Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Residential Building Collapses In Lebanese City Of Tripoli, Trapping Unknown Number Of People Under Rubble - Security Sources And Officials

Taiwan President: Look Forward To Cooperating With You So Taiwan And Japan Can Continue To Face Regional Challenges Together And Promote Peace And Prosperity In The Indo-Pacific

Ukraine President Zelenskiy: Russian Energy Infrastructure Is A Legal Target For Ukrainian Strikes

Japan Election: PM Takaichi Says Will Deepen Economic Security Ties With US, Including Concerning Rare Earth Supply, When She Visits Trump In March

Japan Election: PM Takaichi Says Japan's Lethal Arms Export Restrictions Will Be Eased From Current Levels

Japan Finance Minister Katayama: Need To Take Professional Approach As Tapping This Not Easy, When Asked Whether Japan Could Tap Forex Reserves To Fund Tax Cuts, Spending

Russian President Putin Held A Telephone Call With United Arab Emirates President On Saturday - RIA Cites Kremlin

SOMO - Iraq Sets March Basrah Medium Crude Official Selling Price To North And South America At Minus $1.30/Bbl Versus Asci

SOMO - Iraq March Basrah Medium Crude Official Selling Price To Europe At Minus $3.55/Bbl Versus Dated Brent

SOMO - Iraq Sets March Basrah Medium Crude Official Selling Price To Asia At Minus $1.70/Bbl To Oman/Dubai Average

Ukraine's Oil And Gas Firm Naftogaz Says Russia Attacked Its Facilities In Eastern Poltava Region Overnight

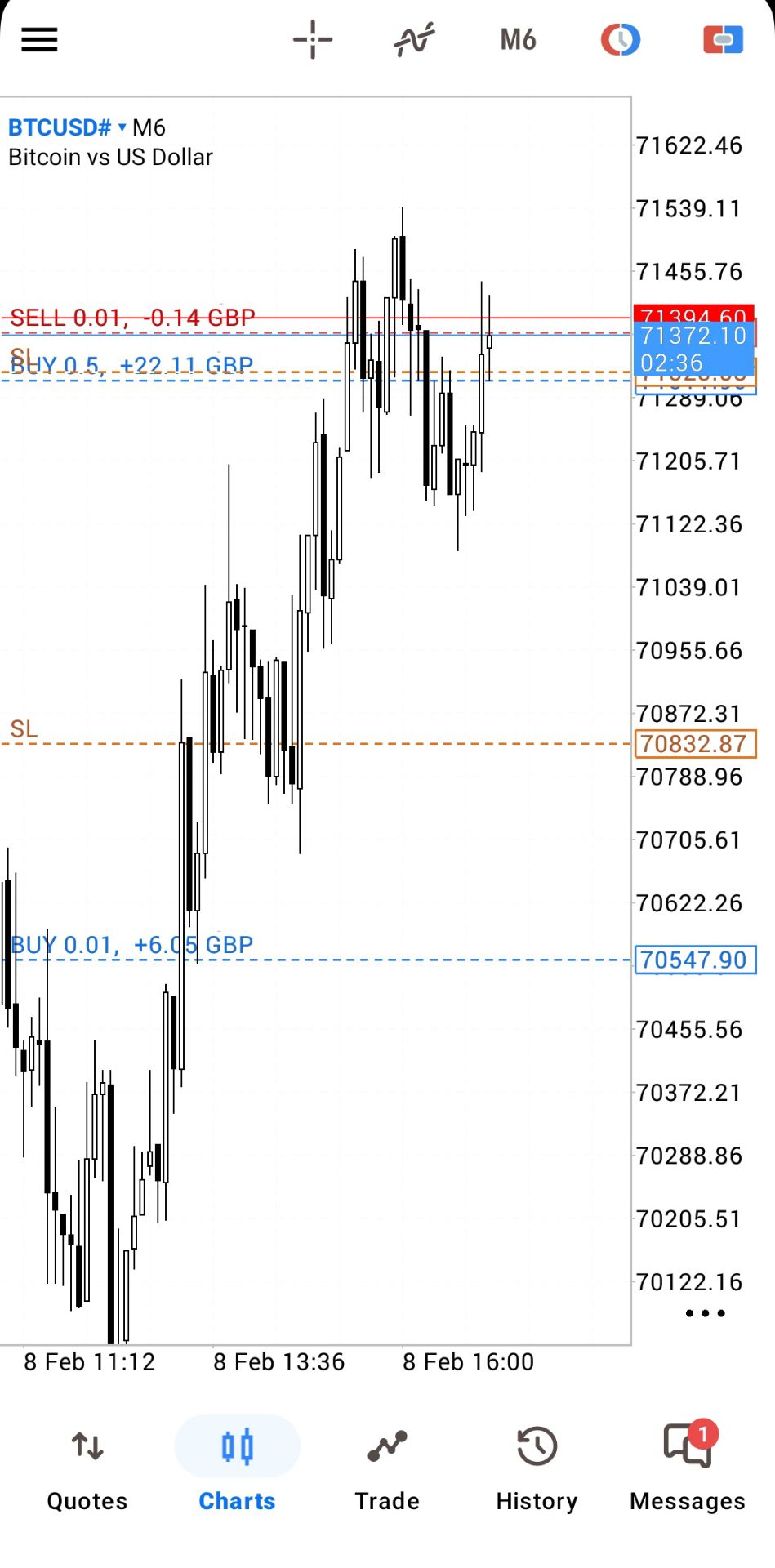

[Polymarket Prediction: "Bitcoin To Rebound To $75K In February" Probability Rises To 64%] February 8Th, As Bitcoin Surged Back Above $70,000, Currently Trading At $70,132. The Probability Of "Bitcoin Rising To $75,000 In February" On Polymarket Has Increased To 64%. Additionally, The Probability Of Rising To $80,000 Is 30%, And The Probability Of Falling To $60,000 Is 37%

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

Japan Leading Indicators Prelim (Dec)

Japan Leading Indicators Prelim (Dec)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Dec)

Germany Industrial Output MoM (SA) (Dec)A:--

F: --

Germany Exports MoM (SA) (Dec)

Germany Exports MoM (SA) (Dec)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Jan)

U.K. Halifax House Price Index YoY (SA) (Jan)A:--

F: --

U.K. Halifax House Price Index MoM (SA) (Jan)

U.K. Halifax House Price Index MoM (SA) (Jan)A:--

F: --

France Trade Balance (SA) (Dec)

France Trade Balance (SA) (Dec)A:--

F: --

Canada Leading Index MoM (Jan)

Canada Leading Index MoM (Jan)A:--

F: --

Mexico Consumer Confidence Index (Jan)

Mexico Consumer Confidence Index (Jan)A:--

F: --

P: --

Canada Employment (SA) (Jan)

Canada Employment (SA) (Jan)A:--

F: --

Canada Full-time Employment (SA) (Jan)

Canada Full-time Employment (SA) (Jan)A:--

F: --

Canada Part-Time Employment (SA) (Jan)

Canada Part-Time Employment (SA) (Jan)A:--

F: --

Canada Unemployment Rate (SA) (Jan)

Canada Unemployment Rate (SA) (Jan)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Jan)

Canada Labor Force Participation Rate (SA) (Jan)A:--

F: --

P: --

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11.

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11. U.S. UMich Consumer Sentiment Index Prelim (Feb)

U.S. UMich Consumer Sentiment Index Prelim (Feb)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Feb)

U.S. UMich Consumer Expectations Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Jan)

Canada Ivey PMI (Not SA) (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Feb)

U.S. UMich Current Economic Conditions Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (SA) (Jan)

Canada Ivey PMI (SA) (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)A:--

F: --

P: --

Russia Retail Sales YoY (Dec)

Russia Retail Sales YoY (Dec)A:--

F: --

P: --

Russia Unemployment Rate (Dec)

Russia Unemployment Rate (Dec)A:--

F: --

P: --

Russia Quarterly GDP Prelim YoY (Q1)

Russia Quarterly GDP Prelim YoY (Q1)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Dec)

U.S. Consumer Credit (SA) (Dec)A:--

F: --

China, Mainland Foreign Exchange Reserves (Jan)

China, Mainland Foreign Exchange Reserves (Jan)A:--

F: --

P: --

Japan Wages MoM (Dec)

Japan Wages MoM (Dec)--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Dec)

Japan Trade Balance (Customs Data) (SA) (Dec)--

F: --

P: --

Japan Trade Balance (Dec)

Japan Trade Balance (Dec)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Feb)

Euro Zone Sentix Investor Confidence Index (Feb)--

F: --

P: --

Mexico CPI YoY (Jan)

Mexico CPI YoY (Jan)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Jan)

Mexico 12-Month Inflation (CPI) (Jan)--

F: --

P: --

Mexico PPI YoY (Jan)

Mexico PPI YoY (Jan)--

F: --

P: --

Mexico Core CPI YoY (Jan)

Mexico Core CPI YoY (Jan)--

F: --

P: --

ECB Chief Economist Lane Speaks

ECB Chief Economist Lane Speaks Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

China, Mainland M0 Money Supply YoY (Jan)

China, Mainland M0 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Jan)

China, Mainland M2 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Jan)

China, Mainland M1 Money Supply YoY (Jan)--

F: --

P: --

ECB President Lagarde Speaks

ECB President Lagarde Speaks U.K. BRC Overall Retail Sales YoY (Jan)

U.K. BRC Overall Retail Sales YoY (Jan)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Jan)

U.K. BRC Like-For-Like Retail Sales YoY (Jan)--

F: --

P: --

Indonesia Retail Sales YoY (Dec)

Indonesia Retail Sales YoY (Dec)--

F: --

P: --

France ILO Unemployment Rate (SA) (Q4)

France ILO Unemployment Rate (SA) (Q4)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Jan)

U.S. NFIB Small Business Optimism Index (SA) (Jan)--

F: --

P: --

Brazil IPCA Inflation Index YoY (Jan)

Brazil IPCA Inflation Index YoY (Jan)--

F: --

P: --

Brazil CPI YoY (Jan)

Brazil CPI YoY (Jan)--

F: --

P: --

U.S. Retail Sales YoY (Dec)

U.S. Retail Sales YoY (Dec)--

F: --

P: --

U.S. Labor Cost Index QoQ (Q4)

U.S. Labor Cost Index QoQ (Q4)--

F: --

P: --

U.S. Import Price Index MoM (Dec)

U.S. Import Price Index MoM (Dec)--

F: --

P: --

U.S. Export Price Index YoY (Dec)

U.S. Export Price Index YoY (Dec)--

F: --

P: --

U.S. Export Price Index MoM (Dec)

U.S. Export Price Index MoM (Dec)--

F: --

P: --

U.S. Import Price Index YoY (Dec)

U.S. Import Price Index YoY (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Dec)

U.S. Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales MoM (Dec)

U.S. Core Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales (Dec)

U.S. Core Retail Sales (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Dec)--

F: --

P: --

No matching data

As my colleague Kenneth Lamont recently wrote, artificial intelligence is the “defining investment theme of our era.” The most well-known beneficiary is Nvidia NVDA, which became the world’s first $4 trillion company by enabling the technology.

As my colleague Kenneth Lamont recently wrote, artificial intelligence is the “defining investment theme of our era.” The most well-known beneficiary is Nvidia NVDA, which became the world’s first $4 trillion company by enabling the technology. Less obvious winners include Vertiv VRT, an industrial business that supplies AI data centers.But ever since ChatGPT burst onto the scene nearly three years ago, traditional growth stocks have captured most of the market spoils. Morningstar’s broad US growth index has outperformed its value counterpart by a wide margin since late 2022. That’s not to say value hasn’t had moments. During pullbacks in the fourth quarter of 2024 and from February through April 2025, value stocks held up best. When AI enthusiasm resumed, however, growth pulled ahead.

Will the value side of the market ever make a sustained run? Growth stock dominance in the US really goes back more than 10 years—well before AI enthusiasm took hold (internationally, it’s a different story). Periods of value resurgence, like 2016 and 2022, look like aberrations in retrospect. Value investors can be forgiven for capitulating.It’s worth remembering, though, that change is the only constant in markets. The stocks, sectors, and styles that triumphed in the past are rarely future leaders. Turning points are only obvious in retrospect.

Catalysts for market rotations are also hard to identify in advance. That’s why I was struck by the prediction Vanguard chief economist Joe Davis made during a recent interview on Morningstar’s The Long View podcast. Davis thinks AI is likely to boost economic growth and thinks its stock market impact will be greatest on the value side of the market. “[I]f you’re the most bullish on AI, you actually want to invest outside of the Mag 7 and technology sphere, because it’s going to be that transformational. I’m not picking on those companies at all. I’m talking about the second half of the chessboard.”

I asked him to elaborate.

Lefkovitz: Joe, you made a comment earlier, I wanted to come back to, about value stocks and how they might be a surprise winner from AI. Wondering if you could lay that out a little bit more.Davis: This was a surprise. I didn’t know this, and it’s not infallible like the motions of the tide, the ocean. If the tides are going out, they’re definitely coming back in. But I think the odds are tilted that way. And what was a surprise to me is that there are stylistically, so very loosely, there’s two phases to a technology cycle. First of all, you have to know that you’re actually in a transformative technology cycle. Like, did I know in 1992 that a personal computer—I know now a personal computer was transformative, but did I really know in 1992? Probably not. Our system, our data-driven framework, gives you a modest sense, but with uncertainty in real time, in 1992, because of the signals it picks up. Today, it says we’re certainly likely to be in this extended technology cycle, which means there’s a general-purpose technology likely to emerge.

Now, in periods when they happen—I wish we had hundreds of those examples. Dan, we just don’t. You have electricity, you have a combustion engine. And people, even economists, debate what a general-purpose technology is. Just because we use something a lot doesn’t mean it lifted everyone and fundamentally changed society. Like the microwave oven, it’s a new technology. It’s not a general-purpose technology. However, we are in that, and our odds are more likely than not that AI is a general-purpose technology. What happens is there’s, what I was surprised to find is that there’s two phases to the technology cycle. The first phase is what I call just the production of the technology is starting to spread. There’s a massive investment in the space. A lot of new businesses are formed trying to produce the technology. It was in the personal computer. It was hardware, software, and the dial-up internet. I’ll use that as an example because it makes it tangible.

And some will say, Oh, there’s a bubble that emerges. I don’t know. I mean, yes, generally enough, I don’t want to make that claim. And that’s really almost immaterial to the second half. What emerges in the second half of the investment cycle is what was surprising to me and gets to your question, Dan. And if this technology is that transformational as we think it is, it starts to benefit companies through higher earnings, to productivity, to new products with that technology as a platform. I’ll give you two examples.

In the personal computer, now I know with the benefit of hindsight, things such as online shopping, companies that sell it all, I don’t know, books and music ended up being 4% of the company—I’m trying not to use company names, but you can think of like the jungle, Amazon AMZN emerged. But that was not technically a technology company by the true letter of the law. It was a consumer staple. With electricity, guess what powered the assembly line? Well, two winners emerged. They were called Ford Motor Company F and General Motors GM. Now, electricity didn’t lead to their profitability, but without those disruptive technologies, I don’t think we’re talking about those companies today. It’s spread to sectors outside of electricity on the one hand and computers on the other. But that’s how technology works. And if it’s not that transformative, then it hasn’t lifted growth; then it’s a dud to begin with.

That’s what was surprising to me is that if we play out—and you have to give this five or seven years, and again, the irony is that outside of the tech sector, parts of those investing universes don’t have the multiples that say the Magnificent Seven (Alphabet, Amazon.com, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla) or the technology stocks do have. And I’m not saying they’re not delivering value. I just said that this AI has the likelihood of being as transformative as a personal computer. That’s pretty high praise. But what it says is that if it is truly this transformational, other opportunities emerge, and that’s where it pushes you at the margin, given the multiples outside of value and outside of the United States. It’s not being skeptical of technology. Quite the contrary. It’s actually saying, no, if this thing has legs, then it’s going to spider web into outside of Silicon Valley.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up