Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

At the end of May, we noted that the German stock index DAX 40 (Germany 40 mini on FXOpen) was exhibiting significantly stronger performance compared to other global equity indices. However, we also highlighted the 24,100 level as a strong resistance zone.

At the end of May, we noted that the German stock index DAX 40 (Germany 40 mini on FXOpen) was exhibiting significantly stronger performance compared to other global equity indices. However, we also highlighted the 24,100 level as a strong resistance zone.

Two months have passed, and the chart now suggests that bearish signals are intensifying.

From a technical analysis perspective, the DAX 40 (Germany 40 mini on FXOpen) formed an ascending channel in July (outlined in blue). However, each time the bulls attempted to push the price above the 24,460 level (which corresponds to the May high), they encountered resistance.

It is worth noting the nature of the bearish reversals (indicated by arrows) – the price declined sharply, often without intermediate recoveries, signalling strong selling pressure. It is likely that major market participants used the proximity to the all-time high to reduce their long positions.

From a fundamental standpoint, several factors are weighing on the DAX 40 (Germany 40 mini on FXOpen):→ Ongoing uncertainty surrounding the US–EU trade agreement, which has yet to be finalised (with the deadline approaching next week);→ Corporate news, including disappointing earnings reports from Puma, Volkswagen, and several other German companies.

Given the above, it is reasonable to assume that bearish activity could result in an attempt to break below the lower boundary of the ascending blue channel.

The armed military conflict between Thailand and Cambodia presents limited risks to most business sectors for now while tourism industry experts are taking a wait-and-see stance to assess the impact.

Thailand is warning of an all-out war with its neighbouring country as the US has called for a ceasefire. The clashes, though, are limited to border areas far removed from popular tourist destinations, such as Bangkok and Phuket.

“We’ve been monitoring the situation and have yet to see significant changes in travel searches to these destinations,” booking site Expedia said in an emailed statement.

The border clashes aren’t expected to affect Thailand’s tourism sector under the current circumstances, Chai Arunanondchai, president of the Tourism Council of Thailand, said at a Thursday briefing.

Nonetheless, the conflict is already adversely affecting overall economic confidence and disrupting trade and investment between the two countries, the Thai Chamber of Commerce said in a Thursday statement.

Exports from Thailand to Cambodia, including jewellery, oil and sugar, totalled US$5.1 billion (RM21.52 billion) in the first half of 2025, according to the Thai Commerce Ministry. Thailand imported US$732 million of Cambodian goods, mostly fruits and vegetables.

The flareup, which included Thai airstrikes on Cambodian military bases, wasn’t initially expected to have a significant effect on food, media, cement and retail sectors in Thailand, UOB Kay Hian analysts said in a June 17 note to investors.

Thai convenience store CP All and conglomerate Berli Jucker have limited exposure in Cambodia, they said in a research note.

Thailand’s Carabao Group beverage maker, though, has relatively high sales in Cambodia, Citi Research said in a Friday note to investors. The clash could increase freight costs because of shifting trade routes due to the conflict, it said.

“A prolonged dispute could weaken consumption sentiment in provinces close to border region,” according to Citi.

Carabao is estimated to derive 28% of its energy drink revenue this year from Cambodia, CGS International said.

Thailand’s Bumrungrad Hospital, as well as herbal supplement maker Mega Lifesciences, is estimated to receive about 6% of their fiscal-year revenue from Cambodia and could face limited risks, CGS added.

Cambodia’s economic growth was already expected to slow, according to a July 17 report by Maybank Securities Pte.

The country has more than half a million workers in Thailand, according to official estimates, though Maybank said undocumented migrants could push that number closer to 1.2 million people. Officials in Thailand’s Chanthaburi and Trat provinces said some 2,000 Cambodian migrant workers have gathered at a checkpoint to return home.

Starlink systems used by Ukrainian military units were down for two and a half hours overnight, a senior commander said, part of a global issue that disrupted the satellite internet provider.

Ukraine's forces are heavily reliant on thousands of SpaceX's Starlink terminals for battlefield communications and some drone operations, as they have proved resistant to espionage and signal jamming throughout the three and a half years of fighting Russia's invasion.

Starlink experienced one of its biggest international outages on Thursday when an internal software failure knocked tens of thousands of users offline."Starlink is down across the entire front," Robert Brovdi, the commander of Ukraine's drone forces, wrote on Telegram at 10:41 p.m. (1941 GMT) on Thursday.

He updated his post later to say that by about 1:05 a.m. on Friday the issue had been resolved. He said the incident had highlighted the risk of reliance on the systems, and called for communication and connectivity methods to be diversified."Combat missions were performed without a (video) feed, battlefield reconnaissance was done with strike (drones)," Brovdi wrote.

Oleksandr Dmitriev, the founder of OCHI, a Ukrainian system that centralises feeds from thousands of drone crews across the frontline, told Reuters the outage showed that relying on cloud services to command units and relay battlefield drone reconnaissance was a "huge risk"."If connection to the internet is lost ... the ability to conduct combat operations is practically gone," he said, calling for a move towards local communication systems that are not reliant on the internet.

Although Starlink does not operate in Russia, Ukrainian officials have said that Moscow's troops are also widely using the systems on the frontlines in Ukraine.

Key points:

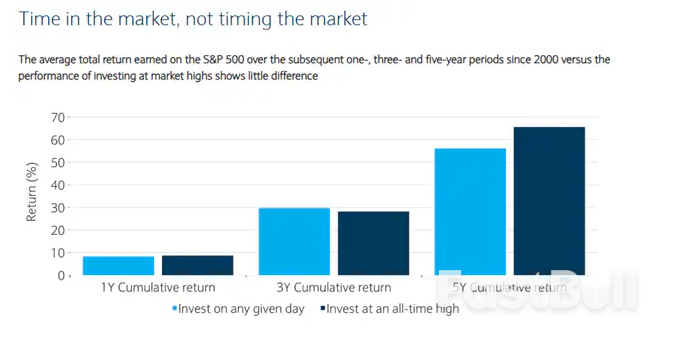

The myth of waiting for the perfect entryIn theory, “buy low, sell high” sounds perfect. In practice, most investors struggle to do either.In fact, if you only invested on days when the S&P 500 hit an all-time high, your long-term returns would often be higher than if you invested on any random day.

That’s because record highs typically happen during bull markets, and bull markets tend to last longer than expected.The real challenge isn’t timing the market. It’s having a strategy that works when prices feel high, and sticking to it.

What to do instead: smart moves at market highs

Even when the overall market is rising, individual stocks and sectors often face short-term dips. Those can be opportunities.

What you can do:

While technology and AI stocks have led the charge, many parts of the market have lagged, and may offer better value and catch-up potential if the rally broadens out.

What to consider:

Market leadership today is shaped less by geography or sector, and more by macro forces like interest rates, trade policies, and geopolitical risk. Traditional diversification alone may not be enough. It’s time to think about how different parts of your portfolio respond to shifting policy and economic drivers.

How to position:

Even if some of these areas have gained attention recently, their relevance over the long term means they may still be underrepresented in many portfolios.

Waiting for the “perfect moment” to invest often leads to missed opportunities. Even when markets dip, fear and uncertainty can prevent action, leaving cash on the sidelines and long-term goals unmet.

What works better:

Buying at market highs can feel uncomfortable, but history shows that long-term investors are often rewarded for staying the course.If you diversify smartly, lean into underappreciated areas, and stay consistent with your investing plan, you won’t need to worry about whether you’re “too late.”Because long-term wealth isn’t built by picking the perfect moment.It’s built by showing up, again and again.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up