Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

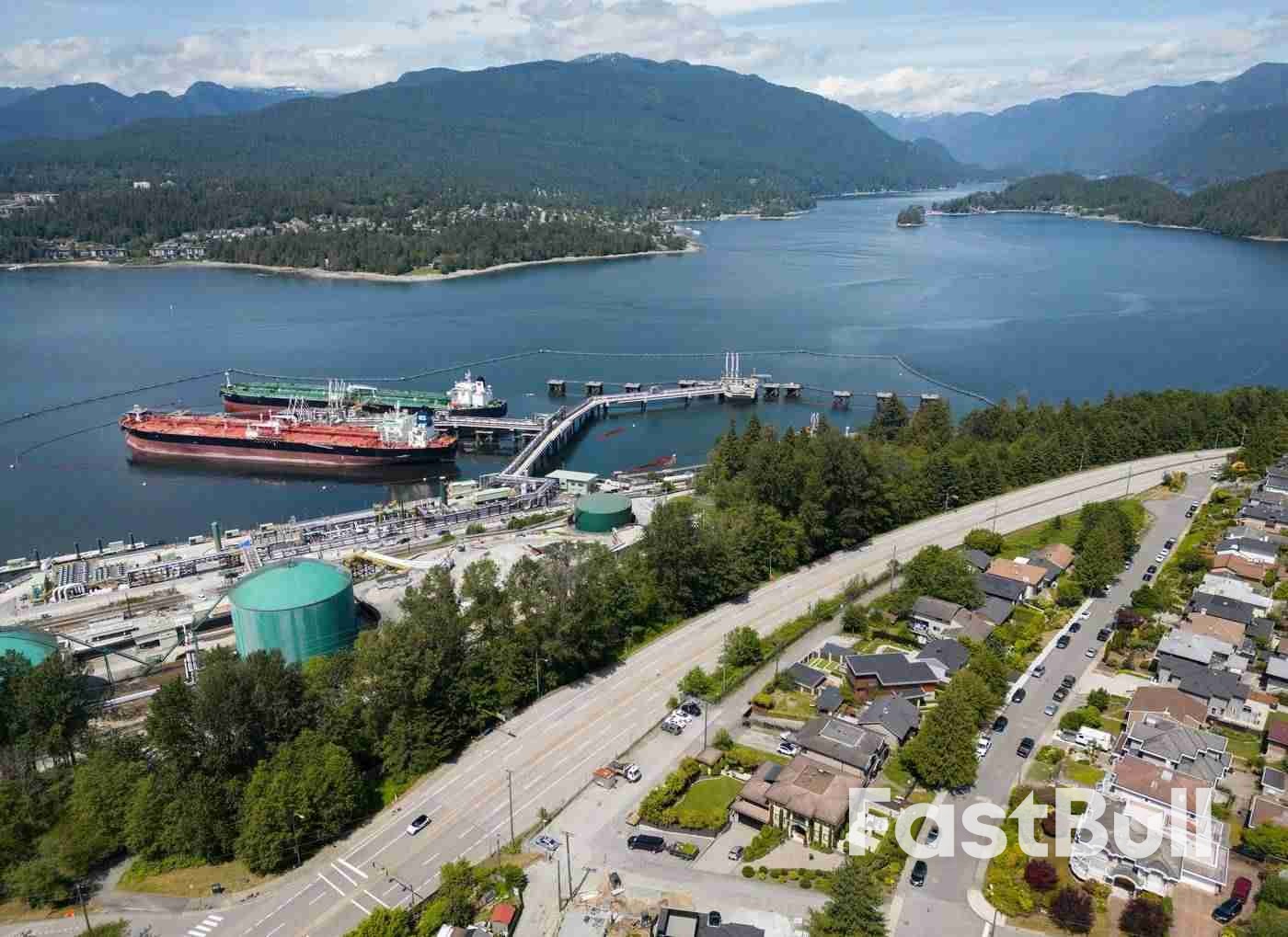

Global oil demand will keep growing until around the end of this decade despite peaking in top importer China in 2027, as cheaper gasoline and slower electric vehicle adoption in the United States support consumption, the International Energy Agency said on Tuesday.

Global oil demand will keep growing until around the end of this decade despite peaking in top importer China in 2027, as cheaper gasoline and slower electric vehicle adoption in the United States support consumption, the International Energy Agency said on Tuesday.

Despite seeing an earlier demand peak for China, the IEA, which advises industrialized countries, stuck to its prediction that global demand will peak by 2029. This view sharply contrasts with that of producer group OPEC, which says consumption will keep growing for much longer.

Oil demand will peak at 105.6 million barrels per day (bpd) by 2029 and then fall slightly in 2030, a table in the Paris-based IEA’s annual report shows. At the same time, global production capacity is forecast to rise by more than 5 million bpd to 114.7 million bpd by 2030.

A conflict between Israel and Iran has highlighted the risk to Middle East supplies, helping send oil prices up 5% to above $74 a barrel on Friday.

Still, the latest forecasts suggest ample supplies through 2030 if there are no major disruptions, the IEA said.

“Based on the fundamentals, oil markets look set to be well-supplied in the years ahead,” said IEA Executive Director Fatih Birol in a statement. “But recent events sharply highlight the significant geopolitical risks to oil supply security,” Birol said.

In a separate report on Tuesday, which included a commentary on the market impact of the Israel-Iran conflict, the IEA said the world market looks well supplied this year in the absence of a major disruption as growth in supply exceeds that of demand.

Global supply in 2025 will rise by 1.8 million bpd, up 200,000 bpd from last month, the IEA said. This is partly because OPEC+, which groups the Organization of the Petroleum Exporting Countries plus Russia and other allies, is raising output.

World demand in 2025 will rise by a much lower 720,000 bpd, the IEA said, down 20,000 bpd from last month’s forecast.

After decades of leading global oil demand growth, China’s contribution is sputtering as it faces economic challenges as well as making a big shift to EVs.

The world’s second-largest economy is set to see its oil consumption peak in 2027, following a surge in EV sales and the deployment of high-speed rail and trucks running on natural gas, the IEA said. In February, it predicted China’s demand for road and air transport fuels may have already peaked.

China’s total oil consumption in 2030 is now set to be only marginally higher than in 2024, the IEA said, compared with growth of around 1 million bpd forecast in last year’s report.

By contrast, lower gasoline prices and slower EV adoption in the United States, the world’s largest oil consumer, have boosted the 2030 oil demand forecast by 1.1 million bpd compared with the previous prediction, the IEA said.

U.S. electric vehicles are now expected to account for 20% of U.S. total car sales in 2030, down from 55% assumed last year, the report said.

Since returning to office, U.S. President Donald Trump has demanded OPEC lower oil prices and has taken aim at EVs through steps such as signing resolutions approved by lawmakers barring California’s EV sales mandates.

A gauge of U.S. homebuilder sentiment slid unexpectedly to its lowest level in two and a half years in June, with more than a third of residential construction firms cutting prices to lure buyers sidelined by high mortgage rates and economic uncertainty due to President Donald Trump's tariffs.

The National Association of Home Builders/Wells Fargo Housing Market Index fell to 32, the lowest reading since December 2022, from 34 in May. Economists polled by Reuters had expected the sentiment score to improve to 36.

Measures of current sales conditions, future sales expectations and buyer foot traffic all fell. On a regional basis, the Northeast posted a small rise while the South, Midwest and West all declined.

"Rising inventory levels and prospective home buyers who are on hold waiting for affordability conditions to improve are resulting in weakening price growth in most markets and generating price declines for resales in a growing number of markets," Robert Dietz, NAHB's chief economist, said in a statement. "Given current market conditions, NAHB is forecasting a decline in single-family starts for 2025."

Mortgage rates remain elevated. The average rate on the most popular home loan, the 30-year fixed-rate mortgage, was 6.84% last week, according to home finance firm Freddie Mac, squarely in the middle of the 6.60% to 7.04% range over the past six months.

"Buyers are increasingly moving to the sidelines due to elevated mortgage rates and tariff and economic uncertainty," said NAHB Chairman Buddy Hughes, a home builder and developer based in Lexington, North Carolina. "To help address affordability concerns and bring hesitant buyers off the fence, a growing number of builders are moving to cut prices."

The survey showed 37% of builders were cutting prices in June, the highest percentage since NAHB began tracking the metric on a monthly basis in 2022. That figure was up from 34% in May and 29% in April, while the average price cut held steady at 5%. The use of any kind of incentive ticked up a point to 62%.

The US Industrial Production, a key indicator of the total inflation-adjusted value of output produced by manufacturers, mines, and utilities, has reported a downturn, according to recent economic data. The actual figure came in at -0.2%, marking a surprising shift in the nation’s industrial performance.

This recent figure starkly contrasts with the forecasted 0.0% change, indicating a more significant downturn than economists had predicted. The negative reading signals a contraction in the sector, a development that could be interpreted as bearish for the US dollar.

When compared to the previous figure of 0.1%, the current -0.2% actual figure underscores a clear downward trend in industrial production. This shift from a slight increase to a decrease in production could potentially signal underlying issues within the manufacturing, mining, and utilities sectors.

The importance of the Industrial Production figure is underscored by its two-star rating, indicating a significant impact on the overall economic health of the country. The decrease in production could potentially impact the US dollar’s strength, given that a higher than expected reading is typically seen as positive for the USD.

This unexpected downturn in industrial production could potentially raise concerns among investors and economists. The forecasted stability in industrial production was seen as a positive sign for the US economy, suggesting steady output from key sectors. However, the actual decrease could imply a slowdown in these sectors, potentially affecting overall economic growth.

While the immediate impact on the USD remains to be seen, the lower than expected reading could potentially influence future monetary policy decisions. As the US economy continues to navigate the complexities of the post-pandemic landscape, these figures will undoubtedly play a pivotal role in shaping the path forward.

In the face of this unexpected downturn, the focus will now turn to how the US economy responds. The coming months will provide further insight into whether this is a temporary blip or a sign of a more prolonged contraction in the industrial sector.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up