Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Markets await CPI data after a strong rally from eased U.S.-China trade tensions. Trump targets drug prices, Coinbase joins S&P 500, and UnitedHealth CEO steps down amid rising medical costs.

UBS downgraded U.S. equities to Neutral from Attractive following an 11% rally in the S&P 500 since early April.

The bank pointed to reduced upside after progress on U.S.-China trade talks drove market gains.

“We downgrade U.S. equities to Neutral from Attractive,” UBS said, noting that “risk-reward in equities is now more balanced.”

The firm had upgraded U.S. stocks on April 10, arguing that excessive trade-related pessimism was priced in. But with tariffs temporarily paused and markets rebounding, UBS believes the easy gains are behind.

On Monday, the S&P 500 rose 3.3% and the Nasdaq jumped 4.4% after the U.S. and China agreed to reduce tariffs for 90 days while negotiations continue.

U.S. levies on Chinese imports will fall to 30% from 145%, while China will cut tariffs on U.S. goods to 10% from 125%.

“The pace and scale of tariff reductions agreed in this initial round have exceeded market expectations,” UBS said.

Despite the downgrade, UBS emphasized it is “not a bearish view, nor a call to sell equities.”

“Uncertainty is still high,” UBS cautioned, “and investors will soon begin to focus on whether this temporary fix can evolve into a lasting agreement.”

The bank continues to advise a full strategic allocation to U.S. stocks and expects equities to be higher 12 months from now.

UBS’s sector preferences remain unchanged, with Attractive ratings on communication services, tech, health care, and utilities.

Looking ahead, UBS said the “durability of this rally will depend on two key factors: whether U.S.-China negotiators can turn this into a lasting trade agreement, and how Beijing proceeds with anticipated stimulus.”

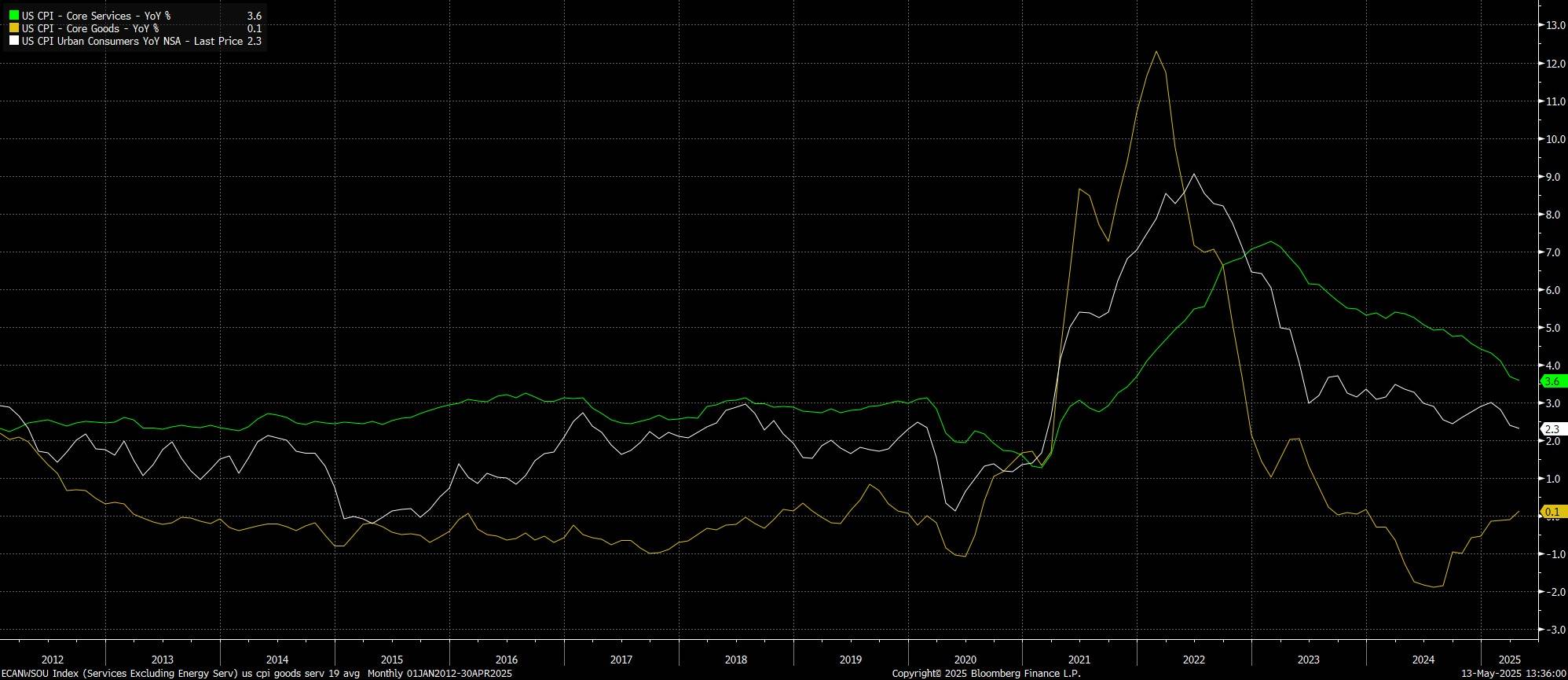

Headline CPI rose 2.3% YoY last month, cooler than consensus expectations for an unchanged 2.4% YoY, while core prices rose by 2.8% on an annual basis. So-called ‘supercore' prices, meanwhile, aka core services inflation less housing, rose 2.7% YoY in April, a fresh low since early-2021, and a notable decline from the prior 2.9% annual rate.

On an MoM basis, meanwhile, price pressures firmed compared to the previous couple of months, largely a result of tariffs beginning to boost prices across the economy, the impacts of which will continue to show up over the next quarter or two, even though the most drastic trade levies have been dramatically pared back since ‘Liberation Day'. Headline CPI rose 0.2% MoM in April, cooler than expected but still the firmest print since January, while prices excluding food and energy also rose 0.2% MoM over the same period.

Annualising this monthly data helps to provide a better idea of the inflationary backdrop, and underlying price trends:

Digging a little deeper into the data, the April CPI report pointed to a continuation of recent trends, with goods price pressures continuing to firm, as core goods deflation came to an end for the first time since the start of 2024, even as core services prices continued to ebb.

In the aftermath of the data, money markets underwent a modest dovish repricing, though little moves of any significance, with the USD OIS curve continuing to discount two 25bp Fed cuts by year-end, in September and December.

On the whole, the April inflation figures won't be a game-changer, or anything of the sort, for the FOMC and the near-term policy outlook. Powell & Co. remain firmly in ‘wait and see' mode for the time being, seeking to sit on the sidelines amid a ‘well positioned' policy stance, assessing both incoming economic data, as well as changes in trade policy, and digesting how these shifts may alter the balance of risks facing each side of the dual mandate.

Primarily, though, the Committee's focus remains on ensuring that inflation expectations remain well-anchored as, even in light of the recent reduction in US tariffs on Chinese goods, the substantial rise in the overall average effective tariff rate is near-certain to result in CPI continuing to head higher through the summer.

With these upside inflation risks in mind, as well as the considerable degree of uncertainty that continues to cloud the economic outlook, and the labour market remaining in rude health, the bar to Fed action in the short-term remains a very high one indeed. While the direction of travel for rates remains lower, any cuts before the end of the third quarter seem a very long shot indeed, barring a significant deterioration in labour market conditions and policymakers obtaining sufficient confidence in price pressures remaining contained in the meantime.

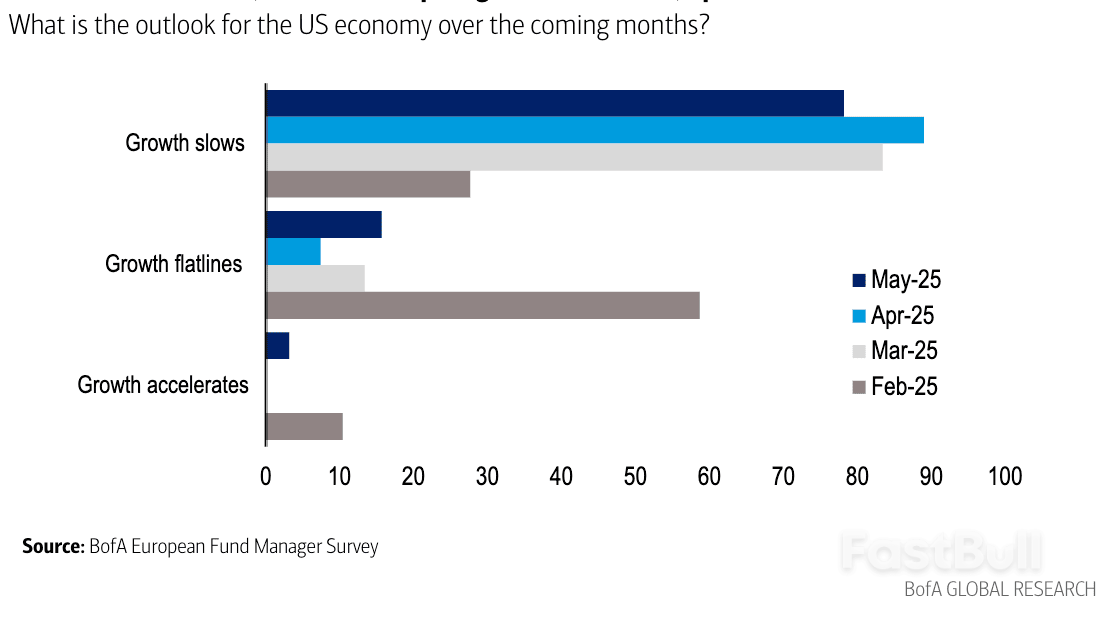

Above: "78% of European investors expect US growth to slow over the coming months, down from 89% last month, while 16% expect growth to flatline, up from 7% last month" - Bank of America.

Above: "78% of European investors expect US growth to slow over the coming months, down from 89% last month, while 16% expect growth to flatline, up from 7% last month" - Bank of America.The British pound has edged higher on Tuesday. In the European session, GBP/USD is trading at 1.3218, up 0.34% on the day.

Uncertainty over the global economy, particularly US tariff policy, weighed on the UK employment report. The economy added 112 thousand jobs in the three months ending in March, down sharply from 206 thousand a month earlier and shy of the market estimate of 120 thousand. It was the weakest job growth in three months.

The unemployment rate inched up to 4.5% from 4.4%, in line with expectations and its highest level since August 2021. Wage growth including bonuses eased to 5.5% from a revised 5.7%, above the market estimate of 5.2%.

The Bank of England cut rates by a quarter-point to 4.25% last week but remains in a bind. The cooling job market should push inflation lower but wage growth remains stubbornly high and is an upside risk to inflation. The BoE will have to carve out a rate path that balances a weaker labor market with high wage growth – this could mean a delay in further rate cuts until late in the year. The BoE meets next on June 19.

The US releases the April inflation report later today. Headline CPI is expected to rise to 0.3% m/m, up from -0.1% in March, which marked the first decline since June 2024. Annually, headline CPI is expected to remain unchanged at 2.4%. Core CPI is also expected to climb to 0.3% from 0.1%. Annually, core CPI is projected to remain at 2.8%.

The escalating trade tensions due to US tariffs have raised concerns that US growth will fall and inflation will decline, even resulting in a recession in the US. The US-China agreement to slash tariffs, which will be in effect for 90 days, is an important de-escalation in the trade war and should curtail inflation and reduce the risk of a recession.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up