Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Systematic risk affects all traders, no matter the strategy or asset class. It comes from market-wide forces—like interest rates, inflation, or geopolitical shifts—that influence entire sectors at once.

Systematic risk affects all traders, no matter the strategy or asset class. It comes from market-wide forces—like interest rates, inflation, or geopolitical shifts—that influence entire sectors at once. Unlike unsystematic risk, it can’t be avoided through diversification. This article breaks down what systematic risk is, how it’s measured, and how traders may incorporate it into their analysis.

Systematic risk refers to the kind of risk that affects entire markets or economies, rather than just individual assets. It’s the result of large-scale forces—like inflation, interest rates, central bank policy, geopolitical conflict, or economic slowdowns—that ripple through multiple asset classes at once.

A sharp rise in interest rates, for example, tends to push bond prices lower and can drag down equity valuations as borrowing costs climb and consumer spending slows. Similarly, during a global event like the 2008 financial crisis or the COVID-19 shock in 2020, almost all sectors saw simultaneous drawdowns. These events weren’t tied to poor management or bad earnings reports—they were macro-level shifts that hit everything.

Because it’s a largely undiversifiable risk, systematic risk is a key consideration for traders assessing overall market exposure. It often drives correlation between assets, particularly in times of stress. This is why equities, commodities, and even currencies can start to move in the same direction during periods of heightened volatility.

So, can systematic risk be diversified against? Only relatively speaking. Traders and investors may shift into defensive positions to limit potential drawdowns (e.g. gold, bonds, healthcare stocks vs tech companies). However, no matter how diversified a portfolio is, it remains exposed to this kind of risk because it’s tied to broader market movements rather than asset-specific events.Note: systematic risk differs from systemic risk. The systemic risk definition relates to the potential collapse of the financial system, such as in a banking crisis. It is rare but severe.

Systematic risk is broad and market-driven. Unsystematic risk, on the other hand, is specific to a company or sector. It might come from a product failure, a major lawsuit, or a change in management. For example, if a tech company misses earnings due to poor execution, that’s unsystematic. If the entire sector drops because of a global chip shortage or policy change, that’s systematic.

Unsystematic risk can be reduced through diversification. Holding assets across industries may help spread exposure to isolated events. But systematic risk can’t be avoided by simply adding more assets. It affects everything to some extent.

That’s why traders track both systematic and unsystematic risk—understanding where their risk is concentrated and whether their exposure is tied to broad market movements or individual events. Clear separation of the two may help traders analyse potential drawdowns more accurately.

Systematic risks tend to stem from structural or macroeconomic forces, and while they can’t be avoided, traders can track them to better understand the environment they’re operating in. Below are some of the most common types of systematic risk and how they influence market-wide movement.

Central banks play a huge role in shaping market conditions. When interest rates rise, borrowing becomes more expensive, which tends to slow down spending and investment. That usually puts downward pressure on risk assets like equities. Conversely, rate cuts or quantitative easing often lead to a surge in asset prices as liquidity improves.

Traders closely monitor central bank statements and economic projections, especially from institutions like the Federal Reserve, the Bank of England, and the European Central Bank.

Inflation affects everything from consumer behaviour to corporate earnings. Higher inflation can reduce real returns and push central banks to tighten policy. Deflation, though less common, signals weak demand and falling prices, which also tends to hurt equities. Commodities, currencies, and bonds often react sharply to inflation data.

Booms and busts are among the most well-known examples of systematic risk, influencing everything from job creation to earnings growth. During expansions, risk appetite tends to rise. In downturns, investors often shift towards defensive assets or cash. GDP figures, manufacturing data, and consumer spending are key indicators traders watch.

Elections, wars, trade tensions, and sanctions can drive sharp market reactions. These events introduce uncertainty, increase volatility, and can disrupt global supply chains or investor sentiment.

Panic selling or sudden shifts in positioning can cause assets to move together, even if fundamentals don’t support it. During liquidity crunches, correlations spike and markets can move sharply on little news. This is often driven by leveraged positioning unwinding or large institutions adjusting risk.

Systematic risk can’t be removed, but it can be measured, and that may help traders understand how exposed they are to broader market swings.

One of the most widely used tools is beta. Beta shows how much an asset moves relative to a benchmark index. A beta of 1 indicates that the asset typically moves in the same direction and by a similar percentage as the overall market. Above 1 means it’s more volatile than the market; below 1 means it’s less volatile. For example, a high-growth stock with a beta of 1.5 would typically move 15% when the market moves 10%.

Another approach is Value at Risk (VaR), which estimates the potential loss on a portfolio under normal market conditions over a specific timeframe. It doesn’t isolate systematic risk but gives a sense of how exposed the overall portfolio is.

Traders also watch the VIX—often called the “fear index”—which tracks expected volatility in the S&P 500. When it spikes, it usually signals rising market-wide risk.

More complex models like the Capital Asset Pricing Model (CAPM) use beta and expected market returns to price risk, but some traders use these tools to get a clearer picture of how exposed they may be to movements they can’t control.

Systematic risk isn’t just a background concern—it plays a direct role in how traders assess the market, structure portfolios, and manage exposure. By understanding how market-wide forces are likely to affect asset prices, traders can adjust their approach to reflect broader conditions rather than just focusing on technical analysis or individual names.

When systematic risk is elevated—during tightening cycles, political unrest, or global economic slowdowns—traders may scale back position sizes or reduce leverage. The aim is to avoid being caught in a correlated sell-off where multiple positions move against them at once. It's common to see increased cash holdings or a shift towards lower beta assets in these periods.

Systematic risk also shapes how capital is distributed across asset classes. For example, during periods of strong economic growth, traders may lean into equities, particularly cyclical sectors. In contrast, during uncertain or contractionary periods, there may be a move towards defensive sectors, fixed income, or commodities like gold. Some rotate between assets based on macro trends to stay aligned with the dominant forces driving markets.

Understanding systematic risks may help traders prepare for potential market reactions. A trader can analyse upcoming interest rate decisions, inflation prints, or geopolitical tensions and assess which assets are likely to be most sensitive. If recession risk increases, they may expect higher equity volatility and reassess exposure accordingly.

As systematic risk rises, correlations between assets often increase. Traders who normally count on diversification may find their positions moving together. Keeping track of these shifts may help reduce false confidence in portfolio structure and encourage more dynamic risk controls.

As mentioned above, systematic risk is mostly unpredictable and fully unavoidable. There are some other things you should consider when trying to analyse it. Here are a few points traders often keep in mind:

FAQ

What Is Systematic Risk?

Systematic risk refers to the type of risk that affects an entire market or economy. It’s driven by macroeconomic forces such as interest rates, inflation, economic health, and geopolitical events. Because it impacts broad segments of the market, systematic risk cannot be eliminated through diversification.

What Is Systematic Risk vs Unsystematic Risk?

Systematic risk is market-wide and linked to broader economic conditions. Unsystematic risk is asset-specific and tied to events like company earnings, leadership changes, or industry developments. According to theory, unsystematic risk can be reduced by holding a diversified portfolio, while systematic risk remains even with strong diversification.

What Are the Five Systematic Risks?

The main categories include interest rate risk, inflation risk, economic cycle risk, geopolitical risk, and currency or exchange rate risk. Each can affect multiple asset classes and contribute to broad market shifts.

Can You Diversify Systematic Risk?

No. While diversification may help reduce unsystematic risk, systematic risk affects most assets. It might be managed, not avoided.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

(Aug 22): A key measure of euro-area pay growth jumped, supporting caution by the European Central Bank (ECB) on further reducing interest rates.

Second-quarter negotiated wages rose 4% from a year ago, the ECB said Friday. That’s up from 2.5% in the first three months of the year, though still below the 5.4% peak recorded in 2024.

The ECB’s confidence in stabilising inflation at 2% rests on salary gains moderating and price growth in the labour-intensive services sector — still stuck near 3% — abating.

Its own pay tracker for the 20-nation eurozone signals a significant retreat into the start of next year. While the Bundesbank reported a strong boost in German wages this quarter, it also sees a softening ahead “due to declining inflation rates and the weak economic environment”.

The ECB is widely expected to leave the key deposit rate at 2% when it reconvenes after its summer break in September, extending a pause that began last month following a yearlong campaign of cuts.

Most officials see rates in a good place, at a level that neither restricts nor supports economic activity. Some, though, have suggested further reductions shouldn’t be excluded.

Earlier, when analysing the chart of the UK’s FTSE 100 stock index (UK 100 on FXOpen), we outlined an ascending channel and anticipated a scenario with a continued upward trend and an attempt to establish a new historical high.

Since then:

→ The index has risen by almost 5%. The channel structure has shifted slightly, but not dramatically – after adjustment, it remains relevant given the latest price dynamics.

→ Yesterday, the stock index climbed to 9,325, thereby setting an all-time high.

Bullish sentiment was supported by news of a shrinking public sector deficit and increased private sector output. How might the situation develop further?

Technical Analysis of the FTSE 100 Chart

From a bullish perspective:

→ The market remains in bullish territory.

→ The price successfully broke through the resistance zone at 9,180–9,200 (in effect since late July).

→ The 0→1 impulse was strong, signalling buyers’ dominance.

→ The price remains above the 50% Fibonacci retracement of the 0→1 impulse, which may serve as support during a pullback.

→ Additional support could come from the green zone, where bulls were strong during the breakout above the 9,180–9,200 resistance area.

From a bearish perspective: the upper boundary of the channel has confirmed its role as resistance. At the same time, peaks 1 and 2 have formed:

→ They show signs of a bearish Double Top pattern, creating bearish divergence with the RSI indicator.

→ The fact that the second peak is slightly above the first adds weight to the bearish case: this could have been a bull trap for late buyers, while in reality the rally may already be exhausted.

The ability of bulls to keep the price above the green zone may confirm the strength of the FTSE 100 (UK 100 on FXOpen). Nevertheless, in the short term, scenarios involving pullbacks and retests of the mentioned support levels might be realised (as seen in early August, when the 9,040 level was tested in an aggressive manner).

On Monday, we:

● noted that the US Dollar Index (DXY) was consolidating at the start of a week packed with key events;

● outlined a descending channel (shown in red);

● highlighted that the price was trading around the channel’s median line, signalling a balanced market;

● suggested that a test of one of the quarter lines (QL or QH), which divide the channel into four parts, could take place.

As the DXY chart indicates, since then the balance has shifted in favour of buyers, with the price forming an upward trajectory (shown in purple lines) and breaking through short-term resistance R (which has now turned into support, as marked by the blue arrow). Support line S remains relevant.

Today brings the key event that may have the greatest impact on the US Dollar Index (DXY) this week – Jerome Powell’s speech at the annual Jackson Hole Symposium.

This appearance is particularly significant because:

● it is likely to be Powell’s last speech after seven years as Fed Chair, with his term expiring in May amid ongoing tensions with President Trump;

● market participants will closely monitor the tone of his remarks, as a rate cut is expected in September, while recent economic data – namely the rise in the Producer Price Index – suggest that the US economy could face renewed inflationary pressures due to Trump’s tariffs.

Technical analysis of the DXY chart

From a bullish perspective, in the short term the US dollar is advancing within the purple channel, supported by:

● the lower boundary of this channel;

● the demand imbalance zone in favour of buyers (shown in green), confirmed by yesterday’s sharp bullish candle.

From a bearish perspective:

● the RSI has entered overbought territory;

● bullish momentum may fade after a breakout above the QH line;

● a key resistance at the 99 level lies nearby – a level that reclaimed its role as resistance at the beginning of August (indicated by black arrows).

A corrective pullback in the US Dollar Index (DXY) could happen after its rally to the highest level since 6 August. However, the further trajectory will largely depend on Powell’s words this evening. According to Forex Factory, the speech is scheduled for 17:00 GMT+3.

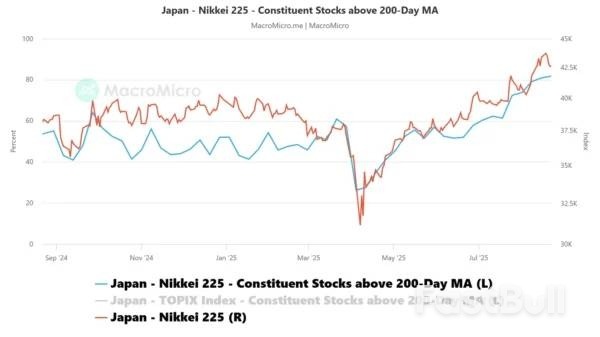

The Japan 225 CFD Index (a proxy of the Nikkei 225 futures) rallied as expected and hit the first resistance level of 43,560 as mentioned in our previous report. It printed a fresh intraday record high of 43,943 on Monday, 18 August.Thereafter, it staged a decline of -4% to record an intraday low of 42,330 on Friday, 22 August, before it recovered to an intraday level of 42,570 at the time of writing.Several technical elements and a fundamental factor suggest that the ongoing 5-day decline is likely a minor corrective decline within its medium-term uptrend phase rather than the start of a medium-term bearish trend.

Preferred trend bias (1-3 days)

Maintain a bullish bias with short-term pivotal support at 42,000/41,760 for the Japan 225 CFD Index, and a clearance above 43,060 sees the next intermediate resistances coming at 43,470 and 44,050/44,110 (Fibonacci extension cluster levels) (see Fig. 1).

Key elements

Alternative trend bias (1 to 3 days)

A break below the 41,760 key support invalidates the bullish recovery to see an extension of the corrective decline to expose the 41,275/41,070 medium-term support zone.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up