Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

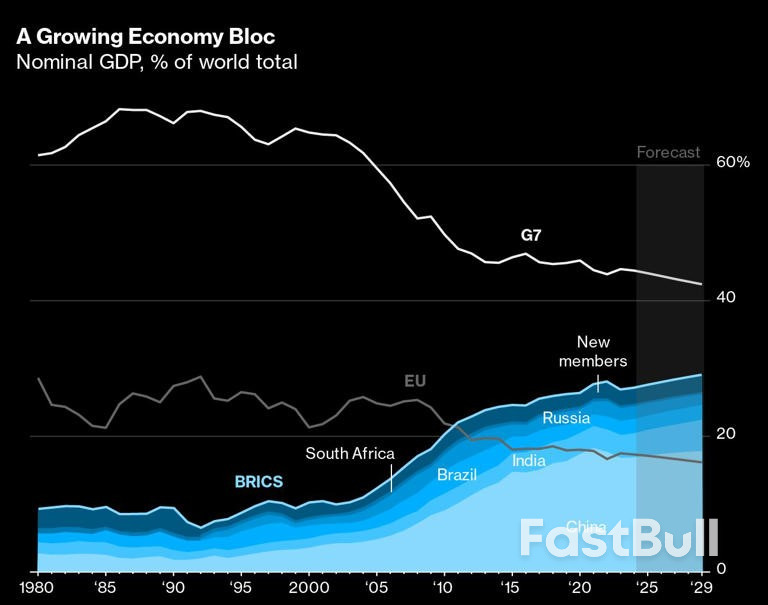

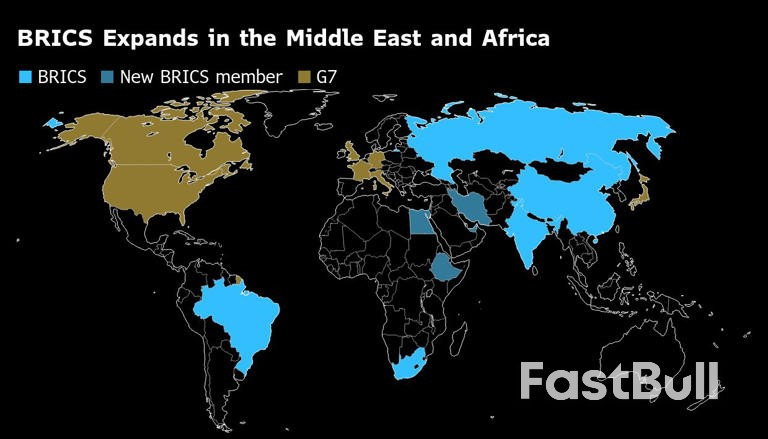

Trump warned of a 10% tariff on nations aligning with BRICS’ "Anti-American" policies, increasing trade uncertainty. Emerging market currencies fell, as BRICS criticized U.S. tariffs and discussed alternative payment systems.

The European Union still aims to reach a trade deal with the United States by July 9 after Commission President Ursula von der Leyen and U.S. President Donald Trump had a "good exchange", a Commission spokesperson said on Monday.

It was not immediately clear, however, whether there had been a meaningful breakthrough in talks to stave off the imposition of sweepingtariff hikeson the United States' largest trading partner.

The clock is ticking down on a deadline for countries around the world to conclude deals with the U.S. after Trump unleashed a global trade war that has roiled financial markets and sent policymakers scrambling to protect their economies.

As he keeps much of the world guessing, Trump on Sunday said the U.S. was close to finalising several trade pacts in coming days and would notify other countries by July 9 of higher tariff rates. He said they would not take effect until August 1, a three-week reprieve.

He also put members of the developing nations' BRICS group in his sights as its leaders met in Brazil, threatening an additional 10% tariff on any countries aligning themselves with the "anti-American" policies.

The BRICS group comprises Brazil, Russia, India and China and South Africa along with recent joiners Egypt, Ethiopia, Indonesia, Iran, and the United Arab Emirates.

The EU has been torn over whether to push for a quick and light trade deal or back its own economic clout in trying to negotiate a better outcome. It had already dropped hopes for a comprehensive trade agreement before the July deadline.

"We want to reach a deal with the U.S. We want to avoid tariffs," the spokesperson told reporters at a daily briefing. "We want to achieve win-win outcomes, not lose-lose outcomes."

Without a preliminary agreement, broad U.S. tariffs on most imports would rise from their current 10% to the rates set out by Trump on April 2. In the EU's case that would be 20%.

Von der Leyen also held talks with the leaders of Germany, France and Italy at the weekend, Germany said. German Chancellor Friedrich Merz has repeatedly stressed the need for a quick deal to protect industries vulnerable to tariffs ranging from cars to pharmaceuticals.

"Time is money in the truest sense of the word," the German spokesperson told reporters in Berlin.

"In this respect, we should give ourselves another 24 or 48 hours to come to a decision."

Russia said the BRICS group had never tried to undermine other countries.

"It is very important to note here that the uniqueness of a group like BRICS is that it is a group of countries that share common approaches and a common world view on how to cooperate, based on their own interests," said Kremlin spokesman Dmitry Peskov.

"And this cooperation within BRICS has never been and will never be directed against any third countries."

The S&P 500 continuesto be supported given the lack of bearish drivers. Last Thursday’s NFP lookedlike it could offer a bigger pullback on a hawkish repricing in interest rateexpectations but the positive data came with lower wage growth, which is greatfor the stock market.

In the short-term, the onlyrisk I can see is further hawkish repricing in interest rates expectations, butwe will likely need a hot CPI for that. That should provide a deeper pullback. Butgiven that the Fed's reaction function remains to either wait more or cut, themarket should eventually get back to its upward trend.

We now have two main risksahead for the bulls: tariffs noise and US CPI. The White House is expected tosign trade deals and send letters with the new tariff rates to countries thathave not reached a deal yet. The good news is that we have once again adeadline, which is August 1st. Therefore, it looks like the usual negotiationstactic to speed up the process and accept the US requests.

On the other hand, we havethe US CPI coming up next week. To keep the trend going, we would likely needsoft inflation figures as a hot report should trigger a deeper pullback.

S&P 500Technical Analysis – Daily Timeframe

On the daily chart, we cansee that the S&P 500 continued to print new all-time highs pretty much everydayonce the price broke above the February highs. From a risk managementperspective, the buyers will have a better risk to reward setup around theprevious all-time high at 6,160-ish level to position for the continuation ofthe uptrend. The sellers, on the other hand, will want to see the price breakinglower to pile in for a drop into the 6,000 level next.

S&P 500 TechnicalAnalysis – 4 hour Timeframe

On the 4 hour chart, we cansee that we have an upward trendline defining the uptrend. If we were toget a pullback all the way into the trendline, we can expect the dip-buyers tolean on it to position for a rally into new all-time highs with a better riskto reward setup. The sellers, on the other hand, will look for a break lower toincrease the bearish bets into the 5,800 level next.

S&P 500 TechnicalAnalysis – 1 hour Timeframe

On the 1 hour chart, we cansee that we have a minor upward trendline defining the bullish momentum on thistimeframe. The buyers will likely continue to lean on the trendline to keeppushing into new highs, while the sellers will look for a break lower to targeta deeper pullback into the 6,236 level first and, upon a further break lower,into the 6,160 price area.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up