Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

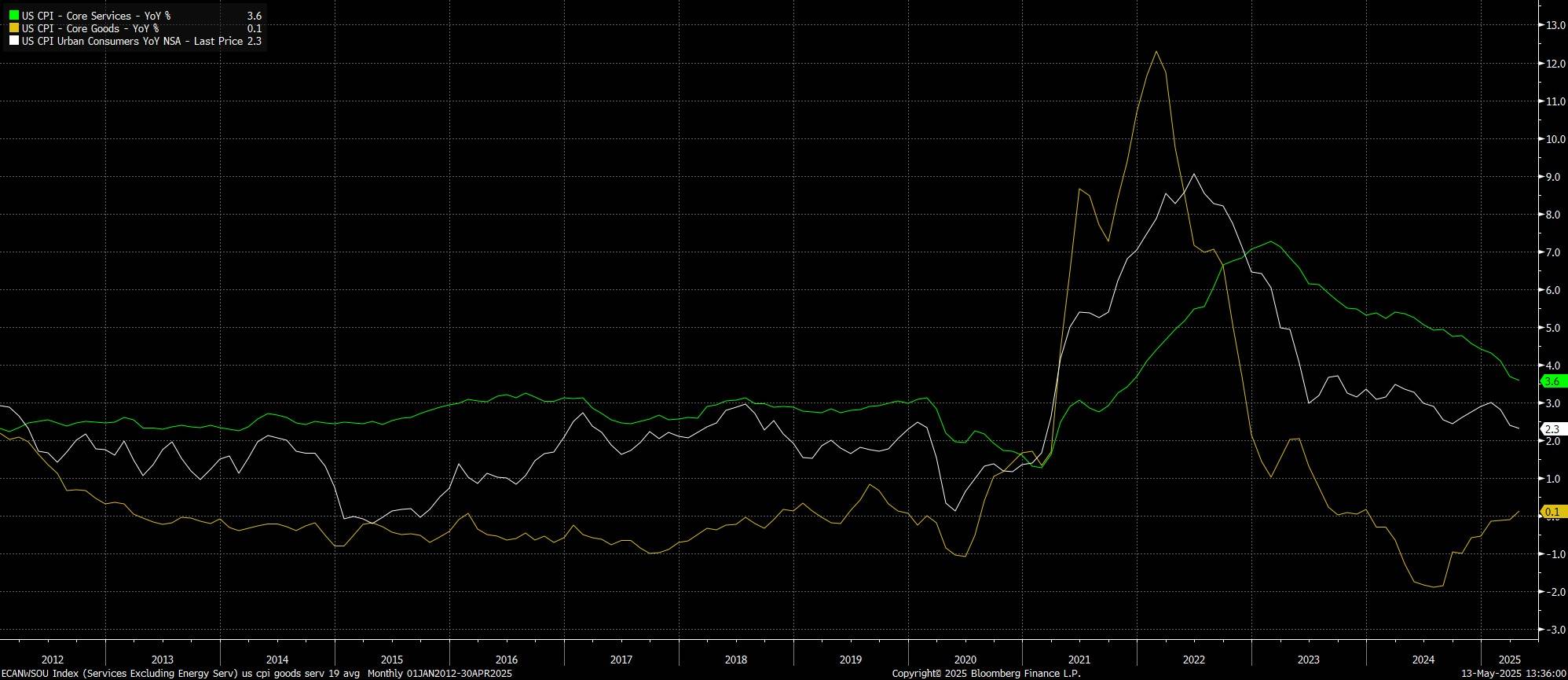

Headline CPI rose 2.3% YoY last month, cooler than consensus expectations for an unchanged 2.4% YoY, while core prices rose by 2.8% on an annual basis. So-called ‘supercore' prices, meanwhile, aka core services inflation less housing, rose 2.7% YoY in April, a fresh low since early-2021, and a notable decline from the prior 2.9% annual rate.

Headline CPI rose 2.3% YoY last month, cooler than consensus expectations for an unchanged 2.4% YoY, while core prices rose by 2.8% on an annual basis. So-called ‘supercore' prices, meanwhile, aka core services inflation less housing, rose 2.7% YoY in April, a fresh low since early-2021, and a notable decline from the prior 2.9% annual rate.

On an MoM basis, meanwhile, price pressures firmed compared to the previous couple of months, largely a result of tariffs beginning to boost prices across the economy, the impacts of which will continue to show up over the next quarter or two, even though the most drastic trade levies have been dramatically pared back since ‘Liberation Day'. Headline CPI rose 0.2% MoM in April, cooler than expected but still the firmest print since January, while prices excluding food and energy also rose 0.2% MoM over the same period.

Annualising this monthly data helps to provide a better idea of the inflationary backdrop, and underlying price trends:

Digging a little deeper into the data, the April CPI report pointed to a continuation of recent trends, with goods price pressures continuing to firm, as core goods deflation came to an end for the first time since the start of 2024, even as core services prices continued to ebb.

In the aftermath of the data, money markets underwent a modest dovish repricing, though little moves of any significance, with the USD OIS curve continuing to discount two 25bp Fed cuts by year-end, in September and December.

On the whole, the April inflation figures won't be a game-changer, or anything of the sort, for the FOMC and the near-term policy outlook. Powell & Co. remain firmly in ‘wait and see' mode for the time being, seeking to sit on the sidelines amid a ‘well positioned' policy stance, assessing both incoming economic data, as well as changes in trade policy, and digesting how these shifts may alter the balance of risks facing each side of the dual mandate.

Primarily, though, the Committee's focus remains on ensuring that inflation expectations remain well-anchored as, even in light of the recent reduction in US tariffs on Chinese goods, the substantial rise in the overall average effective tariff rate is near-certain to result in CPI continuing to head higher through the summer.

With these upside inflation risks in mind, as well as the considerable degree of uncertainty that continues to cloud the economic outlook, and the labour market remaining in rude health, the bar to Fed action in the short-term remains a very high one indeed. While the direction of travel for rates remains lower, any cuts before the end of the third quarter seem a very long shot indeed, barring a significant deterioration in labour market conditions and policymakers obtaining sufficient confidence in price pressures remaining contained in the meantime.

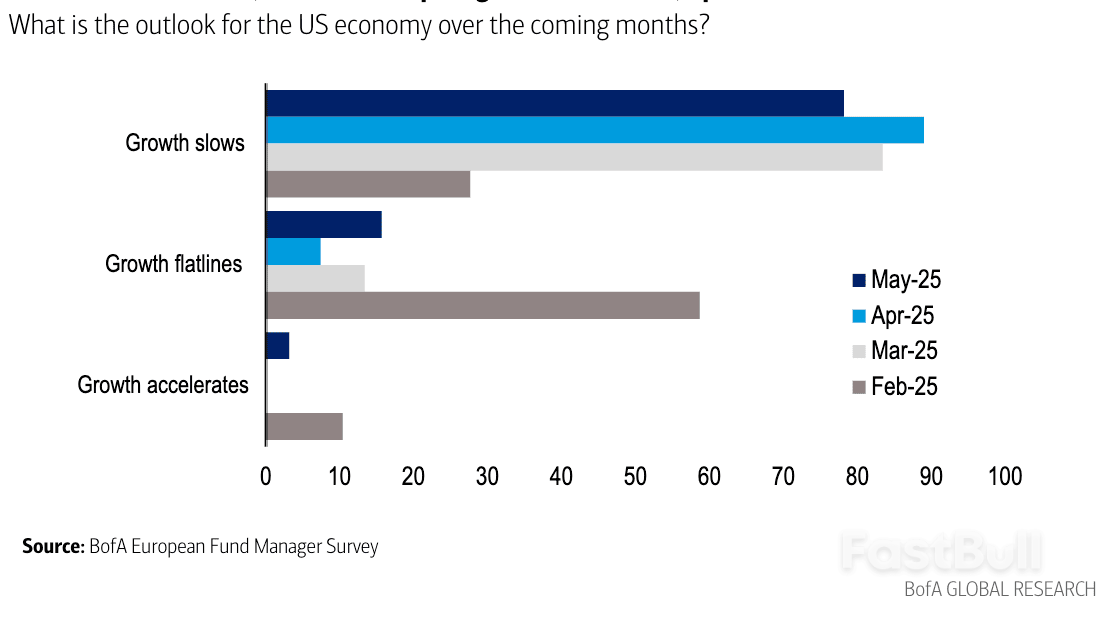

Above: "78% of European investors expect US growth to slow over the coming months, down from 89% last month, while 16% expect growth to flatline, up from 7% last month" - Bank of America.

Above: "78% of European investors expect US growth to slow over the coming months, down from 89% last month, while 16% expect growth to flatline, up from 7% last month" - Bank of America.The British pound has edged higher on Tuesday. In the European session, GBP/USD is trading at 1.3218, up 0.34% on the day.

Uncertainty over the global economy, particularly US tariff policy, weighed on the UK employment report. The economy added 112 thousand jobs in the three months ending in March, down sharply from 206 thousand a month earlier and shy of the market estimate of 120 thousand. It was the weakest job growth in three months.

The unemployment rate inched up to 4.5% from 4.4%, in line with expectations and its highest level since August 2021. Wage growth including bonuses eased to 5.5% from a revised 5.7%, above the market estimate of 5.2%.

The Bank of England cut rates by a quarter-point to 4.25% last week but remains in a bind. The cooling job market should push inflation lower but wage growth remains stubbornly high and is an upside risk to inflation. The BoE will have to carve out a rate path that balances a weaker labor market with high wage growth – this could mean a delay in further rate cuts until late in the year. The BoE meets next on June 19.

The US releases the April inflation report later today. Headline CPI is expected to rise to 0.3% m/m, up from -0.1% in March, which marked the first decline since June 2024. Annually, headline CPI is expected to remain unchanged at 2.4%. Core CPI is also expected to climb to 0.3% from 0.1%. Annually, core CPI is projected to remain at 2.8%.

The escalating trade tensions due to US tariffs have raised concerns that US growth will fall and inflation will decline, even resulting in a recession in the US. The US-China agreement to slash tariffs, which will be in effect for 90 days, is an important de-escalation in the trade war and should curtail inflation and reduce the risk of a recession.

EUR/USD dropped to 1.1110 on Tuesday, with the US dollar surging by over 1% in the previous trading session. The rally was driven by market reactions to news of a provisional agreement between China and the US to reduce tariffs, which helped alleviate global recession fears.

Washington and Beijing have agreed to cut tariffs to 30% and 10%, respectively, for 90 days.

Meanwhile, US Treasury Secretary Scott Bessent confirmed plans to meet with Chinese representatives again in the coming weeks to begin negotiations on a broader trade deal.

The tariff reductions boosted market sentiment towards the dollar, which had previously faced pressure over concerns that President Donald Trump’s trade policies were diminishing the appeal of US assets. However, market nervousness is likely to persist until the White House establishes stable trade terms with all key partners.

Attention now turns to the latest US inflation report, which may show how the new tariff policy affects prices.

On the H4 chart, EUR/USD broke below 1.1190, completing the third wave of decline towards 1.1065. Today, we anticipate a corrective wave retesting 1.1190 (from below). Once this correction concludes, a new downward wave towards 1.1040 is expected. This scenario is technically confirmed by the MACD indicator, with its signal line below zero and pointing decisively downward.

On the H1 chart, the market has achieved the local downside target at 1.1065. Today, a potential rebound to 1.1126 is in focus. If this level is breached upwards, a further correction towards 1.1190 may follow. Subsequently, the downward trend could resume, targeting 1.1040. This outlook is supported by the Stochastic oscillator, whose signal line is above 80 but poised to decline towards 20.

The US dollar’s resurgence reflects improved risk sentiment following the US-China tariff truce, though uncertainty lingers over long-term trade relations. Technically, EUR/USD remains under pressure, with further downside likely after a brief correction.

It’s been almost three years since former US President Joe Biden journeyed to Saudi Arabia pleading for more oil, only to return empty-handed.

His successor, Donald Trump, is having more luck — even before he started this week’s Middle East tour.

Riyadh has led two supersized production increases from the OPEC+ cartel in recent weeks in apparent deference to the president’s calls for cheaper crude. Prices have crashed to a four-year low.

The fate of that strategy could become clearer when Trump meets the kingdom’s rulers today.

At $65 per barrel, oil prices remain significantly below the levels the Saudis need, according to the International Monetary Fund. The nation’s budget deficit has soared.

That poses a particular challenge for the $600 billion in investments Crown Prince Mohammed bin Salman has promised the US as well as the big-ticket deals that top the American president’s agenda.

What the prince will tell Trump remains unknown, but if ever there was a moment to explain that the drive for lower oil prices has unintended consequences, this is it.

On June 1, the Organization of the Petroleum Exporting Countries and its partners will consider another output increase.

Officials maintain that the alliance’s supply push is aimed at punishing cheating members and not meant as a concession to Washington. Nonetheless, it’s impossible to ignore the geopolitical backdrop.

If Trump’s visit yields any indications that Riyadh has latitude to tighten supplies, crude futures could rally. But if it appears the president is piling on pressure for more barrels, the market could sink back toward $60 a barrel.

Of course, OPEC+ strategy isn’t the only oil-related element of Trump’s trip, which includes stops in the United Arab Emirates and Qatar.

Trump is laboring on a nuclear pact with Iran, which could eventually relieve sanctions on the Islamic Republic’s oil exports. A ceasefire with its Yemeni proxies, the Houthis, hints at progress.

While the Gulf states once pushed a hawkish stance on Tehran, recently they’ve grown more pragmatic, steering Washington away from the military measures advocated by Israel.

If negotiations gather momentum, Iran could add to the tide of Middle East barrels: a win for Trump but another blow for prices.

--Grant Smith, Bloomberg News

A drop in naphtha sales has weighed on Russia’s refined-fuel exports so far this month. Seaborne shipments of petroleum products totaled 2.07 million barrels a day through May 10, according to data compiled by Bloomberg from analytics firm Vortexa Ltd. That’s 7% lower than April’s daily average. Market participants look to these numbers as a gauge of Russian oil production in the absence of official information.

Trump arrived in Riyadh today with a contingent of business leaders as he tries to secure $1 trillion in investment from the Saudis. Follow our live blog on his visit.

Phillips 66 shareholders should vote for all four board candidates nominated by activist investor Elliott Investment Management in its upcoming annual meeting, proxy advisory firm Institutional Shareholder Services Inc. said.

Chinese rare-earth exporters are asking the government to clarify whether they’re allowed to sell to the US now that Beijing and Washington have called a ceasefire in their trade war.

Clean-tech companies eligible for federal support under Biden’s policies are considering leaving the US as the Trump administration pulls the plug on financing, says the former head of the program that vetted the firms.

US shale oil output has probably peaked, just don’t expect a rapid decline like the downturns of 2015 and 2020, Bloomberg Opinion’s Javier Blas writes.

Ten US cargoes of liquefied natural gas plied key routes from May 5 to 11, three more than a week earlier and the most since November, according to BloombergNEF. Two tankers traversed the Suez Canal for deliveries to Egypt. One carrier crossed the Panama Canal, and the rest sailed around the Cape of Good Hope. Global LNG imports recovered 2% week-on-week to almost 7.5 million metric tons.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up