Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Euro Zone M3 Money Supply YoY (Dec)

Euro Zone M3 Money Supply YoY (Dec)--

F: --

P: --

Euro Zone 3-Month M3 Money Supply YoY (Dec)

Euro Zone 3-Month M3 Money Supply YoY (Dec)--

F: --

P: --

South Africa PPI YoY (Dec)

South Africa PPI YoY (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

In the euro area, flash PMIs for January are set for release. In December, both services and manufacturing PMIs declined but from levels that still suggest quite modest growth in the final quarter of the year.

In the euro area, flash PMIs for January are set for release. In December, both services and manufacturing PMIs declined but from levels that still suggest quite modest growth in the final quarter of the year. We expect that growth momentum continued into January, with PMIs little changed compared to December, aligning closely with consensus. Specifically, we forecast the PMI composite to come in at 51.6 (cons: 51.8, prior: 51.5), PMI manufacturing at 49.0 (cons: 49.1, prior: 48.8), and PMI services at 52.4 (cons: 52.6, prior: 52.4).

In Sweden, focus turns to the Labour Force Survey (LFS) unemployment figures for December and the fourth quarter. Indicators for the labour market have shown clear signs of improvement, but the official LFS data is lagging. Unemployment, as measured by Sweden's public unemployment agency, has improved, as well as indicators for labour demand. However, our assessment is that the Public Employment Service's statistics are once again leading the way for the LFS, just as they did after the pandemic. Our forecast for the LFS unemployment is 8.7% SA and 8.2% NSA.

What happened overnight

In Japan, as widely expected, the Bank of Japan kept the overnight call rate at 0.75% following the recent hike in December. The new outlook report reveals a hawkish bias, as the central bank has revised its core inflation expectations somewhat higher across the forecast horizon running until 2027. The market reaction has been very muted. Further fiscal stimulus looks inevitable, as election campaigns have been kicked off with VAT cut promises from all major players. This has propelled Japanese government bonds higher at fast pace, and a still weaker yen is threatening to exacerbate inflation problems. Overnight data shows December core inflation declined slightly to 2.9%, while PMIs indicate a strong start to the year in both service and manufacturing, bringing composite PMI to 52.8 in January, the highest level in 17 months. We will listen in to the press conference later this morning for potential more hawkish tunes.

What happened yesterday

In the euro area, the ECB minutes from the December meeting revealed no major new insights, with most members viewing inflation risks as two-sided. Overall, while the ECB is in a solid position from a monetary policy perspective, the stance was not considered static. The softening of downside risks since September supports the view that maintaining current interest rates represented a solid path under the baseline outlook. An extended period of steady rates appears likely, assuming December inflation projections for both headline and core figures materialise.

Additionally, January consumer confidence improved more than expected to -12.4 (cons: -13.0, prior: -13.2). While the improvement is encouraging for the economic outlook, as consumption is expected to drive growth this year, the historically low level calls for caution in overinterpreting this trend.

In Norway, Norges Bank's interim meeting unfolded as expected, with the policy rate remaining unchanged at 4.00% and no new signals on future policy direction. We still expect the third 25bp rate cut to come in June and pencil in four quarterly cuts from June 2026 to March 2027. The market reaction upon announcement was non-existent.

In Denmark, consumer confidence rose for the second consecutive month in January to -13.4 from -17.3, marking the highest level in a year. The improvement was driven by better perceptions of personal finances and a more optimistic view of the national economy. This progress is surprising given recent concerns over Trump's interest in Greenland, which caused significant economic worry a year ago. However, confidence remains negative, with expectations of worsening personal and national finances over the coming year.

In the Ukraine war, President Zelenskiy announced after 'positive' talks with President Trump in Davos that security guarantees for Ukraine have been finalised. However, the critical territorial dispute with Russia remains unresolved – a key point for Kremlin. Diplomatic efforts continue with upcoming trilateral peace talks in Abu Dhabi today and Saturday.

In the Greenland debate, no significant new details surfaced about the NATO-brokered framework that led to Trump's U-turn on Wednesday. At an extraordinary summit, EU leaders stressed 'respect' in transatlantic relations, with Denmark reiterating Greenland's sovereignty as a red line. However, they voiced concerns over Europe's reliance on the US and the broader implications of the deal.

Equities: Global equities moved higher yesterday across regions and sectors, led by cyclicals in what still looks like a geopolitical relief trade. Notably, small caps once again outperformed large caps. Year-to-date, small caps are now roughly 6% ahead of large caps after just the first three weeks of the year. Worth highlighting that this comes in a week when equities overall are still marginally lower, yet small caps stand out as the best-performing style. There is a strong underlying signal in the ongoing rotations, across sectors, regions, and particularly in style allocation preferences. In the US yesterday, Dow +0.6%, S&P 500 +0.6%, Nasdaq +0.9%, Russell 2000 +0.8%. This morning, Asian equities are higher. European futures are marginally lower, while US futures are marginally higher.

FI and FX: As we enter the final session of an eventful week the "Sell US"-theme has gotten increased traction with general EM, Scandies and Antipodeans being the clear winners while the greenback has continued to trade on the backfoot. EUR/USD has decoupled from short-end rate spreads and is on track for its best week since August. The JPY has also had a rough week amid focus on the upcoming elections, the likelihood of considerably more expansionary fiscal policy and subsequently higher yields. This morning Bank of Japan stayed put but lifted its inflation forecast underpinning expectations that the central bank is far from done in its hiking cycle. The general underperformance of Japanese fixed income has also impacted global markets this week with Japanese investor flight weighing on long duration portfolios. Finally, precious metals continue to rally while European natural gas prices have hit the highest level in almost a year amid cold weather and market concerns as to the potential geopolitical vulnerability of US LNG exports.

Chinese President Xi Jinping has extended congratulations to To Lam following his re-election as general secretary of Vietnam's ruling Communist Party. The message underscores the intricate relationship between the two nations, which Xi described as a "community with a shared future."

In a congratulatory note sent on Friday, Xi lauded Vietnam for achieving "remarkable results" in its socialist development and reforms, according to Chinese state news agency Xinhua. He also acknowledged the country's growing international influence.

China and Vietnam are among the world's few remaining states governed by communist parties. Xi's message emphasized their shared political identity, referring to them as "friendly socialist neighbours."

Xi stated that he places high value on the relationship between the two countries and their respective parties. He expressed a willingness to work with Lam to enhance strategic communication, promote their traditional friendship, and advance the socialist cause, contributing to regional and global stability.

To Lam secured his leadership position for another five years after a unanimous vote by the party's central committee on Friday.

Despite the official warmth between their ruling parties, the two neighbors have a long history of mistrust and ongoing territorial disputes. These conflicts notably include competing claims over islands and waters in the South China Sea.

This complex backdrop makes high-level communication a critical component of managing the relationship and preventing disputes from escalating.

Beyond politics, economic ties form a crucial pillar of the China-Vietnam relationship. China stands as Vietnam's largest trading partner and serves as a vital source of materials and equipment for the Southeast Asian nation's manufacturing industries.

The importance of this economic partnership was highlighted during Xi's visit to Vietnam last April. At a time when both countries were impacted by U.S. tariffs, Xi called for strengthening trade connections and securing supply chains.

The Japanese yen spiked dramatically on Friday after Bank of Japan (BOJ) signals sent short-term government bond yields to their highest level in three decades. The currency initially slid past 159 per dollar before abruptly reversing course, showcasing extreme market tension.

The whiplash move saw the yen jump from around 159.2 to as strong as 157.3 against the dollar in just a few minutes. This sudden strength came shortly after BOJ Governor Kazuo Ueda’s press conference concluded, catching many traders off guard.

Market participants remain on high alert for potential government intervention to support the currency, which has struggled despite rising interest rates. The Ministry of Finance did not immediately provide a comment.

"It has been quite common recently for the yen to weaken after Governor Ueda's press conferences, and there is no doubt that the FX market has become nervous once USD/JPY moves above 159," noted Hirofumi Suzuki, chief foreign-exchange strategist at SMBC. He added, "For a while, USD/JPY is likely to trade in a volatile manner amid lingering uncertainty and suspicion."

Earlier in the day, the BOJ held its policy settings steady but raised its forecasts for both economic growth and inflation. This decision was widely anticipated, as the central bank had already lifted interest rates to a 30-year high of 0.75% at its previous meeting.

At his press conference, Governor Ueda confirmed the central bank’s stance, stating that rates will continue to rise if the economy and inflation perform as projected.

This focus on inflation was interpreted as a hawkish signal. "I think it shows that the BOJ intends to continue to hike the policy rate," said Tohru Sasaki, chief strategist at Fukuoka Financial Group. "The question is: How fast, how far?"

Financial markets are already pricing in further tightening. According to LSEG calculations, swaps markets currently anticipate two additional quarter-point hikes this year, with the first fully priced in by July.

The hawkish outlook had a direct impact on Japan's government bond (JGB) market.

• Short-Term Yields Soar: The two-year JGB yield, which is highly sensitive to monetary policy expectations, climbed 3.5 basis points to 1.25%, a level not seen since August 1996.

• Mid-Term Yields Follow: Yields on five- and 10-year notes also ticked higher.

• Long-Term Yields Ease: In contrast, yields on the longest-dated bonds eased from record peaks hit earlier in the week.

Governor Ueda acknowledged the rapid moves in the bond market. "Long-term interest rates are rising at quite a fast pace," he said. "We are ready to take nimble action to cope with exceptional moves that are different from usual."

The market is also navigating a shifting political landscape. Prime Minister Sanae Takaichi dissolved parliament on Friday, paving the way for a snap election on February 8. Her recent pledge to expand fiscal stimulus, including a potential suspension of the consumption tax on food, has added to worries about fiscal discipline and pressured long-term bonds.

Meanwhile, Finance Minister Satsuki Katayama reiterated warnings that officials are closely monitoring currency markets, especially as the dollar-yen rate approaches the 160 level that previously triggered intervention in 2024.

Japanese stock markets closed just before Ueda’s press conference began, with the Nikkei rising 0.3% to 53,846.87 and the broader Topix index gaining 0.4% to finish at 3,629.70.

Prime Minister Sanae Takaichi announced that her proposed two-year consumption tax cut on food will not be funded with new debt, a direct message to financial markets ahead of the general election on February 8.

In an interview with Nikkei on Friday, just before dissolving the lower house of parliament, Takaichi emphasized the need for clear communication. "This applies only to food products and is limited to two years," she stated. "We must convey this correctly as a message to the market." She added that this point is sometimes misunderstood by international observers.

Takaichi outlined a clear fiscal strategy, insisting that the temporary tax relief would not rely on issuing deficit-financing bonds. Instead, the government plans to cover the cost through a combination of other fiscal measures.

The prime minister confirmed that sufficient funding could be secured for the two-year period by:

• Increasing non-tax revenue streams.

• Cutting existing subsidies.

• Reducing tax incentives.

She noted that any final decision on funding sources must also weigh trends in financial markets, such as interest rates and exchange rates, and consider the impact on local government budgets.

Addressing recent volatility in the long-term yield of Japanese government bonds, Takaichi attributed the fluctuations to broader global market trends rather than specific domestic policies.

She affirmed her government's commitment to fiscal responsibility and stated it would strengthen its outreach to international investors. The core message is one of "responsible and proactive public finance." As evidence, Takaichi pointed to the new fiscal year's budget, which maintains low levels of new government bond issuance and has helped the state's general account achieve a primary balance surplus for the first time in 28 years.

The Prime Minister positioned her Liberal Democratic Party's (LDP) proposal as more fiscally conservative than those of her political rivals. While opposition parties are campaigning on promises of broad, permanent consumption tax reductions, Takaichi described the LDP's limited, temporary plan as "more disciplined."

This targeted tax cut on food is framed as a temporary measure designed to provide immediate relief without compromising long-term fiscal health.

Takaichi clarified that the food tax cut is a short-term solution. Her core long-term policy for easing the burden on middle- and low-income households is the introduction of a refundable tax credit system.

The details of this system, including its funding, will be developed through cross-party discussions in a new "national council" focused on social security reforms. When asked about a timeline for implementation, Takaichi did not provide a specific date, stating only that it would be "as soon as possible after details are finalized, the tax legislation passes and the system adjustment is complete."

Remarks of Officials

Middle East Situation

Latest news on the Israeli-Palestinian conflict

Palestinian-Israeli conflict

Political

Economic

Jared Kushner, adviser to President Donald Trump, has unveiled a bold vision for a postwar Gaza: a modern metropolis with gleaming skyscrapers, a thriving port, and a tourist-friendly Mediterranean coastline. Speaking at an economic forum in Davos, Switzerland, Kushner suggested this transformation could happen in as little as three years, but only if one massive condition is met: security.

This optimistic timeline, presented as world leaders gathered to ratify the charter for a new Board of Peace overseeing Gaza's reconstruction, clashes sharply with the grim reality on the ground. For the territory's two million residents, the landscape is defined by collapsed apartment blocks, unexploded ordnance, and contaminated water, not luxury real estate potential.

Kushner’s presentation outlined a future for Gaza with advanced manufacturing, data centers, and a new airport to replace the one Israel destroyed over two decades ago. The plan also calls for eight distinct residential zones, parks, and an industrial complex. A coastal stretch, currently home to most of Gaza's displaced population, is designated for tourism.

According to a joint estimate from the UN, the European Union, and the World Bank, this ambitious redevelopment carries a price tag of $70 billion. However, Kushner emphasized that not a single dollar of investment would flow into the region without stability. His presentation made it clear that reconstruction would not begin in any area that has not been fully disarmed.

The entire plan hinges on achieving "security," a goal fraught with complexity. The path to demilitarizing Gaza is uncertain, and violence continues to simmer despite a ceasefire.

Can Hamas Be Disarmed?

A central challenge is the disarmament of Hamas. While the militant group has indicated it might consider "freezing" its weapons as part of a path to Palestinian statehood, it maintains its right to resist Israeli occupation.

The demilitarization process is intended to be managed by a US-backed Palestinian committee known as NCAG, which would eventually hand control of Gaza to a reformed Palestinian Authority. However, it remains unclear if Hamas, which seized control from the Palestinian Authority in 2007, will cede its power or weapons to this body.

The situation is further complicated by other armed groups in Gaza, some of which have received support from Israel as a countermeasure to Hamas during the war. Kushner's plan states these groups would either be dismantled or integrated into the NCAG.

The Fragility of the Ceasefire

Since the latest ceasefire took effect on October 10, Israeli forces have killed at least 470 Palestinians in Gaza, including women and children, according to the territory's Health Ministry. Israel states its troops have only opened fire in response to ceasefire violations. Amid these conditions, Kushner noted that the Board of Peace is working with Israel on "de-escalation" while focusing on the larger goal of demilitarization.

Beyond security, the logistical challenges are staggering. The United Nations Office for Project Services estimates there are over 60 million tons of rubble in Gaza—enough to fill nearly 3,000 container ships. Clearing this debris is projected to take more than seven years, even before demining can begin.

Kushner’s plan did not specify how the pervasive threat of unexploded missiles and shells would be handled, nor did it address where Gaza's displaced population would live during the lengthy reconstruction. Rights groups report that Israel has prevented heavy machinery from entering the main civilian zones, stalling clearance and demining efforts.

The presentation noted that construction would start with "workforce housing" in Rafah, a southern city now controlled by Israeli troops, where some demolition is reportedly underway. The reconstruction of Gaza City, rebranded as "New Gaza," would follow, with the promise of creating "great employment."

Even if the security and logistical issues could be solved, the plan faces major political opposition. Nomi Bar-Yaacov, an international law and conflict resolution expert at the Geneva Center for Security Policy, labeled the concept "totally unrealistic." She argued that it reflects a real estate developer's perspective rather than a peacemaker's, noting that Israel would never accept high-rise buildings with clear views of its nearby military bases.

Furthermore, the plan's reliance on the Palestinian Authority runs directly counter to the stated position of Israeli Prime Minister Benjamin Netanyahu, who has vehemently opposed any postwar role for the PA in Gaza. The Palestinian Authority itself also suffers from widespread unpopularity due to corruption and its perceived collaboration with Israel.

Chinese leader Xi Jinping pledged support for Brazil and the broader Global South in a phone call with Brazilian President Luiz Inacio Lula da Silva, emphasizing the need for both nations to uphold the United Nations' role in a turbulent international environment.

The conversation followed Lula's recent criticism of a US attack on Venezuela, which he outlined in an opinion piece for the New York Times.

According to state news agency Xinhua, Xi stressed that China and Brazil should work together to protect the common interests of developing nations and maintain the UN's authority.

Xi and Lula's discussion comes just weeks after the Trump administration seized Venezuelan President Nicolas Maduro for prosecution in the United States on narcotics charges, a move that has thrown Caracas into political uncertainty.

This action has fueled anxiety across Latin America, with countries concerned about the potential for similar forceful interventions in their own territories. The move also drew sharp criticism from the United Nations.

UN Secretary-General Antonio Guterres told BBC Radio 4's "Today" programme that the United States was acting with impunity, threatening the UN's founding principles, including the equality of member states.

In his January 18 article, Lula argued that the future of Venezuela—and any nation—must be decided by its own people.

"In more than 200 years of independent history, this is the first time that South America has come under direct military attack by the United States, though American forces previously intervened in the region," he wrote. "It is crucial that the leaders of the major powers understand that a world of permanent hostility is not viable. However strong those powers may be, they cannot rely simply on fear and coercion."

Tensions have also flared with traditional security allies across the Atlantic following President Trump's threat to use force to acquire Greenland, an autonomous territory of Denmark.

The US actions in Venezuela and the capture of Maduro also represent a challenge to China's growing influence in Latin America and the Caribbean, a region where Xi has promised new credit lines and significant infrastructure investment.

During the call, Xi reaffirmed China's commitment to the region, telling Lula, "China is willing to remain a good friend and partner to Latin American and Caribbean countries."

Xi highlighted the 2024 strategic partnership between the two nations as a prime example of solidarity among Global South countries. This partnership aims to align China's Belt and Road Initiative with Brazil's national plans for agriculture, infrastructure, and the energy transition.

He added that China is also working to build a China-Latin America community with a shared future.

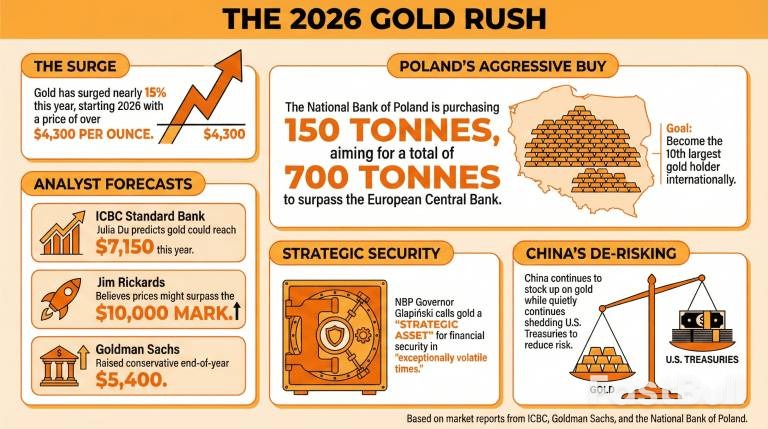

The precious metals rally that closed out 2025 has continued with force this year, as gold and silver lead the charge in a global market defined by uncertainty.

Gold has already surged by nearly 15% in 2026, opening the year with a price above $4,300 per ounce. This significant movement is widely seen as an indicator that several countries are actively pursuing a return to gold as a primary reserve asset.

Analysts are in broad agreement that the outlook for gold is positive in both the short and medium term. Julia Du at ICBC Standard Bank has stressed that the metal could reach $7,150 per ounce this year. Meanwhile, Jim Rickards believes gold prices have the potential to not only reach but surpass the $10,000 mark.

Even more conservative predictions remain surprisingly bullish. Goldman Sachs recently raised its end-of-year forecast for gold from $4,900 to $5,400. The firm notes that strong buying from investors seeking to diversify and hedge their portfolios is providing a solid floor for the price.

Beyond private investors, central banks are also signaling that demand for gold will remain hot this year. This trend is highlighted by strategic acquisitions from key national banks.

Poland's Push to Become a Top Holder

The National Bank of Poland (NBP) recently revealed its plans to purchase 150 tonnes of gold. This move is part of a larger strategy to become one of the world's 10 largest gold holders. Upon completion of this accumulation phase, Poland will hold 700 tonnes of gold, surpassing the reserves of the European Central Bank.

NBP Governor Adam Glapiński was clear about the motivation, describing gold as a strategic asset for ensuring the state's financial security in "exceptionally volatile times." He also acknowledged that selling was not a consideration, even if gold prices face a significant correction.

China's Strategy: De-Risking With Gold

China has also emerged as a perennial gold buyer. The country appears to be executing a de-risking strategy by consistently stocking up on gold while quietly reducing its holdings of U.S. treasuries.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up