Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

South Korea Services Output MoM (Nov)

South Korea Services Output MoM (Nov)A:--

F: --

P: --

Russia IHS Markit Services PMI (Dec)

Russia IHS Markit Services PMI (Dec)A:--

F: --

P: --

Turkey Economic Sentiment Indicator (Dec)

Turkey Economic Sentiment Indicator (Dec)A:--

F: --

P: --

Brazil Unemployment Rate (Nov)

Brazil Unemployment Rate (Nov)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index YoY (Oct)

U.S. S&P/CS 10-City Home Price Index YoY (Oct)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Oct)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Oct)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Oct)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Oct)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Oct)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Oct)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Oct)

U.S. FHFA House Price Index YoY (Oct)A:--

F: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Oct)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Oct)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Oct)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Oct)A:--

F: --

U.S. FHFA House Price Index (Oct)

U.S. FHFA House Price Index (Oct)A:--

F: --

P: --

U.S. FHFA House Price Index MoM (Oct)

U.S. FHFA House Price Index MoM (Oct)A:--

F: --

U.S. Chicago PMI (Dec)

U.S. Chicago PMI (Dec)A:--

F: --

P: --

Brazil CAGED Net Payroll Jobs (Nov)

Brazil CAGED Net Payroll Jobs (Nov)A:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

FOMC Meeting Minutes

FOMC Meeting Minutes U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

South Korea CPI YoY (Dec)

South Korea CPI YoY (Dec)A:--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Dec)

China, Mainland NBS Manufacturing PMI (Dec)A:--

F: --

P: --

China, Mainland Composite PMI (Dec)

China, Mainland Composite PMI (Dec)A:--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Dec)

China, Mainland NBS Non-manufacturing PMI (Dec)A:--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Dec)

China, Mainland Caixin Manufacturing PMI (SA) (Dec)A:--

F: --

P: --

Turkey Trade Balance (Nov)

Turkey Trade Balance (Nov)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

South Africa Trade Balance (Nov)

South Africa Trade Balance (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks Change--

F: --

P: --

South Korea Trade Balance Prelim (Dec)

South Korea Trade Balance Prelim (Dec)--

F: --

P: --

Indonesia Core Inflation YoY (Dec)

Indonesia Core Inflation YoY (Dec)--

F: --

P: --

Indonesia Inflation Rate YoY (Dec)

Indonesia Inflation Rate YoY (Dec)--

F: --

P: --

Turkey Manufacturing PMI (Dec)

Turkey Manufacturing PMI (Dec)--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Dec)

Brazil IHS Markit Manufacturing PMI (Dec)--

F: --

P: --

Mexico Manufacturing PMI (Dec)

Mexico Manufacturing PMI (Dec)--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Dec)

South Korea IHS Markit Manufacturing PMI (SA) (Dec)--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Dec)

Indonesia IHS Markit Manufacturing PMI (Dec)--

F: --

P: --

India HSBC Manufacturing PMI Final (Dec)

India HSBC Manufacturing PMI Final (Dec)--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Dec)

Russia IHS Markit Manufacturing PMI (Dec)--

F: --

P: --

U.K. Nationwide House Price Index MoM (Dec)

U.K. Nationwide House Price Index MoM (Dec)--

F: --

P: --

U.K. Nationwide House Price Index YoY (Dec)

U.K. Nationwide House Price Index YoY (Dec)--

F: --

P: --

Turkey Manufacturing PMI (Dec)

Turkey Manufacturing PMI (Dec)--

F: --

P: --

Italy Manufacturing PMI (SA) (Dec)

Italy Manufacturing PMI (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Final (Dec)

Euro Zone Manufacturing PMI Final (Dec)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Nov)

Euro Zone M3 Money Supply (SA) (Nov)--

F: --

P: --

Euro Zone 3-Month M3 Money Supply YoY (Nov)

Euro Zone 3-Month M3 Money Supply YoY (Nov)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Nov)

Euro Zone Private Sector Credit YoY (Nov)--

F: --

P: --

Euro Zone M3 Money Supply YoY (Nov)

Euro Zone M3 Money Supply YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The U.S. Federal Reserve’s December meeting minutes show a sharply divided committee, with several officials viewing the latest rate cut as a "finely balanced" decision....

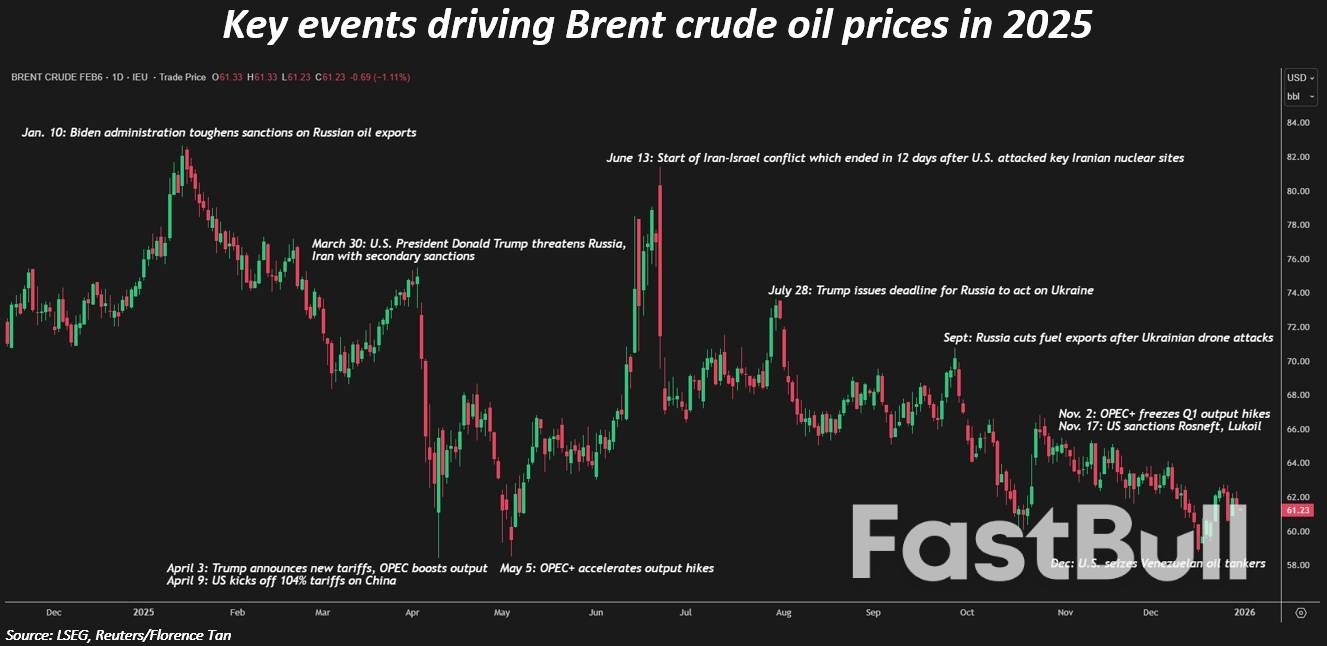

Oil prices were little changed on Wednesday but are set to fall more than 10% for 2025, as supply outpaced demand in a year marked by wars, higher tariffs and OPEC+ output and sanctions on Russia, Iran and Venezuela.

Brent crude futures , down nearly 18% - the most substantial annual percentage decline since 2020 - are on track for a third straight year of losses, their longest-ever losing streak. The March contract, which expires on Wednesday, rose 22 cents to $61.55 a barrel at 0437 GMT.

BNP Paribas commodities analyst Jason Ying expects Brent to dip to $55 a barrel in the first quarter before recovering to $60 a barrel for the rest of 2026 as supply growth is expected to normalise while demand stays flat.

"The reason why we're more bearish than the market in the near term is that we think that U.S. shale producers were able to hedge at high levels," he said.

"So the supply from shale producers will be more consistent and insensitive to price movements."

U.S. West Texas Intermediate crude was at $58.16, up 21 cents, and was headed for a 15% annual decline. The 2025 average prices for both benchmarks are the lowest since 2020, LSEG data showed.

Oil markets had a strong start to 2025 when former President Joe Biden ended his term by imposing tougher sanctions on Russia, disrupting supplies to top buyers China and India.

The war in Ukraine intensified when Ukrainian drones damaged Russian energy infrastructure and disrupted Kazakhstan's oil exports and the 12-day Iran-Israel conflict in June threatened shipping in the Strait of Hormuz, a key oil chokepoint, which fanned oil prices.

Adding to geopolitical tensions, top OPEC producers Saudi Arabia and the United Arab Emirates are engaged in a conflict over Yemen and U.S. President Donald Trump has ordered a blockade on Venezuelan oil exports and threatened another strike on Iran.

But prices cooled after OPEC+ accelerated its output increases this year and as concerns about the impact of U.S. tariffs weighed on global economic and fuel demand growth.

Key events driving Brent crude oil prices in 2025

Key events driving Brent crude oil prices in 2025The Organization of the Petroleum Exporting Countries and its allies have paused oil output hikes for the first quarter of 2026 after releasing some 2.9 million barrels per day into the market since April. The next OPEC+ meeting is on January 4.

Most analysts expect supply to exceed demand next year, with estimates ranging from the International Energy Agency's 3.84 million barrels per day to Goldman Sachs' 2 million bpd.

"If the price really has a substantial fall, I would imagine you will see some cuts (from OPEC+)," said Martijn Rats, Morgan Stanley's global oil strategist. "But it probably does need to fall quite a bit further from here on - maybe in the low $50s."

"If today's price simply prevails, after the pause in Q1, they'll probably continue to unwind these cuts."

John Driscoll, managing director of consultancy JTD Energy, expects geopolitical risks to support oil prices despite fundamentals pointing to an oversupply.

"Everybody's saying it'll get weaker into 2026 and even beyond," he said. "But I wouldn't ignore the geopolitics and the Trump factor is going to be playing out because he wants to be involved in everything."

"We are living in a powder keg and I think that is kind of your ultimate floor," he added.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up