Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Taiwan Overnight Interbank Rate Opens At 0.805 Percent (Versus 0.805 Percent At Previous Session Open)

[CITIC Securities: Current US Financial Market Environment Does Not Favor Balance Sheet Reduction] CITIC Securities Points Out That Although Warsh Repeatedly Mentioned The Policy Direction Of Interest Rate Cuts And Balance Sheet Reduction In 2025, Considering That The Liquidity Pressure In The US Money Market Only Significantly Eased In January, The Current Reserve-to-GDP Ratio Is Still Around 10%, And The Fed's Assets Held As A Percentage Of GDP Are Around 20%, Approaching The Pre-pandemic Level Of 2018, Indicating Limited Overall Reserve Adequacy. If Warsh Becomes The Next Fed Chairman, And If He Quickly Initiates Balance Sheet Reduction After Taking Office, The US Money Market May Face Liquidity Pressure Again. Therefore, Overall, CITIC Securities Believes That The Current US Financial Market Environment Does Not Favor Balance Sheet Reduction

UN Secretary General Guterres: Dissolution Of New Start Could Not Come At A Worse Time, With Risk Of Nuclear Weapon Use At Highest In Decades

U.K. Composite PMI Final (Jan)

U.K. Composite PMI Final (Jan)A:--

F: --

P: --

U.K. Total Reserve Assets (Jan)

U.K. Total Reserve Assets (Jan)A:--

F: --

P: --

U.K. Services PMI Final (Jan)

U.K. Services PMI Final (Jan)A:--

F: --

P: --

Euro Zone Core CPI Prelim YoY (Jan)

Euro Zone Core CPI Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone Core HICP Prelim YoY (Jan)

Euro Zone Core HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone HICP Prelim YoY (Jan)

Euro Zone HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone PPI MoM (Dec)

Euro Zone PPI MoM (Dec)A:--

F: --

Euro Zone Core HICP Prelim MoM (Jan)

Euro Zone Core HICP Prelim MoM (Jan)A:--

F: --

P: --

Italy HICP Prelim YoY (Jan)

Italy HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone Core CPI Prelim MoM (Jan)

Euro Zone Core CPI Prelim MoM (Jan)A:--

F: --

P: --

Euro Zone PPI YoY (Dec)

Euro Zone PPI YoY (Dec)A:--

F: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Brazil IHS Markit Composite PMI (Jan)

Brazil IHS Markit Composite PMI (Jan)A:--

F: --

P: --

Brazil IHS Markit Services PMI (Jan)

Brazil IHS Markit Services PMI (Jan)A:--

F: --

P: --

U.S. ADP Employment (Jan)

U.S. ADP Employment (Jan)A:--

F: --

The U.S. Treasury Department released its quarterly refinancing statement.

The U.S. Treasury Department released its quarterly refinancing statement. U.S. IHS Markit Composite PMI Final (Jan)

U.S. IHS Markit Composite PMI Final (Jan)A:--

F: --

P: --

U.S. IHS Markit Services PMI Final (Jan)

U.S. IHS Markit Services PMI Final (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Price Index (Jan)

U.S. ISM Non-Manufacturing Price Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Employment Index (Jan)

U.S. ISM Non-Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing New Orders Index (Jan)

U.S. ISM Non-Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Inventories Index (Jan)

U.S. ISM Non-Manufacturing Inventories Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing PMI (Jan)

U.S. ISM Non-Manufacturing PMI (Jan)A:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

Australia Trade Balance (SA) (Dec)

Australia Trade Balance (SA) (Dec)A:--

F: --

P: --

Australia Exports MoM (SA) (Dec)

Australia Exports MoM (SA) (Dec)A:--

F: --

P: --

Japan 30-Year JGB Auction Yield

Japan 30-Year JGB Auction Yield--

F: --

P: --

Indonesia Annual GDP Growth

Indonesia Annual GDP Growth--

F: --

P: --

Indonesia GDP YoY (Q4)

Indonesia GDP YoY (Q4)--

F: --

P: --

France Industrial Output MoM (SA) (Dec)

France Industrial Output MoM (SA) (Dec)--

F: --

P: --

Italy IHS Markit Construction PMI (Jan)

Italy IHS Markit Construction PMI (Jan)--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Jan)

Euro Zone IHS Markit Construction PMI (Jan)--

F: --

P: --

Germany Construction PMI (SA) (Jan)

Germany Construction PMI (SA) (Jan)--

F: --

P: --

Italy Retail Sales MoM (SA) (Dec)

Italy Retail Sales MoM (SA) (Dec)--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Jan)

U.K. Markit/CIPS Construction PMI (Jan)--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. Yield--

F: --

P: --

Euro Zone Retail Sales YoY (Dec)

Euro Zone Retail Sales YoY (Dec)--

F: --

P: --

Euro Zone Retail Sales MoM (Dec)

Euro Zone Retail Sales MoM (Dec)--

F: --

P: --

U.K. BOE MPC Vote Cut (Feb)

U.K. BOE MPC Vote Cut (Feb)--

F: --

P: --

U.K. BOE MPC Vote Hike (Feb)

U.K. BOE MPC Vote Hike (Feb)--

F: --

P: --

U.K. BOE MPC Vote Unchanged (Feb)

U.K. BOE MPC Vote Unchanged (Feb)--

F: --

P: --

U.K. Benchmark Interest Rate

U.K. Benchmark Interest Rate--

F: --

P: --

MPC Rate Statement

MPC Rate Statement U.S. Challenger Job Cuts (Jan)

U.S. Challenger Job Cuts (Jan)--

F: --

P: --

U.S. Challenger Job Cuts MoM (Jan)

U.S. Challenger Job Cuts MoM (Jan)--

F: --

P: --

U.S. Challenger Job Cuts YoY (Jan)

U.S. Challenger Job Cuts YoY (Jan)--

F: --

P: --

Bank of England Governor Bailey held a press conference on monetary policy.

Bank of England Governor Bailey held a press conference on monetary policy. Euro Zone ECB Marginal Lending Rate

Euro Zone ECB Marginal Lending Rate--

F: --

P: --

Euro Zone ECB Deposit Rate

Euro Zone ECB Deposit Rate--

F: --

P: --

Euro Zone ECB Main Refinancing Rate

Euro Zone ECB Main Refinancing Rate--

F: --

P: --

ECB Monetary Policy Statement

ECB Monetary Policy Statement U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

ECB Press Conference

ECB Press Conference

Aris Aris

ID: 9979627

No matching data

View All

No data

The U.S. Federal Reserve quietly bought $43.6 billion in Treasury bonds in just four days, signaling a subtle policy pivot that has triggered a surge in gold and bitcoin prices...

Amid the doom and gloom of falling crude prices and weakening demand growth, oil bulls could find one nugget of cheer in the latest report from the International Energy Agency: a modest upward revision to historical consumption.

That may not seem terribly exciting, but it wiped out three years’ worth of apparent global oil stockbuilds and drained an ocean of “missing barrels.”

The world used about 330,000 barrels a day more in 2023 than was previously reported, according to the IEA. Africa accounted for three-quarters of that revision, with higher consumption in Egypt and Nigeria.

Because of the way forecasts are generated, that historical increase gets rolled forward into subsequent years, raising the level of demand for this year and next even if it does nothing for year-on-year growth.

Rather than predicting actual oil consumption for 195 countries, analysts tend to forecast incremental demand by region using assumptions about population and economic growth, and then applying those numbers to “known” historical consumption levels.

Raise the starting point and everything else rises, even as annual growth is unaltered.

At a stroke, the IEA’s revision wiped out all the stockbuilds it saw in 2022, 2023 and 2024.

Rather than adding 220 million barrels of oil to global inventories during those three years, the IEA now says we have drawn them down by nearly 75 million barrels. That swing is equivalent to almost three-quarters of the US strategic reserve.

Before we get too excited, though, the IEA still sees supply running ahead of demand in 2025 and 2026.

Even if OPEC+ pauses its output increases after the big hikes planned for this month and next, supply will still exceed demand by more than 1 million barrels a day in the third quarter, the agency says. And that’s before any possible return of Iranian barrels.

The spare oil will head for storage tanks that are a lot less full than previously believed.

While it’s not a recipe for rising prices, erasure of the missing barrels might help put a floor under them, at least for a little while.

Exports of US crude are tumbling as OPEC+ restores production into a market grappling with weakening demand because of the trade war and reduced refinery capacity. Average US oil exports dropped 10% to 3.76 million barrels a day in the four weeks through May 9, according to Energy Information Administration data. That’s the slowest pace since January and well below seasonal levels from the past two years.

US Treasury officials met with Hong Kong banks in April to warn them against facilitating Iranian oil shipments to China, just a month before sanctioning nine non-bank entities allegedly involved in such trades, people familiar with the matter said.

Canadian oil tycoon Adam Waterous’ Strathcona Resources Ltd. announced plans to make a takeover bid for MEG Energy Corp. that values the oil-sands company at about C$6 billion ($4 billion).

Vistra Corp. agreed to buy seven gas-fired power plants for $1.9 billion, the latest big US generator betting on the fossil fuel to feed the voracious appetite of artificial intelligence.

Taiwan is shutting its last nuclear reactor this weekend, putting pressure on the island’s energy-guzzling chipmakers in the face of soaring demand for their products.

Ice-cream cones will likely cost more this summer as the price of coconut oil, a key ingredient, keeps setting records, Bloomberg Opinion’s Javier Blas writes.

China’s liquefied natural gas demand may see limited benefit from the recent slash in US tariffs, according to BloombergNEF. The existing levies, domestic economic malaise and elevated LNG prices are set to curb Chinese buying interest. Imports may reach 68 million metric tons — 1.1 million tons more than forecast last month during the peak of the trade war. Yet that’s still 8.2 million tons, or 11%, lower year-on-year.

Join us in Doha for the Qatar Economic Forum on May 20-22. Since 2021, the forum powered by Bloomberg has convened more than 6,500 influential leaders to explore bold ideas and tackle the challenges shaping the global economy. Request an invitation today.

President Trump has departed Abu Dhabi aboard Air Force One, concluding a historic week in the Middle East that saw the signing of more than a trillion dollars in deals aimed at advancing his 'America First' agenda.

Ahead of his departure from the Middle East, President Trump addressed business leaders in Abu Dhabi, stating that his administration will unilaterally set tariff rates for U.S. trading partners within the next two to three weeks.

"We just reached a fantastic trade deal with the United Kingdom. And we have another big one that we reached with China," the president said.

He continued, "At the same time, we have 150 countries that want to make a deal—but you're not able to see that many countries." He added that Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick "will be sending letters out essentially telling people what "they'll be paying to do business in the United States."

"I think we're going to be very fair. But it's not possible to meet the number of people that want to see us," Trump said.

The president did not specify which countries want to make deals, nor the ones that will receive letters.

Talks remain ongoing with top trading partners, including Japan, South Korea, India, the EU, and China, with recent progress...

However, the administration appears to have abandoned comprehensive negotiations in favor of setting terms directly for many countries due to what Bloomberg says "the lack of manpower and capacity makes it impossible to hold concurrent negotiations with all the countries caught up in the president's so-called reciprocal tariffs plan."

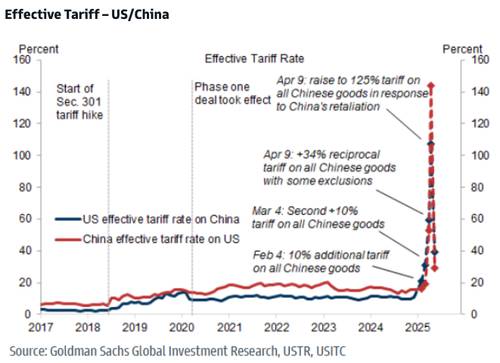

Earlier this week, the U.S. and China announced a breakthrough trade agreement that temporarily lowered tariffs on each other's products for 90 days. The U.S. dropped its 145% on Chinese goods to 30%, while China lowered levies from 125% to 10%.

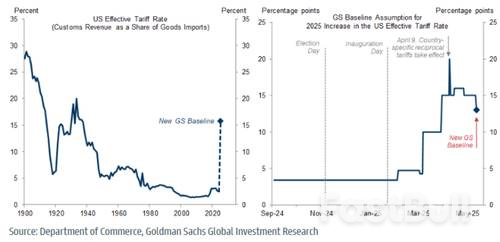

Goldman illustrates the rollercoaster ride of the tit-for-tat trade war between the U.S. and China in recent months, as well as the temporary cooling period aimed at de-escalating tensions.

On Wednesday morning, Goldman analyst Jerry Shen told clients, "We Now Expect the Effective Tariff Rate to increase by 13pp."

Last week, Trump stated, "We have four or five other deals coming immediately. We have many deals coming down the line. Ultimately, we're just signing the rest of them in."

Switzerland has had productive talks with the US on the central bank’s currency interventions, Swiss National Bank President Martin Schlegel said, rejecting the suggestion that the country manipulates the franc’s exchange rate.

“We are no currency manipulator,” he said in Lucerne on Friday, adding that “we had a constructive conversation with the US authorities” on the topic.

Schlegel declined to further elaborate on the format or content of those talks, though a spokesperson later said that the SNB has an ongoing exchange with US authorities, especially with the Department of the Treasury.

The central bank chief pointed out that historically, the SNB has only ever intervened on the franc to meets its price stability directive.

“We have never influenced the exchange rate to get us an advantage,” he said. “We only acted to ensure we fulfill our mandate under the given global economic conditions.”

The franc is typically seen as a haven currency in times of market stress, with the recent market uncertainty triggered by US President Donald Trump’s tariff policy pushing it to a decade high against the dollar last month and near such a high against the euro.

The SNB’s past interventions earned Switzerland a currency manipulator tag during Trump’s first term, though that label was subsequently removed. Schlegel has repeatedly said that the threat of that classification won’t stop the institution from steering the currency if required.

By selling some of its own reserves in foreign denominations, the SNB can strengthen the exchange rate. In 2022 and 2023, it boosted the franc in this way to dampen domestic inflation by making imported goods cheaper.

For several years before that, it had used the mechanism in the opposite direction to keep a lid on the currency. This has seen the SNB’s balance sheet grow to a size some observers deem dangerous as it can yield large profits — as last year — but also large losses.

The latest data show that the Swiss central bank hardly stepped into currency markets in 2024. First-quarter numbers will be available at the end of June.

The SNB is just a month away from its next monetary policy decision, with markets and economists expecting a 25 basis-point reduction to zero at that meeting. Asked if officials may have to embrace negative rates, Schlegel said that “if the economic situation dictates that the interest rate needs to be at that level, then we will go there.”

Nvidia (NVDA.O), opens new tab is seeking a site in Shanghai for a research and development centre, three sources close to the matter said, reflecting the strategic significance of the Chinese market where U.S. curbs on advanced chip exports have hit sales.

The U.S. chipmaker began the search in early 2025 and is primarily evaluating locations in Shanghai's Minhang and Xuhui districts, one of the sources said.

The project gained momentum after a surprise visit to China by Nvidia CEO Jensen Huang last month, said two of the sources.

Huang, who has consistently said China is critical to Nvidia's growth, made his visit immediately after the U.S. placed new restrictions on China-bound shipments of its H20 chips, the only AI chip the company can sell legally in China.

Huang met senior Chinese officials, including Vice Premier He Lifeng and Shanghai's mayor Gong Zheng.

Reuters reported earlier this month that Nvidia plans to release a downgraded version of the H20 chip for China in the next two months, as it seeks to prop up sales in the country, where it has been lost market share to domestic rivals such as Huawei.

China generated $17 billion in revenue for Nvidia in the fiscal year ending January 26, accounting for 13% of the company's total sales.

The local government of Shanghai, which hosts China's largest foreign business community, including firms such as Tesla (TSLA.O), opens new tab, has expressed willingness to offer incentives for the Nvidia project, including tax reductions, said two of the sources.

The local authorities are also considering offering a substantial amount of land to Nvidia for its China R&D centre, one source added.

Nvidia declined to comment, while the Shanghai city government did not immediately respond to a request for comment. The sources declined to be named, as the plan is not public.

Following his visit to China, Huang told CNBC that the country's AI market could reach approximately $50 billion within the next two-to-three years.

He said that being excluded from this rapidly expanding sector would represent a "tremendous loss" for Nvidia, especially as competition with Huawei intensifies.

During an earnings call in February, before H20 chip sales to China were restricted, Nvidia executives said the company's sales to China were about half the level before U.S. export controls.

Since 2022, the U.S. government has imposed restrictions on the export of Nvidia's most advanced chips to China, citing concerns over potential military applications.

The Financial Times first reported on Friday about Nvidia's plan to build a R&D centre in China.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up