Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Australia’s ASX Ltd saw its stock slide over 4% on Monday following a formal investigation by the Australian Securities and Investments Commission (ASIC)...

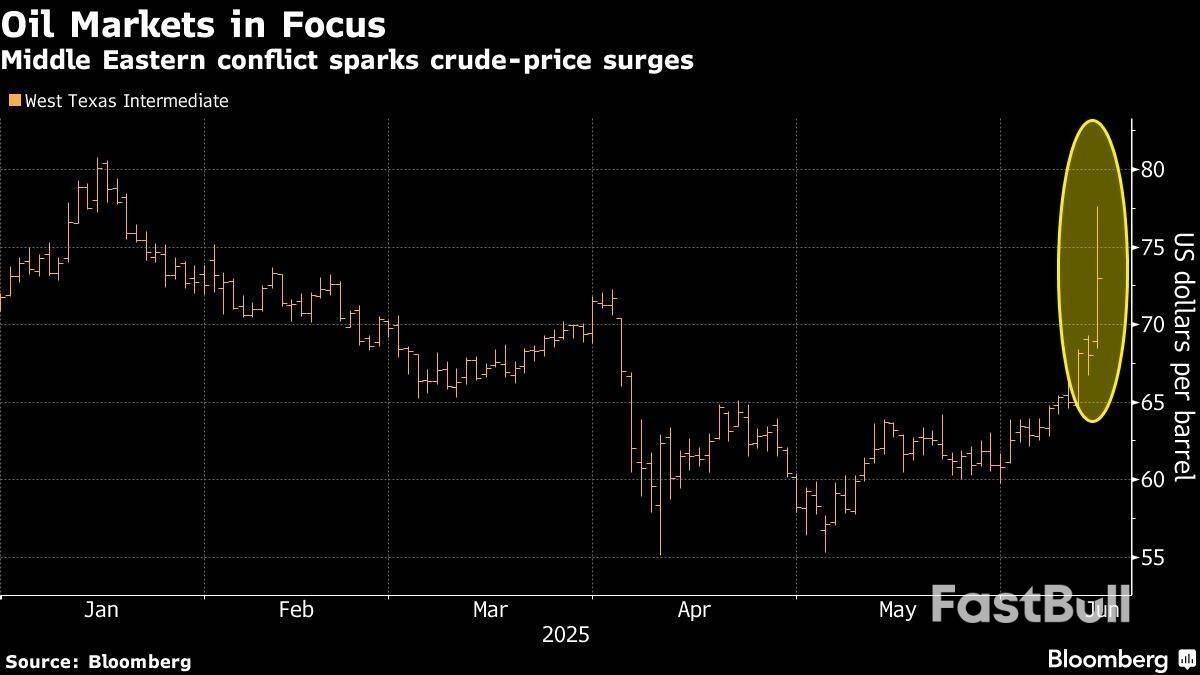

Stock markets in Asia moved higher at the start of trading on Monday, pulling back some of their losses from the end of last week. Oil prices surged as a conflict between Israel and Iran continued to escalate.

The Nikkei 225 index was up around 0.8% at the open, while US equity futures reversed earlier losses to edge higher. A broad gauge of Asian stocks was up around 0.2%.

Stocks had tumbled on Friday as investors reacted to reports that Israel had launched airstrikes against Iran, and the conflict between the two escalated over the weekend with a series of attacks from both sides.

A Bloomberg gauge of the dollar was slightly up in early trading Monday, while safe haven currency the Japanese yen lost ground. Brent crude rose as much as 5.5% in early trading.

Still, there is plenty of uncertainty for markets at the moment. Israel launched an attack on the giant South Pars gas field in the Persian Gulf, forcing the shut down of a production platform, after air strikes on Iran’s nuclear sites and military leadership last week.

“Markets should be prepared for a prolonged period of uncertainty,” said Wolf von Rotberg, an equity strategist at Bank J. Safra Sarasin. “Hedging against potential oil supply-chain disruptions via exposure to the energy market and adding to gold, which may see an acceleration of its structural uptrend, are the best ways to protect a portfolio against a further escalation in the Middle East.”

A major concern for investors is that the conflict leads to a prolonged disruption to the supply of oil. That could weigh on the global economy and potentially fuel a round of inflation just as many central banks pivot towards easing. The Federal Reserve and the Bank of Japan are among a raft of central banks set to announce interest rate decisions this week.

In the region, most Middle East stock indexes dropped on Sunday. Egypt’s main gauge was the worst performer, seeing the biggest losses in more than a year on concern that a halt in Israeli gas production will cause fuel shortages. In Saudi Arabia, the Tadawul gauge’s declines were limited by Aramco, which gained on higher oil prices. Israel’s benchmark ended higher as military supplier Elbit Systems Ltd. rallied.

Open hostilities between Israel and Iran entered a fourth day on Monday with no sign of easing, stoking fears of a wider war in the oil-rich region.

Iran fired several waves of drones and missiles over the last 24 hours, while Israel hit the Islamic Republic’s capital, Tehran, killing another key military official.

Since Friday, 224 people have been killed in Iran, according to the government, which said most of the casualties were civilians. Iranian attacks left 14 people dead and around 400 injured, Israel’s emergency services said.

Tensions between the two countries erupted into direct conflict on Friday, when Israel launched surprise attacks on Iranian military and nuclear sites. Since then, its air campaign has underscored Israeli air superiority and exposed the constraints facing Tehran’s ability to respond effectively.

For Iran, the showdown poses a strategic dilemma. It can’t risk appearing weak, yet its retaliatory options are shrinking — and proxy forces it supports across the region have been largely deterred by Israeli action.

After having urged Iran to reach a nuclear deal on the onset of the Israeli attacks, US President Donald Trump on Sunday said Iran and Israel “should make a deal, and will make a deal.”

“We will have PEACE, soon, between Israel and Iran!” he said on Truth Social. “Many calls and meetings now taking place.”

He also said, in later comments to reporters, that “but sometimes they have to fight it out.”

There was little else suggesting an imminent breakthrough.

“We are in an existential campaign,” Israeli Prime Minister Benjamin Netanyahu said as he visited the site of a missile strike on the coastal city of Bat Yam on Sunday. “Iran will pay a very heavy price for deliberately murdering our citizens, women and children.” His defense minister said the “regime in Tehran” was now a target.

Israeli military said it hit military sites in various parts of Iran and killed the intelligence chief and other key officials of the Islamic Revolutionary Guard Corps.

The tit-for-tat weighed on financial markets, with equities in Saudi Arabia, Egypt and Qatar dropping on Sunday. The Egyptian pound weakened about 1.8% to beyond 50 per dollar in local trades. Israeli stocks rose, led by defense company Elbit Systems Ltd.

Investor caution elsewhere was also on display as trading resumed Monday in Asia, though the magnitude of the moves outside of energy remained relatively contained.

Oil futures traded around 2% higher, compounding steep gains from Friday. The dollar strengthened against all Group of 10 countries in a sign of defensive positioning. US equity index futures, meanwhile, were fractionally lower after declines of more than 1% for the S&P 500 and Nasdaq 100 on Friday.

Iran reported an explosion at one of its natural gas plants linked to the giant South Pars field on Saturday. While the country exports little gas and Israel appears not to have targeted its oil fields or crude-shipment facilities, the move risks pushing up global energy prices — which soared on Friday — even more.

The United Nations’ nuclear watchdog the International Atomic Energy Agency said multiple strikes on Iran’s uranium-conversion facility at Isfahan, south of Tehran, resulted in serious damage.

Iran’s deputy foreign minister, Kazem Gharibabadi, told state television that “we will no longer cooperate with the agency as we did before.”

According to Iran’s Fars news service, a key parliamentary committee said Tehran should no longer adhere to the nuclear Non-Proliferation Treaty, the bedrock arms-control agreement that compels signatories to accept inspections.

For now, it’s unclear if the government will take such steps.

Arch-enemies Israel and Iran have long fought a shadow war. The Jewish state’s been accused of cyber attacks and assassinating Iranian scientists, while Tehran’s funded anti-Israel militias in the Middle East.

Those tensions soared after Hamas, a Palestinian group backed by Iran, attacked Israel on Oct. 7, 2023. That led to Israel and Iran firing missiles and drones on each other twice last year.

Still, this is their most serious conflict yet. Since the fighting began, struck Iran’s nuclear and military sites using jets and drones, and killed several top commanders and atomic scientists.

Israel said it was aiming to end Iran’s ability to build a nuclear bomb, which it sees as an existential threat. Tehran maintains its atomic program has purely civilian purposes.

The attacks on Iran’s defenses seem to have given Israel air superiority over the Islamic Republic, including its capital.

The Israeli military on Sunday urged Iranians to “immediately evacuate” areas near weapons-production facilities and “not return until further notice.”

Netanyahu said his military would “strike at every site and every target of the Ayatollah regime,” while Iran’s Supreme Leader Ayatollah Ali Khamenei has said Israel will “pay a very heavy price.”

The conflict sent shockwaves through global markets last week, with investors buying haven assets such as gold.

Iran canceled its next round of nuclear talks with the US scheduled for Oman on Sunday. The same day, Trump reiterated that the US wasn’t involved in Israel’s attacks and said he could still get a nuclear deal with Iran.

He’s set to meet other leaders of the Group of Seven major economies in Canada and the conflict will be at the forefront of their talks. Israel is calling on Washington and European nations to help it attack Iran, arguing that is what’s needed to stop Tehran developing a nuclear weapon.

While the US has helped defend Israel by intercepting missiles and drones, Trump has not yet indicated if the US will join in the strikes on Iran.

For all that Israel’s already damaged Iranian atomic sites and says it will continue to strike them, many Western analysts say it needs US help to destroy some key facilities located deep underground.

Middle Eastern leaders and Russian President Vladimir Putin are voicing increasing concern that the conflict could spiral out of control. They have urged both sides to calm the situation quickly.

Germany’s Foreign Minister Johann Wadephul, speaking to local broadcaster ARD, urged regional states to talk with Iran, while Berlin continues engaging with Israel.

Germany, France and the UK are, he said from Qatar, ready to negotiate with Iran over its nuclear program.

It’s unclear if Tehran is entertaining last-resort options such as attacking tankers in the Strait of Hormuz, through which Middle Eastern states ship about a fifth of the world’s oil.

That type of action may draw the US, the world’s most powerful military, into the conflict, something Tehran has probably calculated it can’t afford, according to Bloomberg Economics analysts. That’s partly because the Iranian economy is already weak, with inflation at almost 40%, and public frustration with the government is high.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up