Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)A:--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

San Francisco Federal Reserve President Mary Daly reiterated on Thursday it is "reasonable" to expect two interest rate cuts before the end of this year, particularly with the impact of President Donald Trump's tariffs looking more muted than originally expected.

San Francisco Federal Reserve President Mary Daly reiterated on Thursday it is "reasonable" to expect two interest rate cuts before the end of this year, particularly with the impact of President Donald Trump's tariffs looking more muted than originally expected.

Inflation is still above the U.S. central bank's 2% target and there's still "some work to do" to bring it down, Daly said at the Rocky Mountain Economic Summit in Victor, Idaho. But the Fed also doesn't want to keep rates restrictive for too long because that would unnecessarily hurt the labor market, she said.

"I don't think we need to slow precipitously to produce the last mile on inflation," Daly said. "I wouldn't want to see more weakness in the labor market ... I really wouldn't want to see that, which is why you can't wait forever" on cutting rates.

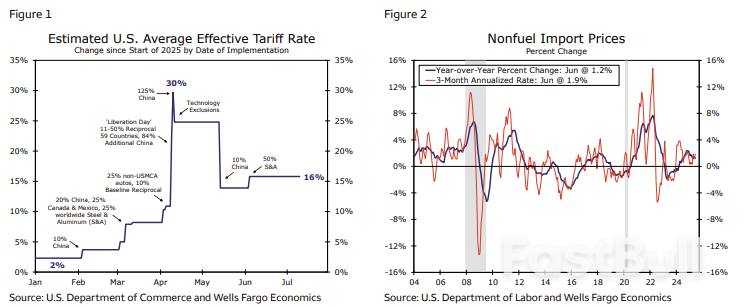

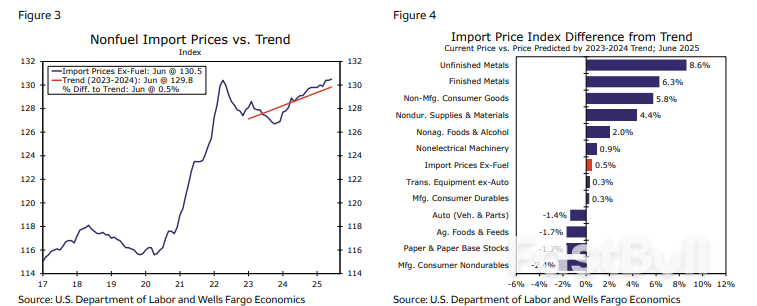

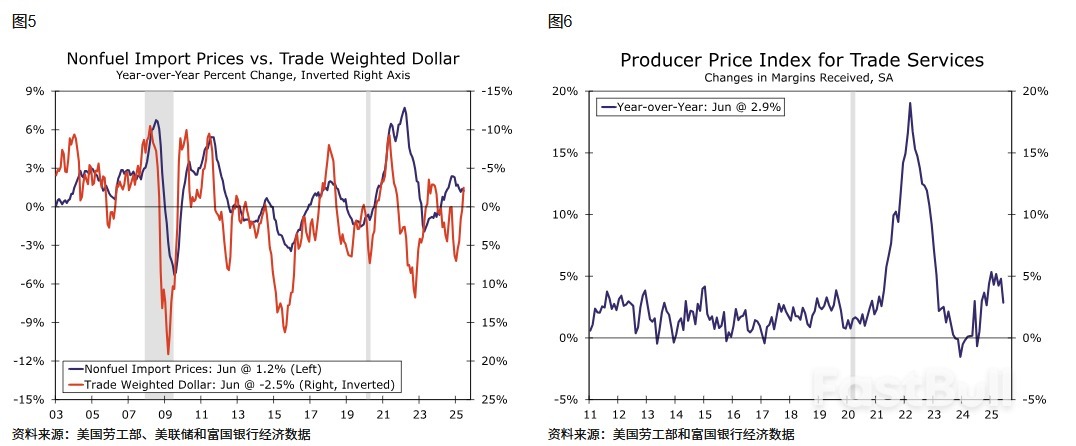

Companies are figuring out ways to avoid tariffs and are not passing on all of their increased costs to their customers, and despite a doubling of the effective average tariff rate under Trump the increased levies on imports are not so far spilling more broadly into overall inflation.

"We haven't seen any evidence that that's occurring," Daly said, though recent consumer price data does show the price of goods is rising. Offsetting that, however, is encouragingly lower inflation in non-housing-related services inflation, she said.

Asked if she would support reducing the current policy rate range of 4.25%-4.50% when the Fed meets in two weeks, Daly noted that she expects rate cuts to resume as inflation falls, with the policy rate at an ultimate settling point of 3% or somewhere higher than that level.

"Whether it happens in July or September or some other month is really not the most relevant piece," she said. More relevant, Daly added, is that rates will be reduced.

"We don't want to unnecessarily tighten the economy in a way that hurts the labor market or growth. So that's the direction of travel," she said.

Two of the Fed's 19 policymakers have said they believe a July rate cut could be appropriate; others have signaled they expect it to take longer to be able to judge the effect of the tariffs and other Trump policies on inflation and the labor market, and therefore to know if a rate cut would be appropriate.

Financial markets reflect very little expectation for a rate cut at the Fed's July 29-30 meeting, with bets focused on the September 16-17 meeting as a much more likely time for the policy easing to resume.

The U.S. Federal Reserve should not cut interest rates "for some time" as the impact of Trump administration tariffs begin passing through to consumer prices, with tight monetary policy needed to keep inflationary psychology in check, Federal Reserve governor Adriana Kugler said on Thursday.

With unemployment stable and low, and inflation pressures building, "I find it appropriate to hold our policy rate at the current level for some time," Kugler said in remarks prepared for delivery at a housing forum in Washington D.C. "This still-restrictive policy stance is important to keep longer-run inflation expectations anchored."

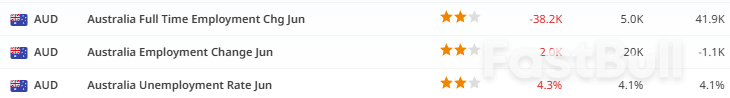

Ongoing hiring and a 4.1% unemployment rate show the job market "stable and close to full employment," Kugler said. "Inflation, meanwhile, remains above the FOMC’s 2% goal and is facing upward pressure from implemented tariffs."

That pressure was apparent in this week's Consumer Price Index report that showed large price increases across an array of heavily imported goods, and Kugler said she felt there were many reasons to think price pressures would continue to build -- including the fact that the administration still seems to intend to impose higher levies on major trading partners in coming weeks.

"I see upward pressure on inflation from trade policies, and I expect additional price increases later in the year," she said. She estimated that coming data will show the Personal Consumption Expenditures price index, which the Fed uses to set its 2% inflation target, increased 2.5% in June, while the "core" measure outside of volatile food and energy items increased 2.8%, higher than in May.

"Both headline and core inflation have shown no progress in the last six months," Kugler said.

The Fed meets on July 29-30 and policymakers are expected to hold the benchmark interest rate steady in the current range of 4.25% to 4.5%. It will be the fifth consecutive meeting without a change since the Fed paused a series of rate cuts in December.

Since then, and to President Donald Trump's consternation, focus has turned to the impact Trump administration trade and other policies will have on inflation, jobs and economic growth. Fed policymakers say they are reluctant to resume rate reductions until they are more certain that tariffs will lead to only a one-time price adjustment, as administration officials contend, and not more persistent inflation.

Appointed to the Fed by former President Joe Biden, Kugler's term at the central bank ends in January, creating a vacancy that the Trump administration may use to appoint a replacement for Fed chair Jerome Powell when his term as Fed chief ends in May.

U.S. retail sales rebounded more than expected in June, suggesting a modest improvement in economic activity and giving the Federal Reserve cover to delay cutting interest rates while it gauges the inflation fallout from import tariffs.

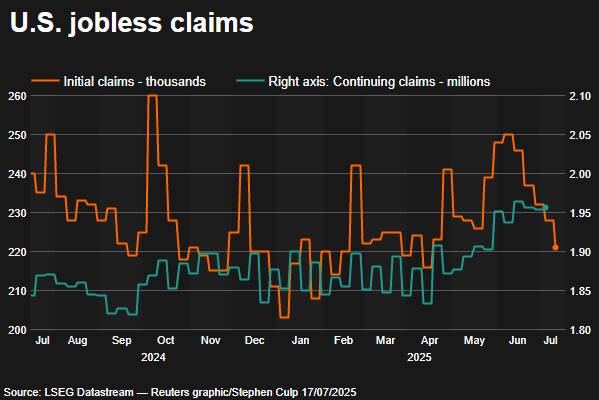

That report was reinforced by data from the Labor Department on Thursday that showed first-time applications for unemployment benefits dropped to a three-month low last week, consistent with steady job growth in July. The U.S. central bank is under pressure from President Donald Trump to lower borrowing costs.

The Fed is, however, expected to keep its benchmark overnight interest rate in the 4.25%-4.50% range, where it has been since December, at its policy meeting later this month.

"Today's data is generally on the firmer side in terms of activity and jobs," said James Knightley, chief international economist at ING. "It supports the view that there is little pressing need for another interest rate cut from the Fed."

Retail sales increased 0.6% last month after an unrevised 0.9% drop in May, the Commerce Department's Census Bureau said.

Economists polled by Reuters had forecast retail sales, which are mostly goods and are not adjusted for inflation, would gain 0.1%. Sales advanced 3.9% on a year-over-year basis.

Part of the nearly broad rise in retail sales last month was likely due to tariff-driven price increases rather than volumes.

Inflation data this week showed solid increases in June in the cost of tariff-sensitive goods like household furnishings and supplies, appliances, sporting goods and toys. Some economists said worries of even higher prices had lifted sales last month.

Still, the retail sales rebound after two straight monthly declines was welcome. Sales had decreased as the boost from households rushing to buy motor vehicles to avoid higher prices from import duties waned.

Auto dealerships led the rise in sales, with receipts increasing 1.2% after decreasing 3.8% in May. Car manufacturers, however, reported a decline in unit sales in June, indicating the rise in receipts was due to higher prices.

Building material garden equipment store sales increased 0.9% last month, as did receipts at clothing retailers. Online retail sales climbed 0.4%, while those at sporting goods, hobby, musical instrument and book stores rose 0.2%.

Sales at food services and drinking places, the only services component in the report, increased 0.6%. Economists view dining out as a key indicator of household finances.

But receipts at electronics and appliance stores dipped 0.1%, as did those at furniture outlets, suggesting tariff-related price rises were suppressing demand.

Stocks on Wall Street were trading higher. The dollar gained versus a basket of currencies. U.S. Treasury yields were mixed.

Retail sales excluding automobiles, gasoline, building materials and food services increased 0.5% last month after a downwardly revised 0.2% in May. These so-called core retail sales, which correspond most closely with the consumer spending component of gross domestic product, were previously reported to have increased 0.4% in May.

But higher prices in June implied that inflation-adjusted core retail sales rose marginally last month. Together with the downward revision to the May data, it suggests consumer spending increased moderately in the second quarter after nearly stalling in the first quarter.

Economists' consumer spending growth estimates converged below a 1.5% annualized rate in the second quarter. Services, which account for a larger share of consumer spending, have been lackluster as households scaled back on travel.

The Atlanta Fed is forecasting GDP rebounded at a 2.4% annualized rate in the second quarter after contracting at a 0.5% pace in the January-March period. Most of the anticipated pick-up in GDP will come from an ebb in imports.

"Although June's numbers likely exaggerate the underlying pace of spending, households appear to be on firmer footing than we had thought," said Jonathan Millar, senior U.S. economist at Barclays.

Consumer spending is being supported by a stable labor market. A separate report from the Labor Department showed initial claims for state unemployment benefits dropped 7,000 to a seasonally adjusted 221,000 for the week ended July 12, the lowest level since April.

Economists had forecast 235,000 claims for the latest week.

Motor vehicle assembly plant closures due to maintenance, annual retooling for new models and other reasons likely accounted for some of the drop in claims. Auto manufacturers typically idle assembly lines in summer, though the timing often varies, which could throw off the model that the government uses to strip out seasonal fluctuations from the data.

Nonetheless, layoffs remain historically low. The claims data covered the period during which the government surveyed employers for the nonfarm payrolls component of the employment report for July. Claims fell between the June and July survey periods. Nonfarm payrolls increased by 147,000 jobs in June.

"The series continues to signal steady labor market growth," said Abiel Reinhart, an economist at J.P. Morgan. "Claims remain within the typical range observed over the last couple years."

Risks are, however, rising for both the labor market and consumer spending. Trade policy uncertainty has left companies hesitant to increase hiring, causing many laid-off workers to experience long bouts of unemployment. The number of people receiving benefits after an initial week of aid, a proxy for hiring, increased 2,000 to a seasonally adjusted 1.956 million during the week ending July 5, the claims report showed.

Wage growth has also slowed. While the stock market has rebounded, house prices have declined in many regions, a reduction in household wealth that could hinder spending.

Higher prices from tariffs could also undercut consumption.

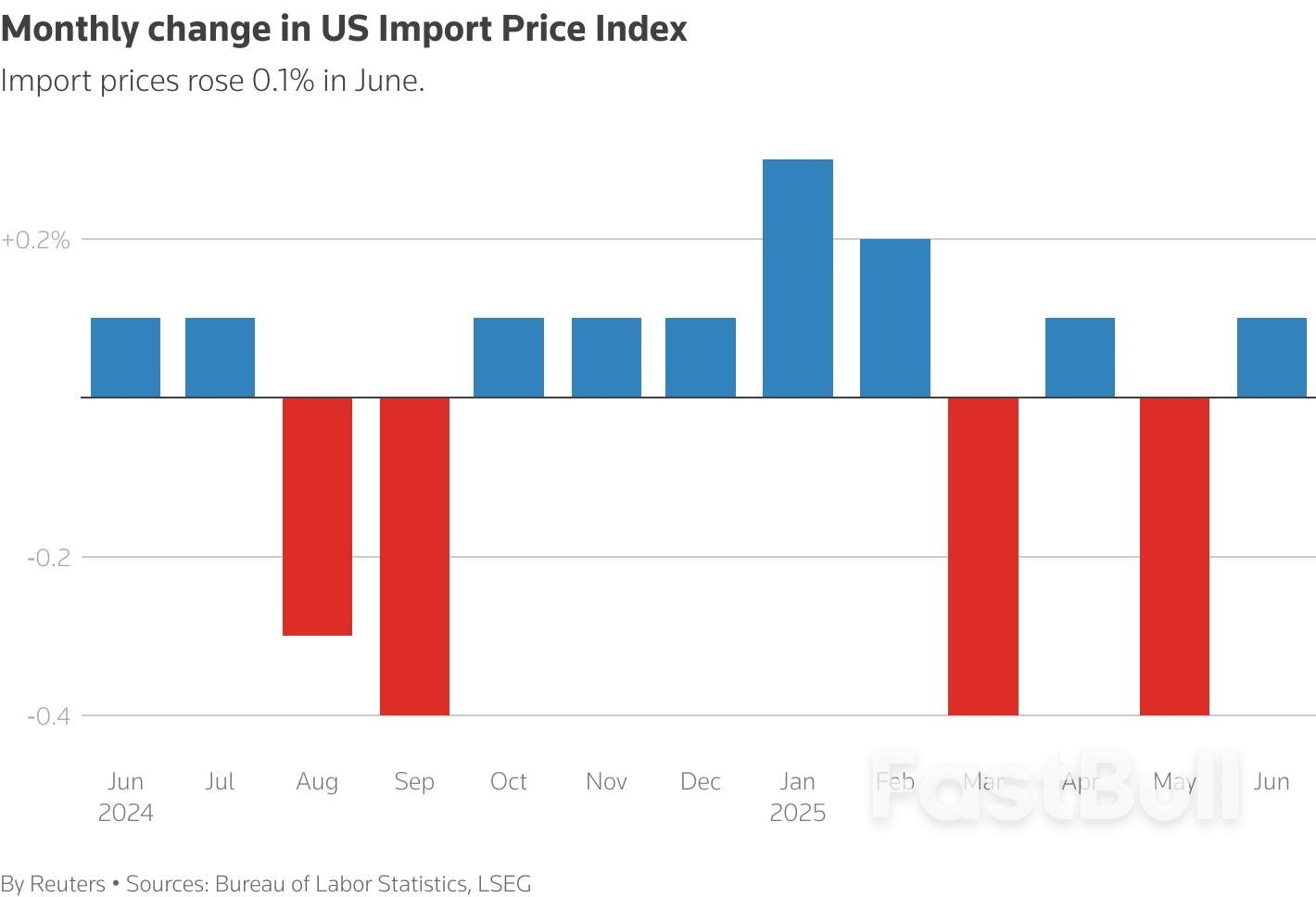

There are few signs of exporters absorbing tariffs. A separate report from the Labor Department's Bureau of Labor Statistics showed import prices rose 0.1% in June.

But there were strong increases in the prices of imports from China, Japan and the European Union. Prices for imports from Canada and Mexico dipped 0.1%.

"If foreign exporters were absorbing the cost of tariffs, import prices would be declining in proportion to the rise in the tariff rate," said Sarah House, a senior economist at Wells Fargo. "The recent rise in import prices points to foreign suppliers generally resisting price cuts."

Key Points:

The passage of the CLARITY Act is an important step for the U.S. digital asset market, with potential to simplify and solidify its regulatory framework.

Rep. Dusty Johnson, a key architect of the CLARITY Act, led the effort for regulatory clarity, aiming to bolster the U.S. as a leader in digital assets. The Act provides specific jurisdictional boundaries between the SEC and the CFTC for major cryptocurrencies. Co-sponsors include leaders from both parties, underscoring the broad political support for the Act. It also impacts stablecoins with national reserve requirements, supporting the U.S. dollar's dominance.

The immediate effects of the Act include increased confidence among institutional investors and developers, as regulatory risks are mitigated. It is expected to encourage new investments in U.S. crypto markets as jurisdictions become clearly defined. Regulatory implications affect consumer protection and market structures, aiming to strengthen the industry and promote innovation within the United States. Key cryptocurrencies such as BTC, ETH, and stablecoins will see clear regulatory paths, influencing compliance interest among blockchain projects.

The House Financial Services Committee document on digital assets highlights insights suggesting potential outcomes from clarified regulations include enhanced market growth and cross-border collaboration due to lowered compliance barriers. Historical trends in crypto regulation highlight the challenge of aligning legal frameworks with market dynamics, a balance this Act strives to achieve by accommodating both traditional and digital financial markets.

Federal Reserve Governor Christopher Waller said on Thursday that he continued to call for the central bank to cut interest rates by end-July, citing growing risks to the economy and limited inflationary risks from trade tariffs.

Waller made the comments in remarks prepared for a gathering of Money Marketeers of New York University, stating that the Fed needed to bring its policy into neutral territory, instead of keeping it restrictive.

Waller also warned that he saw signs of strain in the labor market, furthering the case for lower interest rates.

“It makes sense to cut the FOMC’s policy rate by 25 basis points two weeks from now,” Waller said.

“I see the hard and soft data on economic activity and the labor market as consistent: The economy is still growing, but its momentum has slowed significantly, and the risks to the FOMC’s employment mandate have increased.”

Waller said that the inflationary effects of President Donald Trump’s trade tariffs were likely to be a one-time event that policymakers could look through.

“Tariff increases are a one-time boost to prices that do not sustainably increase inflation… central bankers should—and, in fact, do—look through price-level shocks to avoid needlessly tightening policy in times like these and damaging the economy.”Waller’s comments come just before Fed officials enter a two-week media blackout period before the central bank’s upcoming meeting. The Fed governor is an outlier among members of the central bank, most of which have expressed caution over cutting interest rates.

Fed Chair Jerome Powell said that rates will not fall until the inflation effect of Trump’s tariffs becomes clear.

But Trump has repeatedly called on Powell to cut rates, even engaging in personal attacks against the Fed chair.

Speculation over Trump prematurely firing Powell grew drastically this week, although Trump denied that he intended to do so.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up