Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

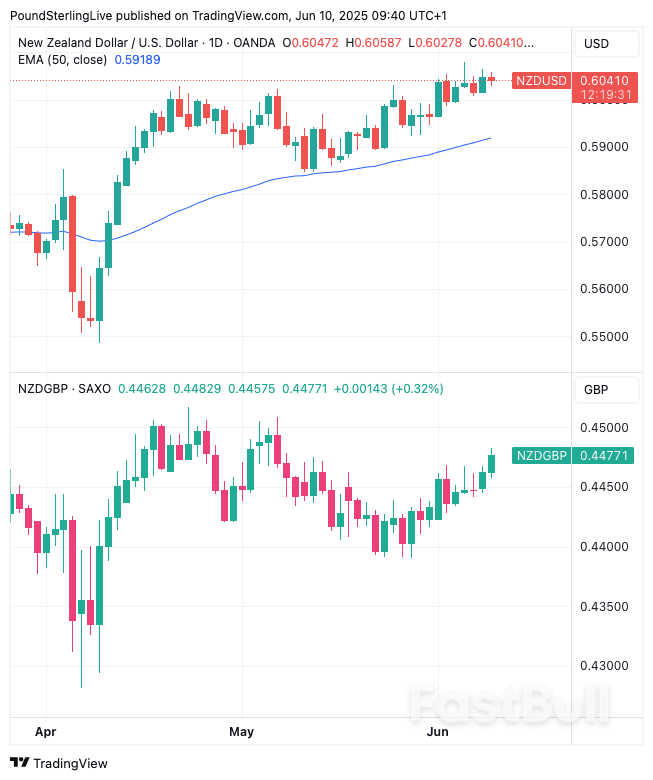

There are some positives building for the NZD in H2 according to new research.

The U.S. dollar was steady on Tuesday as talks between Beijing and Washington continued for a second day, stirring investors' expectations of an easing in trade tensions, while sterling dropped as British jobs data pointed to a weaker labour market.

Officials from the world's two largest economies were meeting in London to try to defuse a dispute that has widened from tariffs to restrictions over rare earths.

"Unlike the Geneva talks (held in May), where tariff relief provided easy wins, the London talks are now tackling thornier issues like chip export controls, rare earths, and student visas," said Charu Chanana, chief investment strategist at Saxo.

U.S. President Donald Trump and his Chinese counterpart Xi Jinping spoke by phone last week at a crucial time for both economies that are showing signs of strain from Trump's cascade of tariff orders since January.

The dollar index, which measures the U.S. currency against six others, was less than 0.1% higher at 98.989, and remained close to a six-week low of 98.351 it touched last week.

The index is down 8.7% this year as investors, worried about the impact of tariffs and trade tensions on the U.S. economy and growth, flee U.S. assets and look for alternatives.

The euro was flat at $1.1423, while the Australian dollar, often seen as a proxy for risk sentiment, was 0.1% lower at $0.6513.

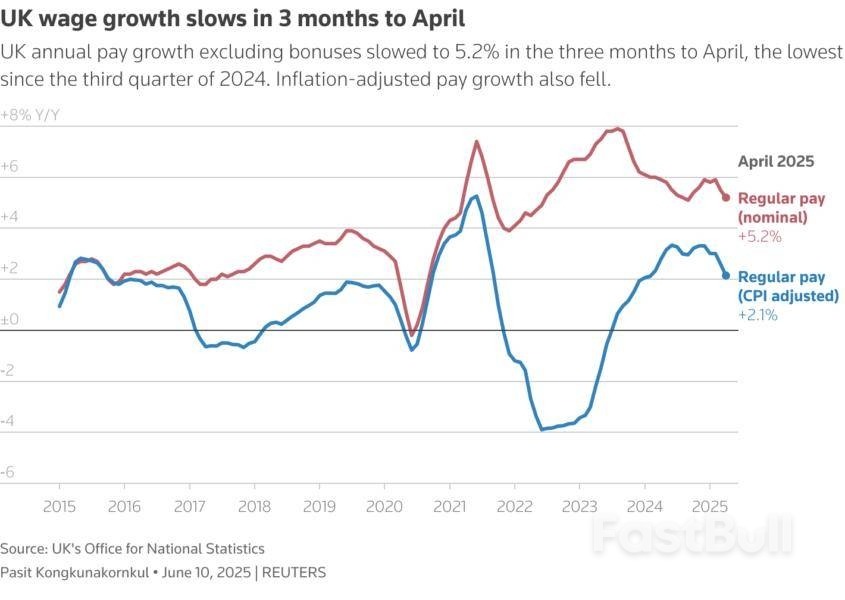

Sterling was weaker after UK jobs data implied further weakness in the labour market, which could influence how quickly the Bank of England cuts interest rates.

British wages rose by a slower-than-forecast 5.2% in the three months to April, pushing sterlingdown 0.4% against the dollar to $1.3499.

The labour market data "was definitely on the weak side", Danske Bank FX analyst Kirstine Kundby-Nielsen said.

"This puts a question mark on the hawkish bias that we've seen from the Bank of England."

The BoE is due to meet next week and is expected to keep the interest rate unchanged. Money market traders are pricing in about 48 basis points of cuts by year-end, up from about 39 bps before the data.

The Bank of Japan is also expected to maintain borrowing costs at current levels at next week's policy meeting. Its governor, Kazuo Ueda, suggested on Tuesday that the timing of the next interest rate hike could be pushed back.

"Once we have more conviction that underlying inflation will approach 2% or hover around that level, we will continue to raise interest rates to adjust the degree of monetary support," Ueda told parliament.

Risks to Japan's export-heavy economy from Trump's tariffs have pushed back market bets on the timing of the next rate hike, and investors are on the look-out for clues from Ueda on how soon rate increases could resume.

The yenwas last little changed at 144.50 per dollar, having gained more than 8.5% against the U.S. currency this year, supported by safe-haven flows during the market tumult unleashed by Trump's tariff chaos.

Investor focus this week will be on the U.S. consumer price index report for May due on Wednesday. The report could give insight into the impact of tariffs, with investors wary of any flare-ups in inflation ahead of the Fed's policy meeting next week.

The U.S. central bank is also expected to hold rates steady, with traders pricing in nearly two 25 basis-point cuts by the end of the year.

USD/JPY ranges within daily cloud (144.43/145.59) also between daily Tenkan and Kijun-sen lines, with Kijun-sen (145.38) capping the action today.

Near term technical structure is slightly bullishly aligned, with growing positive momentum and repeated close above Tenkan-sen supporting the notion.

On the other hand, overbought stochastic might be limiting factor that partially offsets positive signals.

Sideways near-term mode to be expected as long as price holds within the cloud, as strong downside rejection on Monday and upside rejection today supports scenario.

Firmer direction signals to be expected on clear break of either boundary of daily cloud, with dollar being underpinned by optimism on US China trade talks, though support was so far insufficient for stronger movements.

Markets await release of US inflation data this week, to get more clues about Fed’s action in the near future.

Signals that Bank of Japan will keep its monetary policy unchanged in the meeting next week, could be initial negative signal for yen.

Sustained break below cloud base / daily Tenkan to weaken near term structure and risk test of supports at 143.65/00 and 142.40 on stronger acceleration.

Conversely, firm break of cloud top to generate bullish signal and expose targets at 146.15/38 (Fibo 61.8% of 148.64/142.11 / May 29 spike high).

Res: 145.29; 145.59; 146.15; 146.38.

Sup: 144.33; 143.65; 143.00; 142.40.

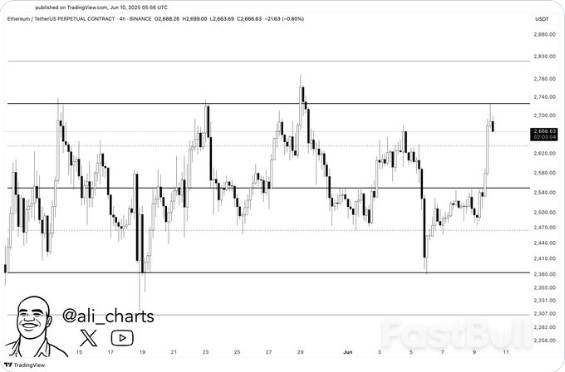

Ethereum (ETH), at this price of $2,750, continues to be a tough challenge, as it has previously prevented the cryptocurrency from increasing. There have been many moments when Bitcoin tried to break away from this level, but it didn’t. There has been a careful review of whether ETH can keep its current level, as it would support any movement towards growth.

The chart by @ali_charts explains that traders should wait for a decisive breakout before deciding on their next moves. Without breaking $2,750, any short-term profits could be fast to vanish. Should the price movement stall, it might mean that traders fell for a bull trap and had to face quick losses. Ethereum’s upcoming movements will depend on its price point.

If Ethereum is turned away from the $2,750 resistance, its price may drop to support levels at $2,500 and $2,380. These levels come from consolidations and substantial recoveries that occurred in these industries before. Ethereum appears to always come back to these points when growth becomes weaker, which could help it minimize a significant drop.

The chances of a correction rise as investors’ confidence lowers or significant economic changes occur. Traders should watch the movements around these supports, since going beyond them can result in more price declines. They provide a set of guidelines for figuring out potential short-term support during times of doubt.

According to the Binance chart, from early 2025 until June 10, Ethereum went from a low of $1,500 to trading close to $2,679. The current RSI number is 61.69, so the price movement is overbought, and this could slow down the market or result in a brief price fall.

At this moment, the MACD is in negative territory at -12.19, demonstrating that investors are still cautious. Still, recent price hikes suggest that an upswing is possibly near. Even with this price increase, signs are warning investors, meaning they should wait for stronger reasons to trade in a certain direction. Since the price of Ethereum is still confined to a range, traders are watching the $2750 level that could decide where the market heads next.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up