Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The City expects a cut in interest rates on Thursday but the economic prospects for 2026 complicate the picture

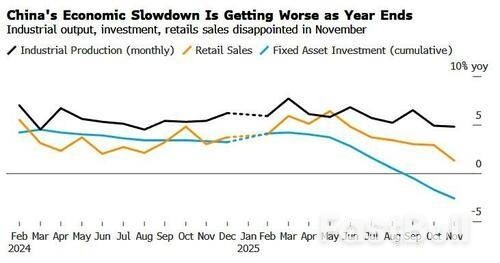

China's economic momentum slowed broadly in November, with a marked weakening in consumer spending, adding pressure on Beijing to stabilize household and business demand in the world's second-largest economy.

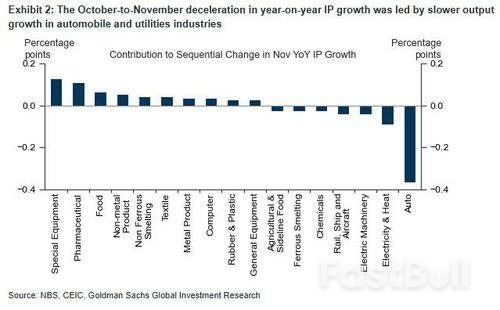

Industrial production (IP) growth edged down in year-on-year terms despite the notable improvement in export growth, with slower output growth in automobile and utilities industries more than offsetting faster output growth in the special equipment and pharmaceuticals industries.

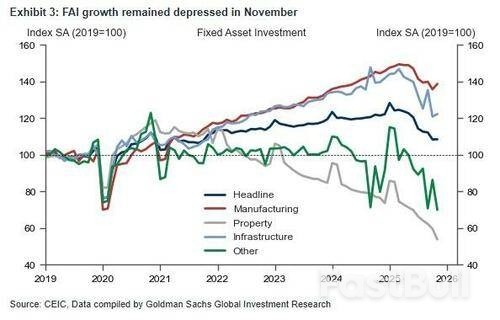

Fixed asset investment (FAI) maintained its double-digit year-on-year contraction in November on a single-month basis, though we would not over-interpret its recent slump as our study suggests that the NBS statistical correction of previously over-reported data has played at least as large a role as fundamental factors (e.g., the "anti-involution" policies and a prolonged property downturn).

Retail sales growth dropped meaningfully in November despite a low base, reflecting slowing auto sales growth and the negative distortion from an earlier-than-usual start of the "Double 11" Online Shopping Festival (which had pulled forward some demand from November to October, similar to the patterns observed in June).

Year-on-year services industry output index growth – which is on a real basis and tracks tertiary (services) GDP growth closely – moderated in November.

Property sector weakness continued in November, while unemployment rates remained largely stable.

Regarding the labor market, the nationwide unemployment rate and the 31-city metric (not seasonally adjusted) both remained flat at 5.1% in November. The latest data available suggests the unemployment rate of the 16-24 age group declined to 17.3% in October from 17.7% in September, while Goldman cautions that this indicator may have underestimated the labor market challenges that younger generation is facing amid weak domestic demand, persistent deflation and fragile private sector confidence, because of the definition change.

Incorporating October-November activity data, Goldman's GDP tracking model based on the production approach points to a small downside risk to our Q4 real GDP growth forecast of 4.5% yoy.

And with downside economic risks building, Bloomberg reports that Chinese President Xi Jinping lashed out at inflated growth numbers and vowed to crack down on the pursuit of "reckless" projects that have no purpose except showing superficial results.

"All plans must be based on facts, aiming for solid, genuine growth without exaggeration, and promoting high-quality, sustainable development," Xi said last week, according to a report on Sunday in the People's Daily, the Communist Party's official newspaper.

"Those who act recklessly and aggressively without regard for reality, impose excessive demands, or deploy resources without careful consideration, must be held strictly accountable," he said at the Central Economic Work Conference.

Xi used stark language to call for quality in economic gains and listed examples of wrongdoing such as unnecessarily huge industrial parks, disorderly expansion of local exhibitions and forums, inflated statistics and "fake construction kickoffs."

Access to data in China can be sensitive and controlled, making it hard for observers to assess the health of the economy, but Xi's latest remarks seem to suggest that he wants a revamp of the existing metrics used to evaluate local officials.

Finally, we note that the initial downturn in Chinese stocks was quickly bid back into positive territory after the 'bad data' as it appeared 'bad news' would be 'good news' from a 'most stimmies' perspective, but Xi's rant dragged stocks down to end the day in the red...

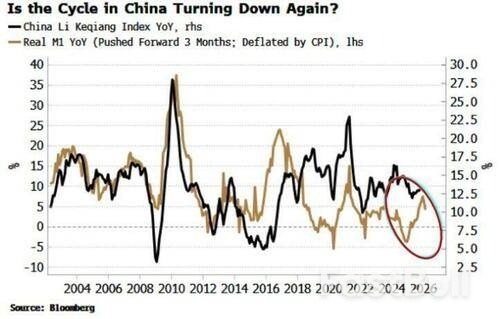

And as a reminder, we warned last week that the pace of money growth in China has slowed for a second month. If that's sustained, global stocks could lose a hitherto supportive tailwind next year.

One snowflake doesn't make a winter, but if M1 in China continues to pare back, that's at least one tailwind global stocks won't have next year.

Zand Bank, the first digital corporate lender in the UAE, is planning to expand to other markets in the Gulf and Africa within the next three years to boost growth and diversify its product offerings, its chief executive has said.

The digital lender, which is in its fourth year of operation, has already been approached by several African banks and financial institutions in the Gulf region for joint ventures and partnership, Michael Chan told The National on the sidelines of Abu Dhabi Finance Week.

"One and half years ago, many banks, at least from four countries in Africa and two in the GCC, approached us asking whether we want to be joint venture partners, leveraging their license, or co-create a new bank together in the region," Mr Chan said.

"But at that time, we were very busy on transformation and that's why I think the next three years is probably the right time."

The higher rate of digital adoption in Africa as well as its strong trade ties with the UAE builds the case for Zand to expand its presence in the continent.

"The UAE actually serves a few purposes – one as an investor and two, as a re-export hub for Africa – on both sides: African trade going out, and also the China trade going in," Mr Chan said.

Zand, he said, is confident its future business and growth based on payment corridors and border trade flows, which is already a strong focus area for the lender. "That's why Africa and GCC will be the next target," Mr Chan explained.

He said there is no particular Gulf or African market Zand is aiming for first. "Banks just follow the money," he said. "The country that's growing the fastest will be the country to go to."

The bank will maintain its UAE DNA, he added, even in new markets, and will not only provide specialty banking services but also serve FinTech sectors in new jurisdictions.

Zand, whose board is chaired by Emaar Properties founder Mohammed Alabbar, counts Abu Dhabi's Al Hail Holding as its largest shareholder with a 55 per cent stake. Other main shareholders include Emirates NBD; Templeton International, which is part of the Franklin Templeton group; and Lulu Group founder Yusuff Ali. Each have a 10 per cent shareholding.

The second lender in the UAE to receive a digital banking licence from the UAE's Central Bank, Zand is primarily focused on organic growth. However, it is also open to acquiring technology that can help it accelerate growth, Mr Chan said.

Zand's dual growth strategy is based on broadening its "niche and unique propositions" and partnerships with top FinTech players to "create the market together", he said.

But "we are always open" to acquisitions as part of the bank's longer-term strategy, he added.

The ambition to position Zand as an international player explains why the lender pivoted from being a retail-focused bank to a corporate lender just months after its formal launch.

"We initially chose to be a digital corporate bank, and not a digital retail bank, because digital retail banking is a single market focus," Mr Chan said.

Zand relies on blockchain and on-chain banking, which is essentially borderless banking. That has also changed its competition dynamics in the UAE market.

It targets mid-to-large corporates, institutions and also government-sector entities. "We are in competition with legacy banks because we provide universal banking services," Mr Chan said.

The bank, which currently offers AI-powered transaction banking; digital asset custody; escrow services; as well as ESG (environmental, social, and governance) financing solutions, expects to grow between 50 per cent to 100 per next year.

Having expanded its revenue base by about 120 per cent last year, Zand is on track to achieve about 60 per cent annual growth this year, Mr Chan said.

The bank is still a start-up, but growth so far has been "quite promising", with Zand also the youngest digital lender to break even and become profitable.

There are more than 300 digital banks worldwide and it takes, on average, six years to reach the break-even stage. However, Zand achieved that milestone in 22 months after Mr Chan became chief executive in November 2022.

The lender established partnerships with several global giants, including Ripple and Mastercard, this year to broaden its suite of services.

In November, the UAE Central Bank also approved Zand AED, a fully regulated, multi-chain AED-backed stablecoin. Zand AED, which is backed one-to-one by the UAE dirham, is available across multiple public blockchains, enabling fast borderless settlement and integration for developers, enterprises, and financial institutions.

Zand is also gearing up to launch its wealth management services within the first quarter of next year, Mr Chan said.

Inflation in Canada unexpectedly held steady last month while core measures broadly cooled, as slowing price growth for services was offset by rising costs of goods.

Headline inflation rose at a 2.2% yearly pace in November, matching the pace in October, Statistics Canada data showed Monday. That was slower than the median expectation of 2.3% in a Bloomberg survey of economists.

On a monthly basis, the consumer price index rose by 0.1%, matching expectations.

The Bank of Canada's two so-called preferred core measures, the median and trim gauges, decelerated to a 2.8% annual pace, from 3% previously. On a three-month moving annualized basis, they slowed to 2.3%, from 2.6% in October.

The central bank has, in recent months, placed less emphasis on these two metrics and instead said a broad range of measures points to underlying inflation of about 2.5%.

Looking at a variety of metrics, core price pressures generally cooled or held steady in November. Excluding food and energy, prices rose 2.4% from a year earlier, down from 2.7% in October. Inflation excluding gasoline prices rose at a 2.6% pace for the third straight month. And the bank's previous measure of core inflation -- CPI excluding eight volatile components and indirect taxes -- held at 2.9%.

Still, the breadth of inflationary pressures widened, with about 42% of items in the consumer price index rising above a 3% yearly pace, from 34% previously.

Altogether, the report shows headline inflation trending down toward the central bank's 2% target, even as some measures of underlying inflation remain closer to 3%. The Bank of Canada is likely to be unfazed by ongoing core pressures, as it sees continued slack in the Canadian economy as US tariffs batter key sectors and weigh on business investment and consumer spending.

The central bank held its policy rate steady at 2.25% last week and reiterated it sees borrowing costs at "about the right level" to support growth while keeping inflation contained. Governor Tiff Macklem set the bar relatively high for a move off the sidelines, saying the bank will respond if there is "a new shock or an accumulation of evidence" that "materially changes the outlook."

Policymakers expect inflation to remain close to the 2% target, around where it's been for more than a year.

In November, lower prices for travel tours and accommodation, as well as slower growth in rent prices, put downward pressure on headline inflation. Higher costs of groceries, as well as a smaller decline in gasoline prices, were the main upside contributors.

Lower travel prices were driven partly by a base-year effect, as Taylor Swift performed in Toronto in November 2024.

Grocery prices rose 4.7% in November, the largest increase since December 2023, as the cost of fresh fruit jumped and prices for beef and coffee continued to be significant contributors. Prices rose at a faster pace in five provinces, led by New Brunswick.

The report is the first of two inflation releases before the central bank's next rate decision on Jan. 28. Traders expect the bank to hold rates steady until at least October 2026, when they see a possible hike.

Russia is considering extending its diesel and gasoline export restrictions until February, according to reports from state news agencies on Monday that cited anonymous sources.

Russian Deputy Prime Minister Alexander Novak led a meeting on the fuel market on Monday with participants from the energy ministry, Federal Anti-Monopoly Service, and oil company representatives.

A spokesperson for Novak said no decision had been made yet regarding the extension of export restrictions. Following the meeting, the government stated that fuel producers had maintained a balanced supply.

"There is a downward trend in fuel prices in the small wholesale segment. Agricultural producers are being supplied with the necessary fuel volumes," the government said.

Russia implemented a partial ban on diesel exports in late September and has already extended its gasoline export ban through the end of the year.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up