Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The United States has imposed a steep 39% tariff on Swiss imports one of the highest globally dealing a significant blow to Switzerland’s export-heavy economy...

On the H4 chart of EURUSD, the market continues to develop a compact consolidation range around 1.1420. Today, 1 August 2025, this range is expected to expand down to 1.1387 and up to 1.1421. A correction to 1.1487 is also possible. Afterwards, a downward wave to 1.1185 is likely. This is a local target.Technically, the Elliott wave structure and the matrix of the downward wave with a pivot point at 1.1487 confirm this scenario. This level is seen as key in the EURUSD wave structure. The market is currently forming a downward wave to the lower boundary of the price Envelope at 1.1185. Once this level is reached, a rebound to the central line at 1.1487 is possible.

Technical indicators for today’s EURUSD forecast suggest a downward wave towards 1.1185.

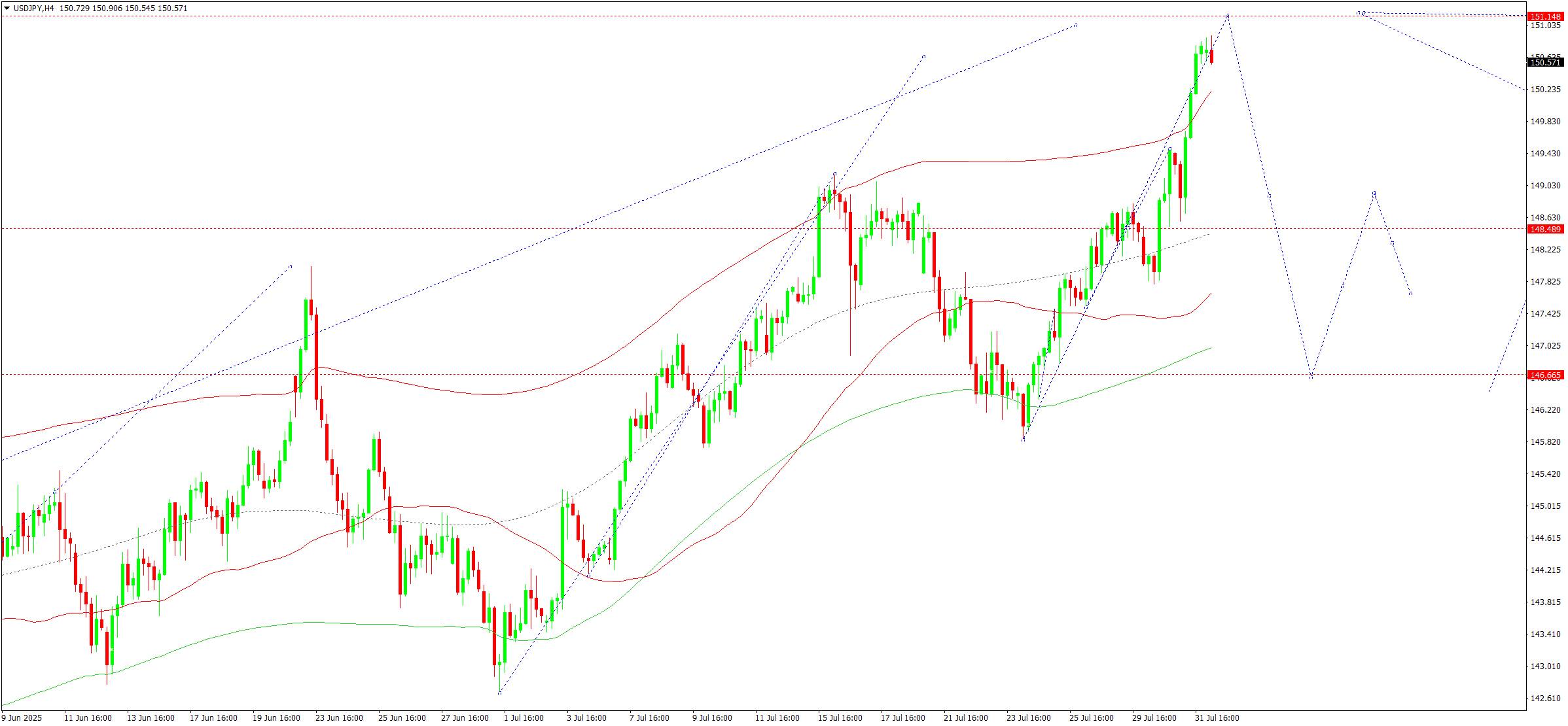

On the H4 chart of USDJPY, the market formed a consolidation range around 148.62 and broke out upwards. Today, 1 August 2025, a growth leg towards 151.45 is possible. Later, the price is expected to correct back to 148.62 (testing from above), followed by a rise to 153.40.Technically, the Elliott wave structure and the matrix of the growth wave with a rotation centre at 148.62 confirm this scenario. This level is considered key in this wave. The market completed a growth wave to the upper boundary of the Price Envelope at 151.45. A decline to the central line at 148.62 is not excluded, followed by a move up to the upper boundary at 153.40.

Technical indicators for today’s USDJPY forecast suggest a rise to 151.45.

On the H4 chart of GBPUSD, the market continues a downward wave towards 1.3155 as a local target. Today, 1 August 2025, this target level may be reached. Afterwards, a correction to 1.3370 (testing from below) is likely, followed by a decline to 1.2950.Technically, the Elliott wave structure and the matrix of the downward wave with a pivot point at 1.3370 confirm this scenario. This level remains key in the wave structure. The market is currently forming a downward wave to the lower boundary of the price Envelope at 1.3155. Later, a correction to the central line at 1.3370 is possible.

Technical indicators for today’s GBPUSD forecast suggest a decline towards 1.3152.

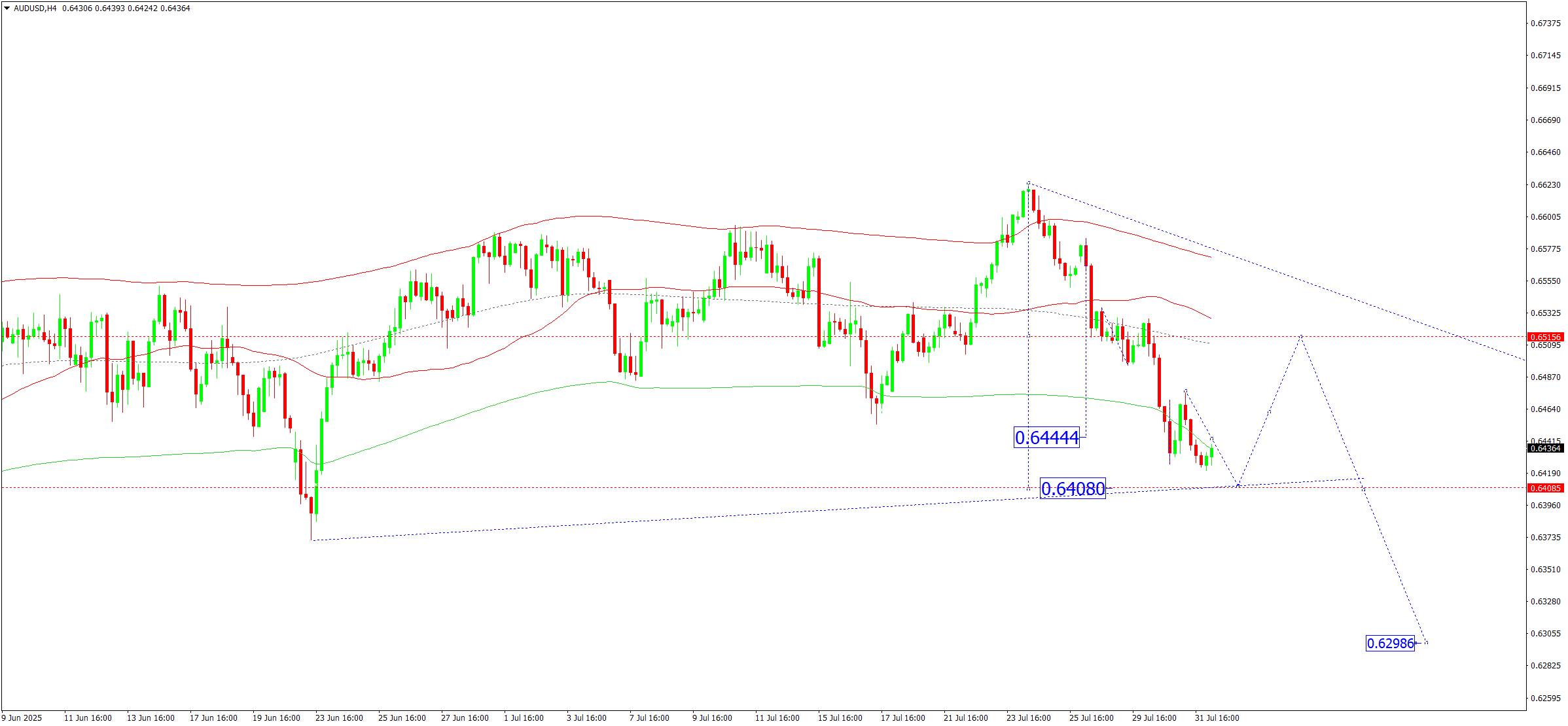

On the H4 chart of AUDUSD, the market continues to develop a consolidation range around 0.6444. Today, 1 August 2025, an upward breakout would open the way for a correction to 0.6555. If it breaks downwards, the downward wave may continue to 0.6408 as the first target.Technically, the Elliott wave structure and the matrix of the AUDUSD downward wave with a pivot point at 0.6515 confirm this scenario. This level is viewed as key in this wave structure. The market is currently forming a downward wave to the lower boundary of the price Envelope at 0.6408. Afterwards, a rise to the central line at 0.6515 is possible, followed by a continued decline to the lower boundary at 0.6400.

Technical indicators for today’s AUDUSD forecast suggest a decline to 0.6408.

On the H4 chart of USDCAD, the market formed a consolidation range around 1.3747 and broke out upwards. Today, 1 August 2025, a continued upward wave towards 1.3920 is expected. Later, a pullback to 1.3750 (testing from above) is possible.Technically, the Elliott wave structure and the matrix of the growth wave with a pivot point at 1.3750 confirm this scenario. This level is considered key in the wave structure of USDCAD. The market formed a consolidation range around the central line of the price Envelope at 1.3750 and broke upwards. Today, the scenario of growth towards the upper boundary at 1.3920 remains relevant.

Technical indicators for today’s USDCAD forecast suggest a move up to 1.3920.

On the H4 chart of XAUUSD, the market is forming a consolidation range around 3,300. The range currently extends down to 3,268 and up to 3,314. Today, 1 August 2025, a decline to 3,247 is possible. This is a local target.Technically, the Elliott wave structure and the matrix of the downward wave with a pivot point at 3,345 confirm this scenario. This level is viewed as key in the wave structure of XAUUSD. The market is executing a downward wave to the lower boundary of the price Envelope at 3,247. Afterwards, a rise to the central line at 3,345 is possible, followed by a decline to the lower boundary at 3,150.

Technical indicators for today’s XAUUSD forecast point to a downward wave towards 3,247.

On the H4 chart of Brent crude, the market is forming a consolidation range around 71.75. Today, 1 August 2025, a downward breakout may lead to a correction to 70.00. If the price breaks upwards, the wave may continue to 73.33 with the potential to extend the trend to 76.00 as a local target.Technically, the Elliott wave structure and the matrix of the growth wave with a pivot point at 71.80 confirm this scenario. This level remains key in the current wave of Brent. The market is forming a consolidation range around the central line of the price Envelope at 71.80. A short-term decline to 70.00 is not excluded, followed by a rise to the upper boundary at 73.33. Later, a pullback to the central line at 70.80 is possible.

Technical indicators for today’s Brent forecast suggest the continuation of the growth wave towards 73.33 and 76.00.

Euro zone inflation was unchanged at a higher-than-expected 2% in July, flash data from statistics agency Eurostat showed Friday.

Economists polled by Reuters had expected the figure to hit 1.9%, after a 2% reading in June.

The inflation figures follow on the footsteps of indications earlier this week that showed the euro zone economy expanded by a better-than-expected 0.1% in the second quarter, which was nevertheless sharply down on the 0.6% growth of the three months to the end of March.

Analysts interpreted the data as Europe's economy so far showing resilience in the face of U.S. President Donald Trump's tariff policies. The European Union and Washington recently inked a trade agreement which includes a 15% baseline levy for EU goods bound for the U.S. Sectoral tariffs and temporarily reduced so-called reciprocal duties have already been in play.

Duties are widely expected to weigh on economic growth, including in the euro zone, and affect prices of goods for U.S. consumers. Their impact on inflation in Europe remains uncertain.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up