Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

ECB’s Isabel Schnabel affirms euro area resilience with stable growth and anchored inflation expectations, while cautioning against inflationary risks from food prices, tariffs, and fiscal stimuli....

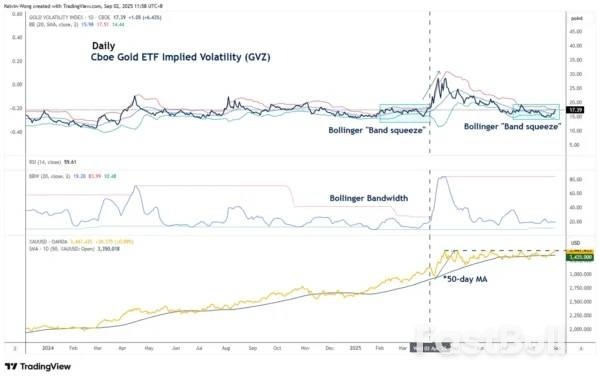

The price actions of Gold (XAU/USD) have staged the expected bullish move, rallied by 2.3% and hit the US$3,435 resistance as highlighted in our earlier publication last Friday, 29 August.The price actions of Gold (XAU/USD) have staged the expected bullish move, rallied by 2.3% and hit the US$3,435 resistance as highlighted in our earlier publication last Friday, 29 August.

For a quick recap, the US$3,435 is considered a significant range resistance on Gold (XAU/USD) as this level has managed to stall prior rallies since its current all-time high of US$3,500 printed on 22 April 2025 and caused Gold (XAU/USD) to oscillate in a choppy sideways range in the past four months.

Gold (XAU/USD) has finally managed to have a proper bullish breakout above the four-month range resistance of US$3,435 in last Friday’s US session, as it recorded a daily close of US$3,447 on 29 August in light of an anticipation of a US Federal Reserve’s dovish pivot in September.Gold (XAU/USD) extended its upward momentum at the start of the week, advancing 0.8% to close at US$3,476 on Monday, 1 September.In this latest report, we will highlight several key technical elements that Gold (XAU/USD) has entered into a potential short to medium-term bullish acceleration phase.

Let’s discuss them in detail, as well as the next short-term directional bias and key levels to watch on Gold (XAU/USD)

Preferred trend bias (1-3 days)

Maintain bullish bias on Gold (XAU/USD) as the yellow metal kickstarts a potential bullish acceleration phase (see Fig. 1).Watch the US$3,451 key short-term pivotal support. A clearance above US$3,500 (the current all-time high) will see the next intermediate resistances coming in at US$3,520/3,524 and US$3,536/3,548 (Fibonacci extension clusters).

Key elements

Alternative trend bias (1 to 3 days)

Failure to hold at the US$3,451 key short-term support on Gold (XAU/USD) negates the bullish tone for another round of minor corrective decline to retest US$3,435/3,432 pull-back support of the former medium-term “Ascending Triangle” range resistance.

Gold prices climbed to an all-time high on Tuesday, extending gains to a sixth session on the back of a weaker dollar and rising bets of a US interest rate cut this month.

Spot gold was up 0.5% at US$3,493.99 (RM14,781) per ounce, as of 0348 GMT, after hitting a record high of US$3,508.50 earlier in the session. US gold futures for December delivery gained 1.4% to US$3,564.40.

"A corollary of the weaker economic backdrop and expectations of US rate cuts is boosting precious metals," said Kyle Rodda, Capital.com's financial market analyst.

"Another factor is the festering confidence crisis in dollar assets because of US President Donald Trump's attack on Fed independence."

Trump has criticised the US Federal Reserve and its chair Jerome Powell for months for not lowering rates, and recently took aim at Powell over a costly renovation of the central bank's Washington headquarters.

On Monday, US Treasury Secretary Scott Bessent said the Fed is and should be independent, but added that it had "made a lot of mistakes" and defended Trump's right to fire Fed governor Lisa Cook over allegations of mortgage fraud.

Traders are currently pricing in a 90% chance of a 25-basis-point Fed rate cut on Sept 17, according to the CME FedWatch tool.

Non-yielding gold typically performs well in a low-interest-rate environment.

Rate-cut expectations and worries over the Fed's independence have weighed on the US dollar, which is languishing near a more than one-month low against its rivals, making gold less expensive for overseas buyers.

Data on Friday showed that the US personal consumption expenditures price index rose 0.2% month-on-month, and 2.6% year-on-year, both in line with expectations.

Investors are now looking forward to the US non-farm payrolls data due on Friday, to determine the size of an expected Fed rate cut later this month.

Elsewhere, spot silver gained 0.1% to US$40.71 per ounce, after hitting its highest since September 2011 in the previous session.

Platinum gained 1% to US$1,415.70, and palladium fell 0.7% to US$1,129.03.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up