Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Toronto Stock Index .GSPTSE Unofficially Closes Up 493.18 Points, Or 1.50 Percent, At 33389.73

The Nasdaq Golden Dragon China Index Closed Down 0.1% Initially. Among Popular Chinese Concept Stocks, Pinduoduo Closed Up Over 1%, While Meituan, Yum China, New Oriental, Tencent, BYD, Baidu, And Alibaba All Rose By More Than 0.9%. Li Auto Fell 0.3%, Pony.ai Fell 0.9%, And WeRide Fell 3.8%

The S&P 500 Closed Up 0.6%, With The Energy Sector Up 2%, Technology And Consumer Discretionary Sectors Up 1%, Real Estate Down 1.4%, And Utilities Down 1.7%. The NASDAQ 100 Closed Up 0.8%, With Its Components Showing Strong Performance: Cadence Electronics Up 7.7%, DoorDash Up 7.3%, Synopsys And Micron Technology Up 5%, Western Digital Up 4.4%, Walmart Down 1.7%, Strategy Down 2.4%, Ceg Down 2.6%, NXP Down 3.1%, And Paratop Networks Down 6.7%. Amazon, Cisco, Goldman Sachs, Salesforce, Disney, And Nvidia Led The Dow Jones Components With Gains Of At Least 1.7%, While Caterpillar, Procter & Gamble, VZ, Boeing, And 3M Fell By Up To 2%

USA Dec Net Private Capital Flow +32.7 Billion Dlrs Versus+159.6 Billion In Nov (Previous +167.2 Billion)

USA Dec Net Long-Term Flow (Including Swaps/Other) +28.0 Billion Dlrs Versus+206.6 Billion In Nov (Previous +220.2 Billion)

USA Dec Net Official Capital Flow +12.2 Billion Dlrs Versus+44.9 Billion In Nov (Previous +44.9 Billion)

USA Dec Net Long-Term Flow (Ex-Swaps/Other) +28.0 Billion Dlrs Versus+206.6 Billion In Nov (Previous +220.2 Billion)

On Wednesday (February 18), The Bloomberg Electric Vehicle Price Return Index Rose 0.92% To 3639.09 Points, Continuing Its Upward Trend Since The Start Of Trading In The Asia-Pacific Region. Among Its Components, Aurora Innovation Rose 5.8%, Panasonic Corporation Closed Up 5.38%, STMicroelectronics' Paris Shares Closed Up 3.84%, Umicore's European Shares Closed Up 3.67%, While Mobileye Fell Approximately 1.7%, Ballard Power Systems Fell 2%, And WeRide Fell 4.1%

Ukraine President Zelenskiy: USA,'Maybe Some Europeans' Discuss New Document Between Russia And NATO

Argentina's Merval Index Closed Down 3.16% At 2.727 Million Points, Continuing Its Downward Trend After Opening Lower

[US Treasury Yields Rise By Over 2 Basis Points] On Wednesday (February 18), In Late New York Trading, The Yield On The 10-year US Treasury Note Rose 2.50 Basis Points To A Daily High Of 4.0865%, Continuing Its Upward Trend Throughout The Day. The Yield On The 2-year US Treasury Note Rose 2.91 Basis Points To 3.4616%; The Yield On The 30-year US Treasury Note Rose 2.23 Basis Points To 4.7108%. The Spread Between The 2-year And 10-year US Treasury Yields Remained Roughly Unchanged At +61.883 Basis Points. The Yield On The 10-year Treasury Inflation-Protected Securities (TPS) Rose 0.77 Basis Points To 1.7894%; The Yield On The 2-year TPS Fell 0.61 Basis Points To 0.7566%; And The Yield On The 30-year TPS Rose 0.96 Basis Points To 2.4824%

Ukraine President Zelenskiy: USA Will Have Leadership In Monitoring Ceasefire, European Representatives Should Also Be Involved

Ukraine President Zelenskiy: Ukraine, Russia 'Close To' Having Document Establishing How Any Ceasefire Will Be Monitored

U.K. Retail Prices Index YoY (Jan)

U.K. Retail Prices Index YoY (Jan)A:--

F: --

P: --

U.K. Core CPI MoM (Jan)

U.K. Core CPI MoM (Jan)A:--

F: --

P: --

France HICP Final MoM (Jan)

France HICP Final MoM (Jan)A:--

F: --

P: --

South Africa Core CPI YoY (Jan)

South Africa Core CPI YoY (Jan)A:--

F: --

P: --

South Africa CPI YoY (Jan)

South Africa CPI YoY (Jan)A:--

F: --

P: --

Canada Existing Home Sales MoM (Jan)

Canada Existing Home Sales MoM (Jan)A:--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. YieldA:--

F: --

P: --

South Africa Retail Sales YoY (Dec)

South Africa Retail Sales YoY (Dec)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

U.S. Total Building Permits (SA) (Dec)

U.S. Total Building Permits (SA) (Dec)A:--

F: --

P: --

U.S. Durable Goods Orders MoM (Dec)

U.S. Durable Goods Orders MoM (Dec)A:--

F: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Dec)

U.S. Durable Goods Orders MoM (Excl.Transport) (Dec)A:--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Dec)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Dec)A:--

F: --

P: --

U.S. Annual New Housing Starts (SA) (Dec)

U.S. Annual New Housing Starts (SA) (Dec)A:--

F: --

U.S. New Housing Starts Annualized MoM (SA) (Dec)

U.S. New Housing Starts Annualized MoM (SA) (Dec)A:--

F: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Dec)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Dec)A:--

F: --

U.S. Building Permits MoM (SA) (Dec)

U.S. Building Permits MoM (SA) (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. Capacity Utilization MoM (SA) (Jan)

U.S. Capacity Utilization MoM (SA) (Jan)A:--

F: --

U.S. Industrial Output MoM (SA) (Jan)

U.S. Industrial Output MoM (SA) (Jan)A:--

F: --

U.S. Manufacturing Capacity Utilization (Jan)

U.S. Manufacturing Capacity Utilization (Jan)A:--

F: --

P: --

U.S. Manufacturing Output MoM (SA) (Jan)

U.S. Manufacturing Output MoM (SA) (Jan)A:--

F: --

U.S. Industrial Output YoY (Jan)

U.S. Industrial Output YoY (Jan)A:--

F: --

P: --

U.S. Conference Board Coincident Economic Index MoM (Jan)

U.S. Conference Board Coincident Economic Index MoM (Jan)--

F: --

P: --

U.S. Conference Board Leading Economic Index (Jan)

U.S. Conference Board Leading Economic Index (Jan)--

F: --

P: --

U.S. Conference Board Lagging Economic Index MoM (Jan)

U.S. Conference Board Lagging Economic Index MoM (Jan)--

F: --

P: --

U.S. Conference Board Leading Economic Index MoM (Jan)

U.S. Conference Board Leading Economic Index MoM (Jan)--

F: --

P: --

Russia PPI MoM (Jan)

Russia PPI MoM (Jan)A:--

F: --

P: --

Russia PPI YoY (Jan)

Russia PPI YoY (Jan)A:--

F: --

P: --

FOMC Meeting Minutes

FOMC Meeting Minutes U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

Japan Core Machinery Orders MoM (Dec)

Japan Core Machinery Orders MoM (Dec)--

F: --

P: --

Japan Core Machinery Orders YoY (Dec)

Japan Core Machinery Orders YoY (Dec)--

F: --

P: --

Australia Employment (Jan)

Australia Employment (Jan)--

F: --

P: --

Australia Full-time Employment (SA) (Jan)

Australia Full-time Employment (SA) (Jan)--

F: --

P: --

Australia Labor Force Participation Rate (SA) (Jan)

Australia Labor Force Participation Rate (SA) (Jan)--

F: --

P: --

Australia Unemployment Rate (SA) (Jan)

Australia Unemployment Rate (SA) (Jan)--

F: --

P: --

Turkey Consumer Confidence Index (Feb)

Turkey Consumer Confidence Index (Feb)--

F: --

P: --

Indonesia 7-Day Reverse Repo Rate

Indonesia 7-Day Reverse Repo Rate--

F: --

P: --

Indonesia Lending Facility Rate (Feb)

Indonesia Lending Facility Rate (Feb)--

F: --

P: --

Indonesia Deposit Facility Rate (Feb)

Indonesia Deposit Facility Rate (Feb)--

F: --

P: --

Indonesia Loan Growth YoY (Jan)

Indonesia Loan Growth YoY (Jan)--

F: --

P: --

Euro Zone Current Account (SA) (Dec)

Euro Zone Current Account (SA) (Dec)--

F: --

P: --

Euro Zone Current Account (Not SA) (Dec)

Euro Zone Current Account (Not SA) (Dec)--

F: --

P: --

Euro Zone Construction Output YoY (Dec)

Euro Zone Construction Output YoY (Dec)--

F: --

P: --

Euro Zone Construction Output MoM (SA) (Dec)

Euro Zone Construction Output MoM (SA) (Dec)--

F: --

P: --

U.K. CBI Industrial Prices Expectations (Feb)

U.K. CBI Industrial Prices Expectations (Feb)--

F: --

P: --

U.K. CBI Industrial Trends - Orders (Feb)

U.K. CBI Industrial Trends - Orders (Feb)--

F: --

P: --

U.S. Philadelphia Fed Business Activity Index (SA) (Feb)

U.S. Philadelphia Fed Business Activity Index (SA) (Feb)--

F: --

P: --

U.S. Philadelphia Fed Manufacturing Employment Index (Feb)

U.S. Philadelphia Fed Manufacturing Employment Index (Feb)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

Canada Trade Balance (SA) (Dec)

Canada Trade Balance (SA) (Dec)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

U.S. Wholesale Inventory Prelim MoM (Dec)

U.S. Wholesale Inventory Prelim MoM (Dec)--

F: --

P: --

Canada Exports (SA) (Dec)

Canada Exports (SA) (Dec)--

F: --

P: --

Canada New Housing Price Index MoM (Jan)

Canada New Housing Price Index MoM (Jan)--

F: --

P: --

No matching data

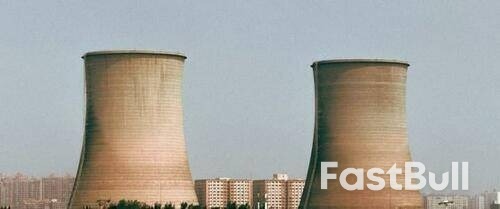

One of the biggest hurdles to expanding the global nuclear power sector is the concern over how best to manage nuclear waste.

● Effective nuclear waste management is a critical global challenge, particularly for countries like the UK looking to expand their nuclear power sectors.

● The UK has a substantial amount of existing radioactive waste and is struggling to implement a long-term disposal solution, with the proposed underground geological disposal facility facing significant hurdles and cost concerns.

● Public and local community pushback against potential nuclear waste sites further complicates the development of new disposal facilities, making finding a solution an ongoing and difficult process.

One of the biggest hurdles to expanding the global nuclear power sector is the concern over how best to manage nuclear waste.While some believe they have found sustainable solutions to dispose of nuclear waste, there is still widespread debate around how safe these methods are and the potential long-term impact of waste disposal and storage.In the United Kingdom, the government has put nuclear power back on the agenda, after decades with no new nuclear developments; however, managing nuclear waste continues to be a major barrier to development.

Nuclear waste remains radioactive for around 10,000 years, meaning it is vital that governments dispose of all waste effectively to ensure people and the environment are kept safe in the long term.As more governments welcome a new nuclear era, they must address nuclear waste concerns and establish clear guidelines and regulations on disposal to ensure that all nuclear power companies adhere to strong safety standards and practices.

There are three types of nuclear waste: low-, intermediate-, and high-level radioactive waste.Most of the waste produced at nuclear facilities is lightly contaminated, including items such as tools and work clothing, with a level of around 1 percent radioactivity.Meanwhile, spent fuel is an example of high-level waste, which contributes around 3 percent of the total volume of waste from nuclear energy production.However, this contains around 95 percent of the radioactivity, making adequate waste management of these products extremely important.

In the U.K., the government continues to battle with how best to dispose of its nuclear waste, as it looks to expand the industry over the coming decades. The U.K. has 700,000 cubic metres of radioactive waste from its previous nuclear power activities, a figure that will grow as more nuclear projects come online. The government is now considering the development of a massive underground nuclear dump, known as a geological deposit facility (GDF), to safely dispose of the waste. While no site has been confirmed for development, it is expected to be developed in one of two potential sites in Cumbria, in the north of England.

A U.K. Department for Energy Security and Net Zero spokesperson stated, “Constructing the UK’s first geological disposal facility will provide an internationally recognised safe and permanent disposal of the most hazardous radioactive waste.”They added, “Progress continues to be made in areas taking part in the siting process for this multibillion-pound facility, which would bring thousands of skilled jobs and economic growth to the local area.”

However, the U.K. Treasury believes the government’s plan for the waste dump is “unachievable”, rating the project as “red”, or not possible, in a recent assessment. This means that, “There are major issues with project definition, schedule, budget, quality and/or benefits delivery, which at this stage do not appear to be manageable or resolvable. The project may need rescoping and/or its overall viability reassessed.” In addition, there are concerns over the projected project cost, which is expected to be anywhere up to $73 billion.Richard Outram, the secretary of Nuclear Free Local Authorities, explained, “The Nista red rating is hardly surprising. The GDF process is fraught with uncertainties, and the GDF ‘solution’ remains unproven and costly.”

At present, the U.K. stores most of its nuclear waste at its Sellafield facility in Cumbria, which is viewed as one of the most complex and hazardous nuclear sites worldwide. However, with the planned decommissioning of several power plants and the development of new nuclear facilities, the government must address its imminent waste issue. This is a long-term problem, with it expected to take until 2150 to dispose of the country’s existing waste into a GDF, if one is developed, before disposing of new waste.

In June, Lincolnshire County Council withdrew from being a potential site for the GDF after engaging with communities about the proposal. This is a common problem with developing nuclear waste sites, as the pushback in proposed waste regions often prevents development due to a not-in-my-backyard perspective from residents in the area. It is still unclear whether communities in Cumbria will hold a similar opinion. Corhyn Parr, the CEO of Nuclear Waste Services, said, “A GDF requires a suitable site and a willing community and will only be developed when both are in place.”

Several countries around the globe are battling with how best to dispose of old and new nuclear waste, as a nuclear renaissance is starting to be seen, in line with global aims for a green transition. While nuclear power is now viewed as extremely safe and clean, there are pressing concerns around the adequate disposal of waste, which can be extremely harmful to human health and the environment if improperly managed, that must be rapidly addressed.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up