Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The EUR/USD currency pair continues to move within the development of a bearish correction…

The EUR/USD currency pair continues to move within the development of a bearish correction and a bullish channel. The moving averages indicate the presence of a short-term upward trend for the pair. Prices have broken through the area between the signal lines upwards, which indicates pressure from buyers of the European currency and a potential continuation of the growth of the currency pair quotes from the current levels. At the time of publication of the forecast, the Euro to Dollar exchange rate for today is 1.1383. As part of the Forex forecast for April 25, 2025, we should expect an attempt to develop a bearish price correction and a test of the support level, which is located on the EUR/USD pair near the 1.1345 area. Next, an upward price rebound and continued growth of the Euro Dollar currency pair. The potential target of such a movement on FOREX is the area above the 1.1745 level.

An additional signal in favor of the development of a bullish scenario on the EUR/USD currency pair tomorrow will be a rebound from the ascending trend line on the RSI indicator. The second signal in favor of this option will be a rebound from the lower border of the bullish channel. The cancellation of the growth option for the Euro Dollar currency pair tomorrow will be a fall and a breakout of the 1.1145 level. This will indicate a breakout of the support area and a continuation of the fall to the area at the level of 1.1065. Confirmation of the rise in the EUR/USD currency pair should be expected with a breakout of the resistance area at the level of 1.1565.

EUR/USD Forecast Euro Dollar for April 25, 2025 suggests an attempt to develop a bearish correction of the pair and a test of the support area near the level of 1.1345. Where should we consider the upward rebound in the price of the Euro Dollar currency pair and an attempt to continue the growth of the asset on the market to the area above the level of 1.1745. An additional signal in favor of the instrument’s rise on the Forex market will be a test of the support line on the relative strength indicator (RSI). The cancellation of the growth option for the EUR/USD pair will be a drop in quotes and a breakout of the 1.1145 level. This will indicate a breakout of the support area and a continuation of the fall of the currency pair on Forex to the area below the 1.1065 level.

The head of the International Monetary Fund urged countries to move “swiftly’’ to resolve trade disputes that threaten global economic growth.

IMF managing director Kristalina Georgieva said the unpredictability arising from President Donald Trump’s aggressive campaign of taxes on foreign imports is causing companies to delay investments and consumers to hold off on spending.

“Uncertainty is bad for business,’’ she told reporters Thursday in a briefing during the spring meetings of the IMF and its sister agency, the World Bank.

Georgieva’s comments came two days after the IMF downgraded the outlook for world economic growth this year. The 191-country lending organization, which seeks to promote global growth, financial stability and to reduce poverty, also sharply lowered its forecast for the United States. It said the chances that the world’s biggest economy would fall into recession have risen from 25%, to about 40%.

Georgieva warned that the economic fallout from trade conflict would fall most heavily on poor countries, which do not have the money to offset the damage.

Since returning the White House in January, Trump has aggressively imposed tariffs on American trading partners. Among other things, he’s slapped 145% import taxes on China and 10% on almost every country in the world, raising U.S. tariffs to levels not seen in more than a century. But he has repeatedly changed U.S. policy — suddenly suspending or altering the tariffs — and left companies bewildered about what he is trying to accomplish and what his end game might be.

Trump’s tariffs — a sharp reversal of decades of U.S. policy in favor of free trade — and the resulting uncertainty around them have caused a weekslong rout in financial markets. But stocks rallied Wednesday after the Trump administration signaled that it is open to reducing the massive tariffs on China. “There is an opportunity for a big deal here,” U.S. Treasury Secretary Scott Bessent said Wednesday.

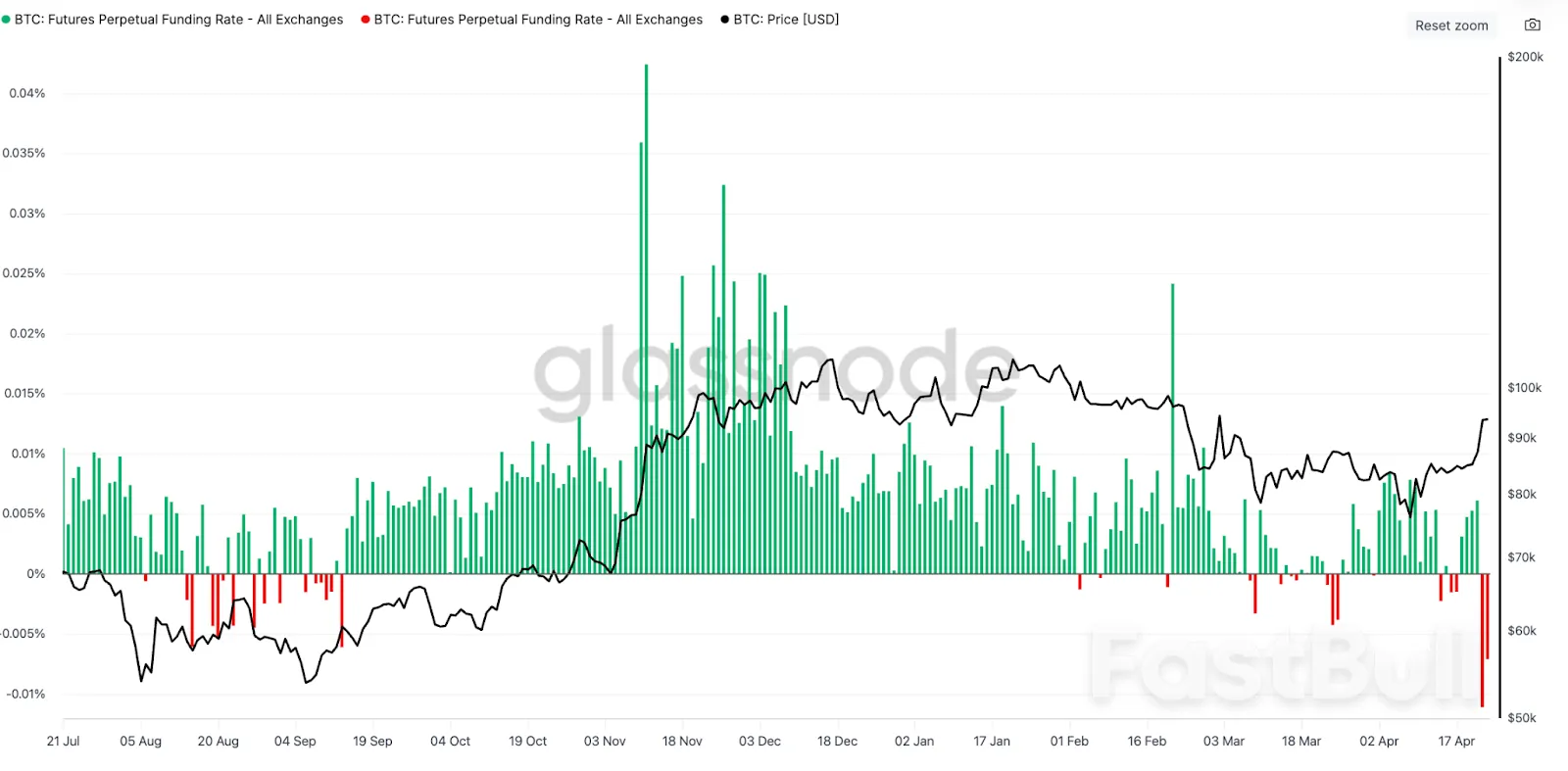

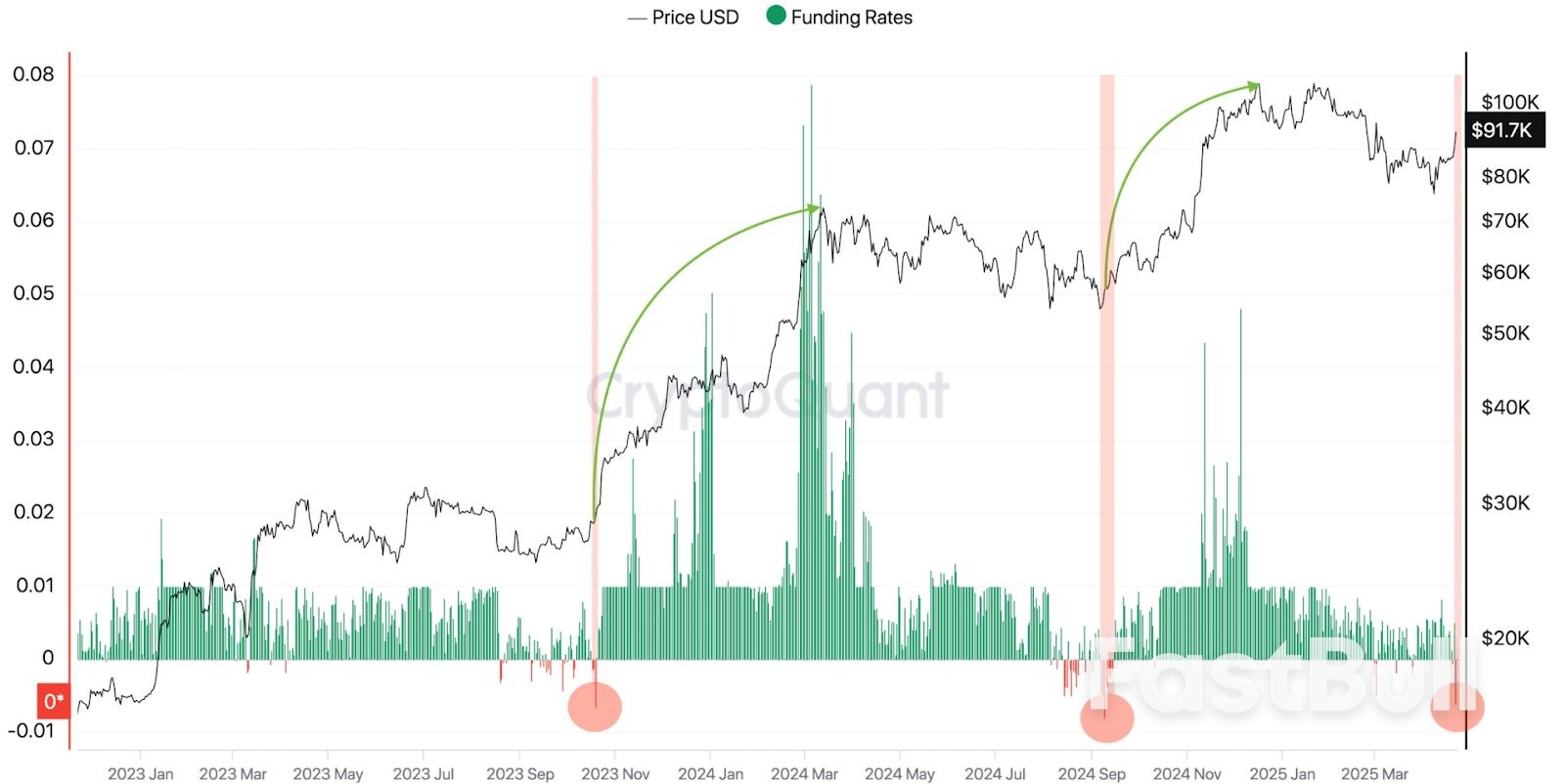

BTC/USD chart. Source: Swissblock

BTC/USD chart. Source: Swissblock Source: AlphBTC

Source: AlphBTC

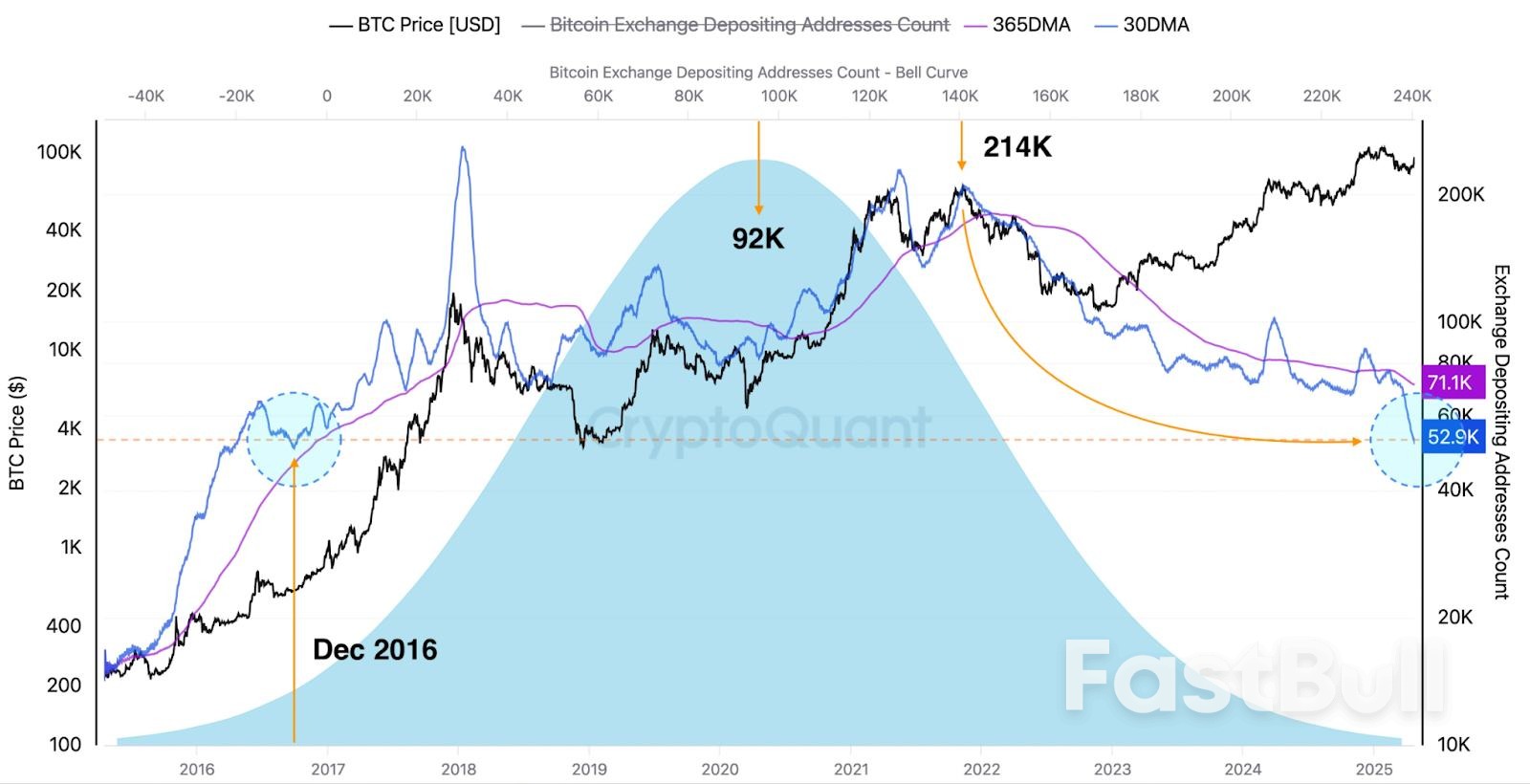

Bitcoin exchange depositing address count. Source: CryptoQuant

Bitcoin exchange depositing address count. Source: CryptoQuant

U.S. applications for jobless benefits rose modestly last week as business continue to retain workers despite fears of a possible economic downturn.

Jobless claim applications inched up by 6,000 to 222,000 for the week ending April 19, the Labor Department said Thursday. That’s just barely more than the 220,000 new applications analysts forecast.

Weekly applications for jobless benefits are considered a proxy for layoffs, and have mostly stayed in a healthy range between 200,000 and 250,000 for the past few years.

The four-week average of applications, which evens out some of the week-to-week volatility ticked down by 750 to 220,250.

The total number of Americans receiving unemployment benefits for the week of April 12 declined by 37,000 to 1.84 million.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up