Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Turkey Trade Balance

Turkey Trade BalanceA:--

F: --

P: --

Germany Construction PMI (SA) (Nov)

Germany Construction PMI (SA) (Nov)A:--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

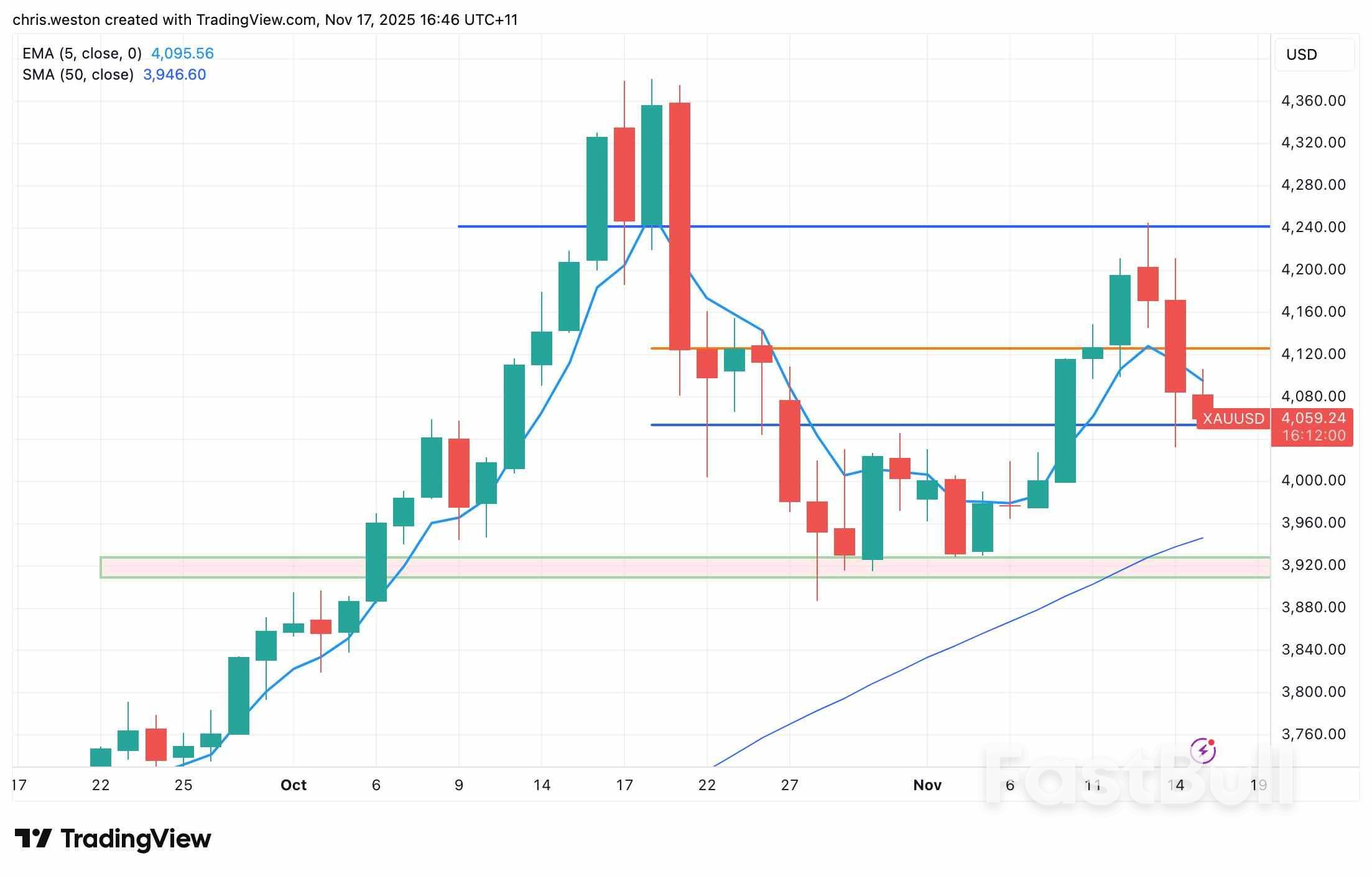

Over the past week, gold prices followed a classic rally-then-retreat pattern. Bulls and bears were both active: on one hand...

Over the past week, gold prices followed a classic rally-then-retreat pattern. Bulls and bears were both active: on one hand, rising uncertainty over the U.S. economic outlook and doubts about the Fed's independence supported safe-haven demand; on the other hand, with the government reopening, some profit-taking by bulls, and continued hawkish signals from Fed officials along with lowered market expectations for easing, bullish momentum was restrained.

This week, market attention is focused on the September nonfarm payrolls report, scheduled for early Friday (AEDT). While the data may be somewhat lagged due to the government shutdown, it could still act as a key catalyst for short-term volatility.

Looking at the XAUUSD daily chart, gold experienced a sharp rally followed by a rapid pullback. Early last week, the price held above $4,000 and broke through $4,100 and $4,200, peaking intraday at $4,245. However, sentiment shifted abruptly on Thursday, sending gold back below $4,100, with a weekly close at $4,085.

This morning, gold is trading around $4,080. On the downside, $4,050 and $4,000 could provide support; on the upside, a move back above $4,100 would put last week's high of $4,245 in focus as a key resistance for challenging historical highs.

Notably, gold's correlation with the USD, Treasury yields, and equities is currently low, meaning prices are largely driven by flows rather than traditional macro factors, which amplifies volatility. Recent fundamental developments are worth monitoring as they could guide future price direction.

Last week's pivotal move in gold stemmed from a sharp decline in market expectations for a Fed rate cut in December. Several Fed officials, including Schmied and Logan, highlighted persistent inflation pressures and issued hawkish signals, directly curbing expectations for further easing this year.

A month ago, the market was nearly certain of a December cut, with odds around 90%; today, that probability has fallen below 50%. The Treasury yield curve has steepened on the downside, indicating traders are repricing both inflation risk and the pace of Fed easing. As a non-yielding asset, gold naturally faces pressure.

Risk-off sentiment, which pushed equities sharply lower, also intensified selling pressure on gold due to margin call pressures.

The Fed's hawkish shift is closely linked to the longest U.S. government shutdown in history, lasting 43 days. While the government reopening and the Treasury's TGA account liquidity boost are supportive, the data gaps created during the shutdown leave policymakers and traders "flying blind."

Key economic data collection was disrupted: October's employment, inflation, and GDP initial estimates have clear gaps; November employment data is incomplete, and inflation statistics remain limited. This uncertainty reinforces gold's appeal as a safe haven.

Additionally, Atlanta Fed President Bostic, a hawk, announced he will not seek reappointment. His position could be filled by a more dovish official, increasing concerns over Fed independence. Hassett publicly stated willingness to lead the Fed and pursue aggressive rate cuts, further heightening policy uncertainty and boosting gold's safe-haven demand.

Overall, gold saw a rally-and-pullback pattern last week, with heightened volatility. The retreat in December rate-cut expectations was the main driver of lower prices, while short-term profit-taking and weak long-position liquidation added pressure. Still, safe-haven demand continues to support prices, and high U.S. debt levels along with ongoing central bank purchases limit medium- to long-term downside.

Short-term, gold is expected to trade in a $4,000–$4,250 range. Market focus will be on upcoming delayed data releases, which could affect rate-cut expectations.

Due to the shutdown, several delayed data points will be released this week:

- U.S. Census Bureau: August construction spending (Mon), factory orders (Tue), trade balance (Wed)- Bureau of Economic Analysis: August international trade data (Wed)- Bureau of Labor Statistics: September nonfarm payrolls (Fri)

Of these, the September nonfarm payrolls report is the most closely watched. Market expectations are for 50k new jobs, up from 22k previously, with unemployment steady at 4.3%. If the data shows a resilient labor market, it could exert modest pressure on gold. For the December 10 FOMC meeting, the November nonfarm report released on December 5 will be more relevant.

Additionally, the October FOMC minutes, due Wednesday, will be important. If the minutes show most officials remain concerned about inflation and oppose easing, gold may face headwinds; if concerns about economic slowdown are highlighted, it could provide limited support.

The USD/JPY pair advanced to 154.72 on Monday, trading near its highest levels since February, despite the release of Japanese economic data that surpassed forecasts.

Japan's GDP contracted by 0.4% quarter-on-quarter in Q3 2025, a reversal from the 0.6% growth recorded in Q2. However, this outcome was better than the 0.6% decline anticipated by economists.

The yen's weakness persists primarily due to Prime Minister Sanae Takaichi's public call for the Bank of Japan (BoJ) to maintain its ultra-low interest rate policy. The government believes this accommodative stance is essential to underpin economic growth and support a gradual rise in inflation.

This puts the government at odds with the central bank. BoJ Governor Kazuo Ueda struck a more balanced tone, noting that consumption remains stable amid rising household incomes and a tight labour market. He observed that core inflation is steadily approaching the 2% target, a development that would justify an early policy tightening.

This creates a visible and rare public imbalance between the dovish government's fiscal priorities and the central bank's potential inclination towards monetary normalisation.

H4 Chart:

On the H4 chart, USD/JPY completed a growth wave to 155.00 and a subsequent correction to 153.63. The pair is now forming a tight consolidation range around this support level. An upward breakout from this range is expected to initiate the next leg of the rally, targeting 155.15 as an initial objective. This bullish scenario is confirmed by the MACD indicator, whose signal line is positioned above zero and pointing firmly upwards, indicating sustained positive momentum.

H1 Chart:

On the H1 chart, the pair reached a local high at 155.00 and completed a corrective structure to 153.63. A fresh growth impulse to 154.66 has since been completed, forming a new compact consolidation range. An upward breakout from this range is anticipated, opening the path for a move towards a minimum target of 155.75. The Stochastic oscillator supports this outlook. Its signal line is above 50 and rising sharply towards 80, reflecting strong short-term bullish momentum.

USD/JPY continues to climb, driven by a fundamental divergence between a dovish Japanese government and the BoJ, which is cautiously laying the groundwork for a future rate hike. Technically, the structure remains firmly bullish. The completion of the recent correction suggests the pair is poised for further gains, with immediate targets at 155.15 and 155.75.

The U.S. dollar edged higher Monday, trading in a steady fashion ahead of the release of key U.S. economic data following the ending of the government's shutdown, with the Federal Reserve holding its final policy meeting of the year next month.

At 04:00 ET (09:00 GMT), the Dollar Index, which tracks the greenback against a basket of six other currencies, traded 0.1% higher to 99.282, bouncing after a weekly fall.

The focus this week will be on various U.S. data releases for clues on the health of the world's largest economy, with the closely-watched September's nonfarm payrolls report due on Thursday.

This follows the end of the U.S. government shutdown, which had delayed the release of numerous data releases, depriving the markets as well as Fed officials of clarity about the health of the world's largest economy.

"In a week when we should finally start to see US data releases coming through, it is important to note that the outcome of the next Fed rate decision in December looks better priced at a 50% chance of a cut," said analysts at ING, in a note.

"That means that the dollar probably does not have to rally too much on the FOMC minutes released this Wednesday and can take its cue from Thursday's jobs report."

There are also a lot of Fed speakers due this week.

"A repeat of the Fed's recent message that it should not rush into further rate cuts and some uncertainty as to where the neutral policy rate actually sits is probably a mild dollar positive," ING added.

In Europe, EUR/USD traded 0.2% lower to 1.1601, slipping back from the two-week high seen last week.

The next important set of releases for the euro will be Friday's flash PMIs for November.

"Remember, these have been holding up quite well and are suggesting that businesses could be learning to live with the uncertain international environment here," ING added.

"The stronger dollar has dragged EUR/USD back to 1.1600. We would expect some demand to come in should it correct lower to the 1.1560/80 area."

GBP/USD traded 0.1% lower to 1.3162, with sterling stabilizing to a degree following the sharp swings seen at the end of last week on news that Finance Minister Rachel Reeves has no plans to raise income tax rates in the upcoming budget.

Reeves is expected to need to raise tens of billions of pounds to stay on track to meet her fiscal targets in the November 26 annual budget.

In Asia, USD/JPY edged 0.1% higher to 154.68, after earlier data showed that Japan's economy contracted in the third quarter at an annualised decline of 1.8% -- weaker than earlier quarters but slightly better than the median forecast of a 2.5 % drop.

On a quarter-on-quarter basis, GDP fell 0.4%, which was slightly smaller than economists had forecast but still pointed to a loss of momentum.

The contraction was driven by weaker exports that reflected the impact of recently imposed U.S. tariffs. Private consumption contributed little to growth and rose only modestly due to persistent inflation pressures faced by households.

The only strong component within the data was capital expenditure, which increased and suggesting that companies remain willing to invest despite the trade headwinds.

USD/CNY traded 0.1% higher to 7.1045, while AUD/USD gained 0.1% to 0.6534.

The Asia session on November 17 saw mixed activity in regional equity indexes, commodity prices, and currency pairs driven by Japan's weaker GDP, sectoral pressures, and cautious investor sentiment ahead of major U.S., European, and regional data releases. Tourism and retail stocks in Japan were especially impacted, while the Kospi showed relative strength, and oil prices weakened. The yen held steady after the GDP release, and Indian markets opened firm amid strong domestic flows.

Today's trading sessions are characterized by significant uncertainty stemming from delayed U.S. economic data, shifting Fed rate cut expectations (now at 50% for December), and anticipation of critical corporate earnings. Canadian inflation data (1:30 PM GMT) represents the day's key macroeconomic release, while Japan's confirmed GDP contraction highlights global growth concerns. Bitcoin's 25% pullback from October highs reflects broader risk-off sentiment, while oil prices remain under pressure despite geopolitical tensions.

The US dollar is navigating a complex environment marked by diminished Federal Reserve rate-cut expectations, lingering economic uncertainty from the historic government shutdown, and a critical week of data releases ahead. With the DXY testing key support around 99.00 and December Fed rate cut odds falling below 50%, the dollar's near-term trajectory hinges on forthcoming economic indicators that will finally shed light on the US economy's true condition.Central Bank Notes:

Next 24 Hours BiasWeak Bearish

The recently concluded 43-day U.S. government shutdown created significant volatility, initially boosting gold above $4,240 on safe-haven demand before triggering profit-taking on resolution. Delayed economic data and hawkish Fed commentary have introduced genuine uncertainty for the December 10 FOMC meeting.Next 24 Hours Bias Weak Bullish

No major news eventWhat can we expect from EUR today?The euro opened Monday's trading session on a firm footing at 1.1621, supported by a combination of US dollar weakness, stable ECB policy, and resilient eurozone services sector performance. While the ECB maintains its "good place" with rates on hold and only a 40% chance of cuts by September 2026, the Federal Reserve faces growing pressure to ease further, with December rate cut odds now a coin toss at approximately 50%.Central Bank Notes:

Next 24 Hours BiasWeak Bearish

The Swiss Franc enters the week at multi-year highs, supported by three key pillars: the confirmed US tariff reduction from 39% to 15%, ongoing safe-haven demand driven by global uncertainty, and SNB policy stability at 0% with negative rates ruled out. The USD/CHF pair is trading near 0.79, its strongest level since 2011, while EUR/CHF has reached levels not seen since 2015. With Switzerland's Q3 GDP flash estimate due today and the December 11 SNB meeting on the horizon, the franc's trajectory will depend on economic data releases and any shifts in the SNB's confident inflation outlook.Central Bank Notes:

Next 24 Hours BiasMedium Bullish

The British Pound faces significant headwinds as Monday's Asian session begins. The government's fiscal U-turn has raised questions about the UK's fiscal credibility, while persistently weak economic data has cemented expectations for a December rate cut. With markets pricing in a 75-80% probability of a 25 basis point cut on 18 December, and technical indicators pointing to further downside risk, Sterling is likely to remain under pressure unless upcoming data surprises to the upside or Catherine Mann's comments signal resistance to near-term easing. Traders should watch the 1.3150-1.3185 support zone closely, as a break below could accelerate losses toward 1.2875 or lower.Central Bank Notes:

Today marks a pivotal moment for Canadian Dollar traders with the October CPI release. Inflation data coming in line with expectations would likely reinforce the market consensus that the Bank of Canada has paused rate cuts, providing technical support for the loonie around current levels near 1.40. However, the broader outlook remains subdued with rate differentials and trade uncertainty weighing on medium-term CAD performance. The market will closely watch both the headline and core inflation figures alongside any forward guidance cues for the December 10 BoC decision.Central Bank Notes:

Next 24 Hours BiasWeaK Bullish

Oil prices declined on Monday, November 17, as Russian export operations resumed at Novorossiysk following Ukrainian strikes. The market faces significant bearish pressure from a growing supply glut, with the IEA warning of surpluses reaching 4 million bpd in 2026. Despite geopolitical risks from intensifying Ukrainian attacks on Russian energy infrastructure, US sanctions on Rosneft and Lukoil taking effect on November 21, and Iran's tanker seizure in the Strait of Hormuz, these supply risks have proven insufficient to offset fundamental oversupply concerns.

Next 24 Hours BiasWeak Bearish

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up