Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Oct)

Japan Trade Balance (Customs Data) (SA) (Oct)A:--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q3)

Japan GDP Annualized QoQ Revised (Q3)A:--

F: --

China, Mainland Exports YoY (CNH) (Nov)

China, Mainland Exports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)--

F: --

P: --

Canada Leading Index MoM (Nov)

Canada Leading Index MoM (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

Mexico CPI YoY (Nov)

Mexico CPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

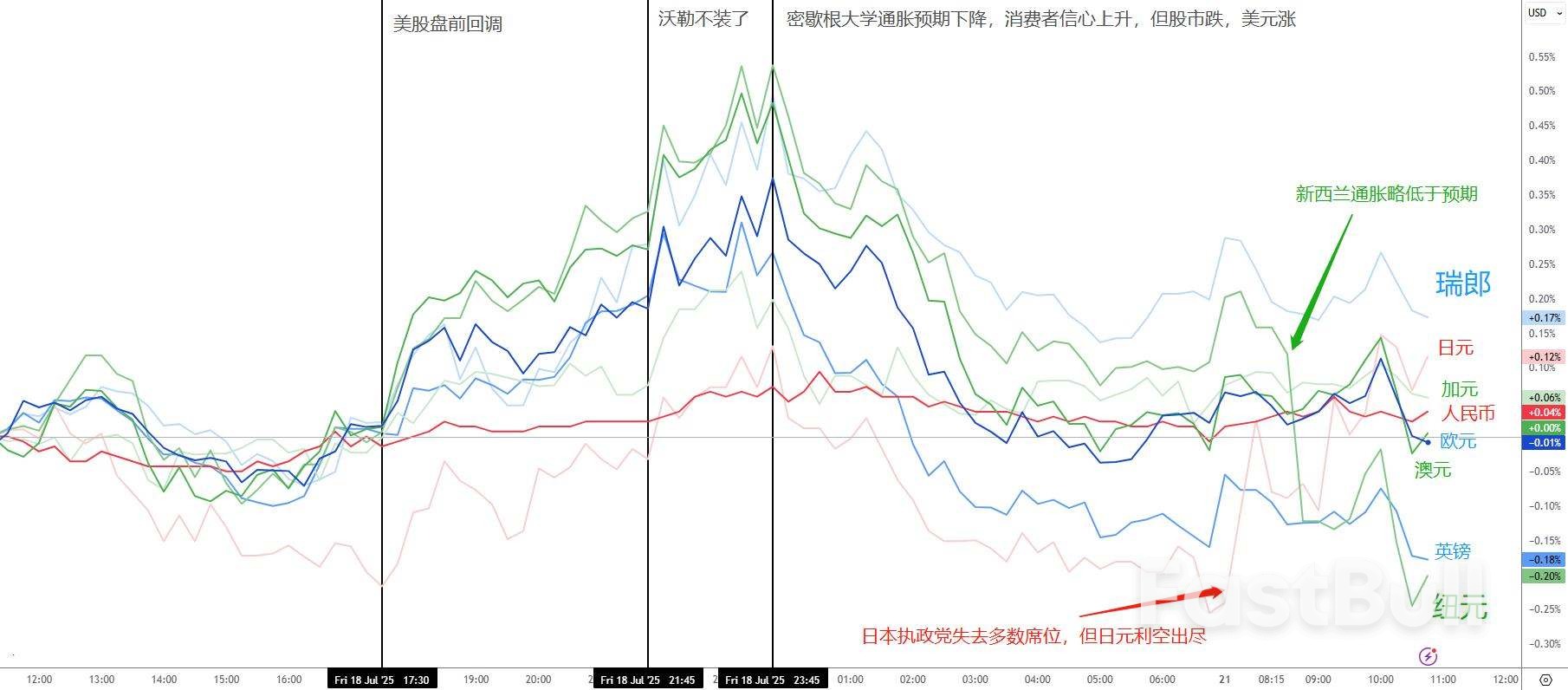

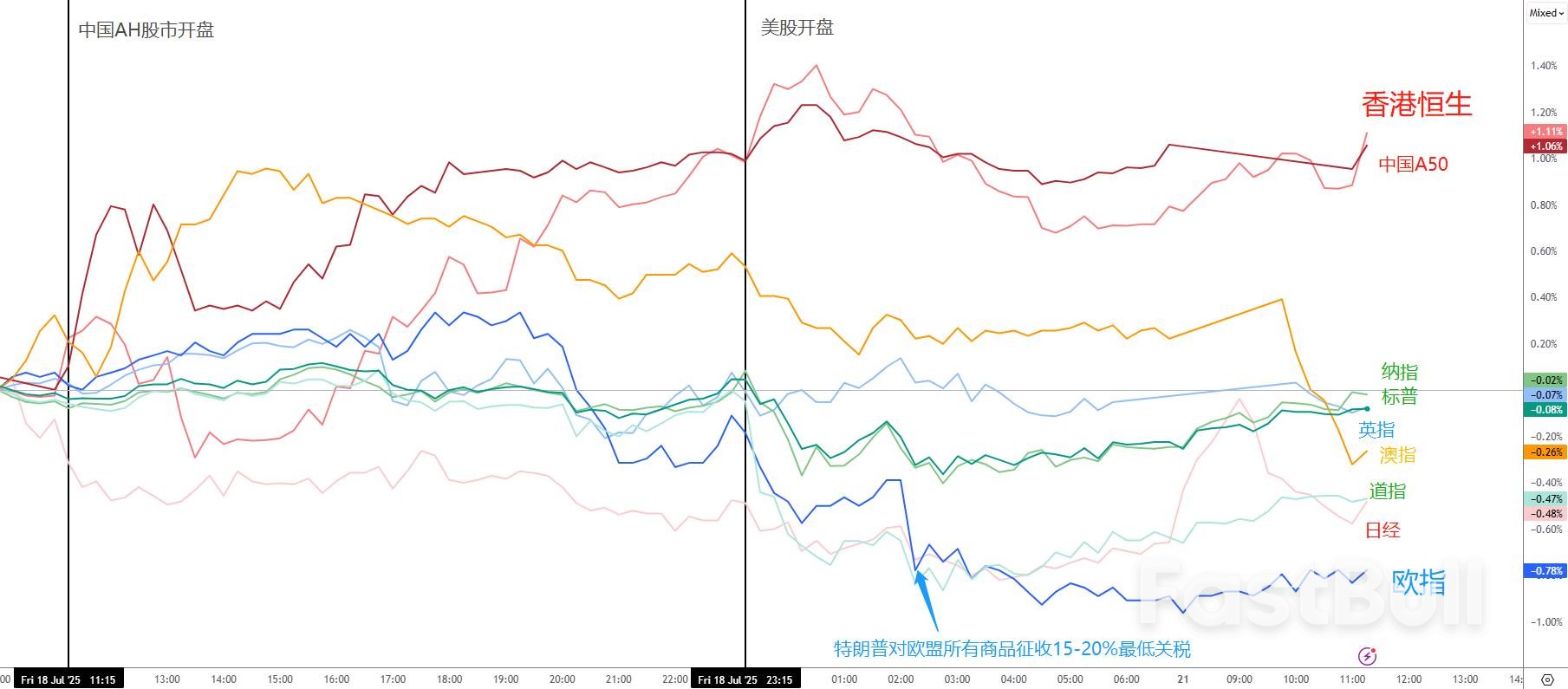

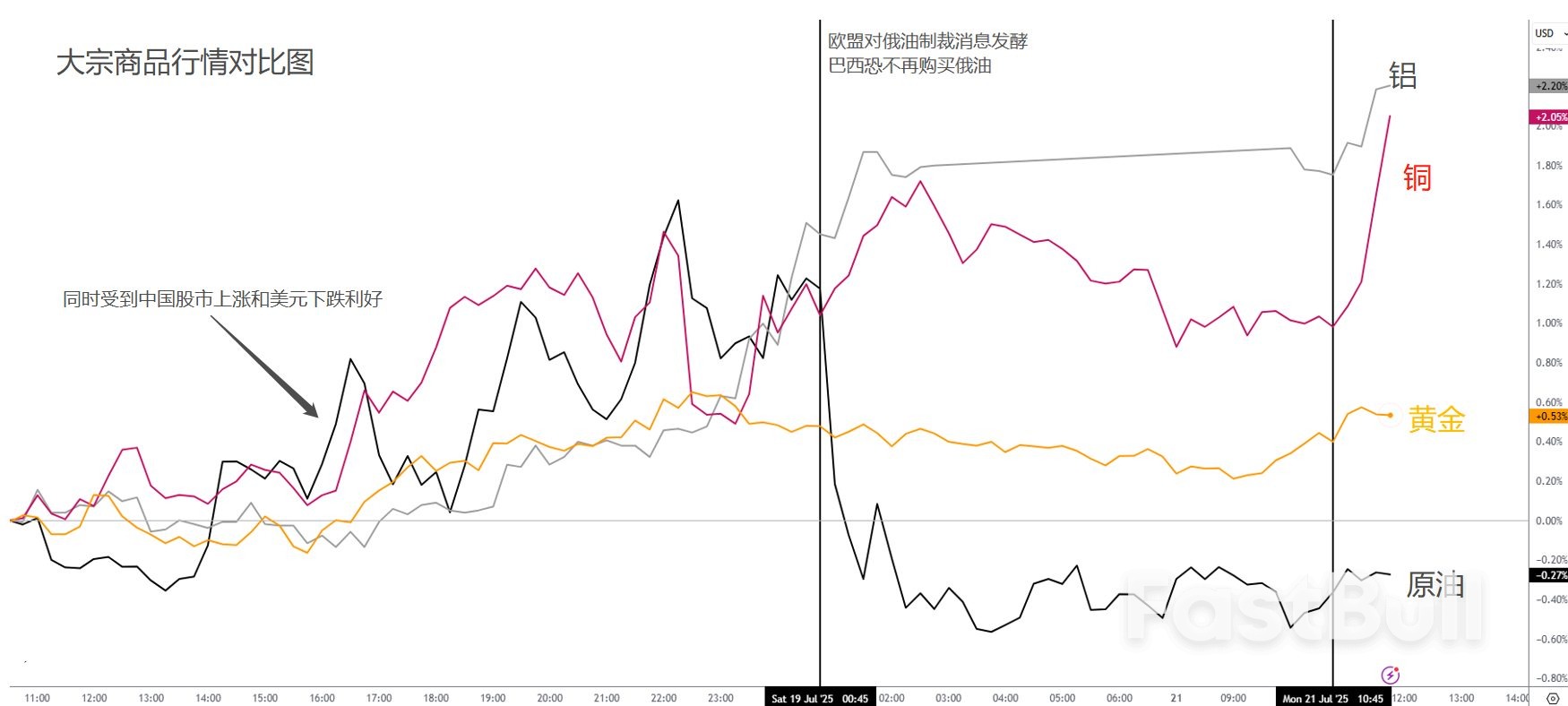

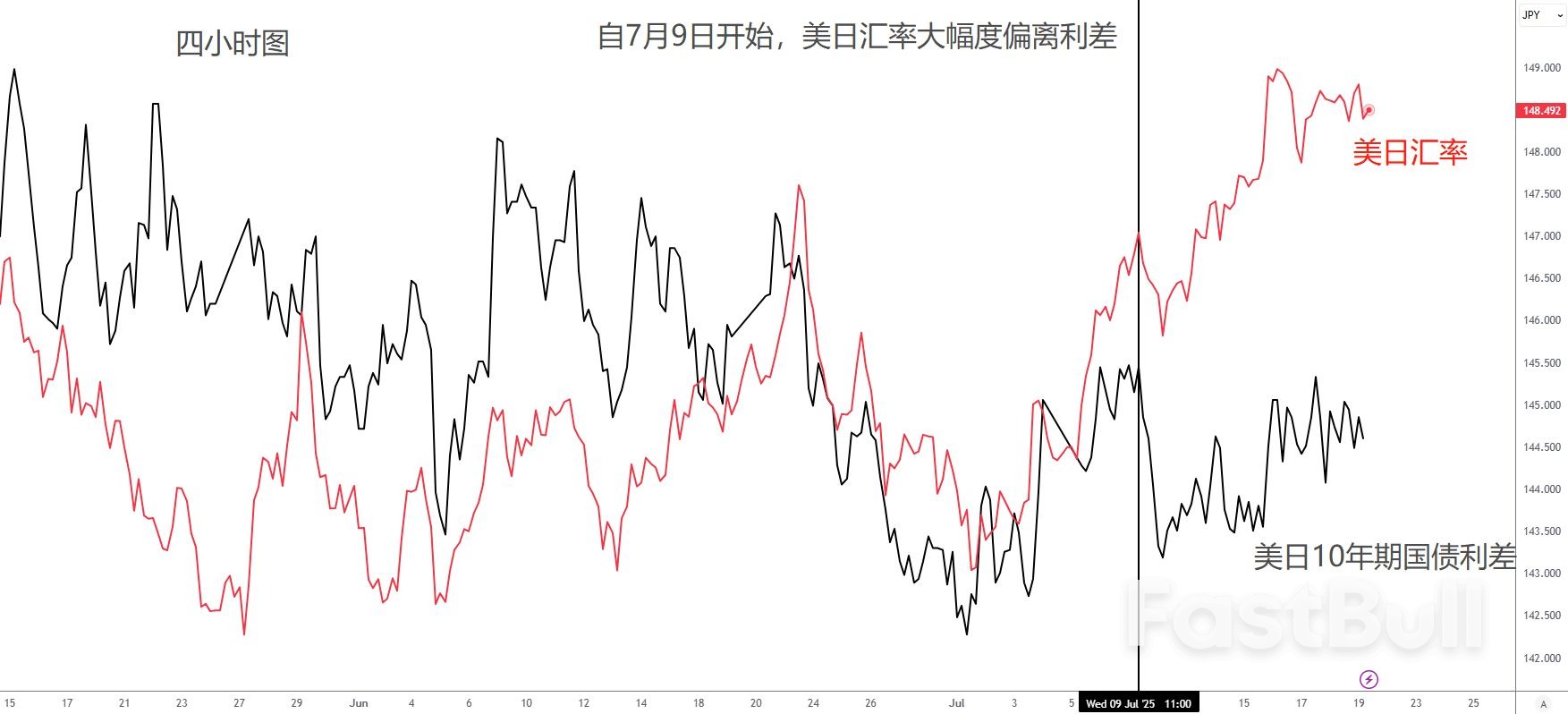

Trump still took action against the EU, and the 15-20% tariff on all goods caused a sharp drop in European stock markets, and the US dollar soared. China's A-share and H-share markets continued to perform strongly. Japan's ruling party lost its majority seats as expected, but the yen rose instead of falling.

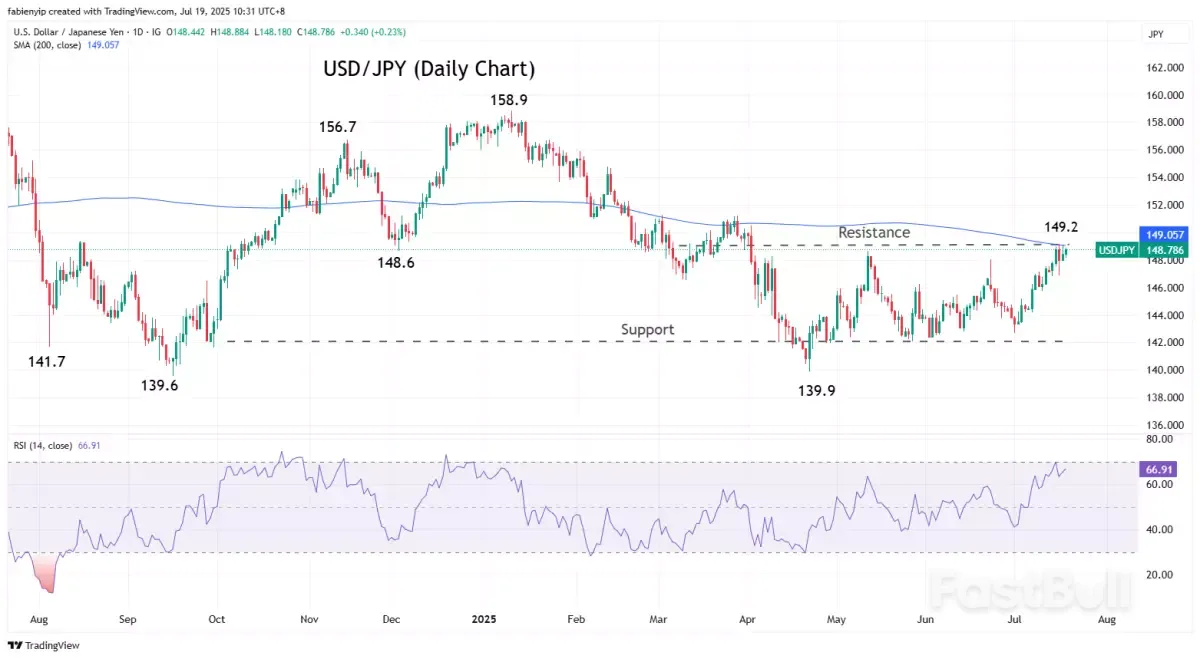

Japanese Prime Minister Shigeru Ishiba sought to buy time for his premiership following a second election setback in less than a year that leaves him in a weaker position to stave off opposition tax cut demands or secure a last-minute trade deal with the US.

“As we are the biggest party in parliament, I believe I must fulfill my responsibility to the nation and its people,” Ishiba said at a press conference held Monday after an election that left the ruling bloc three seats short of maintaining a majority in the upper house. Ishiba raised the US trade talks, inflation and an increasingly tense security environment as pressing issues that must not be left to stagnate due to political instability.

While Ishiba’s comments at the press conference showed his intention for now to soldier on with a minority in both houses, the prime minister remains in a vulnerable position and will likely need to find ways to shore up his leadership within the party. Ishiba is the first LDP leader running an administration without a coalition majority in either of the chambers since the party was established in 1955.

He acknowledged that debate would likely continue within the party about how to proceed moving forward and that he would respond to each development as it occurred.

Historical precedence is not on Ishiba’s side. The last three LDP premiers who lost a majority in the upper house all stepped down within two months of the result. Still, there is little immediate sign of clear appetite within the party to oust him for now, given the lack of an obvious candidate waiting in the wings that might give the LDP an immediate boost.

Ishiba said he had no plans to change around personnel in the administration, implying that there would be no cabinet reshuffle to try and turn around his fortunes.

Instead, Ishiba indicated he would be looking for talks with Donald Trump and tangible results on trade soon, as he continued to emphasize that negotiations should center on investment not tariffs. The deadline for higher across-the-board tariffs looms less than two weeks away. His top negotiator Ryosei Akazawa is set to depart on Monday for Washington to continue discussions with his US counterparts.

The visit appears to be a continuation of an existing tactic to secure as much face-time with US negotiators as possible. Akazawa has clocked up over 90,000 miles over seven visits to the US so far, with little to show in terms of progress.

“I do think that in terms of how the LDP thinks, the best way for Ishiba to go would have been to reach some sort of trade terms with the US tariff talks, but if Ishiba really has no intention to stand down, then that sort of deadline doesn’t matter,” said Yuri Kono, a professor of law at Hosei University who writes frequently on politics.

The election defeat will likely hamper Ishiba’s efforts to pursue domestic policy. With many of the key opposition parties running on a platform to cut the sales tax, Ishiba may well have to make concessions over tax cuts to push any of his policies through.

The main opposition Constitutional Democratic Party, which wants to exempt food from the sales tax for as many as two years, came in second place with 22 seats in the election. The populist Democratic Party for the People finished third with 17 seats, up from four earlier, after seeking a sales tax cut and more take-home pay.

Sanseito, a right-wing party that tapped anti-foreigner sentiment with a “Japanese First” message and wants to phase out the tax in stages, managed to secure 14 seats from just a single seat, winning the third most seats among opposition parties.

Ishiba will need to find ways to cooperate with the opposition and likely have to give some ground. Whether that extends to a temporary tax cut remains a key focus for market players concerned about Japan loosening its control of fiscal policy.

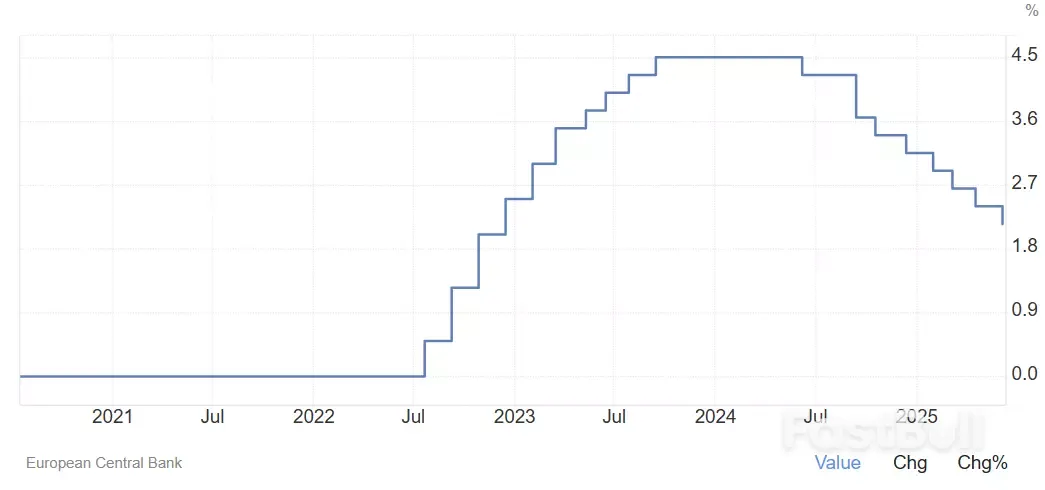

US Commerce Secretary Howard Lutnick said on Sunday that he was confident that the United States can secure a trade deal with the European Union (EU), but Aug 1 is a hard deadline for tariffs to kick in.

Lutnick said he had just got off the phone with European trade negotiators, and there was "plenty of room" for agreement.

"These are the two biggest trading partners in the world, talking to each other. We'll get a deal done. I am confident [that] we'll get a deal done," Lutnick said in an interview with CBS' "Face the Nation".

US President Donald Trump threatened on July 12 to impose a 30% tariff on imports from Mexico and the EU starting Aug 1, after weeks of negotiations with major US trading partners failed to reach a comprehensive trade deal.

Lutnick said that was a hard deadline.

"Nothing stops countries from talking to us after Aug 1, but they're going to start paying the tariffs on Aug 1," he said on CBS.

Trump announced the tariffs in a letter to European Commission president Ursula von der Leyen. He sent letters to other trading partners, including Mexico, Canada, Japan and Brazil, setting blanket tariff rates ranging from 20% to 50%, as well as a 50% tariff on copper.

Lutnick also said that he expects Trump to renegotiate the United States-Mexico-Canada Agreement (USMCA) signed during Trump's first White House term in 2017-2021.

Barring any major changes, USMCA-compliant goods from Mexico and Canada are exempt from tariffs.

"I think the president is absolutely going to renegotiate USMCA, but that's a year from today," Lutnick said.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up