Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

After the recent Federal Open Market Committee meeting, the US Federal Reserve, yesterday, announced its plan to keep its federal funds rate unchanged at 4.25%-4.5%. Every FOMC meeting influences Bitcoin prices, sometimes causing major swings. In the last 24 hours, the price of BTC has seen a rise of 3.1%.

After the recent Federal Open Market Committee meeting, the US Federal Reserve, yesterday, announced its plan to keep its federal funds rate unchanged at 4.25%-4.5%. Every FOMC meeting influences Bitcoin prices, sometimes causing major swings. In the last 24 hours, the price of BTC has seen a rise of 3.1%. This report looks at past rate hikes, how Bitcoin reacted and what traders can expect going forward. Ready? Dive in!

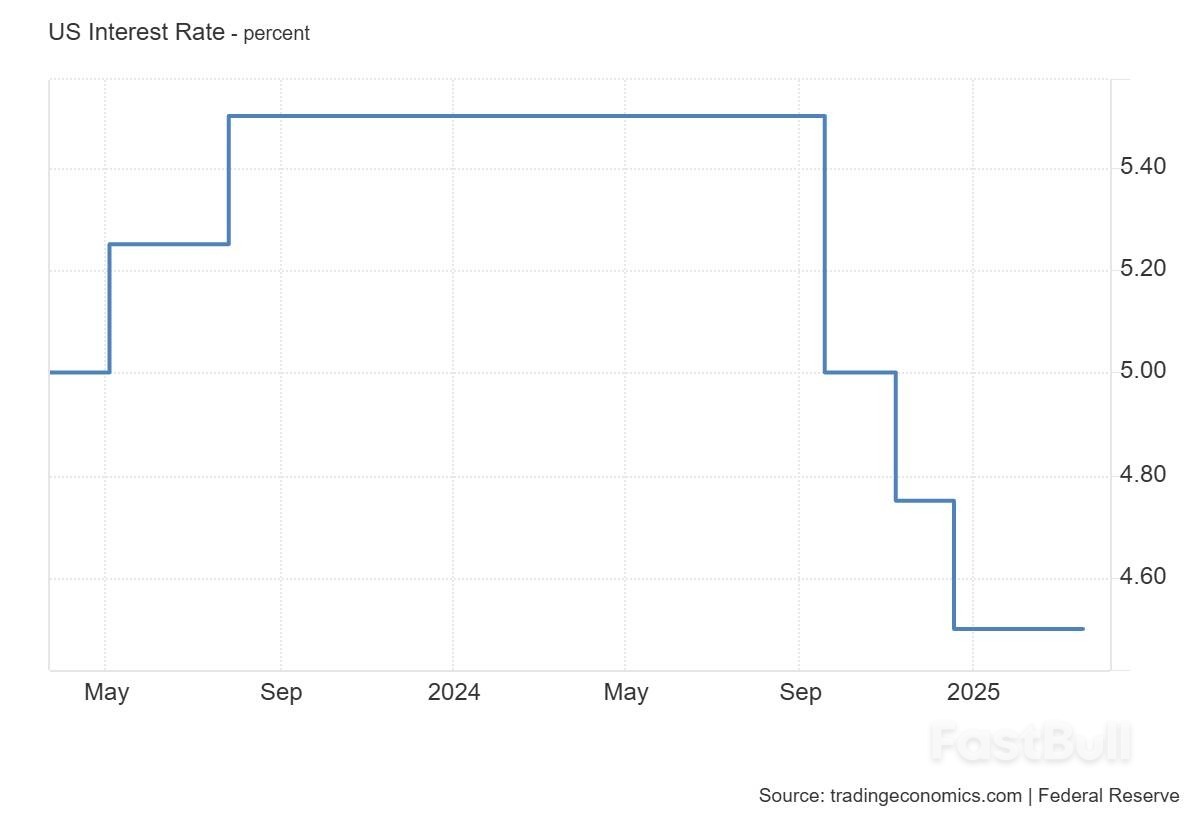

In April 2022, the Fed funds interest rate was as low as 0.5%. It was in May 2022 that the US Fed decided to revisit its interest rate policy. The primary reason was that the inflation rate had reached as high as 8.6% in May 2022. In June, the inflation rate touched a peak of 9.1% - the highest in a decade.

Between May 2022 and July 2023, the US Fed consistently pushed the interest rate upwards. By July 2023, it had reached as high as 5.5%. The level remained unchanged until August 2024.

In August 2024, the inflation rate fell to 2.5%. In fact, between June 2022 and June 2023, the rate declined consistently.

It was in September 2024 that the US Fed reversed its stance on the interest rate policy. In September, the interest rate was reduced from 5.5% to 5%. In November, it was lowered to 4.75%. In December, for the third time in 2024, it was brought down to 4.5%.

In the March 2024 FOMC meeting, the US Fed decided to keep the interest rate unchanged at 5.5%. Initially, the Bitcoin market reacted positively, pushing the price to a new ATH. In April 2024, the market moved sideways, trading within a range of $71K and $61K.

In the May 2024 FOMC meeting, the Fed showed no interest in making any changes. The BTC market showed small signs of recovery.

In the June 2024 FOMC meeting, even though the Fed acknowledged the moderation in inflation, they decided to keep the interest rate unchanged. At one point in June 2024, the BTC price dropped as low as $58,360.67.

In the July 2024 FOMC meeting also, the Fed refrained from making changes. The BTC market plummeted sharply after the meeting. At one point on August 5, it dropped to a low of $48,919.60.

In the September 2024 meeting, the Fed reversed its interest rate policy. It reduced the rate by 25 basis points to 5%. Within ten days of the meeting, the Bitcoin price climbed by 10%. This marked the beginning of a new bull run in the market.

In the November 2024 meeting, the Fed implemented another 25 basis point reduction. November 2024 was a fantastic month for BTC. A favourable macroeconomic and political environment, fueled by Donald Trump’s victory in the US presidential election, contributed to Bitcoin’s steep growth.

In the December 2024 meeting, the Fed reduced the interest rate to 4.5%. It was the third and final reduction implemented by the Fed in 2024. In December, the BTC price touched a new ATH of 108K.

In the January 2025 FOMC meeting, the Fed returned to its “wait and watch” policy. It kept the interest rate unchanged at 4.5%. By January 2025, the Bitcoin market lost the bullish momentum, which had helped the asset reach its ATH of $109K.

(Bloomberg) -- Swiss National Bank officials cut their interest rate to the lowest since September 2022 to deter inflows into the franc, and declared another reduction is less likely for now.

Officials led by President Martin Schlegel trimmed their benchmark by a quarter point to 0.25% on Thursday, in a step anticipated by traders and a large majority of economists. He signaled to reporters in Zurich that the central bank doesn’t anticipate more easing at the current juncture.

“This rate cut has an expansionary impact,” Schlegel said. “In that sense, the probability of additional policy easing is naturally lower.”

The SNB’s fifth step in the current cycle leaves its rate at the lowest of any managing the world’s 10 most-traded currencies. Analysts largely reckon that this was its final reduction of the cycle.

The Swiss franc erased gains after the decision, traded slightly lower at 0.9572 versus the euro. Swaps pricing indicates traders expect no more rate cuts by the SNB this year.

The central bank’s activism contrasts with the hesitancy to ease further by global peers such as the US Federal Reserve, which on Wednesday acknowledged a backdrop of high uncertainty. Similarly, Sweden’s Riksbank kept borrowing costs unchanged and said it has finished cutting.

The SNB move, following up on a surprise half-point reduction in December, shores up its foreign-exchange policy in anticipation of volatile times ahead. While the franc has weakened this year, the currency remains a potential haven for investors guarding against instability just as US President Donald Trump ratchets up global trade tensions and war continues to rage in Ukraine.

“We also remain willing to be active in the foreign exchange market as necessary,” Schlegel said, sticking with the SNB’s standard language, as observed how the backdrop has shifted. “Uncertainty about global economic and inflation developments has increased significantly.”

What Bloomberg Economics Says...

“This decision reflects the increased uncertainty around the inflation outlook amid threats of tariffs and a high level of geopolitical uncertainty, both of which could put upward pressure on the currency. The decision can be seen as insurance against those risks.”

—Jean Dalbard, economist.

ZURICH (March 20): The Swiss National Bank cut its policy interest rate by 25 basis points on Thursday, leaving borrowing costs just above zero, arguing that inflationary pressures were low despite uncertainty over the impact of US President Donald Trump's trade policies.

The SNB reduced its key rate to 0.25% from 0.5%, its fifth successive cut since it started lowering borrowing costs in March 2024, matching economists' expectations in a Reuters poll.

The Swiss franc weakened slightly against both the euro and the dollar after the decision.

It was last flat at 0.95705 against the euro, having traded around 0.9537 earlier and at 0.8803 to the dollar, leaving the US currency up 0.4% on the day.

"The SNB was not only the first big central bank to have started cutting rates in this cycle, with this step today, it likely is also the first one to have finished cutting rates," said Karsten Junius, chief economist at Bank J Safra Sarasin.

"The upward revisions of inflation profile indicate that no further rate cut is needed."

The decision comes on a busy day for central banks, with the Bank of England and Sweden's central bank also due to announce their policy decisions on Thursday.

The US Federal Reserve on Wednesday held interest rates steady, citing a period of "unusually elevated" uncertainty linked to the initial policies of the Trump administration.

The new 0.25% rate is the SNB's lowest since September 2022, and brings it close to sub-zero interest rates again, a move it has previously not ruled out.

"With today's rate adjustment, the SNB is ensuring that monetary conditions remain appropriate, given the low inflationary pressure and the heightened downside risks to inflation," the SNB said.

The cut aims at preventing a further decline in Swiss inflation, which eased to 0.3% in February, its lowest level in nearly four years, and keeping it within the 0-2% target range which the central bank defines as price stability.

The SNB said that its baseline scenario anticipated that global growth will be moderate over the coming quarters and that underlying inflationary pressure should continue to ease gradually over the next quarters, particularly in Europe.

It noted, however, that this scenario for the global economy is currently subject to high uncertainty.

"The situation could change rapidly and markedly, particularly from a trade and geopolitical perspective. For example, increasing trade barriers could lead to weaker global economic development," it said.

"At the same time, a more expansionary fiscal policy in Europe could provide stimulus to the economy in the medium term."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up