Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)A:--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)A:--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook BOE Gov Bailey Speaks

BOE Gov Bailey Speaks ECB President Lagarde Speaks

ECB President Lagarde Speaks BOC Monetary Policy Report

BOC Monetary Policy Report U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)--

F: --

P: --

Russia CPI YoY (Nov)

Russia CPI YoY (Nov)--

F: --

P: --

U.S. Federal Funds Rate Projections-Longer Run (Q4)

U.S. Federal Funds Rate Projections-Longer Run (Q4)--

F: --

P: --

U.S. Federal Funds Rate Projections-2nd Year (Q4)

U.S. Federal Funds Rate Projections-2nd Year (Q4)--

F: --

P: --

U.S. Budget Balance (Nov)

U.S. Budget Balance (Nov)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Federal Funds Rate Projections-Current (Q4)

U.S. Federal Funds Rate Projections-Current (Q4)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

U.S. Federal Funds Rate Projections-1st Year (Q4)

U.S. Federal Funds Rate Projections-1st Year (Q4)--

F: --

P: --

U.S. Federal Funds Rate Projections-3rd Year (Q4)

U.S. Federal Funds Rate Projections-3rd Year (Q4)--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

U.K. 3-Month RICS House Price Balance (Nov)

U.K. 3-Month RICS House Price Balance (Nov)--

F: --

P: --

Australia Employment (Nov)

Australia Employment (Nov)--

F: --

P: --

Australia Full-time Employment (SA) (Nov)

Australia Full-time Employment (SA) (Nov)--

F: --

P: --

Australia Labor Force Participation Rate (SA) (Nov)

Australia Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Australia Unemployment Rate (SA) (Nov)

Australia Unemployment Rate (SA) (Nov)--

F: --

P: --

Turkey Retail Sales YoY (Oct)

Turkey Retail Sales YoY (Oct)--

F: --

P: --

Italy Quarterly Unemployment Rate (SA) (Q3)

Italy Quarterly Unemployment Rate (SA) (Q3)--

F: --

P: --

IEA Oil Market Report

IEA Oil Market Report South Africa Gold Production YoY (Oct)

South Africa Gold Production YoY (Oct)--

F: --

P: --

South Africa Mining Output YoY (Oct)

South Africa Mining Output YoY (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Last week, the U.S. government resumed operations after a shutdown, which led to a significant decline in gold prices. In the short term, market sentiment is leaning toward a downward trend.

4112.00

Entry Price

3950.00

TP

4155.00

SL

201.9

Pips

Profit

3950.00

TP

4091.81

Exit Price

4112.00

Entry Price

4155.00

SL

Monetary policy is moderate tightening, which aligns with expectations and should help suppress demand growth. Last week, the likelihood of a 25-basis-point interest rate cut in December dropped below 50%, depressing non-yielding gold prices for the second consecutive day on Friday.

4076.19

Entry Price

3600.00

TP

4390.00

SL

345.5

Pips

Profit

3600.00

TP

4041.64

Exit Price

4076.19

Entry Price

4390.00

SL

Gold pulls back from three-week highs as fading Fed rate-cut expectations and improved U.S. fiscal sentiment weigh on safe-haven demand, though equity volatility and AI-sector concerns help limit losses.

4120.00

Entry Price

4045.00

TP

4180.00

SL

28.6

Pips

Profit

4045.00

TP

4117.14

Exit Price

4120.00

Entry Price

4180.00

SL

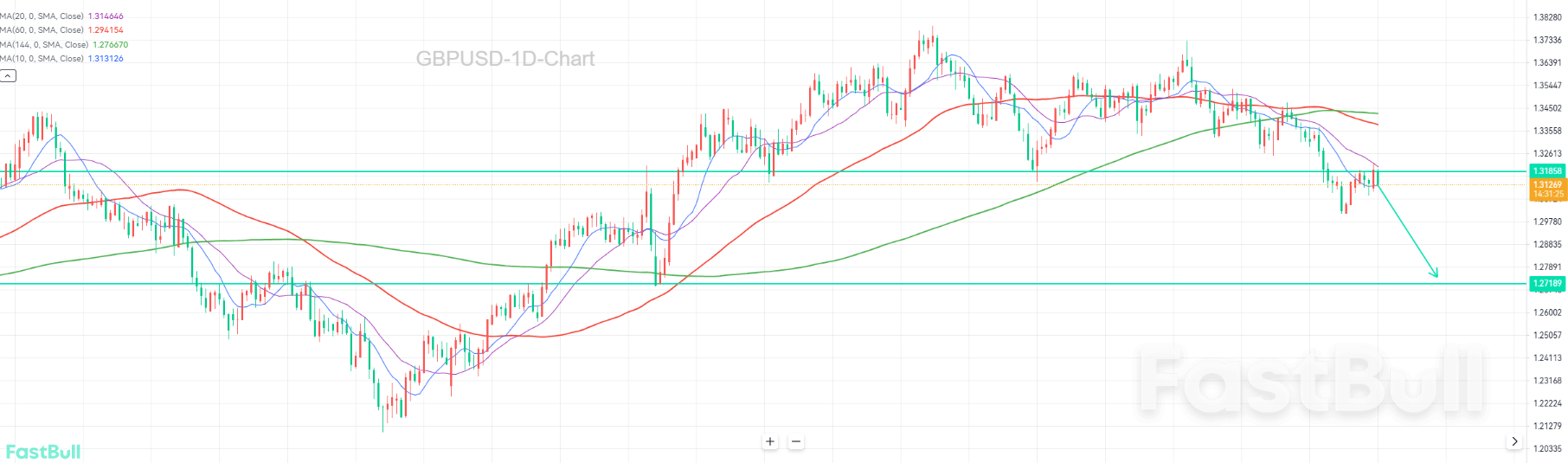

Freshly released, the UK employment and economic data exerted significant downward pressure on the British pound.

1.31565

Entry Price

1.27500

TP

1.32200

SL

94.3

Pips

Profit

1.27500

TP

1.30622

Exit Price

1.31565

Entry Price

1.32200

SL

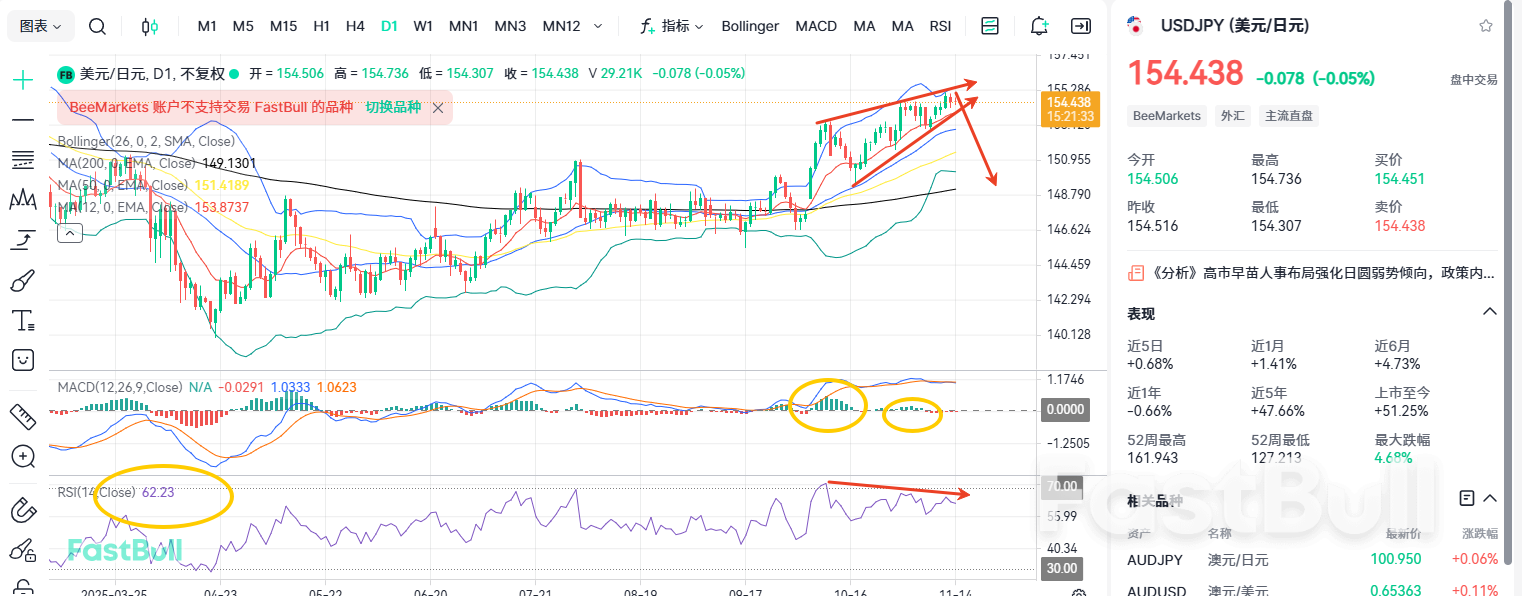

Japan's Prime Minister, Sanae Takaichi, earlier this week emphasized the importance of close policy coordination with the Bank of Japan to stimulate economic growth and indicated a government preference for maintaining ultra-loose monetary policy. This stance has heightened market uncertainty regarding the Bank of Japan's potential tightening trajectory, which has historically been a significant factor contributing to the yen's relative weakness.

154.650

Entry Price

151.400

TP

156.000

SL

35.6

Pips

Profit

151.400

TP

154.294

Exit Price

154.650

Entry Price

156.000

SL

The global shift in risk sentiment is evident from the broadly weak tone in equity markets, which has supported the safe-haven status of gold. At the same time, due to a lack of major economic data releases, an increasing number of Federal Reserve policymakers expressed caution about further easing, leading traders to scale back expectations for another rate cut in December. This, in turn, may dampen the price momentum of non-yielding gold.

4190.00

Entry Price

3800.00

TP

4500.00

SL

--

Pips

EXPIRED

3800.00

TP

4117.95

Exit Price

4190.00

Entry Price

4500.00

SL

Upon touching this channel resistance, the price has shown an immediate bearish reaction, suggesting that a significant downward correction from this level is highly probable.

1.16326

Entry Price

1.15180

TP

1.17100

SL

43.0

Pips

Profit

1.15180

TP

1.15896

Exit Price

1.16326

Entry Price

1.17100

SL

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up