Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Key points: A new alliance reshapes AI computing: Nvidia’s $5B investment in Intel is not just financial support—it puts Intel b

Key points:

Nvidia’s $5 billion investment in Intel and their plan to co-develop custom chips is one of the most consequential alliances in U.S. technology in recent years. It comes just weeks after the U.S. government took a direct stake in Intel, underscoring how strategic semiconductors have become in the U.S.–China rivalry.

For investors, the deal reshapes the AI computing landscape, with implications stretching from Nvidia and Intel themselves to the entire global supply chain.

Nvidia will acquire Intel shares at $23.28 each and the two companies will collaborate on custom data-center and PC chips. These products will combine Intel’s x86 CPUs with Nvidia’s graphics and interconnect technologies, such as NVLink and RTX GPU chiplets.

In simple terms:

Importantly, NVIDIA is not moving its chip manufacturing to Intel yet. This is more about design and partnership than production. But geopolitically, it signals a stronger U.S. push to consolidate domestic semiconductor leadership.

For years, Intel’s processors were treated as basic connectors between GPUs and the rest of the system. With Nvidia now co-developing CPUs that plug directly into its GPUs, Intel’s chips move from a supporting role to a core driver of performance.If you control the world’s most entrenched ecosystem—Windows and x86—and suddenly those chips plug directly into Nvidia’s GPU mesh, you are no longer on the sidelines. Intel, long dismissed as lagging in the AI race, has been pulled back into the center of the conversation.

If you control the entrenched Windows and x86 ecosystem and can now integrate seamlessly into Nvidia’s GPU clusters, you are back in the game in a very real way. In the short run, this gives Intel fresh credibility with customers. Longer term, it plants seeds for Nvidia to eventually use Intel’s foundry as a second manufacturing source if TSMC capacity becomes strained or geopolitics intervene.Intel’s execution challenges remain, however. Its foundry division still has to prove it can scale efficiently.

For Nvidia, the partnership provides flexibility and reach. The company already has ARM-based Grace CPUs, but adding Intel’s x86 architecture broadens its appeal to enterprises that prefer to stick with familiar systems. This strengthens Nvidia’s grip on AI data centers and opens the door to new categories of AI PCs.The deal also helps Nvidia entrench NVLink as the standard interconnect, making its platform harder to dislodge. Political goodwill is another side benefit, as Nvidia shows alignment with U.S. industrial policy.

Still, risks remain. Nvidia must balance the Intel tie-up with its own CPU roadmap, and the deal does not resolve bottlenecks in advanced manufacturing or memory. It will remain heavily dependent on TSMC for leading-edge production and on SK Hynix and Micron for scarce high-bandwidth memory.

The bigger picture is that this partnership represents a form of U.S. technology consolidation. Intel, Nvidia, and the government are aligned in reinforcing domestic leadership at a time when China is rapidly developing its own AI chips.It is unlikely to stop at Intel, and other U.S. chipmakers could also be drawn into similar public–private partnerships as Washington deepens its commitment to securing semiconductor supply chains.

The deal’s impact extends far beyond Nvidia and Intel.

On the other side, AMD could lose relative share in CPUs and PC chips as Intel leverages Nvidia’s ecosystem. Smaller challengers without clear integration into the Nvidia–Intel world may also find it harder to compete.Arm also loses momentum. Cloud providers had been tempted by Arm’s efficiency pitch and the potential of Nvidia’s Grace CPUs. But with x86 systems now offering direct NVLink bandwidth and maintaining enterprise software compatibility, the incentive to shift workloads to Arm has weakened considerably.

For a curated list of stocks across the AI value chain, see Saxo’s AI stocks shortlist.

As with any large partnership, execution risk is significant. New CPUs and PC systems must be delivered on time and at competitive efficiency levels. Supply bottlenecks in HBM and advanced packaging remain tight, which could limit upside. Finally, the geopolitical backdrop is volatile: U.S. stakes in Intel and export restrictions on China mean regulatory or political developments could quickly affect sentiment.

This deal reshuffles the AI competitive landscape. Nvidia now extends its dominance into the CPU layer, Intel reclaims a meaningful seat at the AI table, AMD and Arm face strategic headwinds, and toolmakers like ASML, Synopsys, and Lasertec become even more indispensable.

The bottom line: Nvidia and Intel have redrawn the AI map. Investors should balance exposure between U.S. technology leaders and Asian supply chain enablers, with a tilt toward companies that profit regardless of who wins the CPU–GPU rivalry.

This material is marketing content and should not be regarded as investment advice. Trading financial instruments carries risks and historic performance is not a guarantee of future results. The instrument(s) referenced in this content may be issued by a partner, from whom Saxo receives promotional fees, payment or retrocessions. While Saxo may receive compensation from these partnerships, all content is created with the aim of providing clients with valuable information and options..

The pound headed for its biggest two-day drop since late July on Friday, while bond yields rose, after a surge in UK public borrowing and a Bank of England rate decision that laid bare the challenge for policymakers in balancing growth and inflation.

Official data on Friday showed public sector borrowing between April and August totalled 83.8 billion pounds ($113.39 billion), 11.4 billion pounds more than forecast by the Office for Budget Responsibility earlier this year.

The surge compounds the problem finance minister Rachel Reeves faces with her November budget, in which she had already been expected to announce new tax rises to stay on track to meet her fiscal rules and avoid unsettling financial markets.

"The pound has sunk on this data, and is testing support at $1.35, it is the second-worst performing currency in the G10 FX space today," XTB research director Kathleen Brooks said.

Sterlingfell 0.5% to $1.349. It has lost almost 1.1% in the last two days alone, the largest such decline since July 31.

The BoE left interest rates unchanged on Thursday as expected and opted to reduce the pace of its government bond sales to minimise the impact on the more volatile longer-dated section of the market.

With inflation running at nearly double the central bank's 2% target, the BoE has only limited scope to lower rates much more to help shore up the economy, where evidence is mounting of weakness in the labour market.

UK bond yields rose on Friday, with long-dated 30-year gilts (GB30YT=RR) up 4.3 basis points at 5.547%, pushing the premium over long-term borrowing costs in the United States to the highest in three years.

"A combination of gilt market stress and reversals on welfare reform has used up the thin margin for error in the government's current spending plans, meaning taxes will almost certainly need to rise if the fiscal rules are to be met," Matt Swannell, who is chief economic advisor to the EY ITEM Club, said.

Data on Friday showed retail sales rose by more than expected in August, thanks to sunny weather, although sales growth in July was revised down.

Yet this offered little comfort to bruised UK bonds or the currency.

A number of major retailers, including Primark owner Associated British Foodsand budget supermarket Aldi UK, have signalled concern about the outlook for consumer spending given upcoming tax rises and a deteriorating jobs market.

"This is yet another disappointing piece of economic news which will add to Chancellor Rachel Reeves's woes. But as we saw yesterday, the Bank of England dare not cut rates given that inflation is nearly double the official target of 2%, and likely to rise further," Trade Nation senior market analyst David Morrison said.

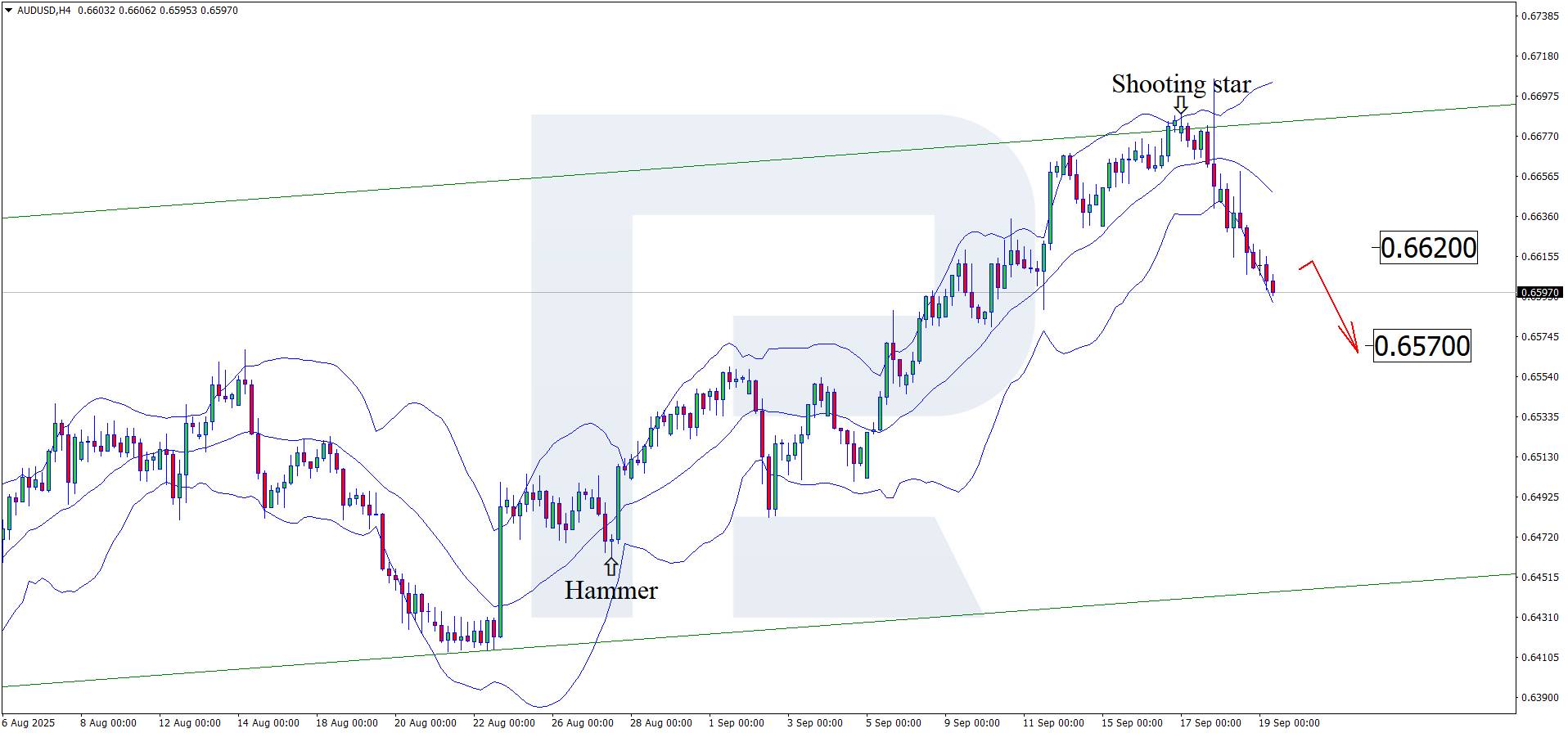

The Australian dollar keeps losing ground against the strengthening USD, with the AUDUSD pair potentially testing the 0.6570 level.

AUDUSD forecast: key trading points

Today’s AUDUSD forecast favours the US dollar, which is steadily regaining strength against the Aussie. The pair is trading near 0.6600 and remains under downward pressure.

Despite expectations for further Fed rate cuts, the USD found support from updated rate projections, which fuelled renewed dollar demand and weighed on the AUDUSD rate.

Australia’s August employment report showed a decline of 5.4 thousand jobs versus expectations of a 21.5 thousand increase. While the unemployment rate held steady at 4.2%, the drop in new jobs raised concerns, adding to pressure on the Australian dollar.

Australia’s economy continues to show resilience, underpinned by elevated inflation, lowering the chances of an RBA rate move at the September meeting.

For 19 September 2025, the outlook also accounts for developments in China, a critical factor for AUD performance. Australia’s demand remains highly dependent on the Chinese economy, particularly in the commodity sector, meaning Chinese news continues to indirectly impact the AUD.

On the H4 chart, the AUDUSD rate formed a Shooting Star reversal pattern after testing the upper Bollinger Band. The pair currently maintains its downward momentum, with the 0.6570 support level as the immediate target.

The AUDUSD forecast also takes into account an alternative scenario. Considering that quotes formed corrective waves in previous trading sessions, another pullback to the nearest resistance level at 0.6620 is possible before a decline.

The AUDUSD pair remains under pressure, with its dynamics shaped by US and Chinese news alongside signals from the RBA. AUDUSD technical analysis suggests a continued decline towards the 0.6570 support level, although a corrective bounce before the move lower cannot be ruled out.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up