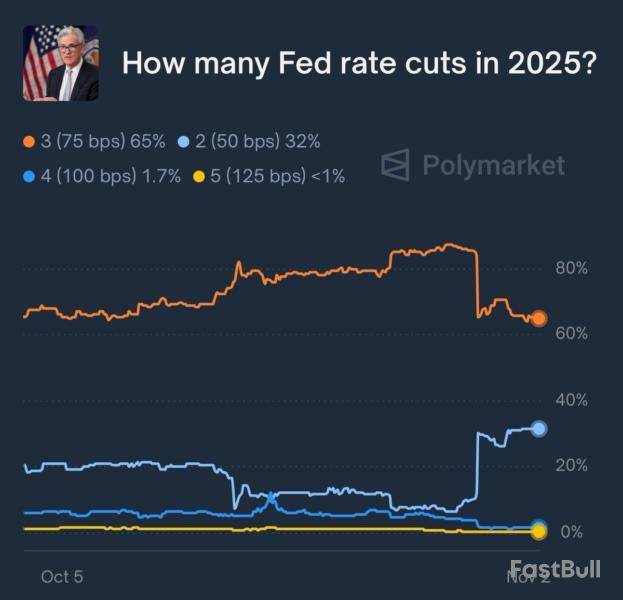

The Federal Reserve (Fed) injected $29.4 billion into the US banking system through overnight repo operations on Friday, the largest single-day move since the dot-com era. At the same time, China’s central bank deployed a record cash infusion to reinforce its domestic banking sector.

These coordinated liquidity moves signal a turning point for global risk assets, especially Bitcoin . Traders are closely monitoring how central banks act to stabilize markets ahead of 2026.

Fed’s Liquidity Move Highlights Market Tension

The Fed’s unusually large overnight repo operation followed sharp Treasury sell-offs and reflected growing stress in short-term credit markets.

Overnight repos enable institutions to exchange securities for cash, providing immediate liquidity in times of tight market conditions. The October 31 injection set a multi-decade record, even compared to the dot-com bubble era.

Many analysts interpret this move as a clear response to stress in Treasury markets. When bond yields rise and funding becomes more expensive, the Fed often steps in to limit systemic risks.

These interventions also expand the money supply, a factor that often correlates with rallies in risk assets such as Bitcoin.

Meanwhile, Fed Governor Christopher Waller recently called for an interest rate cut in December, indicating a potential shift toward more accommodative policy.

This contrasts with earlier hawkish remarks from Fed Chair Jerome Powell, whose caution has fueled market uncertainty. Polymarket data now puts the odds for a third 2025 rate cut at 65%, down from 90%, showing shifting expectations for monetary policy.

If the Fed fails to meet these expectations, markets could face a sharp downturn. Investors have already priced in easier policy, and any reversal might cause capital to exit riskier assets.

The difficult balance between liquidity injections and rate policy highlights the Fed’s challenge as it manages inflation and financial stability.

China’s Record Cash Infusion Boosts Global Liquidity

Meanwhile, China’s central bank also executed a record cash injection into domestic banks, aiming to support economic growth amid softening demand. The People’s Bank of China (PBOC) increased liquidity in a bid to keep lending active and prevent credit tightening. This action comes as Beijing addresses deflation and a weakened property sector.

The size of the PBOC’s move is comparable to its responses during past crises. By supplying extra funds, the central bank wants to lower borrowing costs and stimulate credit growth.

Such stimulus also expands global money supply and could contribute to asset inflation in stocks and cryptocurrencies.

Historically, simultaneous liquidity boosts by the Fed and PBOC have preceded major Bitcoin rallies. The 2020-2021 bull run happened alongside aggressive monetary easing after the COVID-19 outbreak.

Crypto traders now watch for a similar trend, as increased liquidity can lead investors to seek alternative assets that hedge against currency devaluation.

Macro analysts describe the situation as a “liquidity tug-of-war” between Washington and Beijing. The Fed is balancing inflation and financial stability, while the PBOC seeks to promote growth without fueling further debt. The outcome will influence risk appetite and set the tone for asset performance in 2025.

Bitcoin’s Macro Outlook Depends on Ongoing Liquidity

Bitcoin’s price has remained steady in recent weeks, staying within a narrow band as traders weigh the impact of central bank actions.

The pioneer crypto shows signs of consolidation, with Coinglass data indicating open interest dropped from above 100,000 contracts in October to near 90,000 in early November. This decrease signals caution among derivatives traders.

Despite subdued activity, the environment could become positive for Bitcoin if global liquidity continues to grow. Lower inflation in the US, paired with an expanding money supply, favors risk-taking.

Many institutional investors now consider Bitcoin a store of value, especially when monetary expansion puts pressure on the purchasing power of traditional currencies.

However, Bitcoin’s rally may depend on the decisions of central banks. If the Fed reduces liquidity too soon through scaled-back repo operations or unexpected rate hikes, any positive momentum could quickly vanish.

Likewise, if China’s stimulus fails to revive its economy, global risk sentiment may weaken, impacting speculative assets.

The next several weeks will show whether central banks maintain liquidity support or prioritize inflation control. For Bitcoin, the outcome could decide if 2026 brings another strong bull run or just continued consolidation.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up