Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

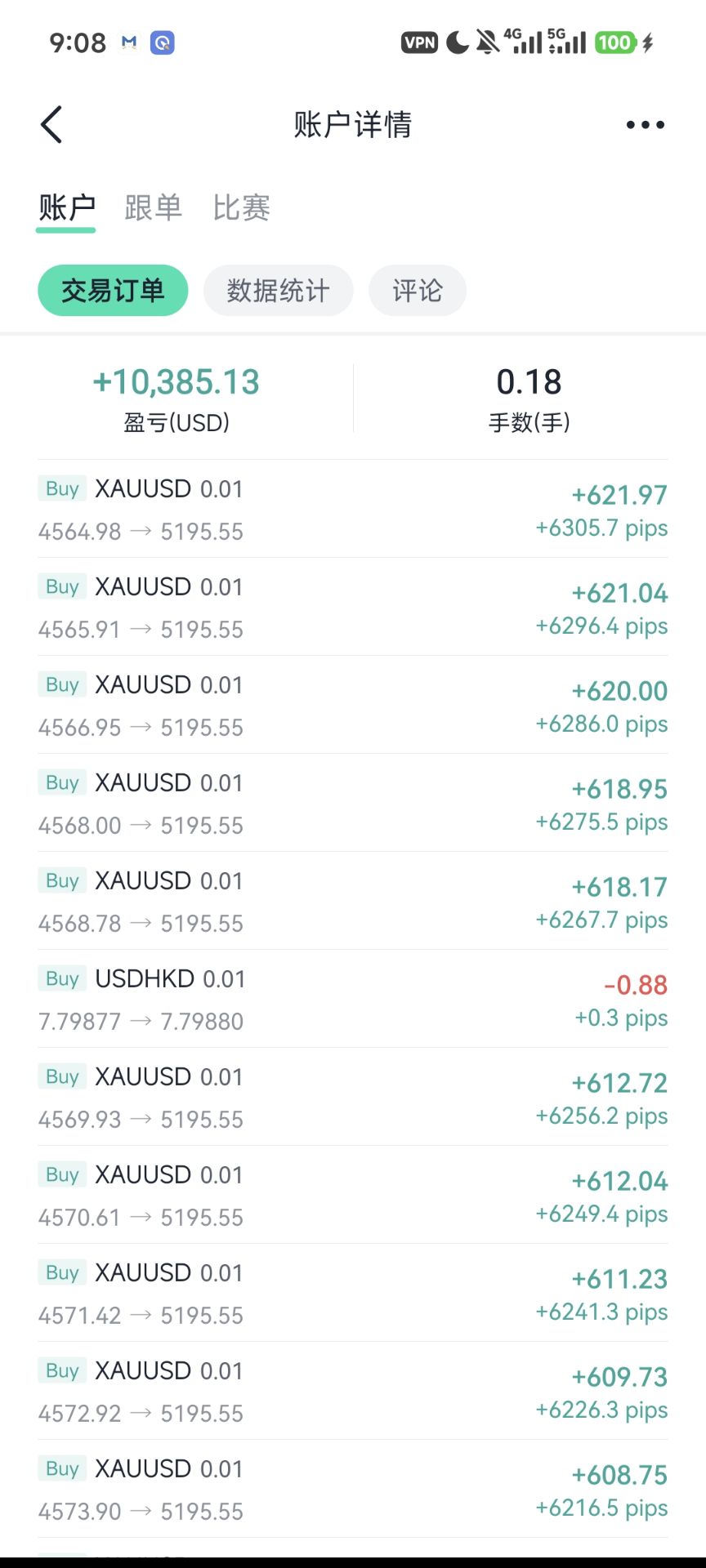

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Adrian Mer

ID: 4465924

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Is Shiba Inu dead? Explore the truth behind SHIB’s decline, market performance, developer updates, and 2025–2030 outlook to see if it’s really over.

The question is Shiba Inu dead has become common among crypto investors as SHIB’s price struggles in 2025. Once a meme-driven phenomenon, Shiba Inu now faces doubts about its long-term potential. This analysis explores SHIB’s fundamentals, community strength, and future outlook to determine if the token still has life left.

Shiba Inu (SHIB) is a decentralized meme token built on the Ethereum network, created in August 2020 as an experiment in community-driven cryptocurrency. While it started as a parody of Dogecoin, the token quickly evolved into a broader ecosystem with ShibaSwap, the Shibarium layer-2 solution, and companion tokens BONE and LEASH.

Despite early hype, some traders have recently asked whether is Shiba Inu dead or just evolving into a new phase. The project’s focus has shifted toward utility, with plans to expand decentralized finance (DeFi), gaming, and metaverse integrations. These efforts aim to prove that Shiba Inu is dead narratives overlook its ongoing ecosystem growth and developer engagement.

Fundamentally, SHIB’s longevity depends on sustained developer activity and meaningful adoption. The question “is Shiba Inu coin dead” resurfaces each market downturn, but its consistent community presence and active updates indicate it remains far from being a dead coin.

Since its launch, SHIB has experienced massive price volatility — from micro fractions of a cent to peaks that made early holders millionaires. After hitting all-time highs in 2021, the token retraced sharply, leading many to speculate is Shiba Inu dead 2024 or if recovery remains possible.

| Year | Average Price (USD) | Market Cap (Billion) | Key Highlights |

|---|---|---|---|

| 2021 | 0.000031 | $13.7 | All-time high fueled by Elon Musk tweets and community hype |

| 2022 | 0.000011 | $6.4 | Bear market correction, early Shibarium testing |

| 2023 | 0.000008 | $4.8 | Low volatility, fewer social spikes |

| 2025 | 0.000009 | $5.2 | Moderate rebound after Shibarium launch and token burns |

Despite lower trading volumes, SHIB remains among the top meme coins by market cap. On forums such as is Shiba Inu coin dead Reddit and crypto Twitter, discussions show both skepticism and renewed optimism. Long-term investors argue that consistent burn initiatives and ecosystem updates could spark gradual recovery through 2025.

The persistent debate around is Shiba Inu dead 2025 reflects broader sentiment in the crypto market: meme tokens must transition from hype to utility. If Shibarium adoption accelerates, SHIB may still have room to grow—proving that Shiba Inu coin is dead headlines are premature.

The narrative that Shiba Inu is dead has circulated across crypto communities since the token’s 2021 peak. After the hype cooled and prices dropped over 90%, many casual traders concluded is Shiba Inu coin dead was not just a question—but a belief. However, this perception stems more from market cycles and investor fatigue than from project failure.

These combined factors keep fueling the is Shiba Inu dead 2025 debate, even though the project continues to evolve quietly behind the scenes.

While some believe Shiba Inu coin is dead, on-chain data and developer activity tell a different story. SHIB’s ecosystem has expanded through Shibarium—a Layer-2 scaling solution improving transaction efficiency and reducing fees. These developments indicate that is Shiba Inu a dead coin may be a misconception rooted in short-term market pessimism rather than reality.

In 2026, SHIB’s price trajectory will depend largely on overall crypto sentiment and Shibarium adoption rates. Analysts estimate moderate growth if network usage and token burns continue steadily. Based on current trends, short-term forecasts suggest a price range of $0.000011 to $0.000016.

| Scenario | Expected Price Range (2026) | Key Triggers |

|---|---|---|

| Bearish | $0.000008 – $0.000010 | Low user adoption, reduced hype |

| Base Case | $0.000011 – $0.000013 | Steady token burns, mild growth |

| Bullish | $0.000014 – $0.000016 | Shibarium expansion, positive sentiment |

If these mid-term catalysts align, SHIB could defy “is Shiba Inu dead” narratives by regaining its meme-market influence.

Long-term forecasts for SHIB depend on sustained development, token scarcity, and mainstream adoption. Analysts tracking is Shiba Inu dead 2024 conversations note that meme coins with active ecosystems can outperform expectations when paired with strong communities.

| Scenario (2030) | Projected Price | Key Assumptions |

|---|---|---|

| Bearish | $0.000007 | Limited network usage, stagnant DeFi growth |

| Moderate | $0.000020 | Steady burn rate, organic adoption |

| Bullish | $0.000045 | Massive retail return, Layer-2 expansion success |

By 2030, if the Shibarium ecosystem matures and decentralized apps gain traction, SHIB could emerge stronger—transforming its identity from “a meme coin” to a sustainable asset. Therefore, while headlines ask is Shiba Inu coin dead, long-term indicators reveal a project still fighting to redefine its place in crypto’s next cycle.

The question is Shiba Inu dead often comes from investors wondering if SHIB can still offer returns amid a crowded meme coin market. While price volatility remains a concern, SHIB continues to hold a top position by market capitalization, signaling resilience rather than extinction. Investors should weigh long-term ecosystem development against short-term hype cycles before deciding.

| Advantages | Disadvantages |

|---|---|

|

|

SHIB may not return to its 2021 glory days quickly, but calling Shiba Inu coin is dead ignores its evolving fundamentals. Long-term investors who believe in the project’s roadmap and deflationary strategy might find 2025 a reasonable entry point, though risks remain high. Before investing, consider whether you view SHIB as a short-term trade or a long-term ecosystem bet.

There is no verified evidence that Elon Musk owns SHIB. Although Musk’s tweets about Dogecoin once boosted meme coin popularity, SHIB’s rise was primarily community-driven. Discussions on is Shiba Inu dead reddit often exaggerate his influence, but SHIB’s performance now depends on fundamentals, not celebrity speculation.

Reaching $1 is mathematically unlikely given SHIB’s enormous circulating supply. For such a price, its market cap would exceed the global economy. However, if the burn rate accelerates and adoption expands, smaller milestones (like $0.0001) could be achievable over time. Investors asking is Shiba Inu a dead coin should consider that even modest gains can yield significant percentage returns.

Historically, SHIB has shown strong rebound potential after major market dips. Analysts expect possible recovery if Shibarium continues to attract developers and new users. While short-term weakness sparks “is Shiba Inu coin dead” narratives, technical indicators and community engagement suggest the token still has room for gradual growth.

Yes. Despite market skepticism, SHIB’s ecosystem and long-term roadmap remain active. The token’s future hinges on developer execution, user adoption, and how effectively the team transitions from meme appeal to functional value. If these milestones are met, 2025–2030 could transform the question from “is Shiba Inu dead 2025” to “how far can SHIB rise next?”

In conclusion, the question is Shiba Inu dead reflects market fatigue more than project failure. While short-term volatility persists, SHIB’s strong community, active development, and gradual utility growth prove it’s far from a dead coin. Its long-term survival depends on continued innovation and sustained adoption within the evolving crypto landscape.

Keir Starmer's Labour Party slumped to its lowest rating on record, according to a YouGov poll that underscored the increasing danger the governing outfit faces on the left from the insurgent Greens.

Just 17% of Britons said they would vote for Labour if an election were held tomorrow, according to the poll published Tuesday. Nigel Farage's right-wing Reform UK led on 27%, while in another record since YouGov's data series began in 2001, the Green Party logged 16%, its highest ever. The Conservatives were level with Labour on 17%, with the Liberal Democrats on 15%.

With five parties on at least 15% support, the survey highlights the UK's increasingly fractured political landscape. And while Starmer doesn't need to call a fresh general election until mid-2029, it lays bare the threat Labour faces in all directions, with a round of local ballots looming in May that some in the governing party say could be existential to Starmer's leadership.

Since Reform dominated this year's local elections in May, Starmer has sought to blunt the threat posed by the populist outfit with tough rhetoric on migration. But the rise of the Greens under Zack Polanski — who has presented himself as the left's populist answer to Farage, with a clear message on taxing the wealthy and an effective social media strategy — shows that Labour risks losing votes to the left as well.

That threat was also in evidence last week when Labour lost a by-election for the Welsh Senedd seat in Caerphilly to the left-wing Welsh nationalists of Plaid Cymru, with Reform in second. Labour had not lost an election in Caerphilly for either the Senedd in Cardiff or the UK Parliament in Westminster in more than a century.

Even Plaid acknowledged that they had benefited from tactical voting in Caerphilly by voters who wanted to keep Reform out. The challenge now for Starmer is to persuade left-leaning voters that it's Labour they need to rally around as the alternative to Reform, which has led national polling since April.

The growing interest in emerging cryptocurrencies has turned investor attention to spx6900 price prediction. This analysis explores SPX6900’s fundamentals, market behavior, and expert forecasts to assess its short- and long-term potential. Whether you plan to buy or hold, understanding its trajectory helps make smarter crypto investment decisions.

SPX6900 is a next-generation cryptocurrency designed to combine scalability, transparency, and efficient transaction processing. It serves as both a utility and governance token within its native ecosystem, allowing holders to participate in staking and decision-making. Analysts believe that its strong fundamentals form a solid base for long-term growth and accurate spx6900 price prediction models.

The SPX6900 network operates on a high-performance blockchain framework with smart contract support and enhanced energy efficiency. Its tokenomics include a limited total supply, periodic burns, and reward-based incentives for validators. Such fundamentals provide the technical foundation for mid- and long-term forecasts like spx6900 price prediction 2025 and spx6900 price prediction 2030.

| Feature | Details |

|---|---|

| Consensus Mechanism | Proof-of-Stake (PoS) |

| Total Supply | 1 Billion SPX6900 |

| Burn Policy | Quarterly deflationary burn events |

| Smart Contract Compatibility | EVM-Compatible |

SPX6900 has gained attention for its growing trading volume, listings on major exchanges, and active social community. Investors are particularly intrigued by its potential to deliver consistent returns as adoption expands. Many forecasts for price prediction spx6900 emphasize strong network engagement, real-world utility, and partnerships that could drive the token’s next growth cycle. These factors shape both near-term momentum and long-term spx6900 coin price prediction scenarios.

As of late 2025, SPX6900 trades in a moderately volatile range, reflecting both speculative activity and emerging utility adoption. While broader crypto markets remain cautious, SPX6900 has maintained a steady position among mid-cap altcoins. Analysts following spx6900 price prediction trends note that investor interest is supported by consistent daily trading volume and gradual liquidity growth.

| Metric | Value (Q4 2025) | Trend |

|---|---|---|

| Current Price | $1.28 | Stable |

| 24h Trading Volume | $42.5 Million | Increasing |

| Market Capitalization | $960 Million | Growing |

| Circulating Supply | 750 Million SPX6900 | — |

The token’s market cap growth throughout 2025 reflects investor confidence in its fundamentals and upcoming development milestones. For those assessing spx6900 coin price prediction potential, its steady trading activity suggests room for further expansion if overall crypto sentiment improves.

From 2023 to 2025, SPX6900 experienced significant price fluctuations aligned with broader market cycles. After its initial listing, it saw rapid appreciation during early adoption, followed by corrections as liquidity stabilized. Analysts reviewing spx6900 price prediction 2025 emphasize that historical volatility patterns can help project future support and resistance zones.

| Year | Average Price | Yearly High | Yearly Low | Market Sentiment |

|---|---|---|---|---|

| 2023 | $0.65 | $0.98 | $0.42 | Speculative |

| 2024 | $1.02 | $1.40 | $0.76 | Optimistic |

| 2025 | $1.25 | $1.48 | $1.05 | Stable |

This three-year trajectory indicates that SPX6900 is transitioning from a speculative token into a more utility-driven asset. The data also provides valuable context for mid- and long-term analyses such as price prediction spx6900 and spx6900 price prediction 2030, helping investors better understand cyclical behavior within the crypto market.

Several elements shape the performance and future of SPX6900 in the crypto market. Analysts evaluating spx6900 price prediction models emphasize that price movements are not only driven by trading volume but also by technical upgrades, tokenomics, and market sentiment. Broader crypto trends—particularly Bitcoin’s price cycles—also affect SPX6900’s liquidity and investor confidence.

| Category | Positive Impact | Negative Impact |

|---|---|---|

| Technology | Smart contract upgrades and reduced fees | Delayed development roadmap |

| Adoption | New DeFi integrations and exchange listings | Limited real-world utility |

| Market Conditions | Crypto bull phase and investor optimism | Macroeconomic tightening, low risk appetite |

The interplay of these factors will likely determine the next wave of investor demand and potential upside for price prediction for spx6900 across short- and long-term horizons.

Market data in late 2025 shows a balance between profit-taking and accumulation. Social metrics reveal moderate growth on Reddit and X (Twitter), with traders speculating on future breakouts. Discussions around spx6900 coin price prediction often reference the token’s resilience during broader market corrections.

| Quarter | Avg. Volume ($M) | Sentiment (Reddit/X) | Trend |

|---|---|---|---|

| Q1 2025 | 38.5 | Optimistic | ↑ |

| Q2 2025 | 45.2 | Neutral | → |

| Q3 2025 | 32.1 | Bearish | ↓ |

| Q4 2025 | 47.8 | Bullish | ↑ |

Despite short-term fluctuations, consistent trading activity and active community discussions suggest SPX6900 retains investor interest. Such sentiment patterns are often early indicators for the next upward trend in spx6900 price prediction 2025 analyses.

Analysts project that SPX6900 could maintain steady growth through early 2026 as market conditions stabilize. Factors such as increasing staking participation, upcoming platform partnerships, and exchange liquidity improvements could support mild appreciation. Based on current modeling, conservative price prediction spx6900 estimates place the token between $1.30 and $1.55 by mid-2026.

| Scenario (2026) | Expected Range | Key Drivers |

|---|---|---|

| Bearish | $1.05 – $1.25 | Low volume, weak sentiment |

| Base Case | $1.30 – $1.55 | Gradual recovery, steady adoption |

| Bullish | $1.60 – $1.85 | Broader crypto rally, high engagement |

Over the long run, spx6900 price prediction 2030 models depend heavily on continued adoption and ecosystem expansion. If SPX6900 successfully scales its network and secures institutional support, the token could outperform its current valuation range. However, macroeconomic cycles and regulatory outcomes remain potential headwinds.

| Year | Conservative | Moderate | Bullish |

|---|---|---|---|

| 2026 | $1.25 | $1.55 | $1.85 |

| 2028 | $1.70 | $2.10 | $2.60 |

| 2030 | $1.95 | $2.45 | $3.10 |

By 2030, if current momentum persists, SPX6900 could achieve new highs within the altcoin market segment. Still, investors should evaluate both opportunity and volatility before acting on any spx6900 price prediction model or forecast.

Before acting on any spx6900 price prediction, investors should evaluate both advantages and risks. SPX6900’s strong fundamentals and growing visibility make it attractive to long-term holders, but volatility remains a key consideration for new entrants.

| Aspect | Pros | Cons |

|---|---|---|

| Growth Potential | High upside during bull cycles | Unproven stability over time |

| Technology | Scalable blockchain with DeFi compatibility | Network updates still in testing phase |

| Adoption | More exchange listings expected | Low institutional demand |

| Market Sentiment | Active community and trader engagement | Short-term hype fluctuations |

Overall, SPX6900 suits investors comfortable with moderate risk and mid- to long-term positioning. Those tracking spx6900 price prediction 2030 scenarios should monitor upcoming development milestones and regulatory changes.

Purchasing SPX6900 is simple for users familiar with major cryptocurrency exchanges. The following guide helps you buy safely and effectively while keeping future price prediction for spx6900 opportunities in mind.

This straightforward process allows investors to enter the market strategically, aligning their portfolio decisions with current and future spx6900 coin price prediction trends.

Based on current spx6900 price prediction 2025 analyses, SPX6900 could reach the $1.60–$1.85 range under bullish conditions. By 2030, optimistic projections estimate potential highs near $3, depending on overall crypto market recovery and network adoption.

Yes. With a growing user base, ongoing ecosystem expansion, and scalable architecture, SPX6900 shows long-term potential. Many experts view it as a sustainable project rather than a short-lived trend, making it relevant for ongoing price prediction spx6900 discussions.

For investors comfortable with medium risk, SPX6900 can be a promising option. Those seeking diversification within emerging altcoins often include it in their portfolios, aligning with moderate spx6900 price prediction 2030 expectations of steady growth.

Like all cryptocurrencies, SPX6900 carries volatility, liquidity, and regulatory risks. Market downturns, exchange delistings, or delayed updates could affect price performance. It’s essential to track real-time data and revised spx6900 price prediction models before investing.

In conclusion, spx6900 price prediction points toward moderate but steady growth, supported by strong fundamentals and community engagement. While short-term volatility remains likely, long-term prospects through 2030 appear promising. Investors should stay updated on market trends, project milestones, and adoption rates before making any final investment decisions.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up