Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

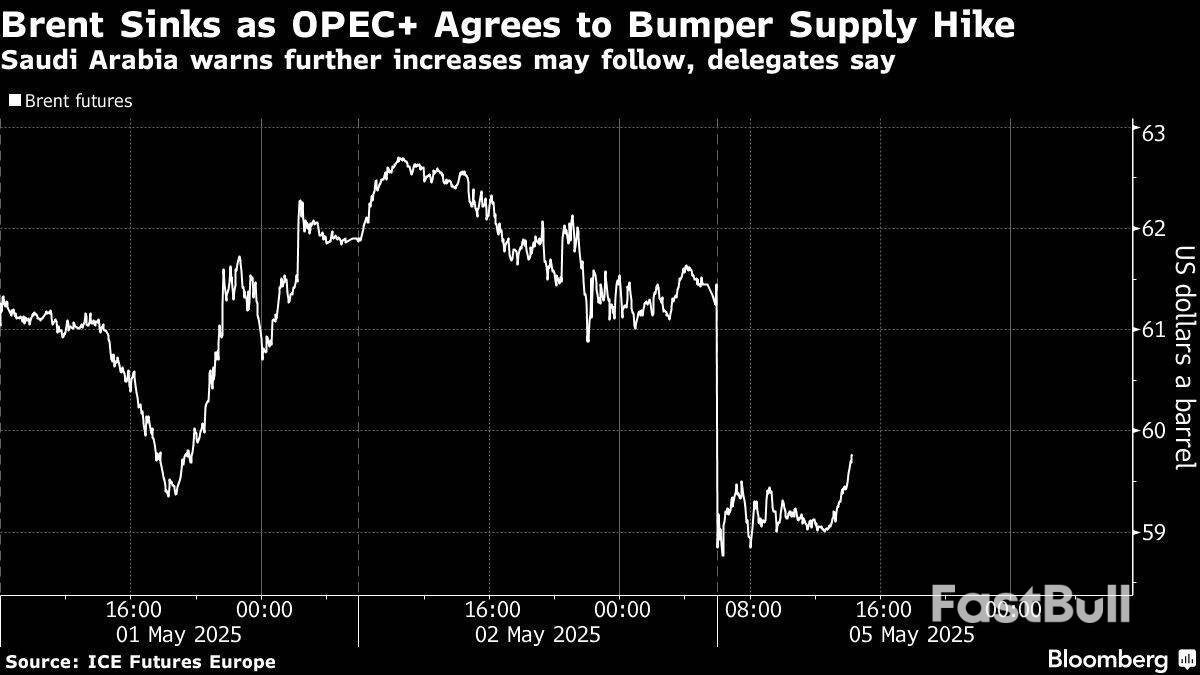

Global shares were mixed and oil prices fell after OPEC+ announced plans to boost output, while thin holiday trading and U.S. tariff uncertainty kept markets cautious.

Oil slipped after OPEC+ agreed to another bumper output increase, raising concern that additional supply could lead to a global glut just as demand looks to be under threat from the trade war.

Brent futures tumbled as much as 4.6% toward $58 a barrel, before paring losses. OPEC and its allies agreed Saturday to continue loosening supply constraints as the group’s leaders seek to punish overproducing members and win back market share.

The latest hike of more than 400,000 barrels a day from June matched a similar increase announced last month, when the group made the shock decision to bring back triple the planned volume for May. The alliance — led by Saudi Arabia and Russia — has been unwinding prolonged output curbs meant to support prices but that also cost the group market share. The strategy shift had already sent prices plunging.

“Projecting larger-than-expected increases marks a reversal in OPEC+ strategy,” Ed Bell head of research at Dubai lender Emirates NBD Pjsc, said in a note. “Providing month-ahead target announcements for producers controlling nearly 30% of global oil production will inject substantial short term volatility to prices” and less cohesion within the group could lead to “a disorderly end” to the alliance’s cooperation, he said.

In a move that could put additional pressure on prices, Saudi Arabia signaled further similar-sized increases could follow, according to delegates. The threat was widely viewed as being aimed at producers like Kazakhstan and Iraq that have pumped beyond their limits.

Crude is trading near a four-year low hit in April, as US President Donald Trump’s tariff war threatens to derail growth, erode investor confidence and undercut energy demand. The dramatic policy pivot by OPEC+ has added momentum to the sustained selloff, which has made oil one of the worst performing major commodities of 2025.

The decline in energy costs — if sustained — may be welcomed by central bankers, including those at the Federal Reserve, who meet this week to assess policy. President Trump — who is scheduled to travel to the Middle East later this month — had called on OPEC+ to bolster production and help bring down energy prices.

At the same time, Saudi Arabia has been seeking to strengthen ties with Washington, which has also been holding talks on a nuclear pact with Riyadh’s political foe and fellow OPEC member, Iran.

Gold prices climbed to 3,260 USD per troy ounce on Monday, as global uncertainty—particularly around US-China trade negotiations—continues to drive demand for safe-haven assets.

Market sentiment remains cautious after US President Donald Trump stated that China is ready to make a deal, yet offered no specifics on the content or timing of renewed negotiations.

Earlier, Beijing confirmed it was reviewing US proposals to restart talks but reiterated that certain conditions must be met before any dialogue can begin. This lingering uncertainty continues to bolster investor interest in gold.

Adding to the upside pressure, the US dollar weakened, making gold more attractive for holders of other currencies.

Investors are now turning their attention to the upcoming Federal Reserve meeting, which begins on Tuesday and concludes on Wednesday evening. Markets widely expect the Fed to maintain current interest rates, despite renewed calls from Trump to lower them.

On the H4 chart, XAU/USD is consolidating around 3,266 USD. A decline to 3,165 USD is possible in the short term. After reaching this level, the market may correct back up to 3,266 USD. If the correction completes, another downward wave could unfold with a target at 3,033 USD. The MACD indicator supports this bearish scenario, with its signal line below zero and pointing sharply downwards.

On the H1 chart, gold broke below 3,266 USD, reached the local target of 3,202 USD, and then corrected back up to test 3,266 USD from below. The formation of another downside wave towards 3,179 USD is relevant today. The Stochastic oscillator confirms this outlook, with its signal line below 80 and heading directly towards 20, indicating continued downward momentum.

Gold remains supported by geopolitical uncertainty and a weakening dollar, while technical indicators point to short-term downside potential before another possible corrective rebound. Key levels to watch are 3,179 USD and 3,165 USD as near-term support, with a broader bearish target at 3,033 USD. The Fed’s upcoming meeting may influence price direction depending on its tone regarding interest rates and the broader economic outlook.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up