Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

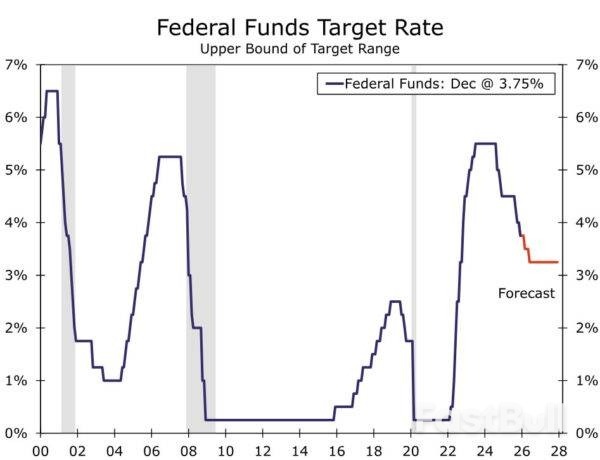

As expected, the FOMC reduced the fed funds target range by 25 bps to 3.50%-3.75% and signaled that additional easing will face a higher bar at its next meeting on January 28.

As expected, the FOMC reduced the fed funds target range by 25 bps to 3.50%-3.75% at the conclusion of its December meeting. As was also anticipated, the decision was not unanimous. Three voting members did not support the policy decision, with dissents registered in both a more hawkish and dovish direction. Specifically, Governor Miran dissented in favor of a steeper, 50 bps cut, while Presidents Schmid (Kansas City) and Goolsbee (Chicago) dissented in favor in keeping the policy rate unchanged.

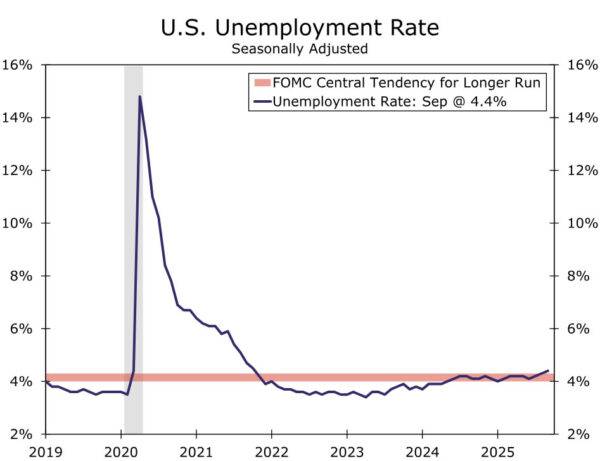

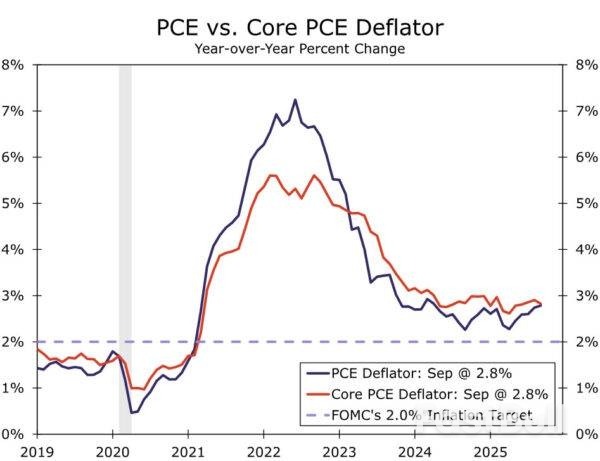

The dispersed views on the best course of action reflect the tricky environment the FOMC finds itself in. The FOMC did not have several key readings on the economy as originally scheduled due to the government shutdown (e.g., Q3 GDP, Oct. & Nov. Employment Situation and CPI, etc.). But, the latest data available continue to indicate some tension in the Committee's employment and inflation mandates (Figures 1 & 2).

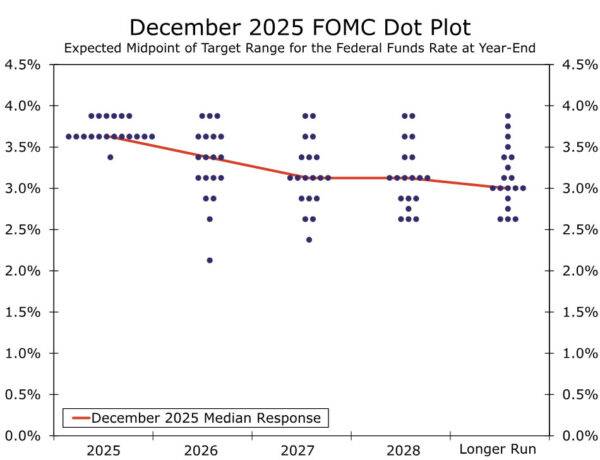

With 75 bps of cuts since September and policy not as clearly restrictive, the bar for additional easing has been raised. In the post meeting statement, the Committee gave itself more optionality around future cuts, saying that "In considering the extent and timing of additional adjustments to the target range…", with the emphasized text new to the statement. The suggestion that the FOMC will not be so ready to cut rates again in the near term likely helped to limit the number of hawkish dissents.

The Summary of Economic Projections did signal some broader unease among the Committee besides the two hawkish dissents. The dot plot revealed that six participants in total did not favor reducing the policy rate at today's meeting, implying four non-voting regional presidents also preferred to hold the policy rate steady. Nonetheless, a bias toward further easing persists among the Committee. The median dot for year-end 2026 and 2027 remained at 3.375% and 3.125%, respectively. The longer-run median was unchanged at 3.00%, with the dot plot illustrating that all but two participants see the current policy rate at least somewhat restrictive.

The biggest change to the SEP was a major upward revision to the 2026 growth outlook, with the median projection rising from 1.8% to 2.3%. Some of this change likely reflects the government shutdown, with Q4-2025 real GDP growth expected to see a material drag, setting the economy up for a bounce-back in Q4-2026. That said, this dynamic cannot fully explain the change, and it puts the median FOMC participant closer to our above-consensus forecast of 2.5% real GDP growth next year. Elsewhere, the changes generally were smaller, with some modest downward revisions to the inflation forecasts next year, and no change to the median longer run projections for the real GDP growth and the unemployment rate.

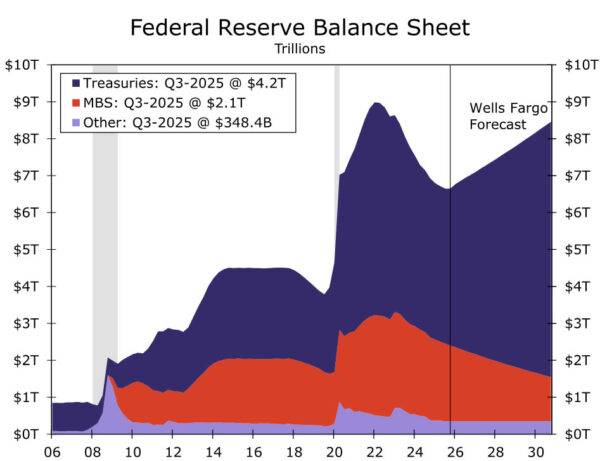

The Federal Reserve also announced that it will begin growing its balance sheet again in the coming days through the purchase of Treasury bills. As we have discussed previously, these purchases are meant to maintain short-term interest rate control, keep bank reserves ample and ensure the smooth functioning of financial markets. Fed officials have been clear for months that this step in no way represents a change in the stance of monetary policy. We agree with this assessment, and the beginning of reserve management purchases (RMPs) will have no bearing on our view of the stance of monetary policy.

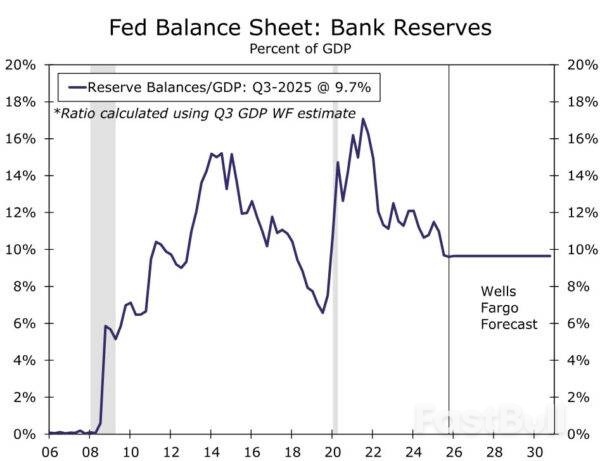

Specifically, the central bank announced that RMPs will begin on December 12 with an initial pace of $40 billion for the month. The post-meeting guidance stated that "the pace of RMPs will remain elevated for a few months to offset expected large increases in non-reserve liabilities in April. After that, the pace of total purchases will likely be significantly reduced in line with expected seasonal patterns in Federal Reserve liabilities." Our working assumption has been that the medium term, "equilibrium" pace of RMPs will be $25 billion per month to keep bank reserves ample. We read the above guidance as indicating that RMPs will downshift to roughly this pace starting in the spring. If realized, the Fed's balance sheet will grow by roughly $370 billion in 2026, and the reserve-to-GDP ratio will be 9.7% at the end of next year, comfortably above the lows in September 2019 when repo markets blew up (Figure 6).

Our base case remains that the current easing cycle is not over yet but rather that it is entering a slower phase. While the labor market is far from collapsing, the softening in conditions to the wrong side of "maximum employment" supports policy returning to a more neutral position. Directional progress on inflation next year should resume as the initial lift from tariffs fade, which would reduce the tension between the FOMC's employment and inflation mandate. We continue to look for two 25 bps rate cuts next year at the March and June meetings. Next week's economic data, specifically the "one and a half" employment report on Tuesday and the November CPI on Thursday, will be key to the outlook. We will have reports out previewing these data releases in the coming days.

Oil prices were broadly stable on Thursday as investors shifted their focus back to Russia-Ukraine peace talks while watching for any fallout from a U.S. seizure of a sanctioned tanker off the coast of Venezuela.

Brent crude futures dipped 5 cents, or 0.08%, to $62.16 a barrel at 0400 GMT, while U.S. West Texas Intermediate crude was down 1 cent, or 0.02%, at $58.45 a barrel.

The benchmarks settled higher a day earlier after the U.S. said it seized an oil tanker off the coast of Venezuela, as escalating tensions between the two countries raised concerns about supply disruptions.

"So far, the seizure has not trickled down to the market, but further escalation will impose heavy crude price volatility," said Emril Jamil, a senior oil analyst at LSEG.

"The market remains in limbo, eyeing the Russian-Ukraine peace deal progress."

On Wednesday, U.S. President Donald Trump said "we've just seized a tanker on the coast of Venezuela, large tanker, very large, largest one ever, actually, and other things are happening."

Trump administration officials did not name the vessel. British maritime risk management group Vanguard said the tanker, Skipper, was believed to have been seized off Venezuela.

Traders and industry sources said Asian buyers are demanding steep discounts on Venezuelan crude, pressured by a surge of sanctioned oil from Russia and Iran and heightened loading risks in the South American country as the U.S. boosts its military presence in the Caribbean.

Investors were more focused on developments in Russia-Ukraine peace talks. The leaders of Britain, France and Germany held a call with Trump to discuss Washington's latest peace efforts to end the war in Ukraine, in what they said was a "critical moment" in the process.

Reports of Ukraine striking a vessel from Russia's shadow fleet lent support to prices for now, IG market analyst Tony Sycamore said in a note.

"These developments are likely to keep crude oil above our key $55 support level into year-end, barring an unexpected peace deal in Ukraine," Sycamore said.

In other news, a sharply divided Federal Reserve reduced its benchmark interest rate. Lower rates can reduce consumer borrowing costs and boost economic growth and oil demand.

Meanwhile, a drawdown in U.S. crude inventories also lent support to prices even though the drop was milder than expected.

Crude inventories fell by 1.8 million barrels to 425.7 million barrels in the week ended December 5, the Energy Information Administration said in its weekly Petroleum Status Report, compared with analysts' expectations in a Reuters poll for a draw of 2.3 million barrels.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up