Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)A:--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The Euro rebounded above 1.1600 on Friday after four straight sessions of losses, supported by easing political tension in France following President Macron’s reappointment of Sébastien Lecornu as Prime Minister and a weaker U.S. dollar. The greenback declined amid renewed U.S.-China trade tensions and softer consumer sentiment data, reinforcing expectations of Fed rate cuts.

On the technical front, EUR/USD has staged a modest rebound but remains below the 72-day Exponential Moving Average (EMA), currently positioned at 1.1675 on the H4 chart, underscoring that the pair is still trading within a short-term bearish structure.

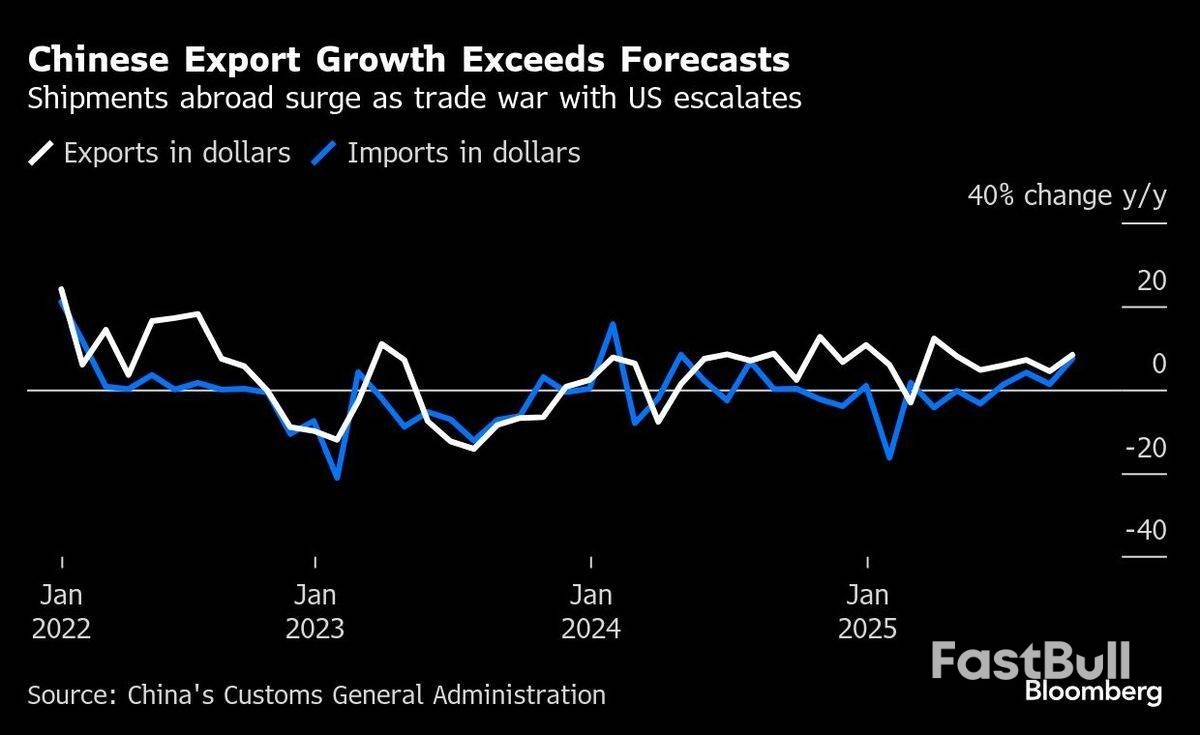

On the technical front, EUR/USD has staged a modest rebound but remains below the 72-day Exponential Moving Average (EMA), currently positioned at 1.1675 on the H4 chart, underscoring that the pair is still trading within a short-term bearish structure.Chinese shipments overseas grew at the fastest rate in six months, far exceeding forecasts in a sign of resilience that’s giving Beijing a stronger hand in the latest trade war with the US.

Exports rose 8.3% in September from a year earlier, according to data from the General Administration of Customs on Monday (Oct 13). That was faster than the 6.6% median estimate in a Bloomberg survey of economists and shows there’s no slowdown yet in the record-breaking flood of goods leaving China’s shores.

Shipments to the US plunged 27%, the sixth month of double-digit declines.

“China’s exports have remained resilient despite US tariffs, thanks to a diversified export market and strong competitiveness,” said Michelle Lam, Greater China economist at Societe Generale SA. “The limited impact from US tariffs on overall trade so far has likely emboldened China to take a tougher stance in US-China trade negotiations.”

Companies have responded to higher US tariffs by trying to seek out alternative markets or routing goods indirectly to the world’s biggest economy.

Exports to the European Union rose by more than 14%, the most in over three years, and those to Africa surged 56%. Shipments to the 10-nation Southeast Asian trading bloc grew almost 16%.

The strength of demand from markets other than the US means that Chinese firms should be less affected by the further increase in tariffs threatened by US President Donald Trump. Higher sales overseas are also providing a boost to a domestic economy in deflation and still struggling to reverse a decline in housing demand and prices.

China is set to announce third-quarter data for economic activity on Oct 20, with most analysts predicting a slowdown from the first half of the year. Still, a strong showing in the first two quarters all but ensures China will reach the official growth target of around 5%.

Imports grew 7.4% in September, far more than forecast, leaving a surplus of US$90.5 billion (RM382.27 billion).

“The current external environment remains grim and complex,” Wang Jun, deputy head of the customs authority, told reporters in Beijing. “Foreign trade faces rising uncertainty and difficulties. Taking into consideration a high base from last year, we need hard work to stabilise trade development in the fourth quarter.”

China unveiled wide-ranging global export controls on products containing even traces of certain rare earths last week, prompting Trump to fire back by threatening to cancel a planned in-person meeting with China President Xi Jinping — their first in six years. The US leader also announced plans to put an additional 100% tariff on Chinese goods, along with sweeping curbs on “any and all critical software”.

The Trump administration later signalled openness to a deal with China to quell fresh trade tensions while also warning that recent export controls announced by Beijing were a major barrier to talks.

Bloomberg Economics estimates that a 100% US tariff hike would lift effective rates on Chinese goods to around 140% — a level that shuts down trade. While the current rate is 25 percentage points above the world average, China’s dominance of manufacturing has kept its exports flowing.

“A durable escalation could prolong China’s deflation, potentially triggering more policy rebalancing efforts,” Morgan Stanley economists led by Robin Xing said in a report before the data release. “In the case of China’s strict rare earth curbs and the US’ durable 100% tariff hike, China’s export growth could decelerate quickly via the direct tariff shock and global supply chain disruption.”

Bank of England Governor Andrew Bailey arrives in Washington this week under even more than the usual scrutiny. He’s now clearly the key vote on a sharply divided Monetary Policy Committee.

The governor has the opportunity to signal his allegiances in two appearances alongside the International Monetary Fund and World Bank meetings at a time when a number of prominent economists have started warning that markets are underpricing the chance of further interest-rate cuts this year.

Bailey is now seen as the crucial swing voter on the nine-strong MPC which is split between four hawkish officials who oppose more reductions and four more dovish rate-setters keen to keep easing hopes alive.

The split reflects different views on whether a spike in inflation to almost double the BOE’s 2% target will cause price pressures to linger and make any attempt to lower borrowing costs too risky. Two of Bailey’s deputies, Sarah Breeden and Dave Ramsden, have in recent weeks played down the threat and said that underlying inflation remains on track.

Expectations surrounding Chancellor of the Exchequer Rachel Reeves’ autumn budget, which she unveils three weeks after the meeting on Nov. 26, are also seen as crucial for guiding the panel.

Bailey has struck a very fine balance in recent comments, saying that the rates which govern millions of Britons’ borrowing costs need to be lower but has warned, “exactly when that will be, and how much it will be, will depend on the path of inflation going down.” He has also signaled that he is content with market pricing that sees little prospect of a cut before the end of the year.

Investors have all but ruled one out at the next meeting in November and see around a 20% chance of a cut in December. However, some economists, including at Barclays, Nomura and TD Securities, still believe that a move before the end of the year is in play.

Jack Meaning, chief UK economist at Barclays, told Bloomberg Bailey seems “genuinely torn between the two camps.” He highlighted tightening financial conditions and the potential for upcoming gross domestic product and labor-market data to disappoint.

If those conditions transpire and inflation remains consistent with the MPC’s expectations that inflation will peak in September and then gradually cool by the end of the year “then, on balance, we think it could sway Bailey to lean to the more dovish side,” he added.

James Rossiter, head of global macro strategy at TD Securities, is among those who view markets as significantly under-pricing the odds of a cut. “There are clearly some on the MPC who are comfortable with the quarterly pace,” he said, adding that “it’s somewhat up to data surprises to dictate the way things go.”

Bloomberg Economics BOESPEAK index, an automated model that tracks the interest-rate sentiment within MPC comments, has moved in a more hawkish direction in recent weeks after gauging a dovish stance from the panel over the summer. It still places Bailey’s recent remarks as tending toward the doves.

The timing of next month’s meeting complicates the BOE’s thinking, since it comes two weeks after September inflation data that is expected to show price growth hitting 4%, and with the budget looming.

That means the period between November and December’s meetings may be crucial. It’s a time when the MPC will receive two rounds of inflation and jobs data.

In addition, the BOE will be watching the budget closely after Reeves was blamed for driving inflation higher with her increase to payroll taxes in April. Another raft of the tax hikes that are widely expected could cut both ways, depending on whether they are seen as more likely to fuel price pressures or subdue the economy further.

The current market pricing “is not a lot for a central bank that has a history of surprising,” said George Buckley, chief UK economist at Nomura.

“A lot really depends how much the tightening announcements in the budget will be upfront versus how much will be delayed until future years,” he said. “If they front-load it, then that will appear in the BOE’s forecast into GDP and that will pull down ultimately on inflation.”

A Bloomberg survey just before the September meeting suggested that the consensus of forecasters still expected a reduction in borrowing costs in the fourth quarter. However, some economists have since deferred their prediction for the next cut to 2026, amid concerns over rising inflation expectations fueled by surging food bills.

\China’s foreign trade showed surprising strength in September, with both exports and imports beating forecasts despite headwinds from mounting global tensions and weakening domestic demand.

However, with a surge in imports, trade balance shrank to a surplus of $90.45 billion, less than expectations of $98.96 billion. The surplus also fell from the $102.33 billion seen in the prior month, customs data showed on Monday.

Exports in dollar terms jumped 8.3% year-on-year, well ahead of the 6.0% gain projected by analysts and sharply up from August’s 4.4% rise.

Imports rose 7.4%, also far exceeding the anticipated 1.5% and reversing the modest 1.3% growth logged in August.

The performance signaled resilience in China’s external sector even as other economic indicators point to softness at home.

Exporters are increasingly shifting focus away from the United States toward Southeast Asia, Africa, and India to offset U.S. tariff pressure. Still, weakness lingers in domestic demand as fixed-asset investment, retail sales, and manufacturing orders remain sluggish.

Policymakers may view the stronger trade print as justification to delay aggressive stimulus measures, but further upside hinges on whether global demand holds up and whether trade tensions intensify.

U.S. President Donald Trump ramped up trade tensions last week, threatening to impose an additional 100% tariffs on Chinese exports, with Beijing vowing to retaliate if measures come into effect.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up