Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Oct)

Japan Trade Balance (Customs Data) (SA) (Oct)A:--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q3)

Japan GDP Annualized QoQ Revised (Q3)A:--

F: --

China, Mainland Exports YoY (CNH) (Nov)

China, Mainland Exports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)--

F: --

P: --

Canada Leading Index MoM (Nov)

Canada Leading Index MoM (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

Mexico CPI YoY (Nov)

Mexico CPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

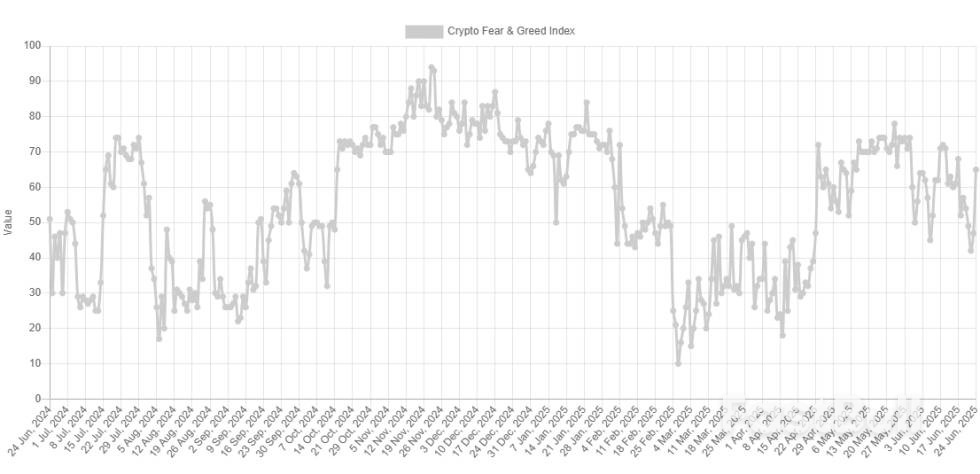

As Bitcoin and other digital assets recover, data shows the sentiment among cryptocurrency investors has returned to a state of greed.

As Bitcoin and other digital assets recover, data shows the sentiment among cryptocurrency investors has returned to a state of greed.

The “Fear & Greed Index” refers to an indicator made by Alternative that measures the net sentiment held by the average trader in the Bitcoin and wider cryptocurrency spaces.

The index uses the data of the following five factors to determine the market sentiment: trading volume, volatility, market cap dominance, social media sentiment, and Google Trends.

The metric represents the calculated mentality as a score lying between 0 and 100. The former end point corresponds to a state of maximum fear, while the latter one to that of maximum greed.

Here’s what the index says regarding the current sentiment among the investors:

As displayed above, the Bitcoin Fear & Greed Index has a value of 65, which suggests the traders currently share a majority sentiment of greed. This is a notable change compared to yesterday, when the indicator was sitting at 47, meaning that the investor mentality was overall neutral.

The holder sentiment earlier declined as a result of the geopolitical situation surrounding the Israel-Iran conflict. Following the announcement of a ceasefire between the nations, prices bounced back and it would appear that with them, so did the investor mood.

The ceasefire has since been violated, so it’s possible that tomorrow’s Fear & Greed Index would be less bullish. That said, Bitcoin has held surprisingly well despite the news, which could imply that the sentiment may also remain the same.

Historically, BTC and digital assets in general have tended to move in the direction that goes against the expectations of the investors. This means that an overly greedy market makes tops likely, while an extremely fearful one bottoms.

At present, the level of greed in the market isn’t too strong, but the fact that it has seen a notable jump alongside the recovery run could still be to take note off. In the scenario that hype keeps increasing in the coming days, another reversal could turn more probable for Bitcoin and company.

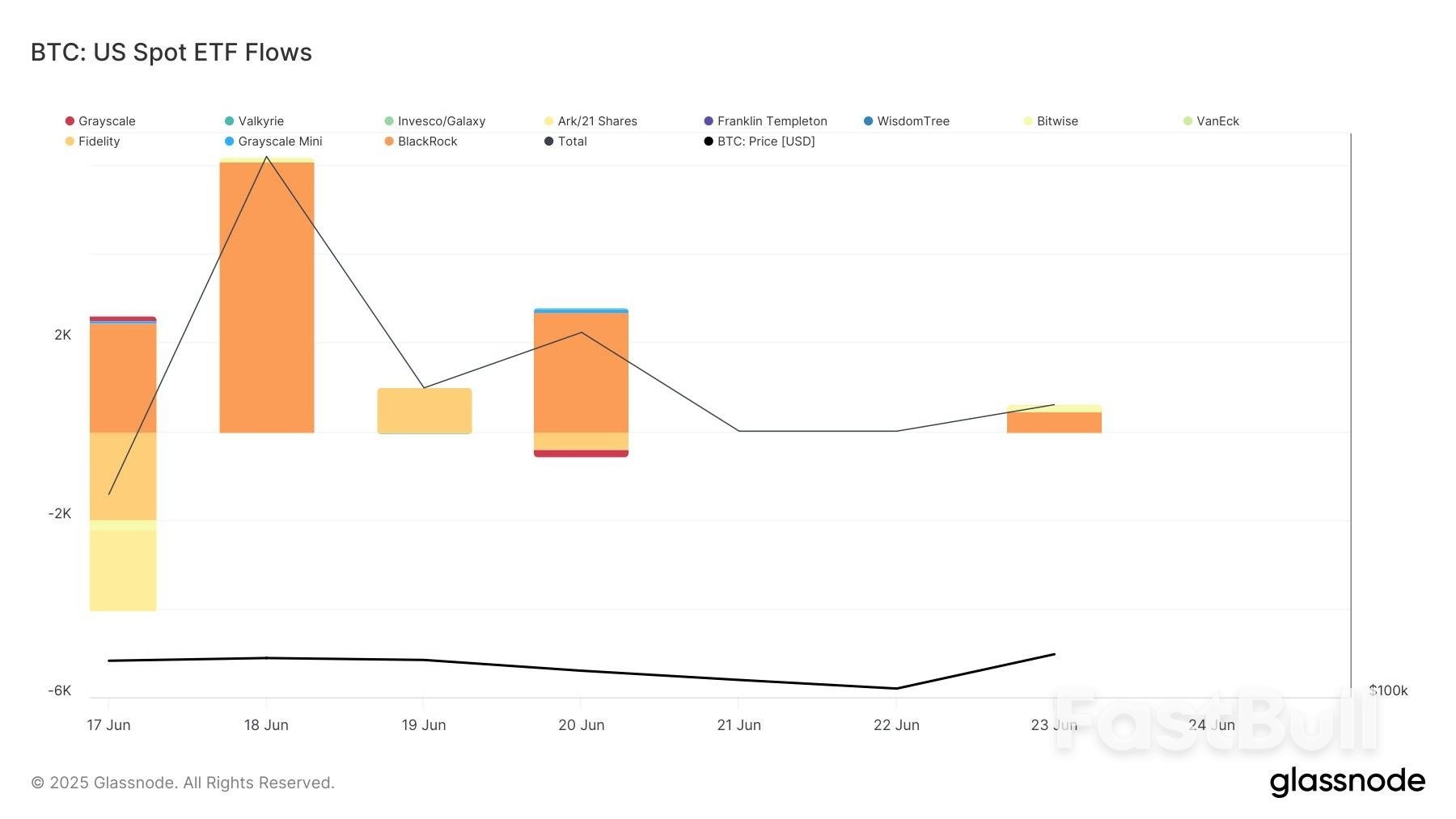

In some other news, the US-based Bitcoin spot exchange-traded funds (ETFs) saw net inflows yesterday, 23rd June, as pointed out by the analytics firm Glassnode in an X post.

As displayed in the above graph, the US Bitcoin spot ETFs saw net inflows of around 598 BTC on this date, despite the geopolitical tensions. “Although the inflows were modest, no major outflows were recorded either, which is notable signal of investor confidence,” notes Glassnode.

Bitcoin has already made recovery beyond the level it was trading at before the plunge, as its price is now back at $106,000.

Gold (XAUUSD) quotes are forming grounds for a rebound, although the outlook remains mixed. The gold (XAUUSD) forecast for today, 25 June 2025, suggests a potential recovery with growth towards 3,350 USD.

Gold (XAUUSD) prices strengthened to 3,300 USD, rebounding from a two-week low. Discover more in our analysis for 25 June 2025.

Gold (XAUUSD) quotes recovered to 3,300 USD per troy ounce on Wednesday, moving away from their lowest level in two weeks. Market participants are evaluating the durability of the ceasefire between Iran and Israel.

Today, preliminary US intelligence assessments revealed that the recent strikes on three Iranian nuclear sites only temporarily stalled Tehran's nuclear programme, which fuels concerns over possible escalation.

The ceasefire brokered by the US appears fragile, with both parties accusing each other of attacks shortly after the truce began.

On the monetary policy front, US Federal Reserve Chairman Jerome Powell said that interest rates will likely remain unchanged until the impact of new tariffs becomes clearer. However, he did not rule out a possible rate cut in July.

These comments contrast with statements from other Fed officials who earlier supported policy easing amid signs of slowing inflation and a weakening labour market.

The gold (XAUUSD) forecast is mixed.

On the H4 chart, gold (XAUUSD) is recovering, although sellers still hold the initiative. XAUUSD rebounded from the lower boundary of the descending channel at 3,295, but to strengthen this momentum, prices must consolidate above 3,350. This would also confirm the emergence of bullish sentiment in the market. If so, the next upside target could be 3,393.

If the rebound fails to gain traction, the market may retreat back to 3,295, increasing market pressure.

Source: RoboForex

Source: RoboForex

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up