Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Treasury Secretary Scott Bessent suggested Jerome Powell should step down from the Fed board in May 2026. Trump seeks a dovish successor amid rising pressure and ongoing Fed leadership speculation.

US President Donald Trump said he reached a deal with Indonesia, without providing any specifics of what is included in the accord.

“Great deal, for everybody, just made with Indonesia. I dealt directly with with their highly respected President. DETAILS TO FOLLOW!!!” the US president posted Tuesday on social media.

The announcement comes after the US president last week threatened to impose a 32% tariff on Indonesian goods starting Aug. 1. The country afterward sent its top trade negotiator to meet with Trump Cabinet officials in order to to secure an agreement.

Indonesia’s Coordinating Minister for Economic Affairs Airlangga Hartarto presented several business deals in meetings with US officials, including US Trade Representative Jamieson Greer, Commerce Secretary Howard Lutnick and Treasury Secretary Scott Bessent, according to the ministry.

An agreement with Indonesia would be the fourth trade framework Trump has announced with foreign governments, after Vietnam and the UK. The US and China also reached a tariff truce that includes the planned resumption of critical minerals and technology trade between the world’s two largest economies.

Pacts announced by Trump have thus far fallen short of full-fledged trade deals, with many details left to be negotiated later. Vietnam’s leadership was caught off guard by Trump’s declaration that Hanoi agreed to a 20% tariff, and the Southeast Asian country is still seeking to lower the rate, according to people familiar with the matter.

The USDCAD has spent the past six trading days consolidating in a tight range between 1.3651 and 1.3710. On Monday, the pair moved up to test the top of that range but met sellers once again. The subsequent dip found support near 1.36697, matching yesterday’s low (and a swing low from Friday as well), before rebounding higher in today’s U.S. session on renewed dollar buying.

The pair is now once again testing the 1.3707–1.3710 resistance zone, which has capped multiple rallies since last Tuesday. Although Friday's spike—driven by U.S. tariff news—briefly pushed the pair above this area, the run higher could not be sustained for long, and buyers quickly pushed the price lower, and reestablished the 1.3710 level as resistance. That failed breakout further reinforces 1.3710 as a critical barrier.

A break and close above 1.3710 would strengthen the bullish case with work to do. The 38.2% retracement at 1.37208, followed by a test of last week’s high at 1.3730 would still need to be broken -and stay broken - to add to the bullish momentum.

On the downside, if sellers lean, watch for support at the 100-hour MA (1.3687) and the 200-hour MA (1.3659). A move below both would shift the short-term bias back in favor of the sellers.

Bottom line: Momentum is tilting higher, but a decisive move above 1.3710 is needed to confirm a bullish breakout. Until then, traders remain stuck in a range awaiting a catalyst.

● Resistance: 1.3707–1.3710 (July highs), 1.3730 (Friday high), 1.3759 (next swing level)

● Support: 1.3687 (100-hour MA), 1.3659 (200-hour MA), 1.3631

A confirmed break above the current resistance zone would turn the short-term bias bullish. Traders remain on alert for follow-through.

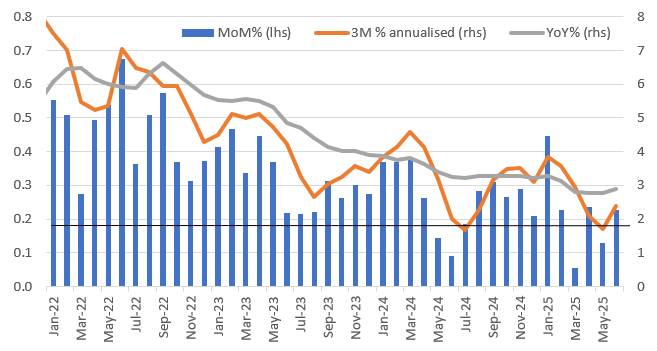

The June consumer price inflation report shows a 0.3% month-on-month reading for headline inflation (0.287% to three decimal places) and a 0.2% MoM outcome for core (0.228%) versus the consensus forecast of 0.3% for both. The details show that there was some scattered evidence of early tariff impacts on some goods components – mainly fresh fruit & vegetables, household appliance, toys, clothing and sporting goods, but this was offset to a large extent by softness in the all-important shelter component, which has an approximately 40% weighting within the core CPI basket. It rose only 0.2% MoM while new vehicle prices fell 0.3% and used cars fell 0.7% despite fears that this could be a source of inflation in coming months given substantial tariffs being applied to the sector. Airline fares fell yet again, but only by 0.1% MoM this time.

Source: Macrobond, ING

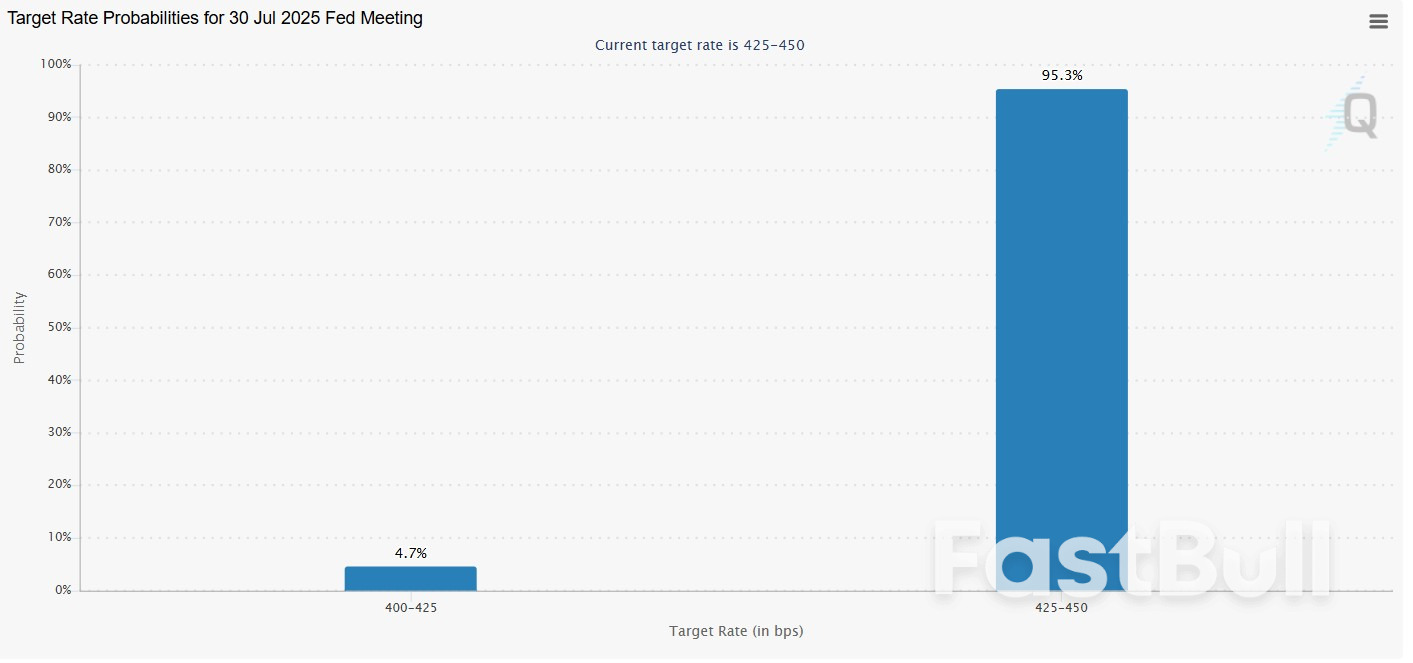

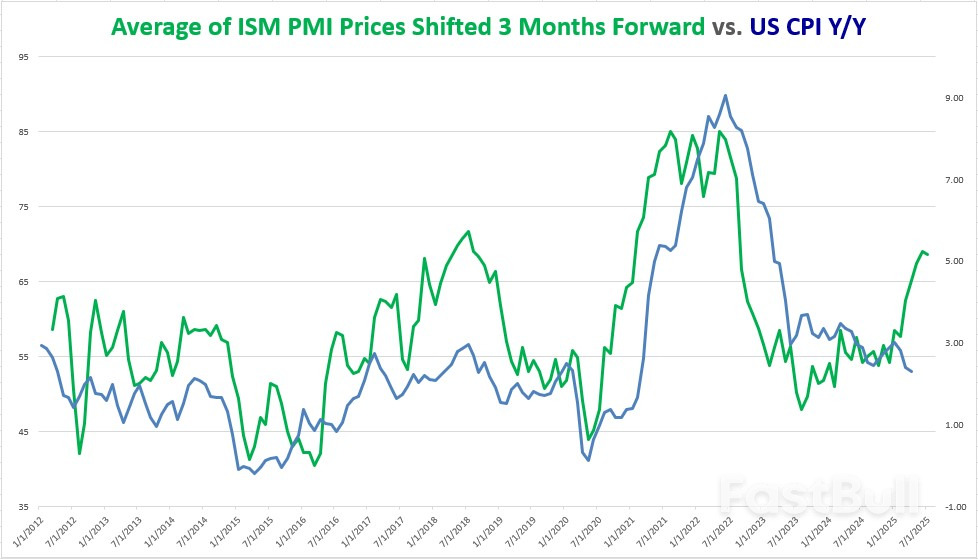

Source: Macrobond, INGThis sub-consensus core CPI figure may give President Trump an excuse to launch another salvo at Jerome Powell, but we always suspected it would be three months from April/May before the tariffs show up in force. That means the July, August and September CPI reports are where we will see the potential for 0.4%+ MoM prints. President Trump has been pushing the Fed to cut rates by 200bp to 300bp immediately, and two of his appointees to the FOMC from his first presidential term (Chris Waller and Michelle Bowman) suggested they could vote in favour of a cut as soon as the July FOMC meeting. However, the rest of the committee feels they have time to wait, especially in light of the recent firmer-than-expected June jobs report.

The Fed was stung by criticism after suggesting the post-pandemic supply shock price hikes would be “transitory”, only for inflation to hit 9% in 2022. We suspect a majority of FOMC members will want to ensure that tariffs are a one-off price change rather than something that leads to greater permanence in inflation. We doubt they will have enough evidence to be certain of that by the September FOMC meeting, so we would need to see some significant weakness in jobs to trigger a rate hike at that point. That suggests the president’s frustrations with Jerome Powell will intensify, with him set to seek a more dovish replacement for when Powell's term as Fed Chair ends early next year.

Source: Macrobond, ING

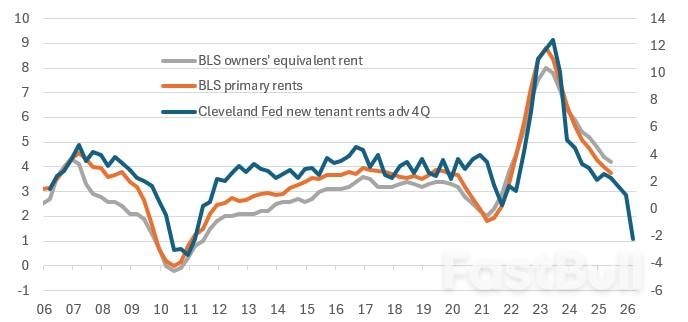

Source: Macrobond, INGNonetheless, interest rate cuts will eventually come. The cooler growth environment with a softer jobs narrative and weakening wage pressures will help ensure that inflation is indeed temporary. Moreover, the shifting dynamics of the housing market will mean housing costs, which have been a major driver of inflation in recent years, will increasingly become a source of disinflationary pressure as hinted at in the chart above using the Cleveland Fed’s new tenant rents series. With the risk that unemployment does start to climb later in the year in response to intensifying growth headwinds, we believe the Fed will be much more comfortable with cutting interest rates from the December FOMC meeting, kicking off with a 50bp move.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up