Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japanese Prime Minister Sanae Takaichi delivers a speech

Japanese Prime Minister Sanae Takaichi delivers a speech Germany Ifo Business Expectations Index (SA) (Jan)

Germany Ifo Business Expectations Index (SA) (Jan)A:--

F: --

P: --

Germany IFO Business Climate Index (SA) (Jan)

Germany IFO Business Climate Index (SA) (Jan)A:--

F: --

P: --

Germany Ifo Current Business Situation Index (SA) (Jan)

Germany Ifo Current Business Situation Index (SA) (Jan)A:--

F: --

P: --

Brazil Current Account (Dec)

Brazil Current Account (Dec)A:--

F: --

P: --

Mexico Unemployment Rate (Not SA) (Dec)

Mexico Unemployment Rate (Not SA) (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)A:--

F: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)A:--

F: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)A:--

F: --

P: --

U.S. Durable Goods Orders MoM (Nov)

U.S. Durable Goods Orders MoM (Nov)A:--

F: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)A:--

F: --

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Jan)

U.S. Dallas Fed General Business Activity Index (Jan)A:--

F: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)--

F: --

P: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. Yield--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The Trump administration's National Security Strategy makes it clear that "national security" is not just about defense spending.

The Trump administration's National Security Strategy makes it clear that "national security" is not just about defense spending. It sets out a broader agenda that links security to how the country is protected, powered, supplied, and technologically equipped.

It prioritises border control and stronger enforcement over entry routes, treating internal security and control of access as foundational. It also highlights the need to protect infrastructure at home—from power systems to transport and communications—so the country can withstand disruption from natural disasters, cyber threats, or hostile actors.

On the military side, the strategy emphasises a more capable and ready force, including missile defense with a homeland focus under the "Golden Dome" concept. Alongside this, it calls for rebuilding the industrial base, with more production capacity onshore and supply chains that can scale in a crisis rather than relying on vulnerable overseas links.

The document also frames energy strength as strategic, explicitly including traditional fuels and nuclear, and points to the importance of the equipment and infrastructure that supports reliable energy supply. It elevates critical minerals as a national security issue as well, recognising that many modern systems depend on materials with concentrated or geopolitically sensitive supply chains.

Finally, it stresses staying ahead in critical technologies—including areas that shape both economic power and military capability—while protecting intellectual property and maintaining an advantage over rivals.

Below we translate the priorities from Trump's National Security Strategy into seven practical lanes, so it's clear what the focus is, why it matters, and which stocks sit closest to it for references (not recommendations).

Border control and homeland security sit alongside "peace through strength." The strategy is clear about modernising the military, improving readiness, and building deterrence, including missile defense for the homeland.

This lane usually has the most direct link to government defence spending and orders, because it includes prime contractors, shipbuilding, secure communications, and mission systems.

What to watch: defence budget details, big programme funding, order backlogs, and major contract wins.

Risks: spending can arrive in waves, not smoothly, and big projects can run over budget or get delayed.

Watchlist: Lockheed Martin (LMT), RTX (RTX), Northrop Grumman (NOC), General Dynamics (GD)

The strategy treats the industrial base as part of national security. The message is simple: the U.S. wants the ability to build things at home and scale production when needed.

This lane is often about the "builders and enablers" behind reshoring and national buildout: industrial automation, equipment, aerospace/defense components, and the machinery that powers investment cycles.

What to watch: signs of rising factory and infrastructure spending, order growth, and company guidance on backlog and capacity.

Risks: these businesses are more tied to the economic cycle, so a slowdown can hit demand even if the policy direction stays supportive.

Watchlist: Honeywell (HON), Teledyne Technologies (TDY), Caterpillar (CAT), Deere (DE)

The strategy explicitly frames energy as strategic and includes oil, gas, coal, and nuclear. The point is energy strength at home and the ability to support industry and resilience.

For investors, this is not only about oil prices. It also touches the "plumbing" of energy: grid equipment, electrification hardware, grid buildout services, firm power, and LNG infrastructure.

What to watch: grid upgrade spending, bottlenecks in equipment, policy signals around energy infrastructure, and power demand trends.

Risks: permitting and regulation can slow projects, and commodity-linked parts of the theme can be volatile.

Watchlist: GE Vernova (GEV), Constellation Energy (CEG), Exxon Mobil (XOM)

The strategy talks about reducing dependence on outside powers for key inputs and expanding access to critical minerals and materials.

This matters because modern defence systems, grids, electrification, and advanced manufacturing all rely on materials with concentrated supply chains. Investors often watch not just mining, but also refining and processing capacity.

What to watch: new processing/refining capacity, offtake agreements, permitting progress, and project timelines.

Risks: commodity prices swing, project timelines slip, and many names are more sensitive to headlines than earnings.

Watchlist: MP Materials (MP), USA Rare Earth (USAR), Critical Metals Corp (CRML), Lithium Americas (LAC)

Low-cost drones versus expensive defenses is one of the real-world problems the strategy highlights. It is also a homeland issue, not just a battlefield issue.

Separately, the FY2026 defence bill policy statement points to expanding counter-drone authority through the SAFER SKIES Act.

This lane tends to be higher volatility because a lot of the companies are smaller and contract-driven.

What to watch: contract wins, delivery schedules, and regulatory/authority changes for counter-drone activity.

Risks: smaller companies can swing sharply on single headlines or single contracts, and competition moves fast.

Watchlist: AeroVironment (AVAV), Kratos (KTOS), Ondas (ONDS)

National security increasingly depends on satellites for communications, navigation, and surveillance. This theme sits naturally alongside the strategy's focus on modern defence and protecting the homeland.

This lane includes launch and space systems, satellite communications, and earth observation.

What to watch: contract wins, launch cadence, satellite deployment milestones, and funding needs.

Risks: timelines are long, execution risk is real, and newer names can be valuation-sensitive.

Watchlist: Rocket Lab (RKLB), Viasat (VSAT), Planet Labs (PL), AST SpaceMobile (ASTS)

The strategy explicitly calls for a modern nuclear deterrent and also includes nuclear within energy dominance.

For investors, nuclear spans several different "sub-stories": uranium supply, fuel services, nuclear components, and advanced reactor development.

What to watch: long-term contracting trends, fuel supply policy signals, project approvals, and buildout timelines.

Risks: the uranium/nuclear trade can be cyclical and headline-driven, and advanced nuclear names carry higher uncertainty.

Watchlist: Cameco (CCJ), Energy Fuels (UUUU), Uranium Energy (UEC)

National security is no longer a single sector story. It is a stack—borders, resilience at home, deterrence, domestic production, energy, materials, and strategic tech. The market will react quickly to the narrative, but the real opportunity is in tracking what actually gets funded and built. Use these seven lanes as a framework and focus on the proof points—budgets, awards, approvals, and buildouts—because that is where the strategy stops being words and starts becoming activity.

Britain's biggest banks including HSBC (HSBA.L), and NatWest (NWG.L) are set to follow their European rivals and lift their key profit targets when they report annual earnings in the coming weeks, people close to the matter said.

HSBC is expected to raise its return on tangible equity (ROTE)outlook - a key measure of profitability - above current guidance of "mid teens or better", while NatWest is likely to upgrade its guidance for 2027, currently at 15%, to as much as 17%, two people said.

Barclays (BARC.L), which in October said it expected an ROTE of 12% or above in 2026, should also lift its targets, a third source familiar with the lender said.

Analysts have also said they believe Barclays and HSBC can raise their targets by as much as 200 basis points when they set out guidance for the coming years. They report their earnings on February 10 and February 25, respectively.

In continental Europe, many banks have already lifted their profit goals, signalling confidence higher margins will last for years.

Increased profitability targets show banks expect to keep benefiting from benign interest rate conditions and continued loan and fee income growth, although aiming higher is not without risks and can leave investors disappointed if economies stutter.

Lloyds Banking Group (LLOY.L) could also lift its targets this year, aiming for ROTE to rise to as much as 18.5% by 2028 from this year's goal of more than 15%, analysts at Jefferies said this month.

The banks all declined to comment.

"UK banks have benefited from earnings resilience lasting longer than initially expected, supported by higher interest rates, robust credit quality and tighter cost control," said Peter Rothwell, head of banking at KPMG UK.

Lloyds and Deutsche Bank (DBKGn.DE) report full-year earnings on Thursday, kicking off the European bank reporting season following a bumper set of numbers on Wall Street.

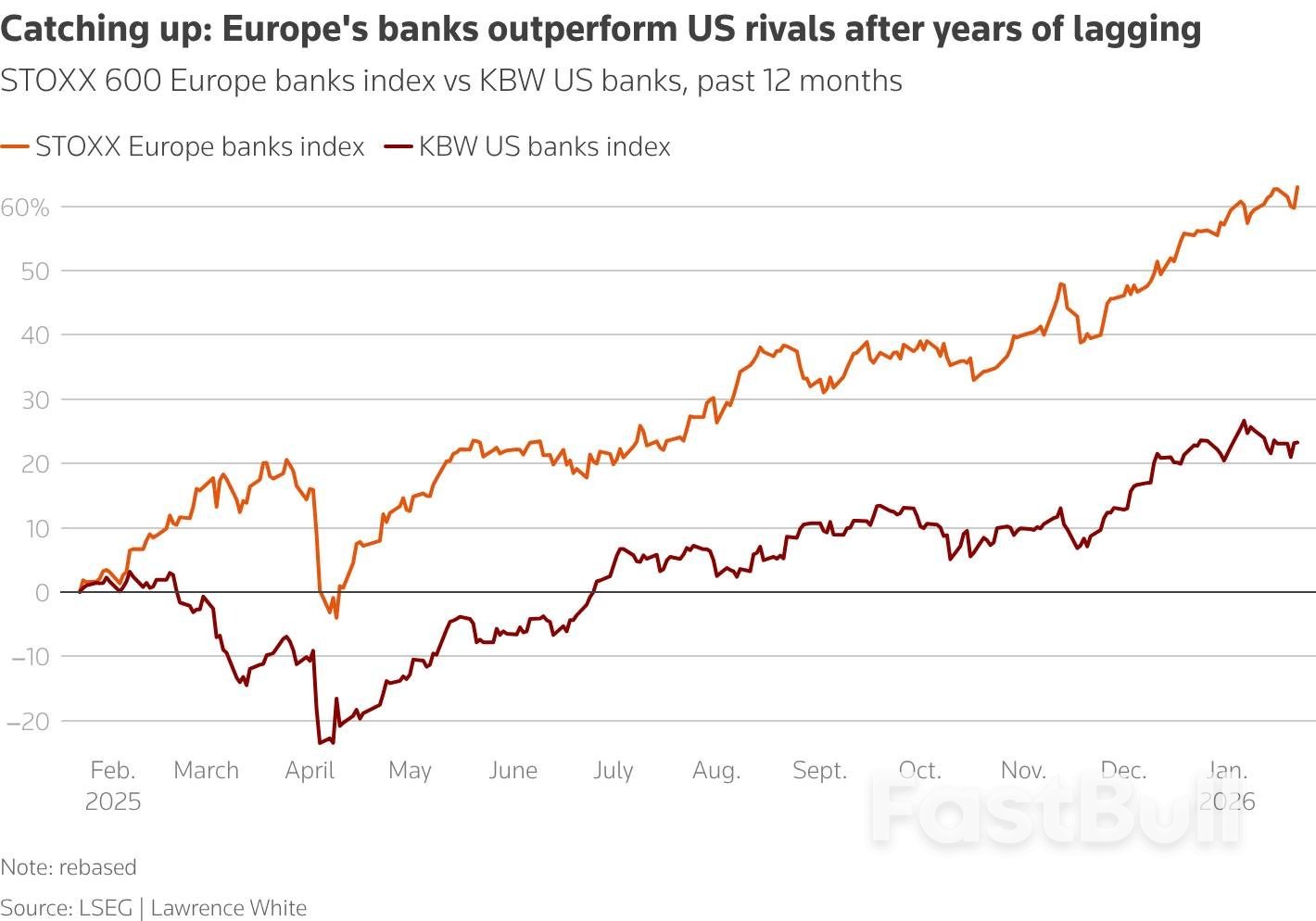

After years of poor profitability and share performance following the financial crisis, European banking stocks (.SX7P) have more than doubled since early 2024 and risen 60% in the past year - far outpacing U.S. banks.

A chart shows STOXX 600 Europe banks index outperforming KBW US banks in the past 12 months

A chart shows STOXX 600 Europe banks index outperforming KBW US banks in the past 12 monthsAmong European rivals, Spanish banks Santander (SAN.MC) and BBVA (BBVA.MC) have grown income while keeping costs under control, raising expectations for improved targets.

JPMorgan expects BBVA to have delivered an around 20% ROTE in 2025, broadly in line with 2024, with profitability rising to 22% in 2026 and reaching 26% by 2028.

Santander could target a ROTE by 2028 of around 19–20%, up from 16.1% as of September, Barclays analysts said.

Germany's Deutsche Bank in November set a new ROTE target for 2028 of greater than 13%, up from its 2025 target of 10%.

Analysts expect Deutsche to confirm it met the 2025 target, alongside figures that could show its biggest profit since 2007.

Volatile markets and a flurry of corporate deals should also lift investment bank earnings, buoying the likes of Deutsche, Barclays and UBS (UBSG.S), after most Wall Street banks reported rising revenues and a bullish outlook.

France's Societe Generale (SOGN.PA), BNP Paribas (BNPP.PA) and Credit Agricole (CAGR.PA) may buck the trend as higher costs and domestic competition weigh on profits, analysts said.

Ethereum's native token, Ether (ETH), showed signs of recovery after dropping by more than 6% during the weekend.

As of Jan. 26, ETH/USD was up by over 3% during the Asian session, mirroring rebounds across the crypto market. The pair rose despite a growing macro risk-off sentiment, with US stock futures recording losses and gold reaching over $5,000 at the start of the week.

ETH/USDT vs. Nasdaq Futures and Gold daily performances. Source: TradingView

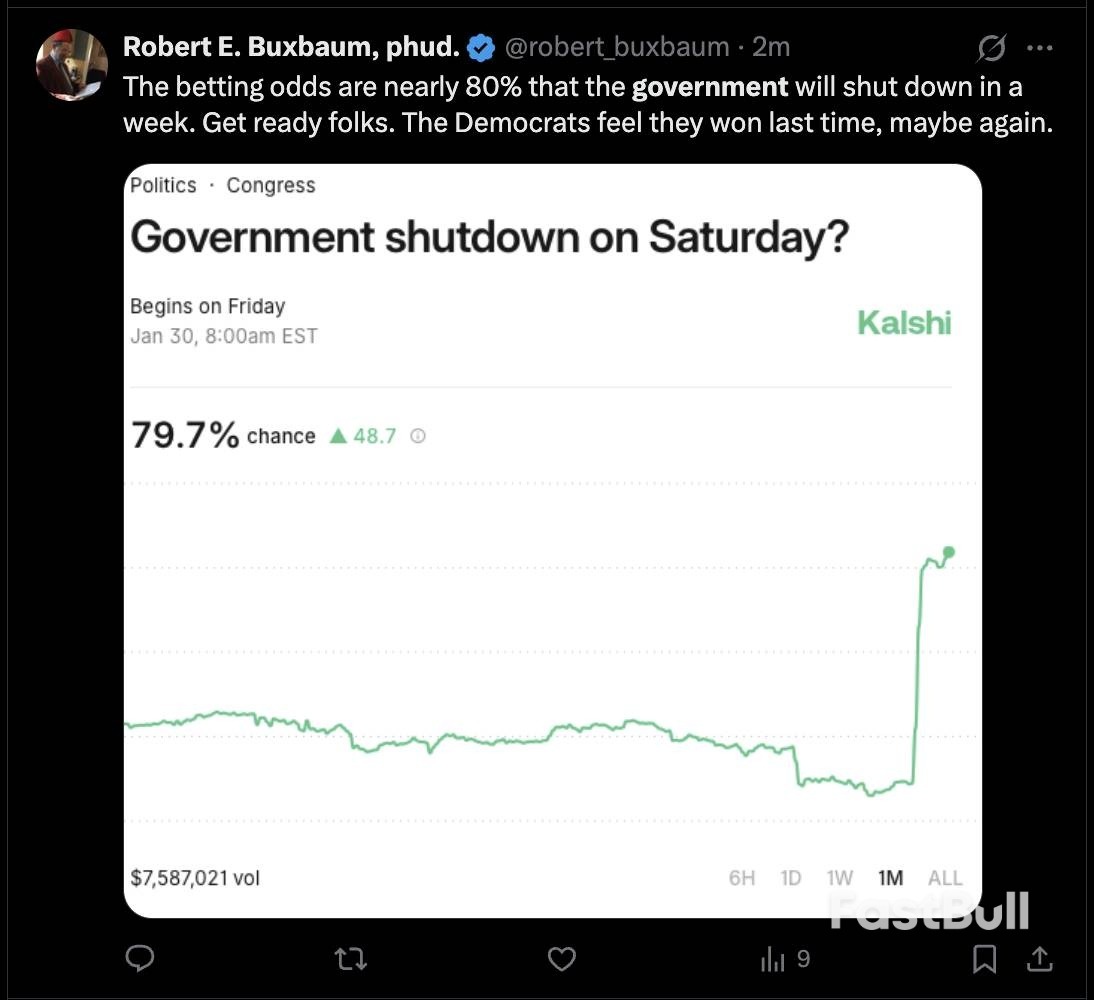

ETH/USDT vs. Nasdaq Futures and Gold daily performances. Source: TradingViewOver the weekend, markets grew uneasy as renewed worries surfaced about a possible US government shutdown, with lawmakers still divided over funding and the risk of a lapse in federal operations.

Source: X

Source: XIn the forex market, attention also turned to Japan, where traders noted the possibilities of the New York Fed preparing to support Japanese officials in a direct yen-defence intervention.

The US dollar logged its steepest weekly drop since May, creating dip-buying opportunities in the Ether market and leading to a modest recovery.

US dollar index daily chart. Source: TradingView

US dollar index daily chart. Source: TradingViewUS-listed spot Ethereum ETFs saw about $611.17 million in net outflows over the past week, a sign that institutional demand for Ether has weakened in the near term.

Spot Ethereum ETF net flows. Source: SoSoValue

Spot Ethereum ETF net flows. Source: SoSoValueThat pullback matters because ETF flows can act as a steady source of spot buying when sentiment improves. Instead, the outflows suggest large investors were reducing ETH exposure, not adding it.

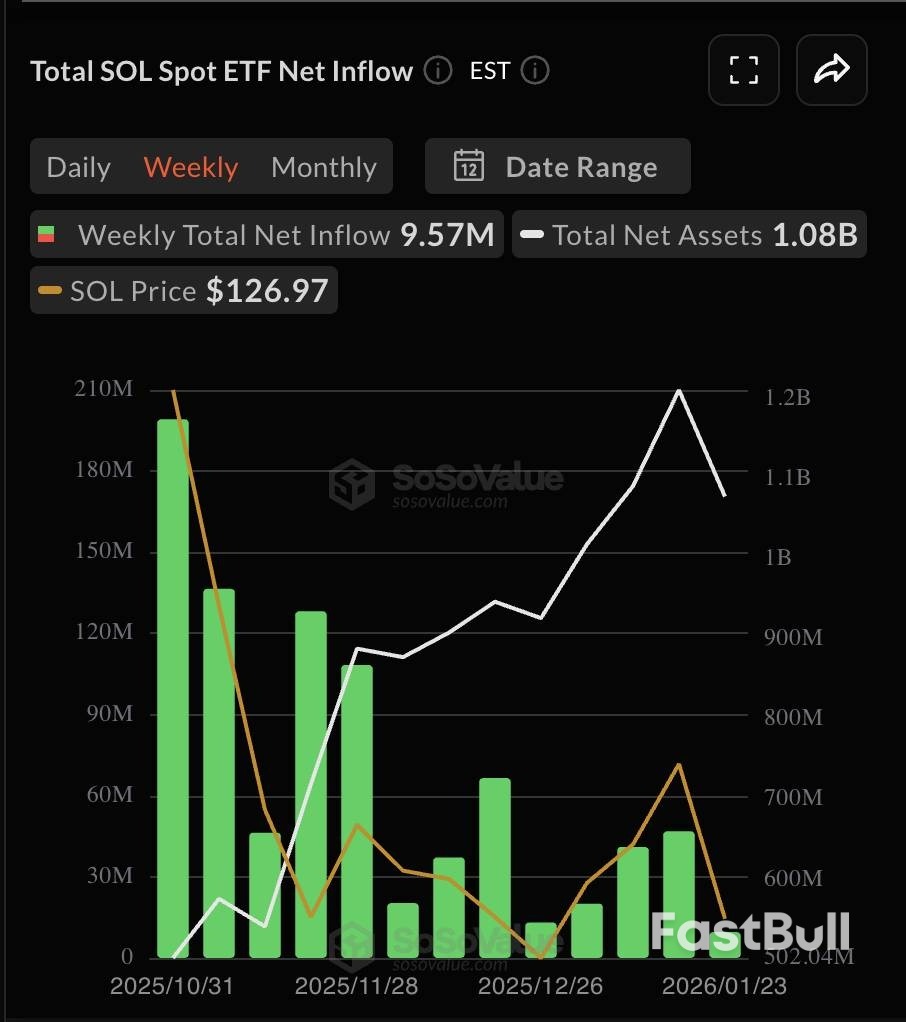

At the same time, traders have been rotating into other large-cap themes—most notably Solana—further thinning Ether's bid.

Spot Solana ETF net flows. Source: SoSoValue

Spot Solana ETF net flows. Source: SoSoValueThe result is a rebound that looks more like short-term dip-buying than the start of a stronger, institution-led uptrend.

Japan's 10-year government bond yields have been climbing toward multi-decade highs as investors demand a higher risk premium amid fresh fiscal-spending concerns and Japan's debt load, which sits above 230% of GDP.

Japan's 10-year bond yield daily chart. Source: TradingView

Japan's 10-year bond yield daily chart. Source: TradingViewIn my view, higher JGB yields can pull capital back toward Japan and reduce the amount of cheap funding circulating through global markets, conditions that typically pressure risk assets.

The macro drag intensified after the Bank of Japan struck a more hawkish tone in its latest outlook, reinforcing expectations that Japan's rate regime may continue shifting higher.

In practice, firmer yields can also strengthen the yen, increasing the risk of a "yen carry-trade unwind," an episode that has previously coincided with broader de-risking across crypto, including Ethereum.

ETH/USD appears to have broken down from an ascending triangle, slipping below the rising support trendline after repeatedly failing near the flat resistance band around the low-$3,300s.

ETH/USD daily price chart. Source: TradingView

ETH/USD daily price chart. Source: TradingViewThe move also leaves ETH trading under its key moving averages (20-day near $3,049 and 50-day near $3,104), reinforcing bearish momentum. RSI has cooled to sub-40, suggesting sellers remain in control.

If the breakdown holds, the pattern's measured move points toward the $2,380 area as the next downside target.

House Majority Whip Tom Emmer delivered a sweeping assessment of the current U.S. policy direction, crediting President Donald Trump’s administration and Republican leadership with driving economic growth and establishing pro-crypto regulation. Emmer argued that the first year of the administration has yielded historic outcomes in a short period.

Echoing Trump's inaugural theme of a "Golden Age of America," Emmer asserted that close coordination between the White House and congressional Republicans has been key to their progress.

"From passing the largest tax cut in American history to securing the border to rooting out the worst waste, fraud, and abuse that has plagued our government for way too long to making America the crypto capital of the world – President Trump, his all-star cabinet, and Republicans in Congress have worked in tandem to accomplish the impossible," he stated.

Emmer framed regulatory clarity for digital assets as a central economic goal. He presented the development of crypto policy as a powerful tool to attract investment, foster innovation, and secure high-skilled jobs, ultimately reinforcing America's global competitiveness.

He also noted that these objectives were achieved despite political friction, criticizing Democratic resistance and shutdown tactics as obstacles that ultimately failed to derail the Republican agenda. Emmer characterized the current momentum as just the beginning, suggesting that economic, security, and digital asset initiatives are designed to expand significantly beyond their first-year results.

While the administration's supporters describe these policies as transformative, critics raise concerns about potential long-term risks to the economy and democratic institutions.

Analysts point to several areas of concern:

• Fiscal Impact: The One Big Beautiful Bill Act is noted for expanding the federal deficit while simultaneously reducing healthcare access for millions.

• Labor Shortages: Labor economists warn that negative net migration is contributing to workforce shortages, which could weigh on GDP growth.

• Government Dysfunction: The 43-day government shutdown in 2025 is widely seen as an economically damaging failure of negotiation, irrespective of which party is held responsible.

• Governance Concerns: Civil service purges and the expanded domestic use of the military have prompted questions about the erosion of checks and balances.

In response, advocates for digital assets maintain that establishing clear crypto regulations can improve compliance, increase transparency, and facilitate capital formation. They argue that regulated innovation, balanced with prudent oversight, could become a significant driver of productivity and sustained economic growth.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up