Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Spot Silver Rebounded After A Decline, Regaining The $100 Mark, And Rebounding By More Than $5 From The Intraday Low

[More US Military Aircraft "Arriving," Satellite Imagery Released] US President Trump Warned Iran On January 28th Via The Social Media Platform "Real Social," Stating That A Fleet Led By The Aircraft Carrier USS Abraham Lincoln Was Heading Towards Iran, And That Any Further US Military Action Against Iran Would Be "far More Serious" Than The US Attack On Iranian Nuclear Facilities Last Summer. Meanwhile, Ali Shamkhani, Political Advisor To Iran's Supreme Leader Khamenei, Also Posted On Social Media On The Same Day, Stating That "any Military Action From The United States Will Lead Iran To Take Action Against Aggressors And The Heart Of Tel Aviv, As Well As Those Countries That Support Them."

Sources Say OPEC+ Is Likely To Maintain Its Decision To Suspend The March Oil Production Increase At Its Meeting On Sunday

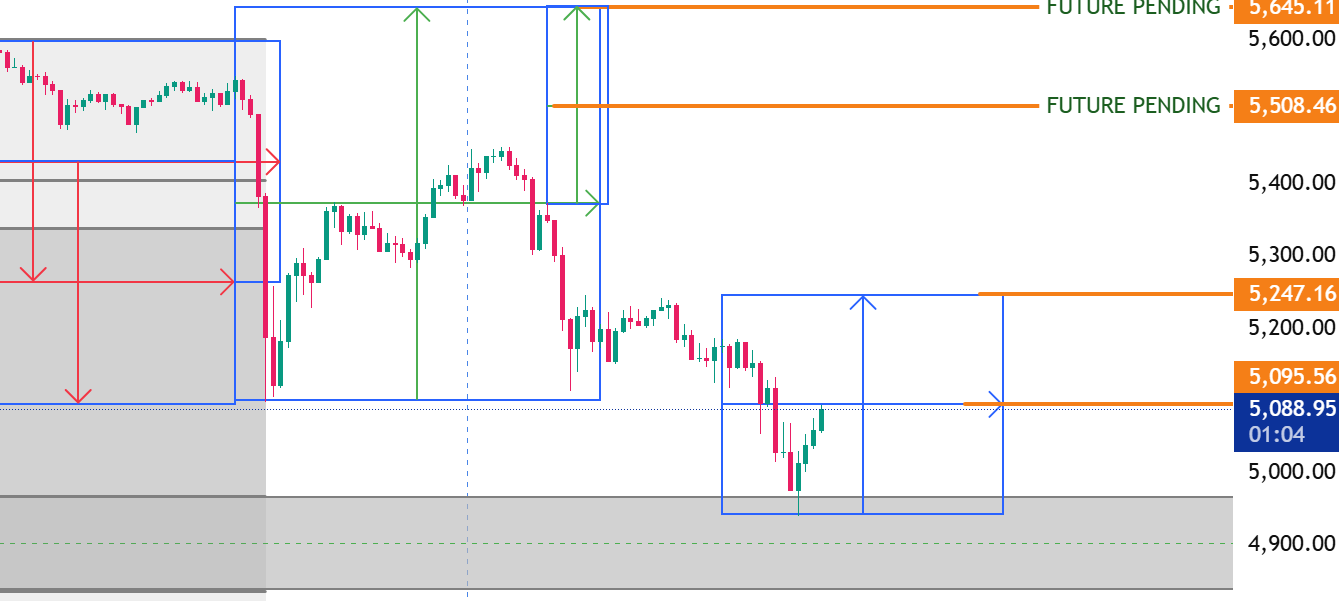

[Massive Losses In International Gold And Silver Market Value] International Spot Silver And Spot Gold Prices Plummeted During The Day, Both Falling Below The $100 And $5,000 Marks, Respectively. Data From Companiesmarketcap Shows That The Global Market Value Of Silver Shrank By 16.45% To $5.382 Trillion, While The Market Value Of Gold Evaporated By 6.59% To $34.779 Trillion. However, Both Still Rank First And Second In Global Market Capitalization, With Silver In Second Place Significantly Ahead Of Nvidia ($4.687 Trillion), Which Ranks Third

Data From Japan's Ministry Of Finance Confirms That Japan Did Not Intervene In The Yen In January

Indonesia Sets Feb Crude Palm Oil Reference Price At $918.47/Metric Ton - Trade Ministry Regulation

Eurostat - Euro Zone Q4 Preliminary Flash GDP +0.3% Quarter-On-Quarter (Reuters Poll +0.2% Quarter-On-Quarter)

Kremlin Says Trump Personally Asked Putin To Halt Strikes On Kyiv Until Feb 1 To Create Favourable Conditions For Negotiations

Spot Gold Has Rebounded After A Decline, Returning Above $5,000, With The Intraday Decline Narrowing To 6.5%, Currently Trading At $5,018 Per Ounce

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)A:--

F: --

P: --

Japan Tokyo CPI MoM (Excl. Food & Energy) (Jan)

Japan Tokyo CPI MoM (Excl. Food & Energy) (Jan)A:--

F: --

P: --

Japan Retail Sales YoY (Dec)

Japan Retail Sales YoY (Dec)A:--

F: --

Japan Industrial Inventory MoM (Dec)

Japan Industrial Inventory MoM (Dec)A:--

F: --

P: --

Japan Retail Sales (Dec)

Japan Retail Sales (Dec)A:--

F: --

P: --

Japan Retail Sales MoM (SA) (Dec)

Japan Retail Sales MoM (SA) (Dec)A:--

F: --

Japan Large-Scale Retail Sales YoY (Dec)

Japan Large-Scale Retail Sales YoY (Dec)A:--

F: --

P: --

Japan Industrial Output Prelim MoM (Dec)

Japan Industrial Output Prelim MoM (Dec)A:--

F: --

P: --

Japan Industrial Output Prelim YoY (Dec)

Japan Industrial Output Prelim YoY (Dec)A:--

F: --

P: --

Australia PPI YoY (Q4)

Australia PPI YoY (Q4)A:--

F: --

P: --

Australia PPI QoQ (Q4)

Australia PPI QoQ (Q4)A:--

F: --

P: --

Japan Construction Orders YoY (Dec)

Japan Construction Orders YoY (Dec)A:--

F: --

P: --

Japan New Housing Starts YoY (Dec)

Japan New Housing Starts YoY (Dec)A:--

F: --

P: --

France GDP Prelim YoY (SA) (Q4)

France GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

Turkey Trade Balance (Dec)

Turkey Trade Balance (Dec)A:--

F: --

P: --

France PPI MoM (Dec)

France PPI MoM (Dec)A:--

F: --

Germany Unemployment Rate (SA) (Jan)

Germany Unemployment Rate (SA) (Jan)A:--

F: --

P: --

Germany GDP Prelim YoY (Not SA) (Q4)

Germany GDP Prelim YoY (Not SA) (Q4)A:--

F: --

P: --

Germany GDP Prelim QoQ (SA) (Q4)

Germany GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)A:--

F: --

P: --

Italy GDP Prelim YoY (SA) (Q4)

Italy GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

U.K. M4 Money Supply (SA) (Dec)

U.K. M4 Money Supply (SA) (Dec)A:--

F: --

U.K. M4 Money Supply YoY (Dec)

U.K. M4 Money Supply YoY (Dec)A:--

F: --

P: --

U.K. M4 Money Supply MoM (Dec)

U.K. M4 Money Supply MoM (Dec)A:--

F: --

P: --

U.K. Mortgage Lending (Dec)

U.K. Mortgage Lending (Dec)A:--

F: --

U.K. Mortgage Approvals (Dec)

U.K. Mortgage Approvals (Dec)A:--

F: --

Italy Unemployment Rate (SA) (Dec)

Italy Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Euro Zone Unemployment Rate (Dec)

Euro Zone Unemployment Rate (Dec)A:--

F: --

P: --

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Euro Zone GDP Prelim YoY (SA) (Q4)

Euro Zone GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoY--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)--

F: --

P: --

U.S. Core PPI YoY (Dec)

U.S. Core PPI YoY (Dec)--

F: --

P: --

U.S. Core PPI MoM (SA) (Dec)

U.S. Core PPI MoM (SA) (Dec)--

F: --

P: --

U.S. PPI YoY (Dec)

U.S. PPI YoY (Dec)--

F: --

P: --

U.S. PPI MoM (SA) (Dec)

U.S. PPI MoM (SA) (Dec)--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)--

F: --

P: --

Canada GDP YoY (Nov)

Canada GDP YoY (Nov)--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)--

F: --

P: --

U.S. Chicago PMI (Jan)

U.S. Chicago PMI (Jan)--

F: --

Canada Federal Government Budget Balance (Nov)

Canada Federal Government Budget Balance (Nov)--

F: --

P: --

Brazil CAGED Net Payroll Jobs (Dec)

Brazil CAGED Net Payroll Jobs (Dec)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Jan)

China, Mainland NBS Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Composite PMI (Jan)

China, Mainland Composite PMI (Jan)--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The inability to form a new local high signals a possible loss of bullish momentum in the short term.

3389.23

Entry Price

3345.00

TP

3415.00

SL

257.7

Pips

Loss

3345.00

TP

3415.09

Exit Price

3389.23

Entry Price

3415.00

SL

The US Dollar plunges amid risk-off sentiment, disappointing US inflation data, and renewed skepticism over Trump’s trade agenda, pushing USD/CHF toward multi-year lows.

0.81400

Entry Price

0.80000

TP

0.82500

SL

41.1

Pips

Profit

0.80000

TP

0.80989

Exit Price

0.81400

Entry Price

0.82500

SL

The euro climbs beyond 1.1600 against the dollar for the first time since November 2021, buoyed by dovish Fed expectations, hawkish ECB rhetoric, and rising trade war fears.

1.15693

Entry Price

1.19500

TP

1.14000

SL

23.3

Pips

Profit

1.14000

SL

1.15926

Exit Price

1.15693

Entry Price

1.19500

TP

EUR/JPY surged near 166.60 on Thursday, reclaiming early-session losses as the Euro gained broad strength.

166.297

Entry Price

168.500

TP

164.000

SL

51.0

Pips

Profit

164.000

SL

166.807

Exit Price

166.297

Entry Price

168.500

TP

The US dollar has been negatively impacted by soft US inflation data and rising expectations for a Federal Reserve rate cut in September. As USDCAD continues to decline within a descending channel, persistent bearish sentiment has taken the lead.

1.36226

Entry Price

1.34700

TP

1.36950

SL

72.4

Pips

Loss

1.34700

TP

1.36953

Exit Price

1.36226

Entry Price

1.36950

SL

After closing in the positive territory on Wednesday, gold prices continued to rise on Thursday, currently trading around $3,380. Following the release of the US May inflation data, US Treasury yields plummeted significantly, and the ongoing weakness of the US dollar has helped to maintain the upward momentum of gold prices.

3364.98

Entry Price

3450.00

TP

3329.00

SL

10.5

Pips

Profit

3329.00

SL

3366.03

Exit Price

3364.98

Entry Price

3450.00

TP

Released today, the UK April GDP data shows an unexpected decline, far below market expectations, which has caused the British pound to come under pressure and weaken. Technical analysis suggests a potential head and shoulders top formation.

1.35692

Entry Price

1.32400

TP

1.36200

SL

50.8

Pips

Loss

1.32400

TP

1.36201

Exit Price

1.35692

Entry Price

1.36200

SL

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up