Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

U.S. Federal Reserve officials feel they need to reconsider the key elements around both jobs and inflation in their current approach to monetary policy given the inflation experience of the last few years and the possibility that supply shocks and the associated price increases may become more frequent in the years ahead, Fed chair Jerome Powell said Thursday.

U.S. Federal Reserve officials feel they need to reconsider the key elements around both jobs and inflation in their current approach to monetary policy given the inflation experience of the last few years and the possibility that supply shocks and the associated price increases may become more frequent in the years ahead, Fed chair Jerome Powell said Thursday.

"We may be entering a period of more frequent, and potentially more persistent, supply shocks—a difficult challenge for the economy and for central banks," Powell said in opening remarks at a two-day conference reconsidering the Fed's current approach to monetary policy, adopted in 2020 as the economy was still scarred by the pandemic.

"The economic environment has changed significantly since 2020, and our review will reflect our assessment of those changes," Powell said.

Powell did not focus on current monetary policy or the economic outlook, though he did say he expected April personal consumption expenditures price inflation to have fallen to 2.2% -- a tepid reading but still likely not reflecting coming tariff-driven price increases.

Still that reflects a "historically unusual result" of disinflation without major damage to the economy, a "soft landing" that did take place under the Fed's current strategy.

Five years ago the Fed recast its approach to allow more room for lower unemployment rates and pledged to use periods of high inflation to offset years in which inflation was weak, a common occurrence from 2010 to 2019.

The inflation that took off after that, and the emerging state of the global economy, means that approach may need a rethink, Powell said.

"In our discussions so far, participants have indicated that

they thought it would be appropriate to reconsider the language around shortfalls" of employment, a change adopted so the Fed would not consider a low unemployment rate in itself a sign of inflation risk, Powell said. "At our meeting last week, we had a similar take on average inflation targeting. We will ensure that our new consensus statement is robust to a wide range of economic environments and developments."

His comments point to possibly extensive revisions to a strategy that had been viewed at its inception as a major shift for the Fed, with a willingness to take more risks in favor of a stronger job market and a willingness to tolerate higher inflation after periods of weakness.

But "the idea of an intentional, moderate overshoot proved irrelevant to our policy discussions and has remained so through today" following the near double-digit inflation that occurred during the pandemic reopening, Powell said.

In a recent economic update, the Producer Price Index (PPI), a key indicator of consumer price inflation, recorded a surprising downturn. The actual figure was reported at -0.5%, a number significantly lower than the forecasted 0.2%.

This unexpected drop in PPI, which measures the change in the price of goods sold by manufacturers, has left market analysts and investors slightly taken aback. The forecast had predicted a modest increase of 0.2%, indicating a healthy, albeit slow, growth in the manufacturing sector. Instead, the actual figure plummeted to -0.5%, marking a stark contrast to the forecasted numbers.

When compared to the previous PPI figure, which stood at a flat 0.0%, the current reading further emphasizes the downward trend. The negative figure indicates a decrease in the prices of goods sold by manufacturers, which can be a precursor to a dip in consumer price inflation.

The PPI is a leading indicator of consumer price inflation, which accounts for the majority of overall inflation. Therefore, a lower PPI often signals a potential decrease in overall inflation. This could have various implications for the economy, including a potential slowdown in economic growth and a decrease in consumer spending.

In terms of the currency market, the lower than expected PPI reading can be seen as bearish for the US dollar (USD). A decrease in the PPI often leads to lower inflation, which in turn can decrease the value of the USD. As a result, investors and traders will be keeping a close eye on the USD, as further fluctuations in the PPI could lead to significant shifts in the currency market.

As the market digests this unexpected change, all eyes will be on the Federal Reserve and other economic indicators for signs of how this could impact the broader US economy.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.

The US economy witnessed a marginal increase in retail sales, according to recent data. The actual increase in retail sales was reported to be 0.1%, a figure that falls significantly short of the forecasted growth of 0.0%.

This slight growth of 0.1% in retail sales is a stark contrast to the previously recorded rate of 1.7%. This indicates a slowdown in consumer spending, which is a key driver of overall economic activity. The retail sales data is seen as a critical barometer of consumer spending patterns and sentiment, and the current numbers point towards a cautious approach by consumers.

The forecast for retail sales growth had been set at 0.0%, indicating an expectation of stability in the market. However, the actual figures have fallen short of these predictions, albeit showing a small increase. This suggests that while there is growth, it is not at the pace anticipated by market forecasters.

Compared to the previous figure of 1.7%, the current growth rate of 0.1% represents a significant drop. This decline could be indicative of a variety of factors, including changing consumer behaviors, market uncertainties, or economic policy impacts.

The retail sales data is closely watched by economists and investors alike as it provides insights into the health of the consumer sector, which forms a substantial part of the US economy. The lower than expected reading is likely to be interpreted as bearish for the USD, as it suggests a slowdown in consumer spending.

While the slight increase in retail sales could be seen as a positive sign of growth, the fact that it falls short of both the forecasted figures and the previous month’s figures raises questions about the strength and stability of consumer spending in the coming months. This data will be closely scrutinized by policymakers and investors as they navigate the economic landscape.

Asian stocks dropped on Thursday after rising for four straight days, as the boost from US-China trade talks started to fade.

Stocks in Japan, China, and US futures all fell, showing a more cautious mood after a week of strong gains driven by trade progress and steady economic performance. Investors are concerned that stocks have risen so much they could be easily affected by unexpected events. European stock futures also dipped slightly.

Heading into the European open, European shares were being weighed down by energy stocks which saw big losses due to falling oil prices, while investors looked ahead to important U.S. economic data and comments from Federal Reserve Chair Jerome Powell.

Oil prices fell over 3% due to the possibility of a U.S.-Iran nuclear deal, which could lift sanctions and increase supply. Big oil companies like BP and Shell saw their shares drop by 5% and 3%, pulling down the main stock index.

Gold prices faltered once more with the precious metal printing an Asian session low of around the $3125/oz handle before recovering to trade around $3158/oz at the time of writing.

Looking at US equities, the mood remained positive in the Asian session as markets still digest a US-China trade truce, a UK agreement, and major Gulf deals which have boosted investor confidence.

The S&P 500 went up by 0.1% overnight, and the Nasdaq 100 rose 0.5%, driven by Nvidia’s gains, which erased its 2025 losses.

Following the European open however, both the S&P 500 and Nasdaq have turned red for the day, trading 0.57% and 0.85% lower respectively.

On the FX front, safe-haven currencies like the Japanese yen and Swiss franc strengthened, with the yen rising 0.6% to 145.88/USD after hitting a one-month low of 148.65 earlier this week. The Swiss franc also gained 0.6%, reaching 0.8376/USD.

The euro increased by 0.2% to 1.12. A Bloomberg report on Wednesday mentioned that the US is not pushing for a weaker dollar in tariff talks, which helped ease market worries.

The dollar index, which tracks the dollar against six other currencies, fell 0.2% to 100.81 but is still set to gain 0.4% for the week. However, the index is down nearly 7% for 2025.

Looking at market sentiment, it remains largely positive. The main focus will be U.S. retail sales data, and investors will also watch for updates on potential trade deals following the U.S.-China tariff truce.

There will also be a speech by Fed Chair Jerome Powell and earnings from Walmart which could rattle markets ahead of the US Open.

For all market-moving economic releases and events, see the MarketPulse Economic Calendar. (click to enlarge)

From a technical standpoint, the DAX index has been consolidating above a key support area having printed fresh all-time highs on Monday.

The support area between 23212 and 23471 continues to hold firm underpinning the index and providing bulls with optimism that another bullish leg may be in offing.

A move higher still needs a clear break and acceptance above the 24000 handle which could lead to a bigger move to the upside.

On the downside, a break of support at 23212 could open up a retest of the 20 and 50-day MAs which rest at 22704 and 22460 respectively.

DAX Daily Chart, May 15, 2025

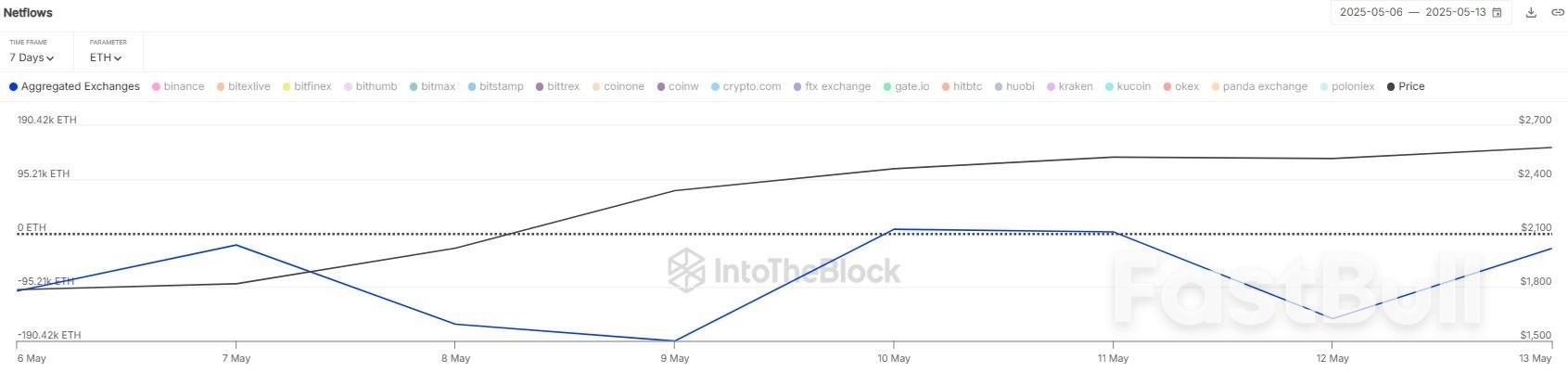

On-chain data shows the Ethereum Exchange Netflow has remained negative during the past week, a sign that could be bullish for ETH.

In a new post on X, the institutional DeFi solutions provider Sentora (formerly IntoTheBlock) has talked about the latest trend in the Exchange Netflow of Ethereum. The “Exchange Netflow” here refers to an on-chain metric that keeps track of the net amount of the cryptocurrency moving into or out of the wallets associated with centralized platforms.

When the value of this metric is positive, it means the investors are depositing a net number of tokens to these platforms. As one of the main reasons why holders transfer to exchanges is for selling-related purposes, this kind of trend can have a bearish impact on the ETH price.

On the other hand, the indicator being under zero suggests the outflows are outweighing the inflows. Generally, investors take their coins away from the custody of exchanges for holding into the long term, so this kind of trend can prove to be bullish for the asset.

Now, here is the chart shared by the analytics firm that shows the trend in the Ethereum Exchange Netflow over the past week:

As displayed in the above graph, the Ethereum Exchange Netflow has mostly been negative inside this window, which implies the holders have been pulling supply out of the centralized exchanges.

In total, the investors have made withdrawals worth $1.2 billion with this outflow spree. “This sustained trend of net outflows, intensifying since early May, signals continued accumulation and reduced sell-side pressure,” notes Sentora.

While ETH has seen this bullish development recently, the cryptocurrency may not be offering that good an entry opportunity right now, as the analytics firm Santiment has explained in an Insight post.

The indicator shared by the analytics firm is the “Market Value to Realized Value (MVRV) Ratio,” which basically provides a measure of the profit-loss situation of the Bitcoin investors.

In the chart, Santiment has included two versions of the indicator: 30-day and 365-day. The former tells us about the profitability of the investors who purchased within the past 30 days and the latter that of the past year buyers.

As is visible in the graph, the 30-day MVRV Ratio for Ethereum has a notable positive value right now, implying the recent buyers are in significant profit. More specifically, the metric is sitting at 32.5%, which is well above the 15% danger zone for altcoins that the analytics firm recommends as a rule-of-thumb.

“It may not mean that prices are about to drop, but it does suggest that the rally will likely slow or halt until the 30-day MVRV dips back down to something more reasonable,” explains Santiment.

At the time of writing, Ethereum is trading around $2,600, up over 43% in the last week.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up