Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Oct)

Japan Trade Balance (Customs Data) (SA) (Oct)A:--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q3)

Japan GDP Annualized QoQ Revised (Q3)A:--

F: --

China, Mainland Exports YoY (CNH) (Nov)

China, Mainland Exports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)--

F: --

P: --

Canada Leading Index MoM (Nov)

Canada Leading Index MoM (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

Mexico CPI YoY (Nov)

Mexico CPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

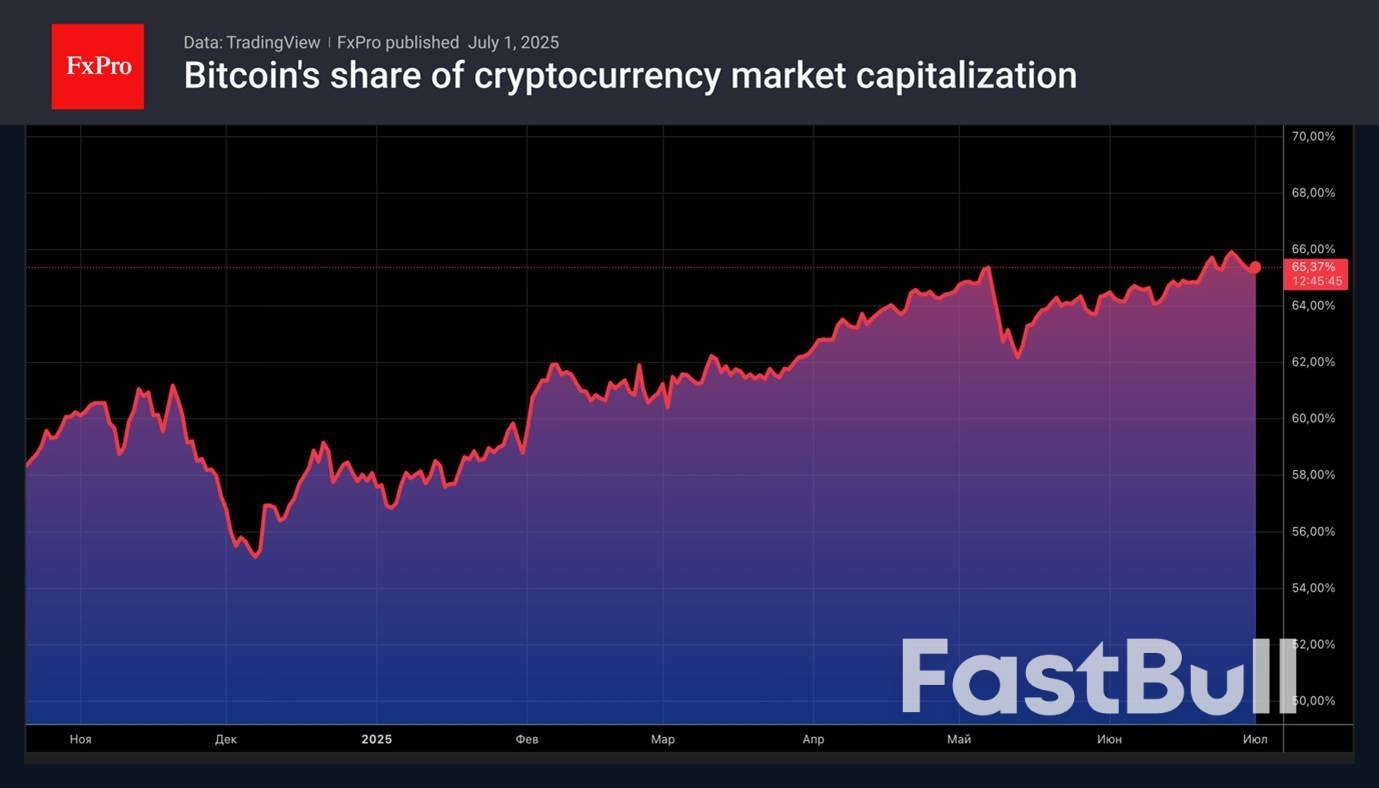

Bitcoin is absorbing most of the cash coming into the digital asset market. Its share in the cryptocurrency market structure increased by 10 percentage points to 65% in the first half of 2025. This is the highest it’s been since January 2021.

Bitcoin is absorbing most of the cash coming into the digital asset market. Its share in the cryptocurrency market structure increased by 10 percentage points to 65% in the first half of 2025. This is the highest it’s been since January 2021. In contrast the capitalisation of altcoins has fallen by $300 billion since the beginning of this year. Thanks to developed infrastructure, support from the White House and regulation, larger tokens are displacing smaller competitors.

The MarketVector Digital Assets 100 Small-Cap Index, which covers the bottom half of the 100 largest digital assets, initially doubled after Donald Trump’s election results in November. However, it then lost all its gains and fell by 50% in 2025. Bitcoin on the other hand, has risen by almost 14% since January and reached a new record high in May. Cryptocurrencies are benefiting from capital inflows into specialised exchange-traded funds and high global risk appetite.

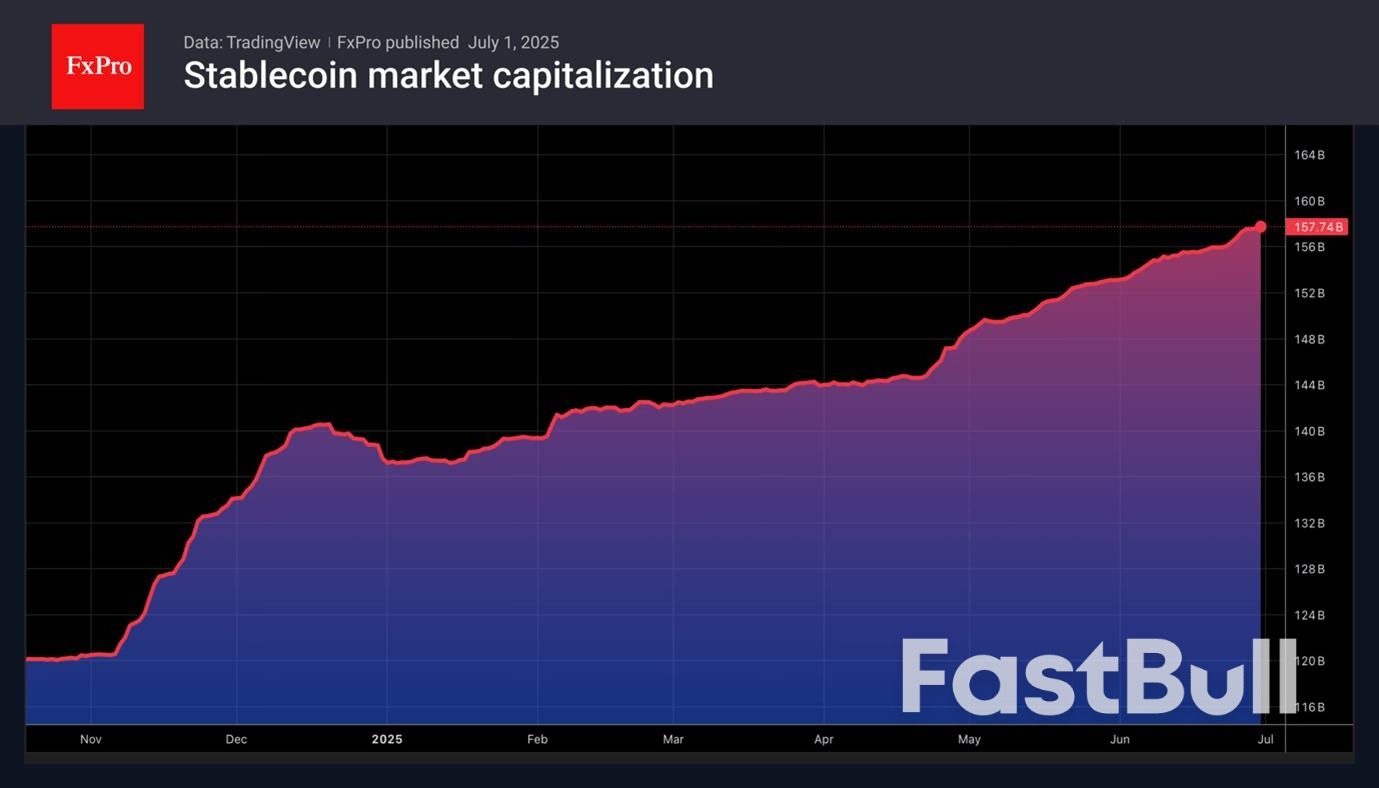

The only competition for Bitcoin comes from stablecoins. The adoption by Congress of legislation regulating their circulation is increasing investor interest in this type of digital asset. In the first half of the year alone, the market capitalisation of stablecoins grew by $47 billion. Not only banks but also large companies such as Amazon are exploring opportunities for their implementation.

Bitcoin is showing little interest in restoring its correlation with US stock indices. The S&P 500 and Nasdaq Composite managed to update their record highs in June, but Bitcoin is in no hurry to do so. The link between the traditional markets and crypto was broken during the armed conflict in the Middle East. Currently the digital assets leader is cautiously watching the approach of the 9th of July, the expiry date of the White House’s 90-day tariff delay.

The escalation of trade wars will increase the risks of a pullback in US stock indices. According to Bank of America, the bubble in the US stock market continues to inflate. If it bursts, all risky assets will suffer. It is not surprising that Bitcoin is cautious. On the contrary, new records for the S&P 500 will allow bitcoin bulls to aim for a new all-time high.

Japanese Prime Minister Shigeru Ishiba said on Wednesday he was determined to protect his country's national interests as trade negotiations with the U.S. struggled and President Donald Trump threatened even higher tariff rates on the Asian ally.

"Japan is different from other countries as we are the largest investor in the United States, creating jobs," Ishiba said in a public debate with opposition party leaders.

"With our basic focus being on investment rather than tariffs, we'll continue to protect our national interest," he said.

Trump on Tuesday cast doubt on a possible deal with Japan, indicating that he could impose a tariff of 30% or 35% on imports from Japan - well above the 24% rate he announced on April 2 and then paused until July 9.

Japanese broadcaster TV Asahi reported on Wednesday that Japan's tariff negotiator Ryosei Akazawa was organising his eighth visit to the United States for trade talks as early as this weekend.

Brent crude prices are expected to drop to the low- to mid-$60 per barrel range in the near term as traders eye an expected uptick in OPEC+ production and a seasonal slowdown in fuel demand, according to analysts at UBS.

In a note to clients, the brokerage predicted that oil markets will see a "larger surplus" after the key summer travel period, adding that prices are anticipated to move lower from current levels.

Crude prices were little moved Wednesday, as traders digested progress towards an Israel-Hamas ceasefire and a build in U.S. inventories ahead of an upcoming meeting of the Organization of the Petroleum Exporting Countries and its allies, a producer group known commonly as OPEC+.

At 03:32 ET, Brent futures inched up 0.1% to $67.16 a barrel and U.S. West Texas Intermediate crude futures were unchanged at $65.45 a barrel.

U.S. President Donald Trump on Tuesday evening said Israel had agreed to the conditions needed to finalize a 60-day ceasefire with Hamas, while also urging the Palestinian group to accept the deal.

Meanwhile, data from the American Petroleum Institute showed that U.S. oil inventories grew 0.68 million barrels in the week to June 27, a build that followed five weeks of deep, outsized draws in U.S. oil stockpiles, and raised some questions over demand during the summer.

For the nascent third quarter, the UBS analysts marginally raised their Brent price target by $3 to $65 a barrel, reflecting a "slightly higher risk premium in the very near term." A risk premium refers to the extra return investors want for holding oil investments.

However, with recent ructions in oil markets cooling following a ceasefire between Israel and Iran last month, the UBS strategists said that they expect traders’ focus will "shift back to funamentals."

"While oil demand has remained more resilient than feared and U.S. onshore activity response to lower prices has been quick, we still see the oil market moving into larger surpluses over the next three quarters," the analysts said.

They noted that this outlook was primarily linked to potential "OPEC+ production increases," predicting that all eight of its members will lift output in August. The jump in production is likely to have a greater impact on prices after the summer "as oil demand comes off seasonally, especially in the Middle East," they said.

Other factors that could impact oil prices include uncertainty around the OPEC+ production plans, the trajectory of sweeping U.S. tariffs, and the risk of a flare up in Israel-Iran tensions denting supply flows, the analysts said.

Against this backdrop, they marginally raised their annual Brent price forecast by $1 to $67 per barrel.

The eurozone’s unemployment rate increased to 6.3% in May from 6.2% in April, according to data released by the European Union’s statistics agency Eurostat on Wednesday.

This small increase was contrary to economists’ expectations, as a consensus poll had predicted the rate would remain steady at 6.2%.

Despite the rise, the unemployment rate in the 20-nation currency area remains close to historically low levels. The April figure of 6.2% had matched the eurozone’s record-low unemployment rate.

Eurostat had previously revised March’s unemployment rate higher to 6.4%.

The slight uptick in May comes as European companies face economic uncertainty related to tariffs and geopolitical tensions.

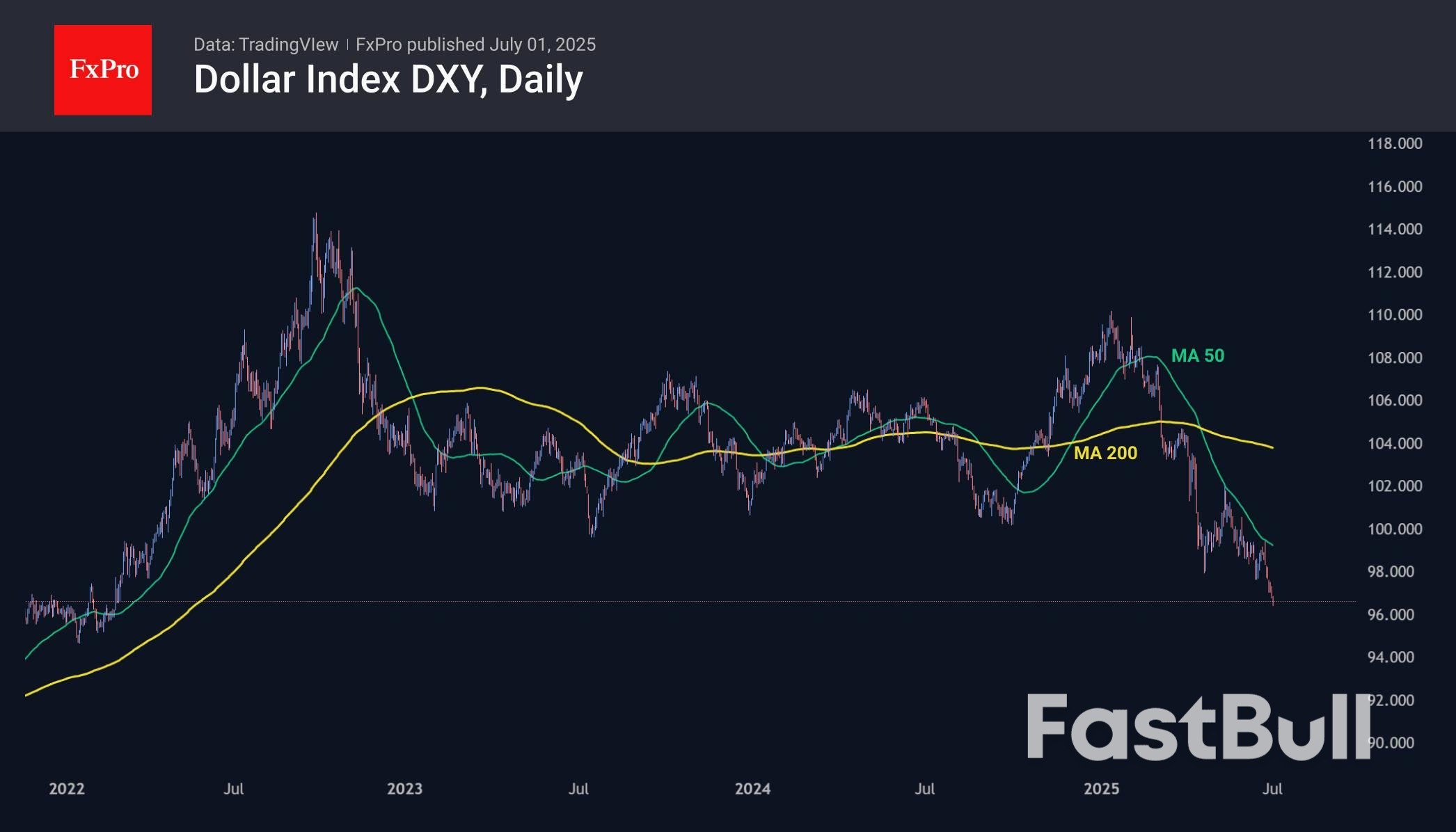

The US dollar is retreating on all fronts, showing a daily decline since last Monday, when the military conflict between Israel and Iran came out of its hot phase and the tax bill in the US returned to the forefront.

Resuming its decline, interrupted by the bombing between Israel and Iran, the dollar index has been updating its more than three-year lows on a daily basis since the second half of last week. With total losses of over 12%, the first half of the year was the worst for the US currency since 1973, i.e. in the entire history of the free forex market.

A more neutral geopolitical background removed the ‘war premium’ from the dollar’s price and brought back the focus on Trump’s pressure on Powell and the discussion of Trump’s bill. This ‘One Big and Beautiful Bill’ promises to create a 7% budget deficit. The situation is not as serious as it was in September 2022 in Britain, but it is moving in the same direction.

However, we still see more influence in the changing mood of market participants, where expectations of a rate cut are growing. Markets are pricing in a 65% chance that there will be at least three cuts by the end of the year, almost double the figure a month ago.

On weekly timeframes, the RSI index has been updating its lows since early 2018, indicating an aggressive decline over the past seven years. This has dashed hopes for a bottoming out and rebound earlier this year.

The technical picture indicates the potential for the dollar to decline by another 7-8% to the 88-90 range on the DXY from the current 96.6. However, this is a rare case where the situation is in the hands of politicians. We turn our attention to representatives of the US Treasury and the Fed with comments on maintaining a strong dollar policy. Strong macroeconomic employment data this week may halt the dollar sell-off, but this is unlikely during a period of economic slowdown.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up