Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Renewed tariff threats and rising Middle East tensions have shaken market optimism, pressuring Nasdaq 100 near key resistance. Technical signals suggest fading momentum, with support at 21,500–21,560 crucial for direction.

Britain's government is planning to ramp up public spending — but market watchers warn the proposals risk sending jitters through the bond market further inflating the country's $143 billion-a-year interest payments.

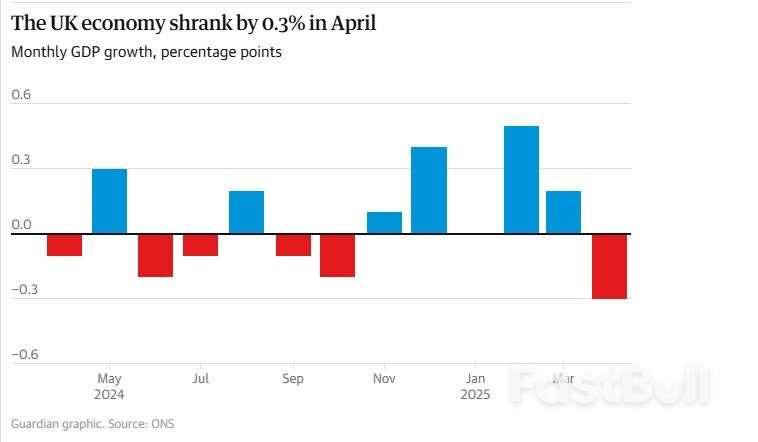

U.K. Finance Minister Rachel Reeves on Wednesday announced the government would inject billions of pounds into defense, healthcare, infrastructure, and other areas of the economy, in the coming years. A day later, however, official data showed the U.K. economy shrank by a greater-than-expected 0.3% in April.

Funding public spending in the absence of a growing economy, leaves the government with two options: raise money through taxation, or take on more debt.

One way it can borrow is to issue bonds, known as gilts in the U.K., into the public market. By purchasing gilts, investors are essentially lending money to the government, with the yield on the bond representing the return the investor can expect to receive.

Gilt yields and prices move in opposite directions — so rising prices move yields lower, and vice versa. This year, gilt yields have seen volatile moves, with investors sensitive to geopolitical and macroeconomic instability.

The U.K. government's long-term borrowing costs spiked to multi-decade highs in January, and the yield on 20- and 30-year gilts continues to hover firmly above 5%.

Official estimates show the government is expected to spend more than £105 billion ($142.9 billion) paying interest on its national debt in the 2025 fiscal year — £9.4 billion higher than at the the time of the Autumn budget last year — and £111 billion in annual interest in 2026.

The government did not say on Wednesday how its newly unveiled spending hikes will be funded, and did not respond to CNBC's request for comment about where the money will come from. However, in her Autumn Budget last year, Reeves outlined plans to hike both taxes and borrowing. Following the budget, the finance minister pledged not to raise taxes again during the current Labour government's term in office, saying that the government "won't have to do a budget like this ever again."

Andrew Goodwin, chief U.K. economist at Oxford Economics, said Britain's government may be forced to go even further with its spending plans, with NATO poised to hike its defense spending target for member states to 5% of GDP, and once a U-turn on winter fuel payments for the elderly and other possible welfare reforms are factored in.

Additionally, Goodwin said, the U.K.'s Office for Budget Responsibility is likely to make "unfavorable revisions" to its economic forecasts in July, which would lead to lower tax receipts and higher borrowing.

"If recent movements in financial market pricing hold, debt servicing costs will be around £2.5bn ($3.4 billion) higher than they were at the time of the Spring Statement," Goodwin warned in a note on Wednesday.

Mel Stride, who serves as the shadow Chancellor in the U.K.'s opposition government, told CNBC's "Squawk Box Europe" on Thursday that the Spending Review raised questions about whether "a huge amount of borrowing" will be involved in funding the government's fiscal strategies.

"[Government] borrowing is having consequences in terms of higher inflation in the U.K. … and therefore interest rates [are] higher for longer," he said. "It's adding to the debt mountain, the servicing costs upon which are running at 100 billion [pounds] a year, that's twice what we spend on defense."

"I'm afraid the overall economy is in a very weak position to withstand the kind of spending and borrowing that this government is announcing," Stride added.

Stride argued that Reeves will "almost certainly" have to raise taxes again in her next budget announcement due in the autumn.

"We've ended up in a very fragile situation, particularly when you've got the tariffs around the world," he said.

Rufaro Chiriseri, head of fixed income for the British Isles at RBC Wealth Management, told CNBC that rising borrowing costs were putting Reeves' "already small fiscal headroom at risk."

"This reduced headroom could create a snowball effect, as investors could potentially become nervous to hold UK debt, which could lead to a further selloff until fiscal stability is restored," he said.

Iain Barnes, Chief Investment Officer at Netwealth, also told CNBC on Thursday that the U.K. was in "a state of fiscal fragility, so room for manoeuvre is limited."

"The market knows that if growth disappoints, then this year's Budget may have to deliver higher taxes and increased borrowing to fund spending plans," Barnes said.

British goods exports to the United States suffered a record fall in April after U.S. President Donald Trump imposed new tariffs, official figures showed on Thursday, pushing Britain's goods trade deficit to its widest in more than three years.

Britain exported 4.1 billion pounds ($5.6 billion) of goods to the United States in April, down from 6.1 billion pounds in March, Britain's Office for National Statistics said, the lowest amount since February 2022 and the sharpest decline since monthly records began in 1997.

The 2 billion pound fall - a 33% drop in percentage terms - contributed to a bigger-than-expected drop in British gross domestic product in April.

Last week Germany said its exports to the United States fell by 10.5% in April although that figure, unlike Britain's, is seasonally adjusted.

The British Chambers of Commerce said the scale of the fall partly reflected manufacturers shipping extra goods in March to avoid an expected increase in tariffs. Even so, April's goods exports were 15% lower than a year earlier.

"The economic effects of the U.S. tariffs are now a reality. Thousands of UK exporters are dealing with lower orders and higher supply chain and customer costs," the BCC's head of trade policy, William Bain, said.

The United States is Britain's largest single goods export destination and is especially important for car makers, although total British exports to countries in the European Union are higher.

Britain exported 59.3 billion pounds of goods to the United States last year and imported 57.1 billion pounds.

The United States imposed 25% tariffs on British steel and aluminium on March 12 and in early April increased tariffs on imports of cars to 27.5% as well as a blanket tariff of 10% on other goods.

Last month Britain agreed the outline of a deal to remove the extra tariffs on steel, aluminium and cars - the only country to do so - but it has yet to be implemented and the 10% tariff remains in place for other goods.

Before the deal, the Bank of England estimated the impact of the tariffs on Britain would be relatively modest, reducing economic output by 0.3% in three years' time.

Thursday's data also showed that the fall in exports to the United States pushed Britain's global goods trade deficit to 23.2 billion pounds in April from 19.9 billion pounds in March, its widest since January 2022 and nearly 3 billion pounds more than had been expected by economists polled by Reuters.

Excluding trade in precious metals, which the ONS says adds volatility to the data, the goods trade deficit was the widest since May 2023 at 21.6 billion pounds.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up