Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Japan’s official development assistance dropped by over 10% in 2024, pushing it out of the top three ODA donors for the first time since 2021 due primarily to currency depreciation and post-pandemic normalization....

U.S. Congress is pushing the Project 2025 crypto bill to curb large firm influence and clarify regulations, involving key financial regulators.

The bill seeks to enhance regulatory clarity in the crypto sector, promoting growth and investor confidence.

The U.S. Congress is advancing the bipartisan Project 2025 crypto bill. It aims to address regulatory gaps and reduce major firms' influence, involving the SEC and FCA oversight.

Key players include U.S. Congress, the SEC, FCA, and the White House, which is active through the national digital asset framework. Changes role of central crypto firms.

Legislation affects stablecoins, DeFi, and staking, inducing market volatility but expected to boost institutional confidence and participant growth. Immediate market adjustments anticipated.

The bill could lead to financial shifts with clearer regulatory landscapes. Growth in U.S. market participation and investment is expected, fostering new industry standards.

Past events like the 2022 Executive Order on Digital Assets led to temporary market disruptions. Legislative clarity historically stabilizes long-term industry dynamics.

Expected outcomes include increased institutional entry and improved security. Clear frameworks historically optimize industry alignment, promoting sustainable growth trends.

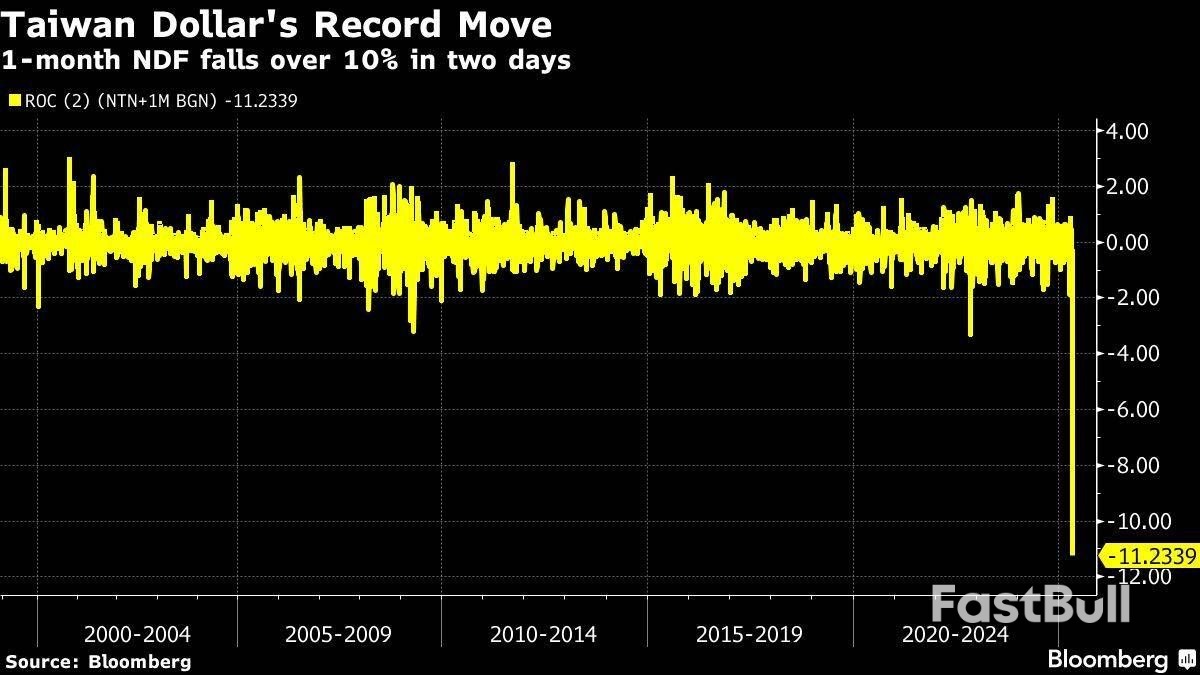

The dollar gained in early Asian trade after a two-day slide as investors across Asia stayed focused on exacerbated currency appreciations from Taiwan to Malaysia.

A gauge of the dollar rose 0.3% after speculation around potential trade deals had pushed the currency lower. The Taiwanese dollar extended its rally after surging the most since the 1980s on Monday. China’s central bank kept its daily fix for the yuan steady as the market reopened. US stock futures edged lower after the S&P 500 halted its longest rally in about 20 years. There’s no cash trading in Treasuries during the Asian day as Japan is closed for a holiday.

President Donald Trump’s aggressive trade talk has rattled markets since he took office in January, undermining the dollar’s traditional haven role in times of stress and leading investors to allocate away from US assets. Central bankers from Taiwan to Hong Kong are responding to the sharp appreciation in local currencies by intervening in the market.

Currency revaluation across Asia “could be a significant development not just in driving the dollar lower but also in the trade negotiation process and accelerate the idea of trade deals”, Chris Weston, head of research at Pepperstone Group, wrote in a note.

The deep inversion of a popular Taiwan-dollar derivative suggests selling pressure on the US currency has plenty of room to run. The spread between the Taiwan dollar spot rate and one-year non-deliverable forwards on the Taiwan dollar-US dollar currency pair swelled to around 3,000 pips on Monday, the widest level in at least two decades.

The divergence is the latest sign of seemingly insatiable demand for Taiwan’s currency on speculation the island will reach a trade deal with the US.

Meanwhile, Hong Kong authorities spent a record amount in an attempt to defend the foreign-exchange peg. The yen and the Malaysian ringgit both dropped Tuesday after gains on Monday.

“I would be cautious about leaning in too much into this appreciation as central banks in Taiwan, Malaysia and especially Hong Kong have significant means to buy dollars if they need to,” said Leah Traub, a portfolio manager and head of the currency team at Lord Abbett & Co.

Investor hopes that Trump may start to pull back from launching new fronts on his trade war were dashed when he announced plans to impose a 100% tariff on films produced overseas, sending shares of Netflix Inc and Warner Bros Discovery Inc lower. While Trump suggested some trade deals may come as soon as this week, there was no indication of an imminent accord with China.

In late hours, Ford Motor Co pulled its financial guidance and said auto tariffs will take a toll on profit. Palantir Technologies Inc dropped more than 8% in late trading Monday after its results failed to live up to investors’ loftiest expectations for a company whose stock has led the S&P 500 in gains this year.

Attention will soon shift to Wednesday’s Federal Reserve decision after bond traders dialled back rate-cut bets that had steadily mounted as Trump’s trade war unleashed havoc in financial markets.

After piling into short-term Treasuries, anticipating the Fed would start easing policy soon to contain the fallout, traders reversed course. Two-year yields rose for a third consecutive session — the longest run since December — as traders bet policymakers will remain in wait-and-see mode until there’s more clarity on the impacts of tariffs.

“Uncertainty rules amid a trade war and the ever-changing landscape of tariffs, but with the hard data on consumer spending and employment still hanging in there, the Fed will remain firmly planted on the sidelines,” said Greg McBride at Bankrate.

XRP has seen some ups and downs recently, but analysts believe it may be getting ready for a bigger move soon. This week, XRP dropped slightly by about 0.3%. While some cryptocurrencies saw a bit of selling, this small dip in XRP isn’t a big concern for most investors. The price is still holding above key support levels.

There’s still uncertainty about whether XRP has started its next big move up. On smaller timeframes, no clear breakout has formed yet, though the price is making higher highs and higher lows — a positive sign.

Crypto analyst Dark Defender said that XRP recently faced resistance at $2.22 and $2.36, with the price pulling back to $2.13. He believes this pullback was expected and that the market is preparing for the next move up, as long as XRP holds above the $2.00 level.

Dark Defender also shared his long-term outlook. He said XRP is in the final phase of a fifth wave structure and expects this to lead to higher prices. He predicts the first move toward $3, followed by further gains with targets of $4.40 and $6.30 if the pattern continues. The key support to watch in the short term is $1.88.

However, some analysts warn that short-term trends are still unclear. The recent price movement has been choppy, and there is no strong sign of an upward impulse yet. A confirmed move above $2.25 would help signal that a new rally is underway.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up