Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

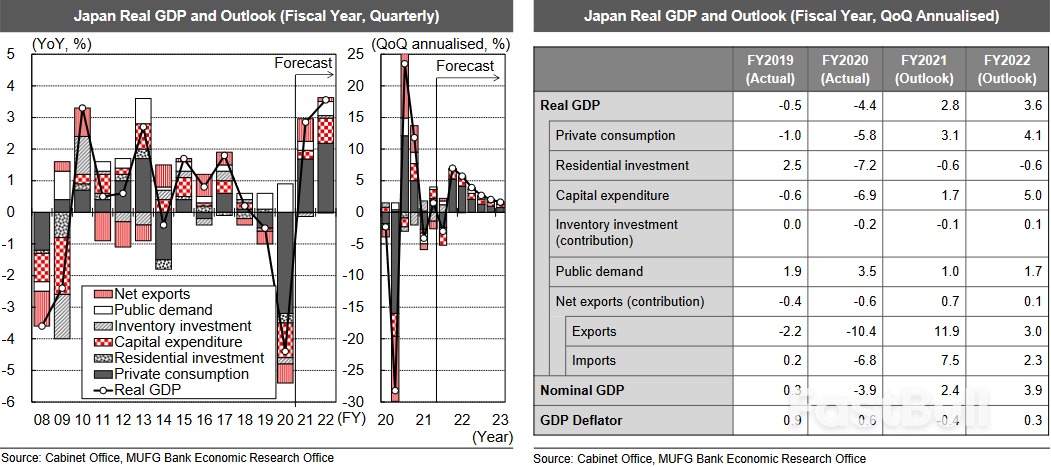

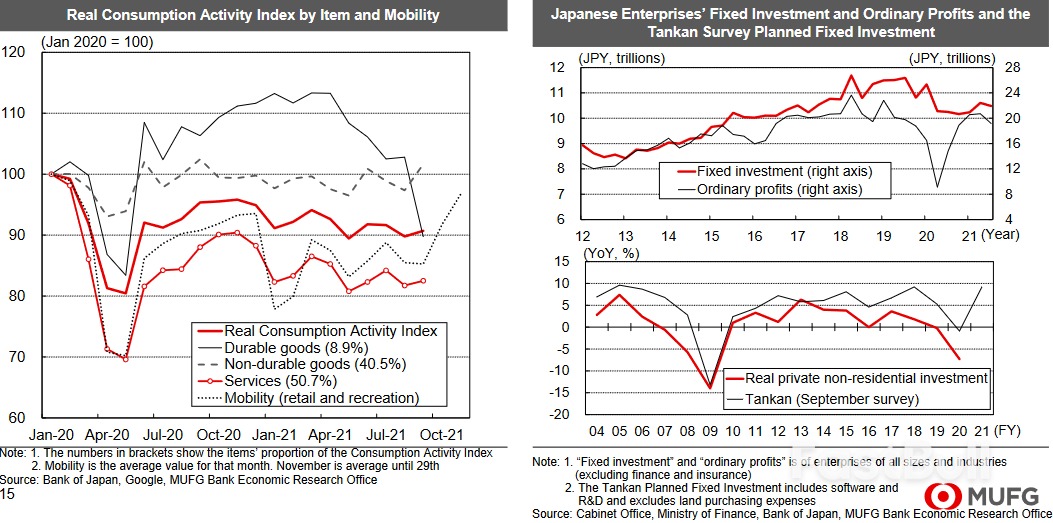

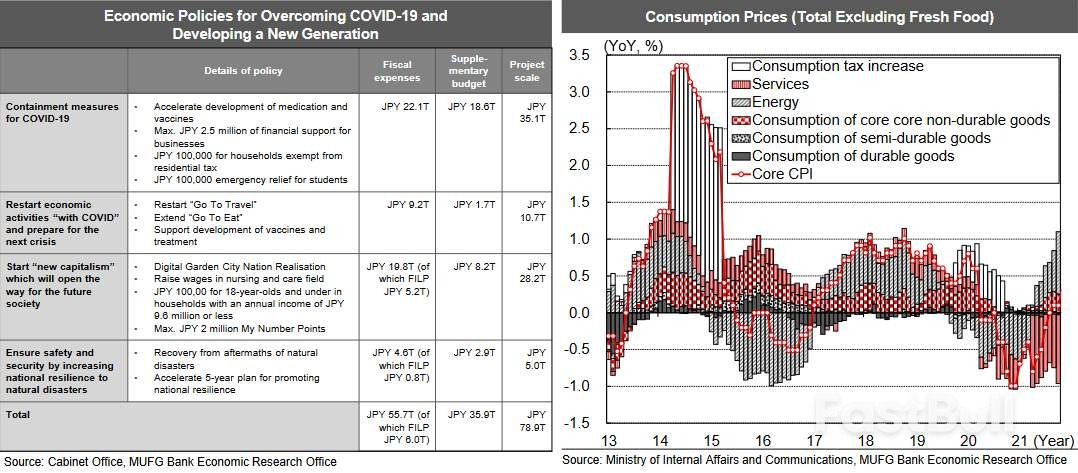

2022 will mark the third year of the COVID-19 pandemic. With the recent emergence of new variants, uncertainty will likely linger. But with advances in vaccines and drags, the situation is expected to move in the direction of improvement and the global economy will likely continue its recovery.How will Japan's economy recover in 2022?

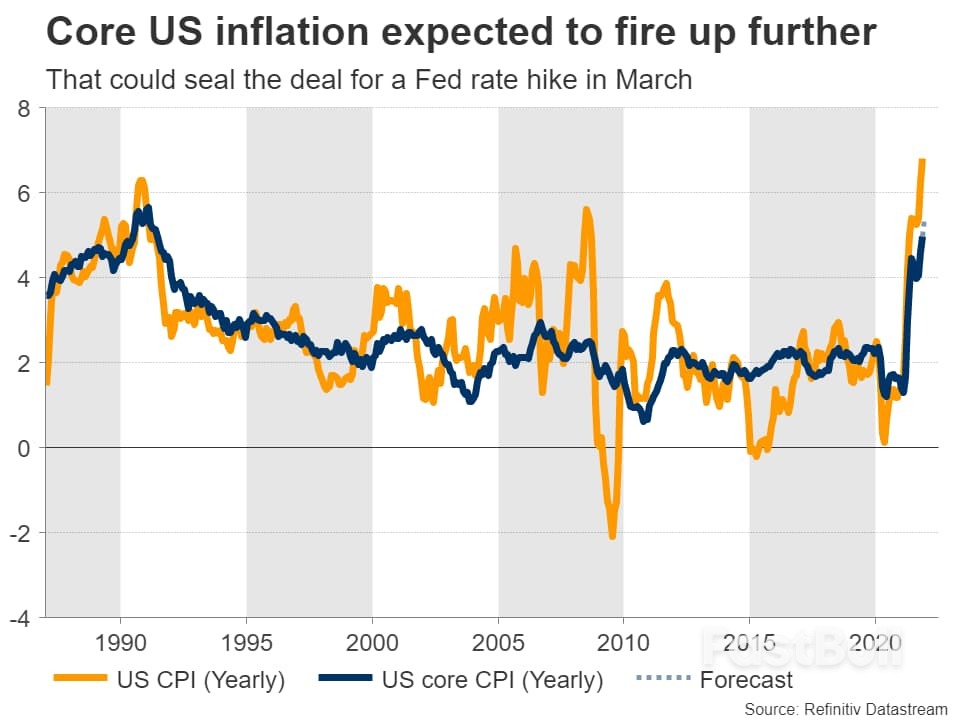

With this in mind, Wednesday's upcoming CPI inflation data and Friday's retail sales report could be crucial. Forecasts show the annual CPI rate steady at 6.8% in December, but the core figure, excluding energy and food prices, is expected to jump to 5.4% from the previous 4.9%.

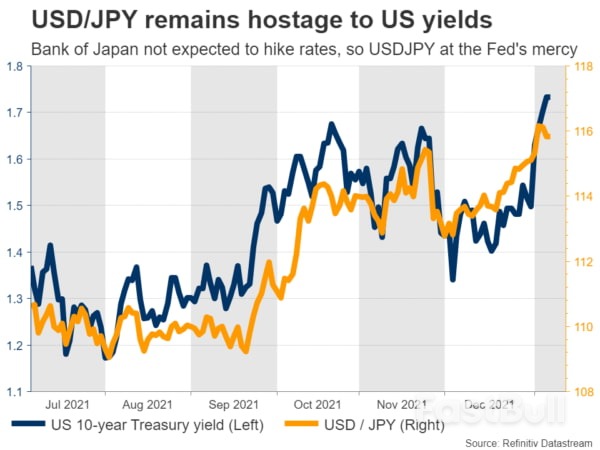

With this in mind, Wednesday's upcoming CPI inflation data and Friday's retail sales report could be crucial. Forecasts show the annual CPI rate steady at 6.8% in December, but the core figure, excluding energy and food prices, is expected to jump to 5.4% from the previous 4.9%. As for the dollar, a big spike in core CPI, coupled with a solid retail sales report, may be enough to solidify expectations that the Fed will begin implementation in March. This could keep the reserve currency in support in the coming months.

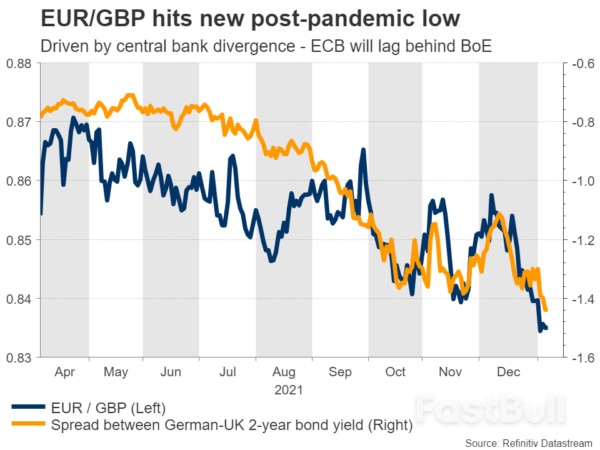

As for the dollar, a big spike in core CPI, coupled with a solid retail sales report, may be enough to solidify expectations that the Fed will begin implementation in March. This could keep the reserve currency in support in the coming months. Currency markets now see a 70% chance that the Bank of England will raise rates again next month, for a total of four rate hikes this year. This helped push EUR/GBP to new post-pandemic lows this week, while Prime Minister Johnson made some comments indicating that new pandemic restrictions are unlikely to be implemented.

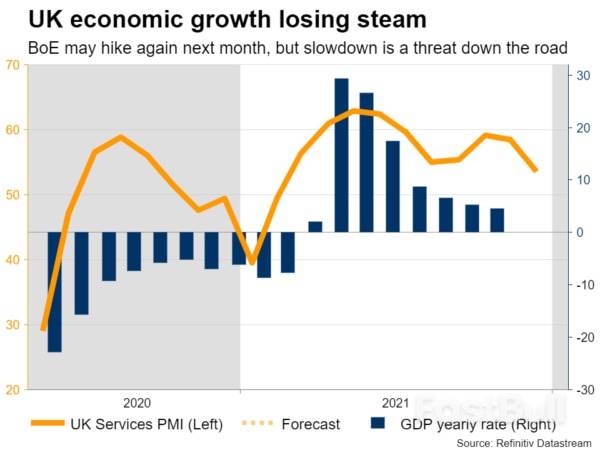

Currency markets now see a 70% chance that the Bank of England will raise rates again next month, for a total of four rate hikes this year. This helped push EUR/GBP to new post-pandemic lows this week, while Prime Minister Johnson made some comments indicating that new pandemic restrictions are unlikely to be implemented. However, there are some risks from a broader perspective. Despite a strong job market and high inflation in the UK, the latest PMI survey shows that economic growth is losing momentum. If this trend continues, the Bank of England may only raise interest rates twice or three times this year, rather than the four expected by the market.

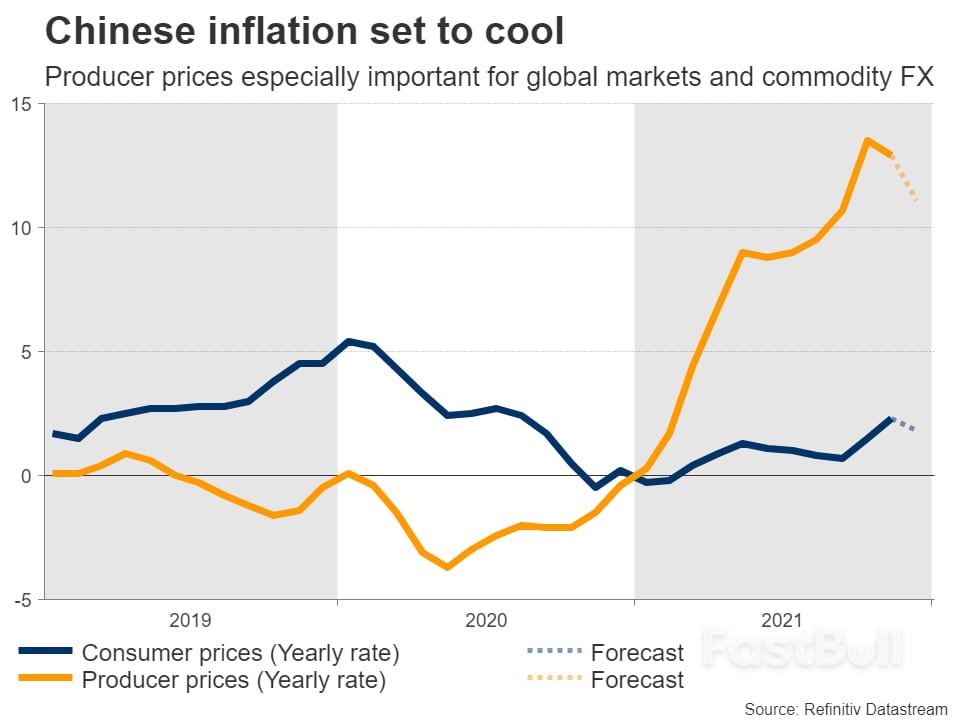

However, there are some risks from a broader perspective. Despite a strong job market and high inflation in the UK, the latest PMI survey shows that economic growth is losing momentum. If this trend continues, the Bank of England may only raise interest rates twice or three times this year, rather than the four expected by the market. Of course, the risk in all of this is China's zero outbreak policy. The government has imposed a severe lockdown on any cities reporting new cases of crown pneumonia, which has the potential to put the global supply chain under pressure for longer. However, the disruptions so far have not been severe.

Of course, the risk in all of this is China's zero outbreak policy. The government has imposed a severe lockdown on any cities reporting new cases of crown pneumonia, which has the potential to put the global supply chain under pressure for longer. However, the disruptions so far have not been severe.

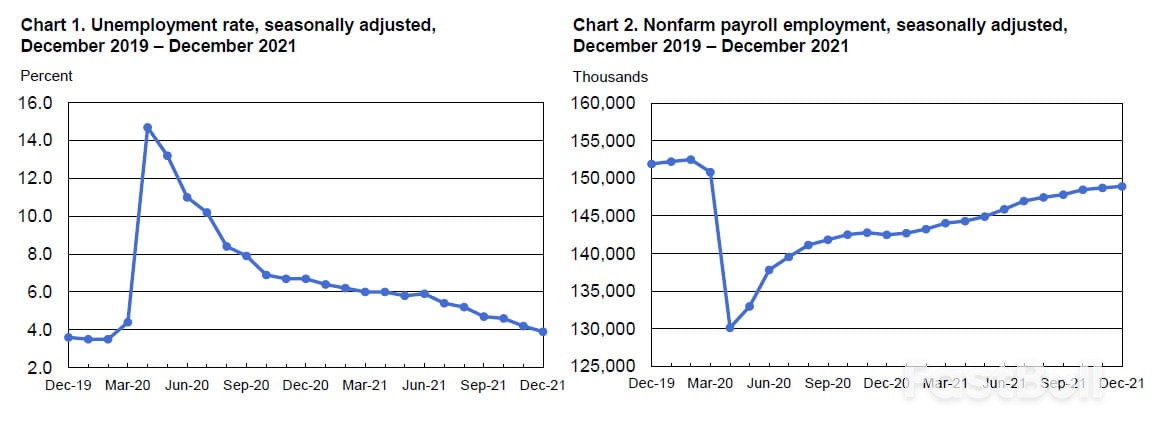

Instant Snapshot - U.S. December Non-Farm Payrolls Data

Instant Snapshot - U.S. December Non-Farm Payrolls Data Instant Observation - U.S. Workforce Still Scarce

Instant Observation - U.S. Workforce Still Scarce Pay Pressures Are Intensifying

Pay Pressures Are Intensifying The Fed Wants To Take Back Control

The Fed Wants To Take Back Control

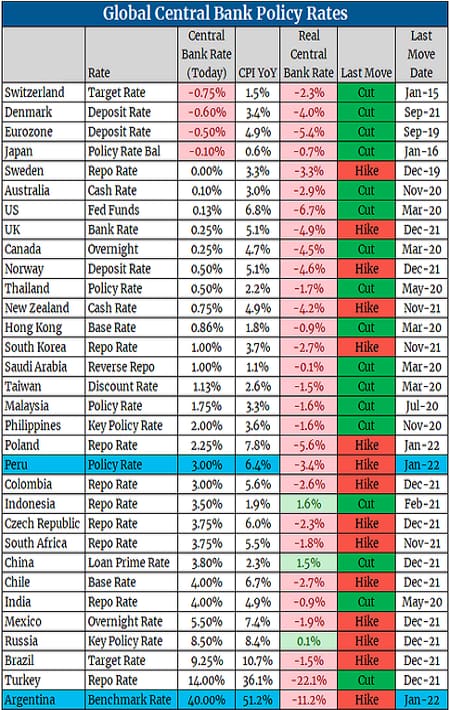

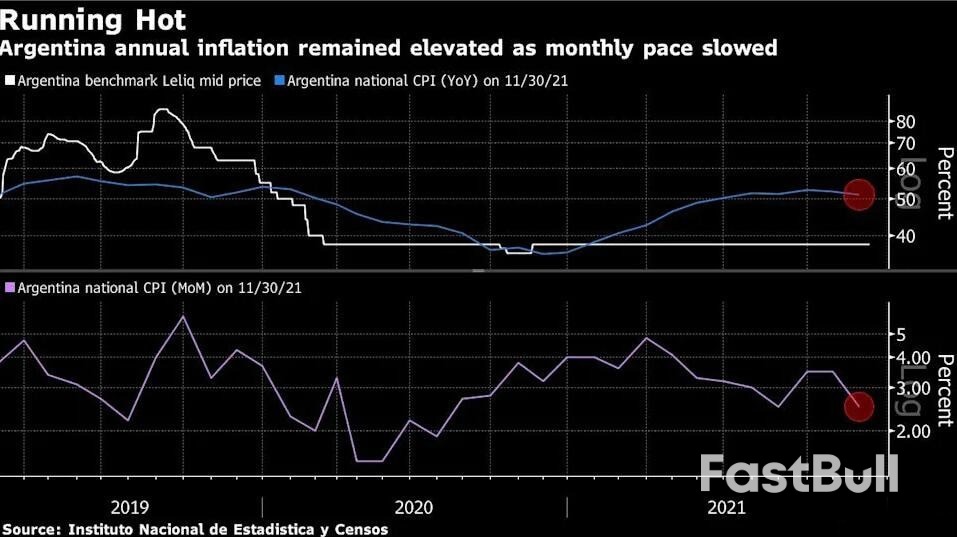

One of the most notable is undoubtedly the "most vulnerable" emerging economy, Argentina, which has been slow to take any monetary policy action for the past year. Turkey experienced a storm of lira devaluation at the end of last year, which at one point made all market participants turn their heads. But even if the turmoil in the Turkish market deepens, the country's domestic inflation rate of about 36% is still " minor " compared to Argentina - the latter's inflation rate has continued to be as high as about 51%.

One of the most notable is undoubtedly the "most vulnerable" emerging economy, Argentina, which has been slow to take any monetary policy action for the past year. Turkey experienced a storm of lira devaluation at the end of last year, which at one point made all market participants turn their heads. But even if the turmoil in the Turkish market deepens, the country's domestic inflation rate of about 36% is still " minor " compared to Argentina - the latter's inflation rate has continued to be as high as about 51%. In its latest statement, Argentina's central bank said the new benchmark interest rate would be in line with the central bank's plans and objectives for 2022 and that the Argentine government hopes to make real returns on local currency investments through interest rate policy, maintain currency as well as foreign exchange market stability, and thus promote economic recovery.

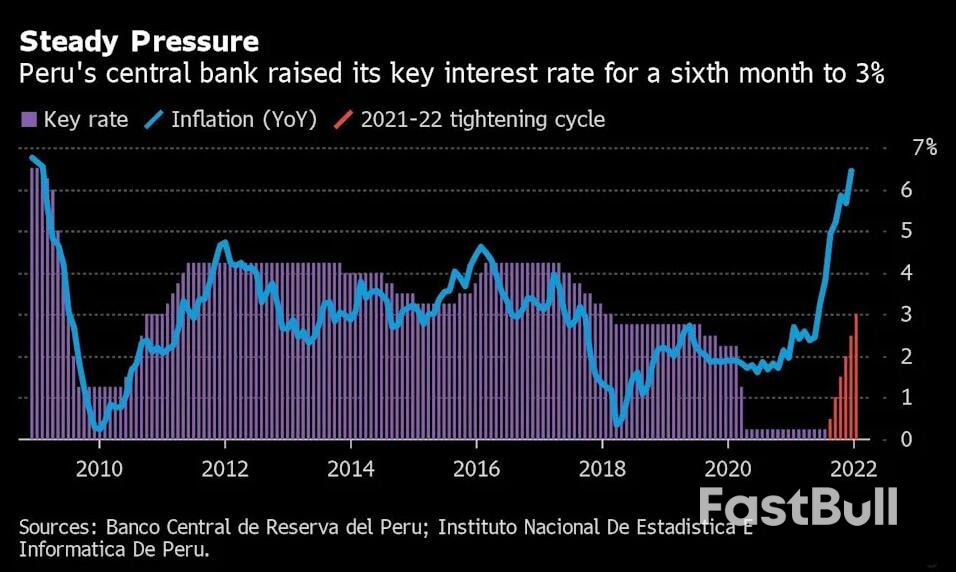

In its latest statement, Argentina's central bank said the new benchmark interest rate would be in line with the central bank's plans and objectives for 2022 and that the Argentine government hopes to make real returns on local currency investments through interest rate policy, maintain currency as well as foreign exchange market stability, and thus promote economic recovery. Peru's CPI has reached a 13-year record high of 6.4% in December due to rising food and energy prices, while the country's central bank's inflation target is only 2%, up or down by one percentage point. Now, with inflation indicators generally exceeding target levels across Latin America, almost all major Latin American central banks are aggressively withdrawing their stimulus programs and moving to raise interest rates.

Peru's CPI has reached a 13-year record high of 6.4% in December due to rising food and energy prices, while the country's central bank's inflation target is only 2%, up or down by one percentage point. Now, with inflation indicators generally exceeding target levels across Latin America, almost all major Latin American central banks are aggressively withdrawing their stimulus programs and moving to raise interest rates.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up