Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Japan’s top oil industry leader supports diversification away from Middle Eastern crude but cautions that importing Canadian heavy oil poses technical and economic challenges...

The GBP/USD pair stabilised around 1.3626 USD on Thursday, following a highly volatile session on Wednesday. The pair remains close to its highest level in over ten weeks, as markets await the Bank of England’s policy decision later today.

The BoE is widely expected to maintain rates at 5.25% (note: corrected from 4% based on current BoE rate) and may signal a reduction in its £100 billion annual bond-purchase program.

Recent data showed UK inflation held steady at 3.8% in August, matching both forecasts and July’s 18-month high. Labour market figures were broadly in line with expectations: unemployment remained at 4.7%, wage growth (ex-bonuses) came in at 4.8% (4.7% including bonuses), and payrolls declined by 8,000.

Market expectations for a BoE rate cut remain subdued, with only a one-in-three chance priced in for a reduction by December.

Meanwhile, the US Federal Reserve delivered a widely anticipated 25-basis-point cut yesterday, with traders now expecting at least two additional cuts by the end of 2025.

H4 Chart:

On the H4 chart, GBP/USD completed an upward move to 1.3723 USD, followed by a downward impulse to 1.3620 USD. The pair is now likely to form a consolidation range around this level. A break below 1.3620 USD could initiate a decline towards 1.3528 USD. A corrective rebound towards 1.3620 USD may then follow. Renewed selling pressure could subsequently drive the pair towards 1.3500 USD, with further downside potential to 1.3277 USD. The MACD indicator supports this outlook, with its signal line positioned above zero but turning decisively downward.

H1 Chart:

On the H1 chart, the pair has completed a downward impulse to 1.3620 USD. A consolidation phase is expected around this level. A break lower would likely trigger the first wave of a new downtrend towards 1.3530 USD. The Stochastic oscillator aligns with this near-term bearish view, as its signal line lies below 50 and is trending downward towards 20.

The pound is trading near multi-week highs as markets await guidance from the BoE. While UK inflation remains elevated, softening labour data and a dovish Fed have limited the GBP’s upside. Technically, the pair appears vulnerable to a near-term correction, particularly if the BoE maintains a cautious tone. Today’s decision and accompanying communications will be critical in determining whether cable extends its rally or enters a deeper corrective phase.

Brent and WTI are two of the world’s leading oil benchmarks, influencing energy costs and economic trends. From geopolitical volatility to shifting demand and the energy transition, their future prices will be shaped by powerful global forces. This article examines key drivers and analytical oil price predictions for 2025–2030 and beyond, providing context for traders.

Brent and WTI are the world’s most closely watched oil benchmarks, shaping energy costs and market sentiment. Their prices reflect a mix of supply-demand balances, geopolitical tensions, and market structure shifts. Understanding their history provides essential context for analysing where the market could head next.

From 2010 through mid-2014, Brent crude consistently traded near or above $100 per barrel, supported by steady global demand, limited spare capacity, and concerns over Middle East supply disruptions. WTI generally traded at a discount of $5–$15 to Brent due to US infrastructure bottlenecks that limited exports. The shale revolution was already underway, but OPEC maintained output, keeping the market tight.

By mid-2014, rapid U.S. shale growth – adding millions of barrels per day – combined with slower demand growth in China, created oversupply. In November 2014, OPEC opted not to cut production, aiming to defend market share against higher-cost producers. Prices collapsed, with both Brent and WTI falling below $30 in early 2016. The sharp drop forced capital expenditure cuts across the industry and began to slow shale output.

From 2016, OPEC and non-OPEC allies (OPEC+) implemented coordinated cuts, helping prices recover. Brent and WTI rose into the $50–$70 range, occasionally breaking higher on geopolitical tensions, such as US sanctions on Iran in 2018. WTI’s discount to Brent narrowed after the US lifted its crude export ban in late 2015, allowing domestic crude to reach international buyers and easing the Cushing storage glut.

The COVID-19 pandemic triggered a sudden, historic drop in oil consumption—down around 20% in early 2020. Storage filled rapidly. In April 2020, the WTI May futures contract settled at –$37.63 per barrel as holders of physical delivery obligations paid to offload barrels due to lack of storage. Brent fell to ~$19 but remained positive. OPEC+ responded with record cuts of 9.7 million bpd in May and June, stabilising prices in the second half of the year.

As economies reopened, demand rebounded quickly. Brent and WTI returned above $80 by late 2021. In February 2022, the start of the Russia-Ukraine conflict triggered a supply shock. Both briefly exceeded $120, while sanctions forced Russian crude to flow at discounts to Asia.

In 2023, slowing global growth and rising non-OPEC supply pressured prices, driving Brent to a yearly low around $70 and WTI to below $64. OPEC+ countered with voluntary cuts totalling around 5 million bpd, led by Saudi Arabia’s extra 1 million bpd reduction. Brent continued to range in 2024, topping out at $91 in April before sinking below $69 by September. WTI rose to $87 and fell to $64 over the same period.

As of 2025, oil remains near its lowest since 2021. Brent/WTI dipped to $58/$55 in April as Donald Trump’s tariff shock hit the market, both recovering to around $77 by June, driven by Israel-Iran tensions.

Oil markets in the second half of the 2020s are expected to be shaped by the interaction of demand growth, supply management, policy shifts, and technological developments. Sources emphasise that these forces are interconnected—changes in one often trigger adjustments in others. While short-term price movements may be driven by immediate events, these structural drivers might set the broader direction of Brent and WTI prices over the period.

Analysts expect that global oil demand growth will slow compared with the early 2020s, but remain positive through most of the decade. The International Energy Agency (IEA) projects an increase of around 0.7 million barrels per day (mb/d) in 2025, the smallest annual gain since 2009 outside the pandemic years. By contrast, OPEC’s analysis points to demand reaching about 113.3 mb/d in 2030, arguing that growth in developing economies will more than offset declines in advanced economies.

Most growth is anticipated to come from Asia, particularly India, China, and Southeast Asia, driven by rising mobility, industrial expansion, and petrochemical output. OECD countries are expected to see flat or declining consumption as efficiency gains, electrification, and policy measures reduce reliance on oil.Sector-wise sources note that road transport remains a major consumer but is seeing slower growth as electric vehicle adoption expands. Petrochemicals are highlighted as a resilient driver, particularly in Asia, where demand for plastics and industrial materials is increasing. Aviation fuel consumption is also projected to rise steadily as global air travel continues to expand.

OPEC+ policy is seen as a central influence on medium-term prices. The group currently controls over 40% of global output and has demonstrated its willingness to withhold production to prevent oversupply. Voluntary cuts of around 5 mb/d in 2023–2024, led by Saudi Arabia, reflect its role in setting a floor under prices. Some think that OPEC+ may continue to adjust output to maintain market balance, especially if demand growth underperforms.

The US shale sector remains an important non-OPEC source, though production growth is expected to plateau at roughly 13.4 mb/d in 2025–2026. Industry capital discipline, investor pressure for shareholder returns, and the depletion of prime drilling locations are contributing to slower output gains.Outside the US, additional supply is expected from Brazil, Guyana, and Canadian oil sands projects. Geopolitical factors remain a persistent risk: tensions in the Middle East, Russia’s ongoing sanctions, and potential instability in countries such as Libya or Nigeria could all cause supply disruptions.

Sources say climate policies and the energy transition are likely to increasingly shape the demand outlook. Net-zero pledges are prompting efficiency gains, renewable energy deployment, and shifts in transport fuels. Electric vehicle adoption is expanding rapidly—over 40% of new car sales in China were electric or hybrid in 2024—and is expected to rise globally.

Carbon pricing is being extended in more markets, with the EU planning to include road transport in its emissions trading system from 2027. Several major economies have announced internal combustion engine phase-out targets for 2035 or later, influencing automaker strategies today. Investor pressure on oil companies to align with ESG goals could restrain long-term upstream investment, potentially tightening supply later in the decade.

Advances in upstream technology are making production more efficient. US shale drillers now produce roughly 2.5 times more per rig than in 2014, with significant cost savings. Offshore projects are also benefiting from improved seismic imaging and standardised designs.

Infrastructure expansion—such as new export terminals, pipelines, and refinery upgrades in Asia and Africa—may improve trade flows and regional supply security. Strategic petroleum reserves remain a market stabiliser; coordinated releases, such as the 180 million barrels from U.S. reserves in 2022, have demonstrated their ability to moderate price spikes. Inventory cycles are also expected to play a role, with surplus years weighing on prices and deficit periods adding upward pressure.

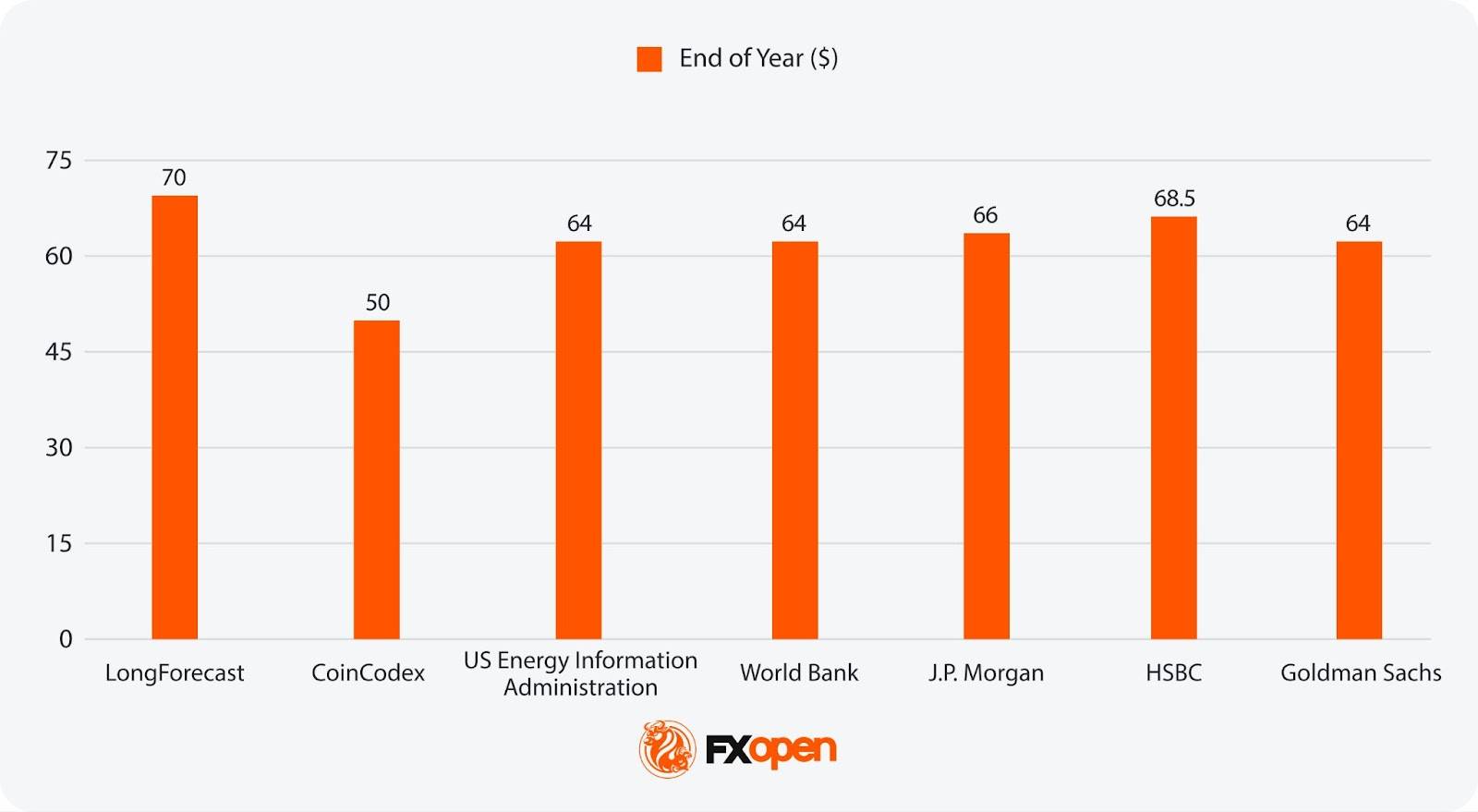

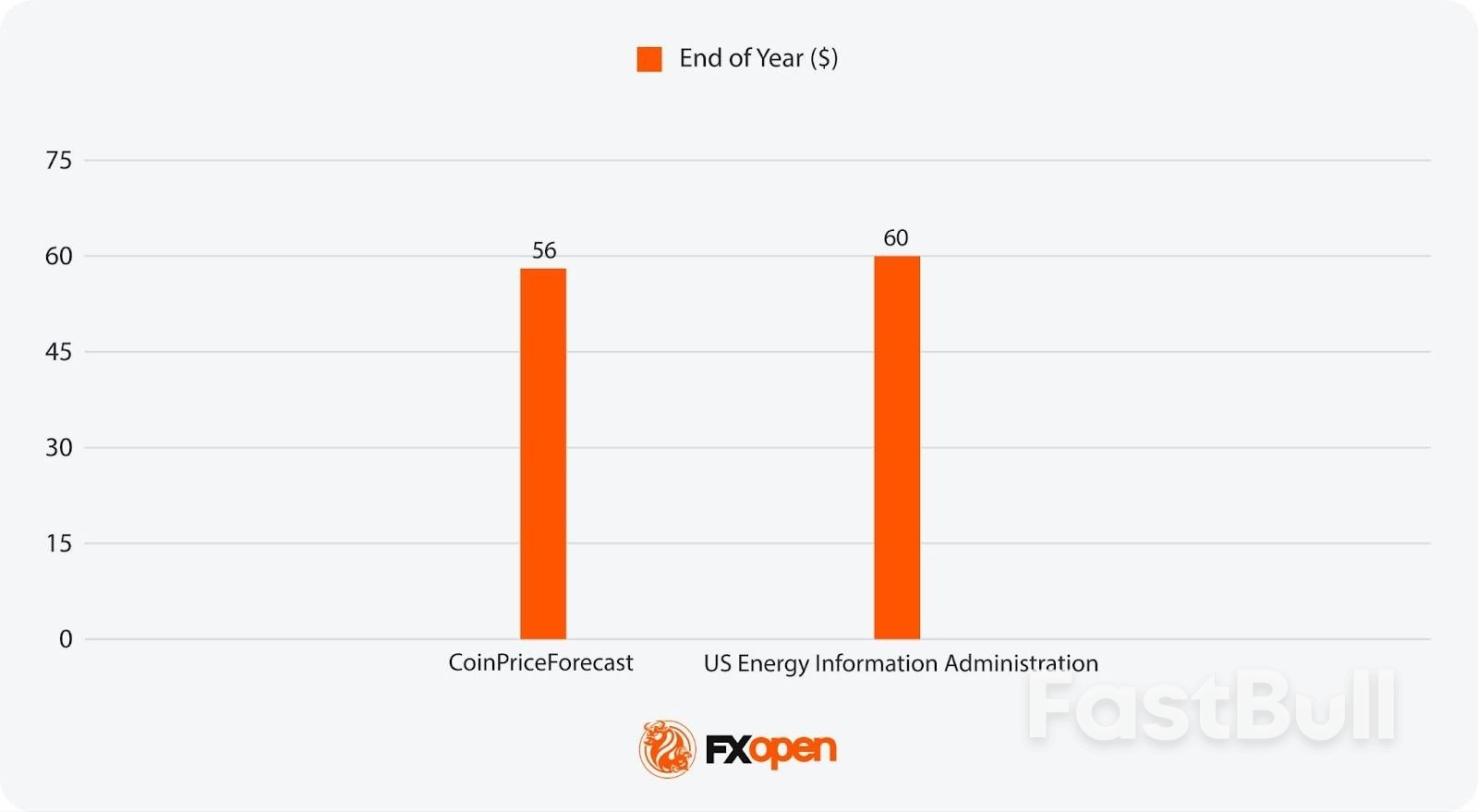

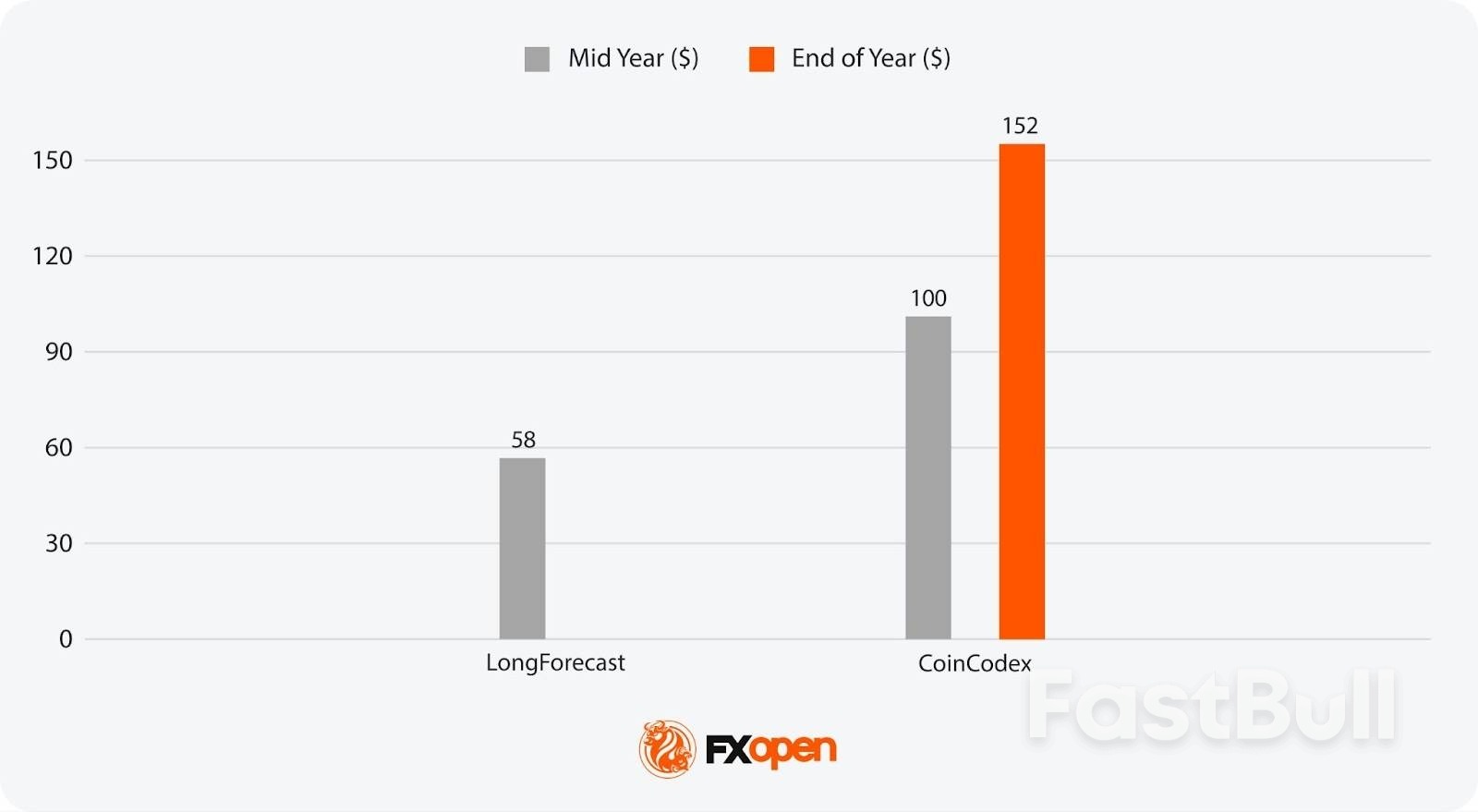

Oil price forecasts in 2025 see modest oversupply, with the World Bank’s crude oil forecast projecting global production to exceed consumption by around 0.7 million barrels per day. Demand growth is likely to slow sharply to about +0.7 mb/d, the weakest since 2009 outside the pandemic, as post-COVID rebounds fade and efficiency gains take hold.Non-OPEC supply from the US, Brazil, and Guyana is anticipated to rise, while OPEC+ is gradually easing some voluntary cuts. As for Brent oil prices, forecasts for 2025 say that barrels could trade in a broad $50–$70 range under these conditions, unless geopolitical risks cause sudden disruptions.

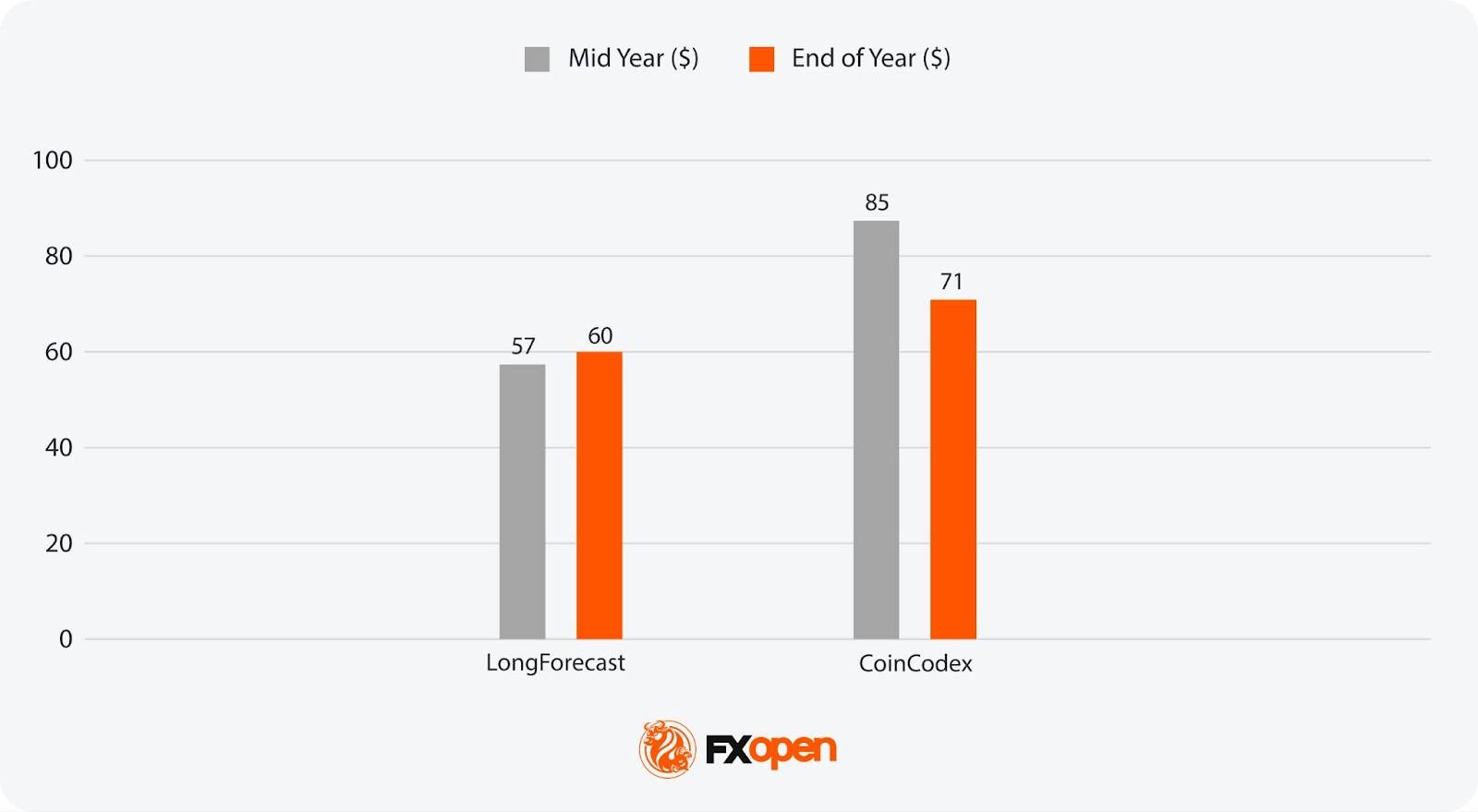

Brent

WTI

Looking ahead to the latter half of the 2020s, analytical oil price outlooks become mixed, with multiple factors that could shape its trajectory.

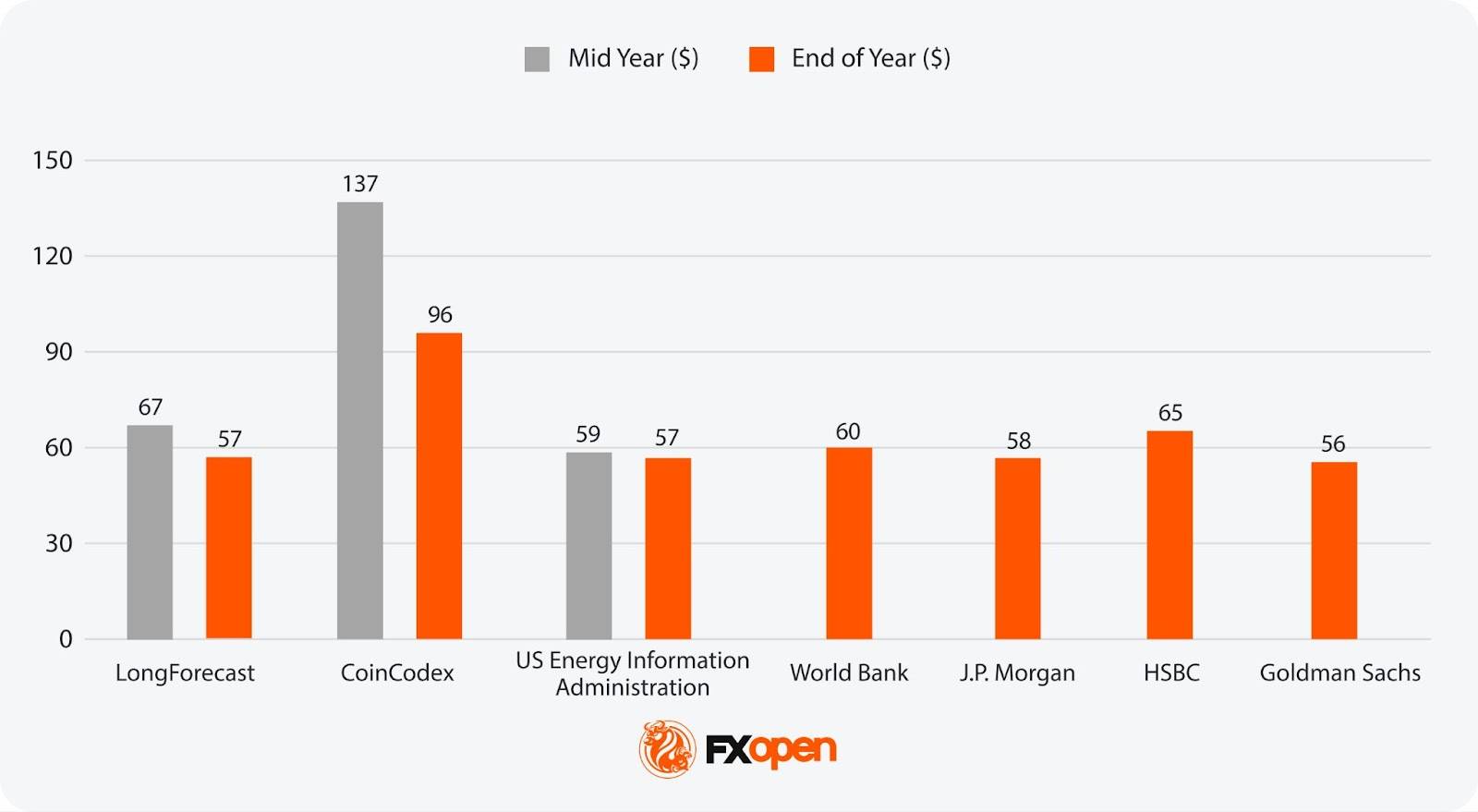

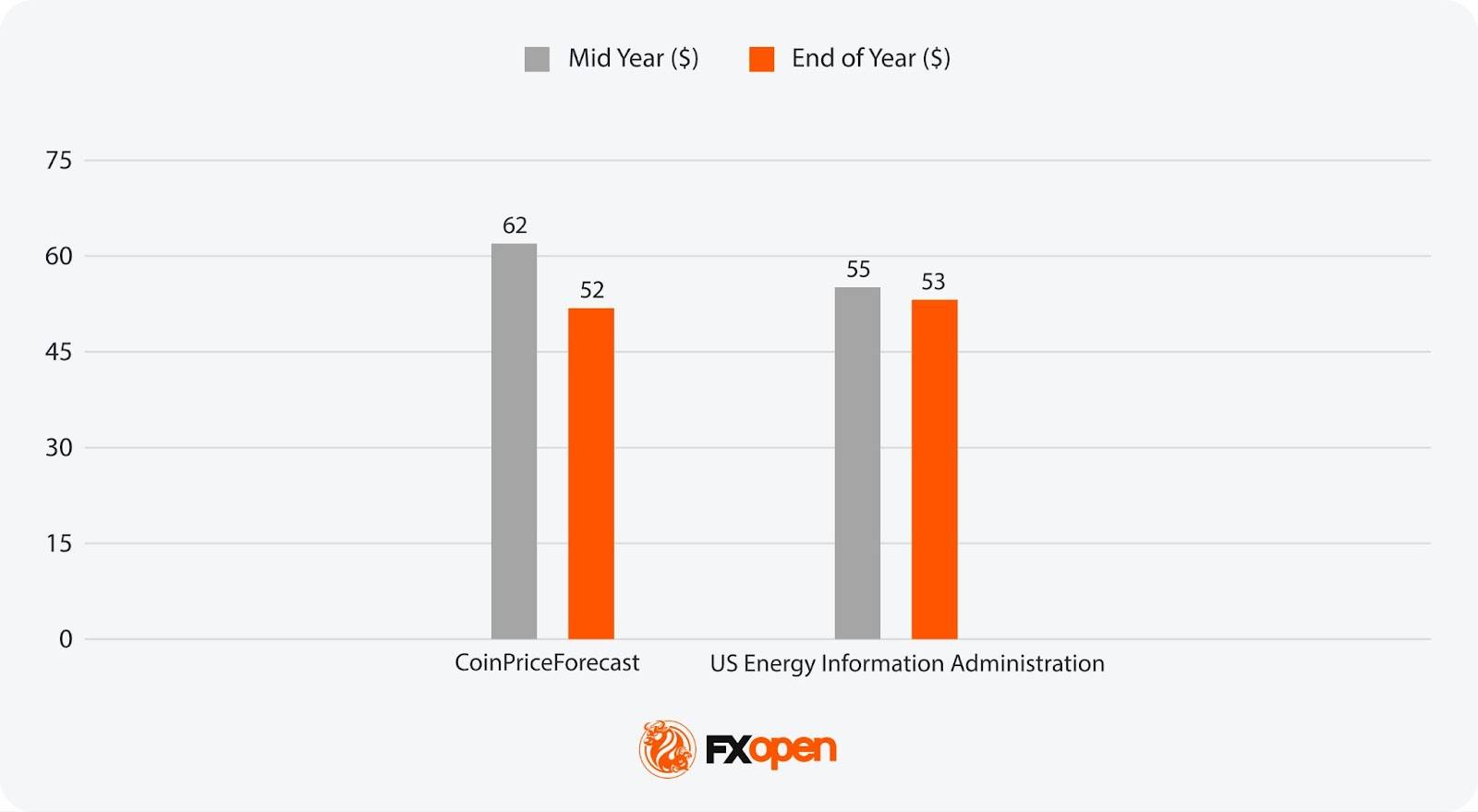

Some sources think 2026 could mark a cyclical low point for prices if inventories continue to build from 2025. US shale output is projected to plateau, but new projects sanctioned earlier in the decade may still be adding capacity.Demand growth is expected to remain subdued, with OECD consumption trending down and emerging market growth moderating. OPEC+ may need to maintain or deepen cuts to counterbalance supply, particularly if global GDP growth is weak. A weaker demand environment could also coincide with increased competition for market share between OPEC+ and other oil producers.

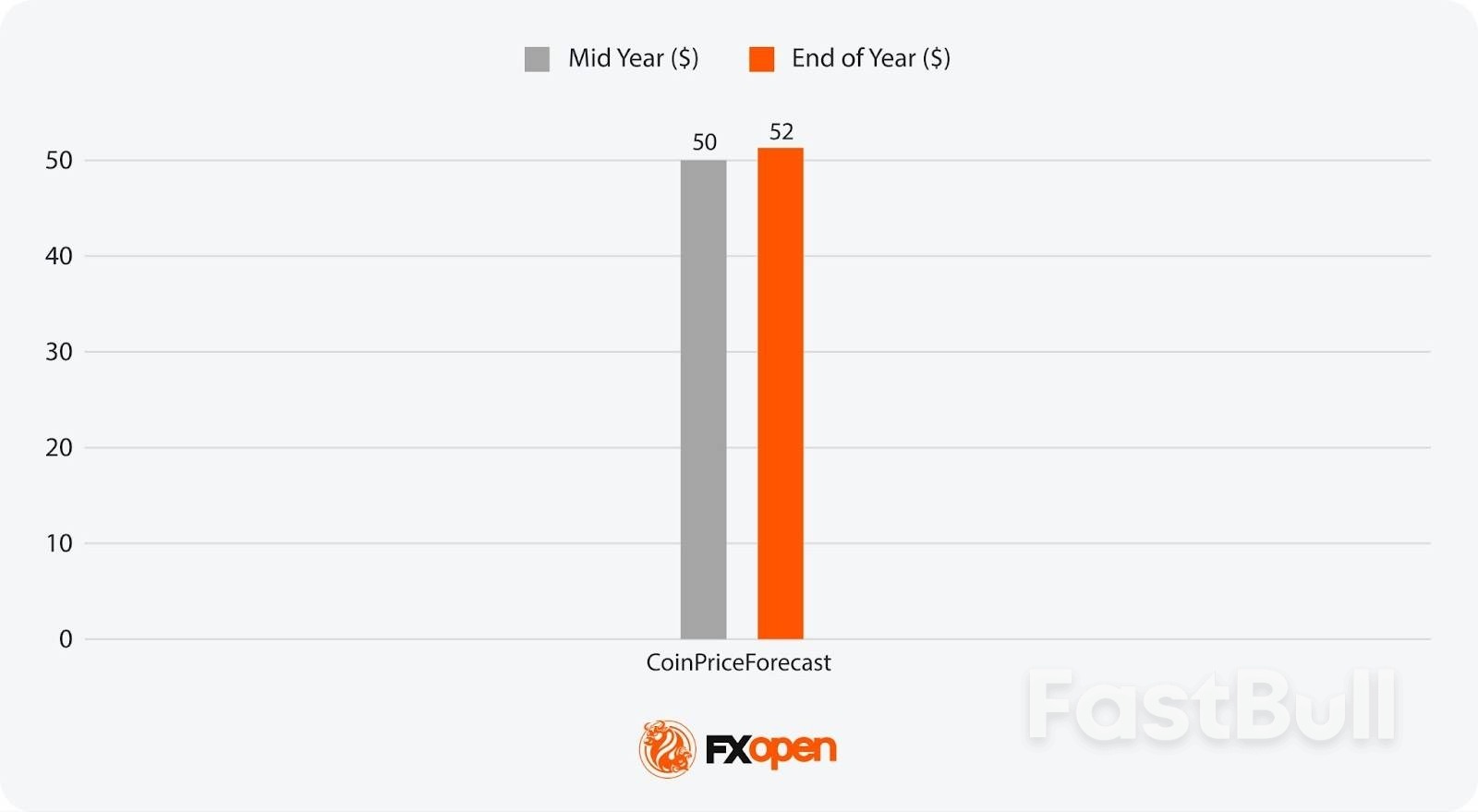

Brent

WTI

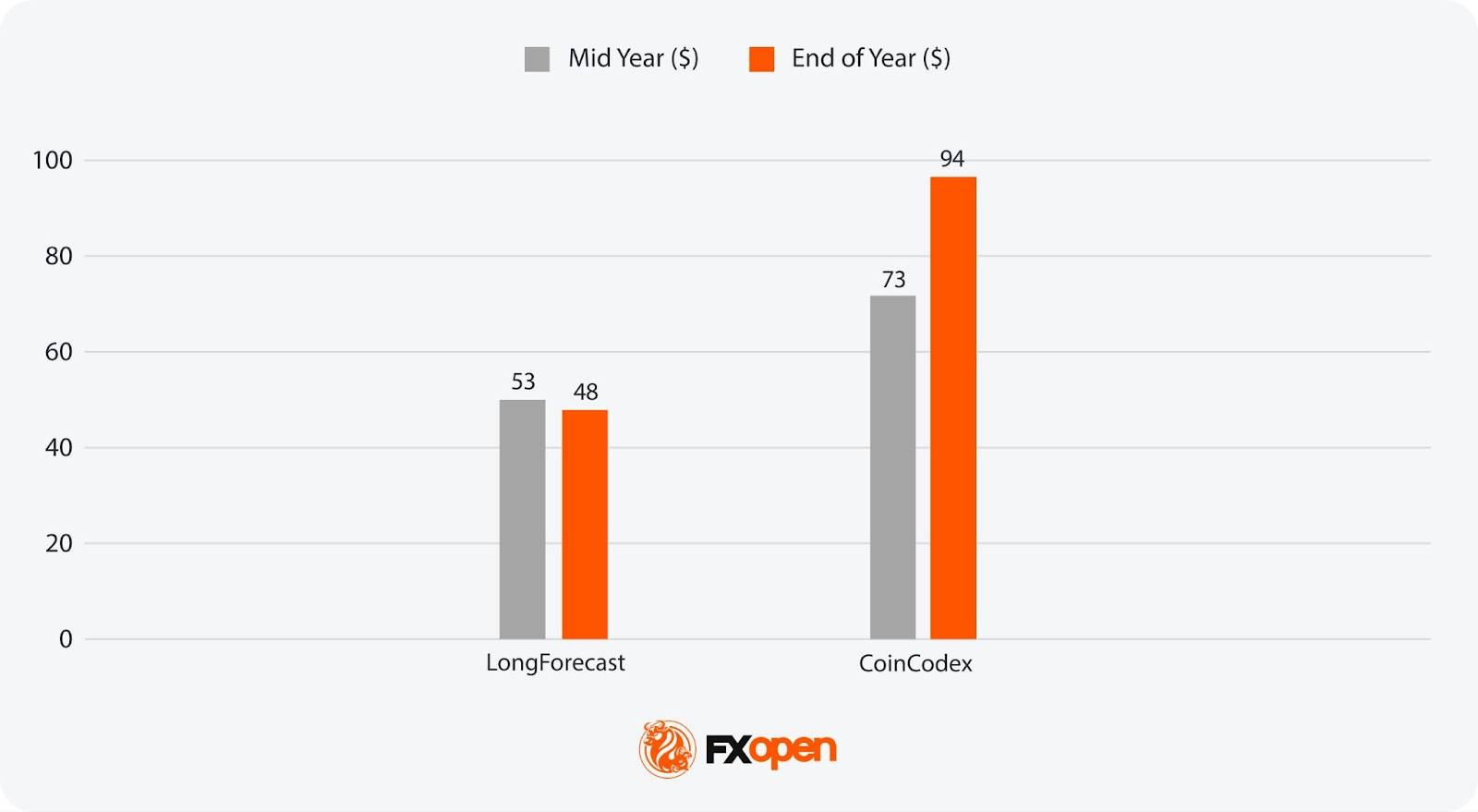

It is expected that 2027 could see the market begin to rebalance. If low prices in preceding years reduce upstream investment, supply growth may slow, while demand could strengthen slightly with improved global economic conditions.Sources say that OPEC’s role could become more prominent if OPEC+ supply peaks, with a greater call on its production to meet rising consumption. Potential inventory drawdowns may support bullish oil price forecasts compared to mid-decade levels, although geopolitical risks and the pace of EV adoption remain key variables.

Brent

WTI

By 2028, demand could approach or exceed 110 mb/d according to OPEC’s outlook, driven by emerging market growth in transport and petrochemicals. Refining capacity in Asia and the Middle East is expected to play a crucial role in meeting this demand.If upstream investment in the mid-2020s has been insufficient, some think spare capacity could tighten, raising the market’s sensitivity to supply shocks. However, if demand growth aligns more closely with the IEA’s slower trajectory, prices may remain moderate, with OPEC+ continuing to manage output.

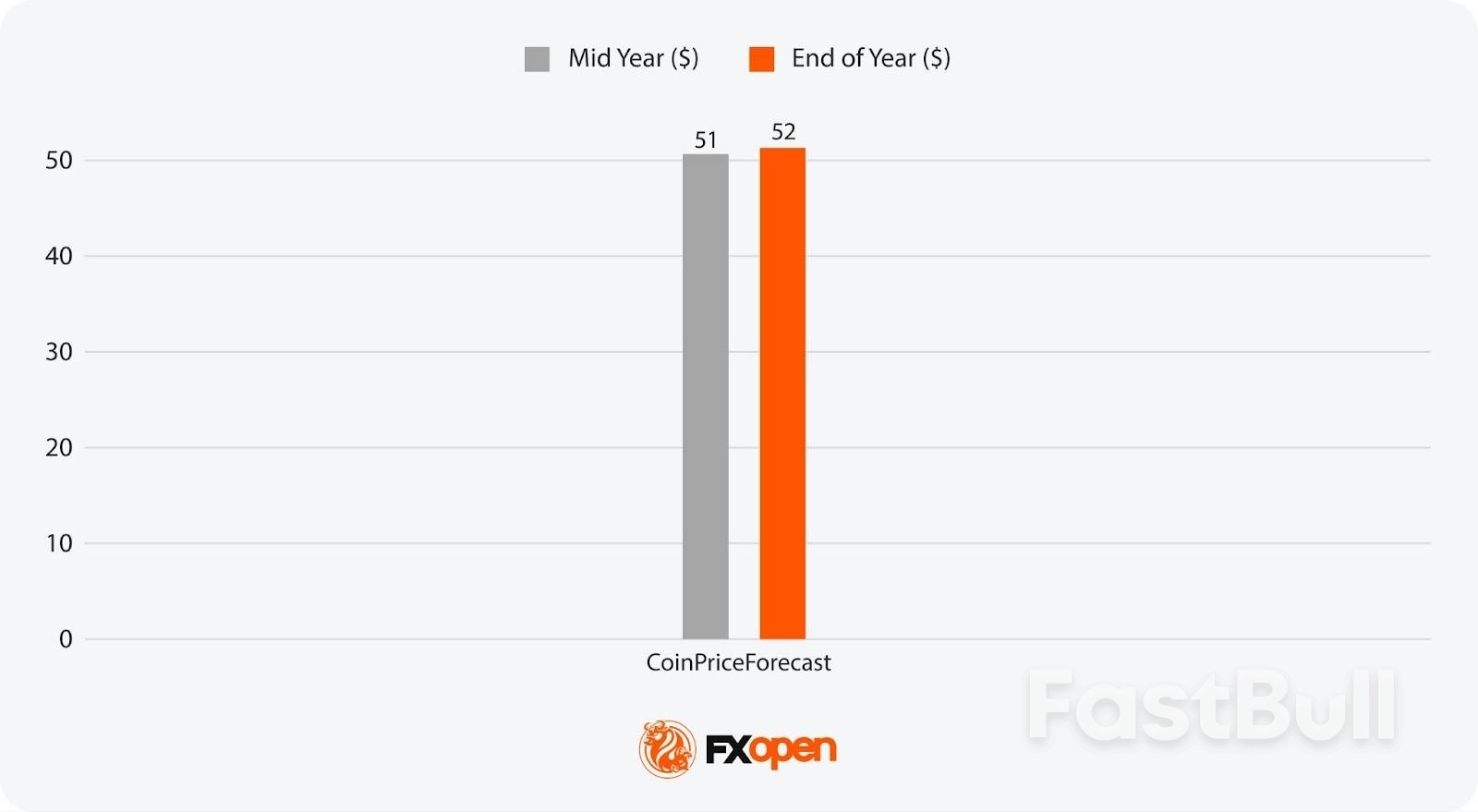

Brent

WTI

Analysts see 2029 as a potential inflection point. In the IEA’s view, demand growth may be close to zero by this stage, signalling a plateau near 102 mb/d. OPEC, however, projects continued expansion towards 112 mb/d, implying divergent market expectations.Low spare capacity in either scenario could lead to higher volatility. The market balance in 2029 may depend heavily on OPEC’s willingness to adjust output and on whether OPEC+ declines accelerate.

Brent

WTI

By 2030, the oil market is expected to reflect the cumulative impact of a decade’s economic, policy, and technological shifts. This is the year when many national climate pledges and industrial transition milestones converge, potentially reshaping demand patterns. Some analysts expect consumption to have already plateaued, while others see emerging markets sustaining modest growth.

2030’s conditions may be more about structural forces—how far electrification, efficiency measures, and fuel substitution have progressed, and whether upstream investment has kept pace with any remaining demand growth. The alignment, or divergence, between policy goals and market realities could set the tone for prices, with the potential for either a steady, well-supplied market or renewed tightness if supply lags.

Beyond 2030, analytical crude oil outlooks say the direction of Brent and WTI prices will depend on whether global oil demand has entered a sustained decline or remains on a plateau. In scenarios where demand peaks early, prices could face downward pressure from structural oversupply unless producers deliberately limit output. OPEC’s influence may increase as OPEC+ supply declines, giving the group greater ability to adjust production to stabilise prices.

Some think underinvestment in upstream capacity during the 2020s could create intermittent supply tightness, even if demand is weakening, leading to more frequent price volatility. The energy transition is expected to accelerate in the 2030s, with higher electric vehicle penetration, efficiency improvements, and alternative fuels reshaping demand patterns. Petrochemicals, aviation, and heavy transport may remain key demand pillars, but consumption in other sectors could contract.

Policy measures, such as carbon pricing and stricter emissions regulations, could add cost pressures to oil use, influencing both consumption levels and production economics. Geopolitical dynamics may continue to be an important factor, particularly in key producing regions with low-cost reserves.Two sources, CoinCodex and CoinPriceForecast, have given WTI price forecasts beyond 2030. WTI oil prices are forecast to be around $81 in 2035, according to LongForecast, while CoinCodex expects it to hit $420 in 2040 and over $1,500 by 2050.Overall, market conditions beyond 2030 might be defined by the interplay of declining demand in some sectors, constrained supply growth, and shifting global energy priorities.

FAQs

What Is the Oil Outlook for 2026?

Analysts generally expect 2026 to be a softer year for prices, with most crude oil predictions placing Brent between $56 and $137 per barrel and WTI in the $52 to $62 range. This reflects anticipated inventory builds from prior years, modest demand growth, and ongoing OPEC+ supply management to prevent deeper declines.

What Are the Analytical Predictions for Oil Prices in 2027?

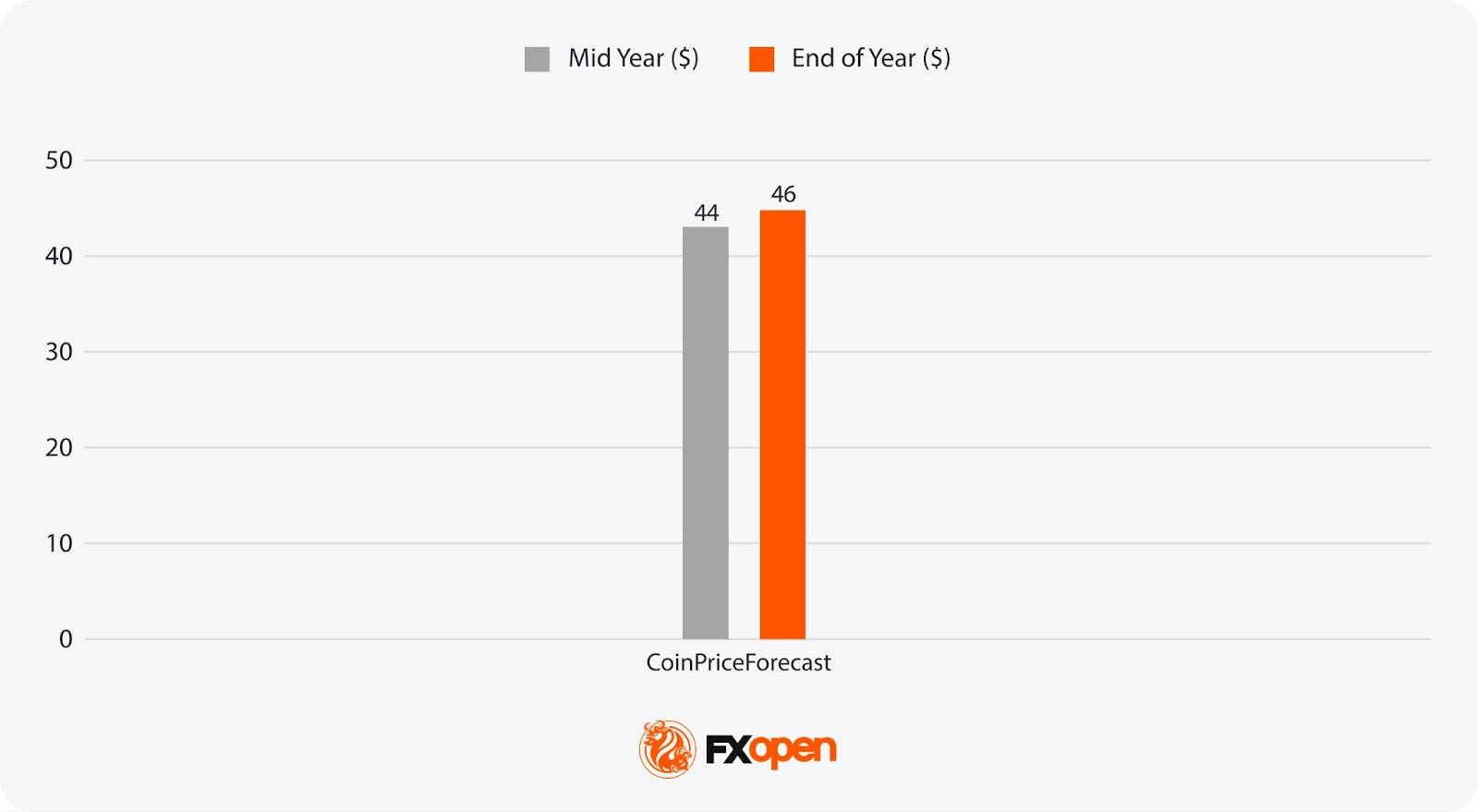

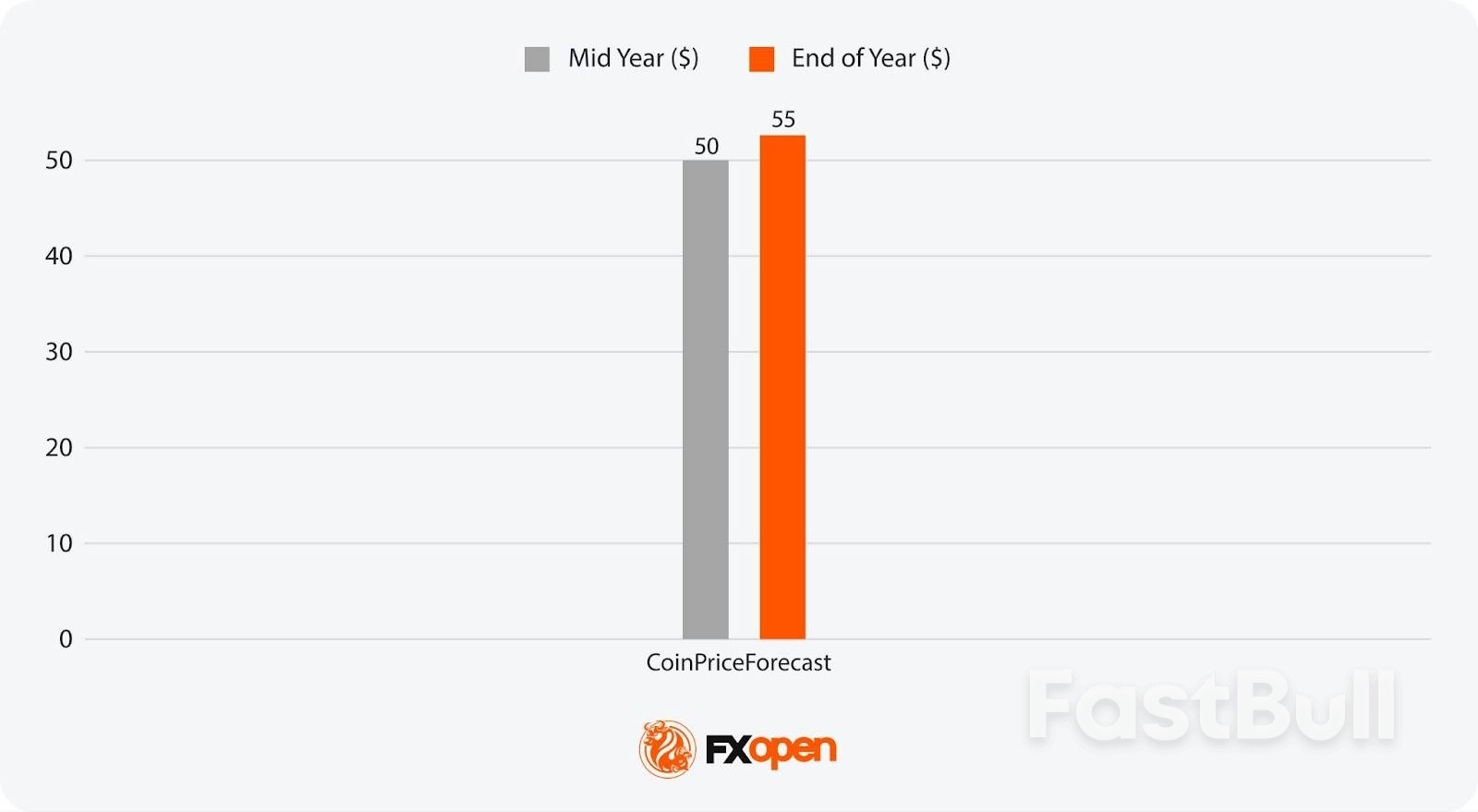

Analytical oil price projections for 2027 are more limited, but some sources provide indicative ranges. LongForecast places Brent between $57 and $85 per barrel, while CoinPriceForecast estimates WTI between $50 and $52. Market balance at that time may hinge on whether supply growth slows due to reduced investment.

What Could Crude Oil Be Worth in 2030?

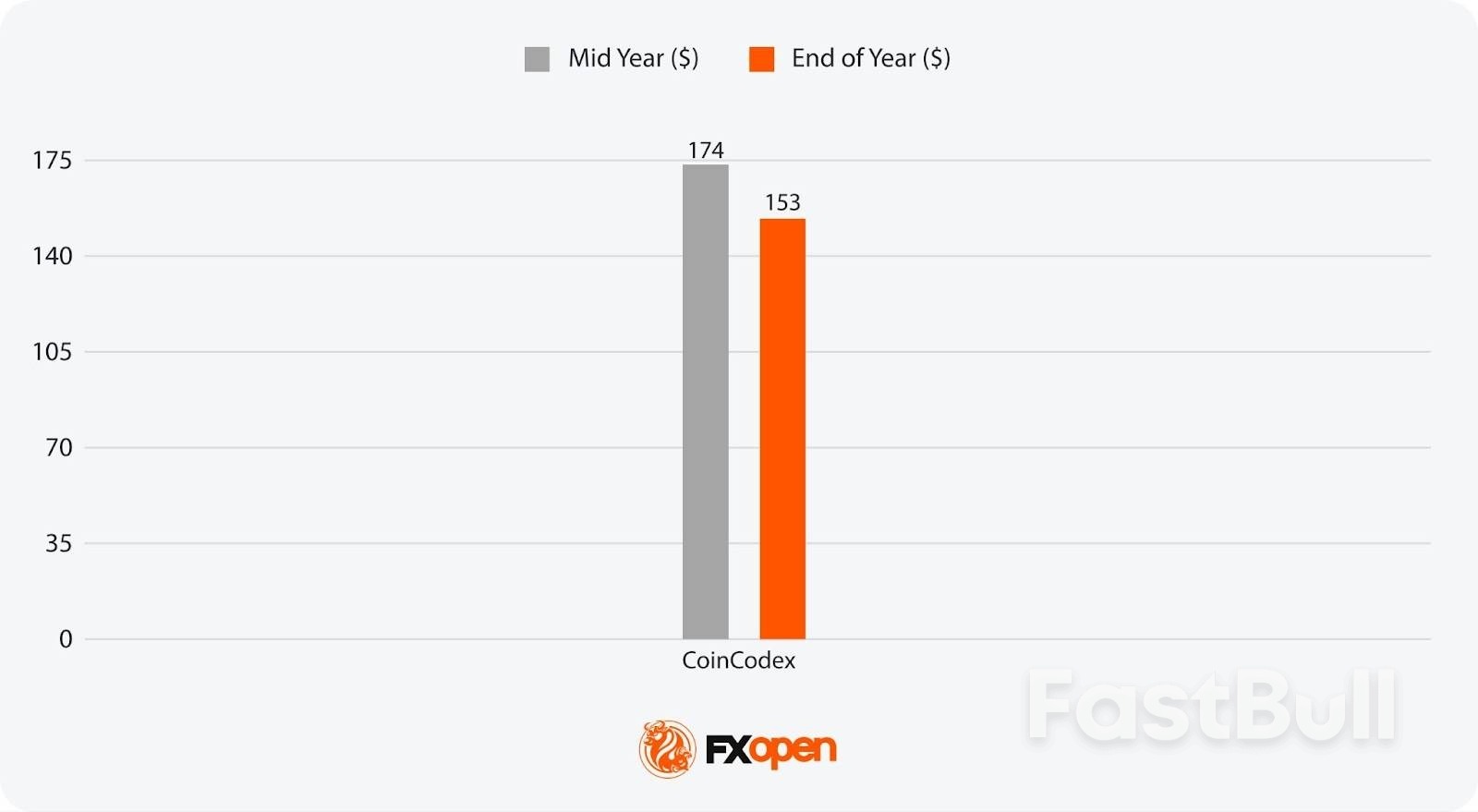

Analytical long-range projections are scarce, but CoinCodex has suggested Brent could reach $174 per barrel, while CoinPriceForecast puts its WTI oil price forecast between $50 and $55. These disparities reflect uncertainty over demand trends, energy transition policies, and investment levels.

Could Oil Prices Go Up?

According to analysts, prices could rise in tighter market conditions or during supply disruptions, but they may also soften in surplus years.

Could Oil Be a Good Investment in 2025?

CFD trading enables traders to participate in the market regardless of whether an asset’s price is rising or falling, allowing them to potentially take advantage of both volatile upward and downward price movements.

Today’s Asia session was defined by the fallout from the Fed’s quarter-point rate cut and Australia’s worse-than-expected jobs data, which pressured the AUD and weighed on local equities. Regional equities were mixed, with Japan’s Nikkei continuing to set the pace, while safe-haven flows supported the yen and gold. Markets are now awaiting outcomes from the BOJ meeting and Japanese inflation data later in the week.

Thursday’s dollar performance reflected the ongoing market adjustment to the Fed’s dovish pivot, with the currency showing modest strength despite underlying concerns about labor market deterioration. The dollar’s recovery from Wednesday’s lows suggests markets are taking a more balanced view of the Fed’s cautious approach to further easing, though significant uncertainty remains about the pace of future rate cuts.Central Bank Notes:

Next 24 Hours BiasWeak Bearish

The euro showed resilience despite minor Thursday weakness, maintaining near four-year highs against the dollar. Key supportive factors include eurozone inflation stabilizing at the ECB’s 2% target, improved economic growth projections, and market expectations that the central bank’s rate-cutting cycle has concluded. However, ongoing trade policy uncertainty and mixed economic indicators suggest cautious optimism, with the ECB maintaining its data-dependent approach while emphasizing that the disinflationary process is complete.Central Bank Notes:

Next 24 Hours BiasMedium Bullish

The Swiss Franc continues to attract safe-haven flows as global uncertainty lingers, with its value versus the USD and other major currencies close to recent highs. The Swiss National Bank is expected to hold rates steady, and no major new data or surprises are anticipated today. Global strategists view CHF as a preferred safe-haven, particularly in comparison to the Japanese yen, given Switzerland’s fiscal stability and prudent central bank policy.Central Bank Notes:

Next 24 Hours BiasMedium Bullish

The Canadian dollar remains under slight pressure following the rate cut, with the central bank signaling flexibility for further action if economic weakness persists. Traders are awaiting the US Federal Reserve signals and watching oil prices and trade policy for further direction. The USD/CAD exchange rate is currently around 1.3760, with CAD to USD at about 0.726. Exchange rates have fluctuated in a relatively tight range over the past week, and CAD is up about 0.7% weekly after the rate cut.Central Bank Notes:

Next 24 Hours BiasWeak Bearish

Oil markets on September 18, 2025, reflect a complex interplay of bearish supply-demand fundamentals and ongoing geopolitical risks. While the Federal Reserve’s rate cut provides potential longer-term demand support, immediate concerns about U.S. economic weakness, rising distillate inventories, and OPEC+ production increases are keeping prices under pressure. The market continues to trade within its established $5 range, with Brent around $68 and WTI near $64, as traders await clearer signals about global economic recovery and supply disruption risks from the ongoing Russia-Ukraine conflict.

Next 24 Hours BiasMedium Bearish

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up