Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Adrian Mer

ID: 4465924

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

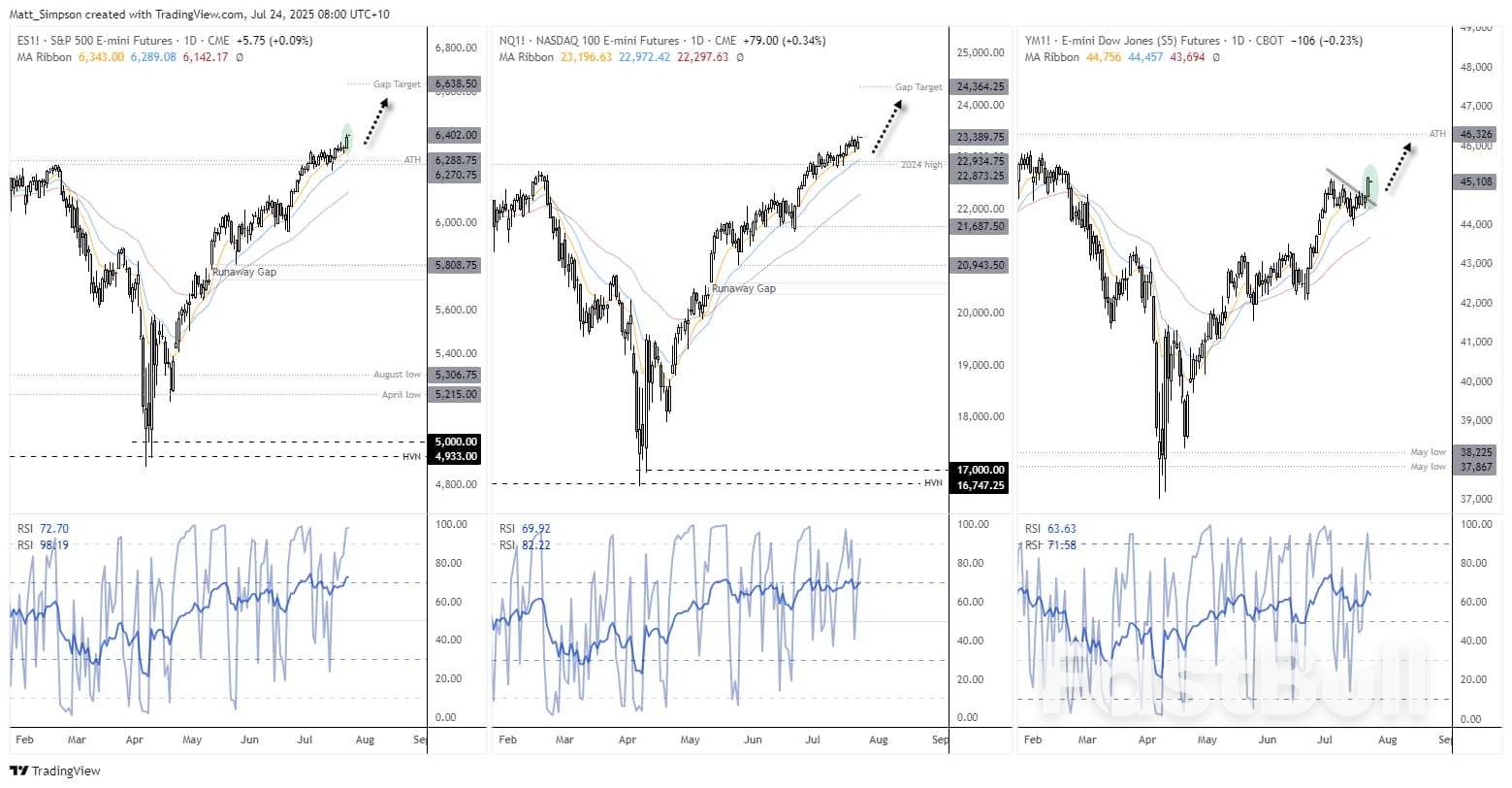

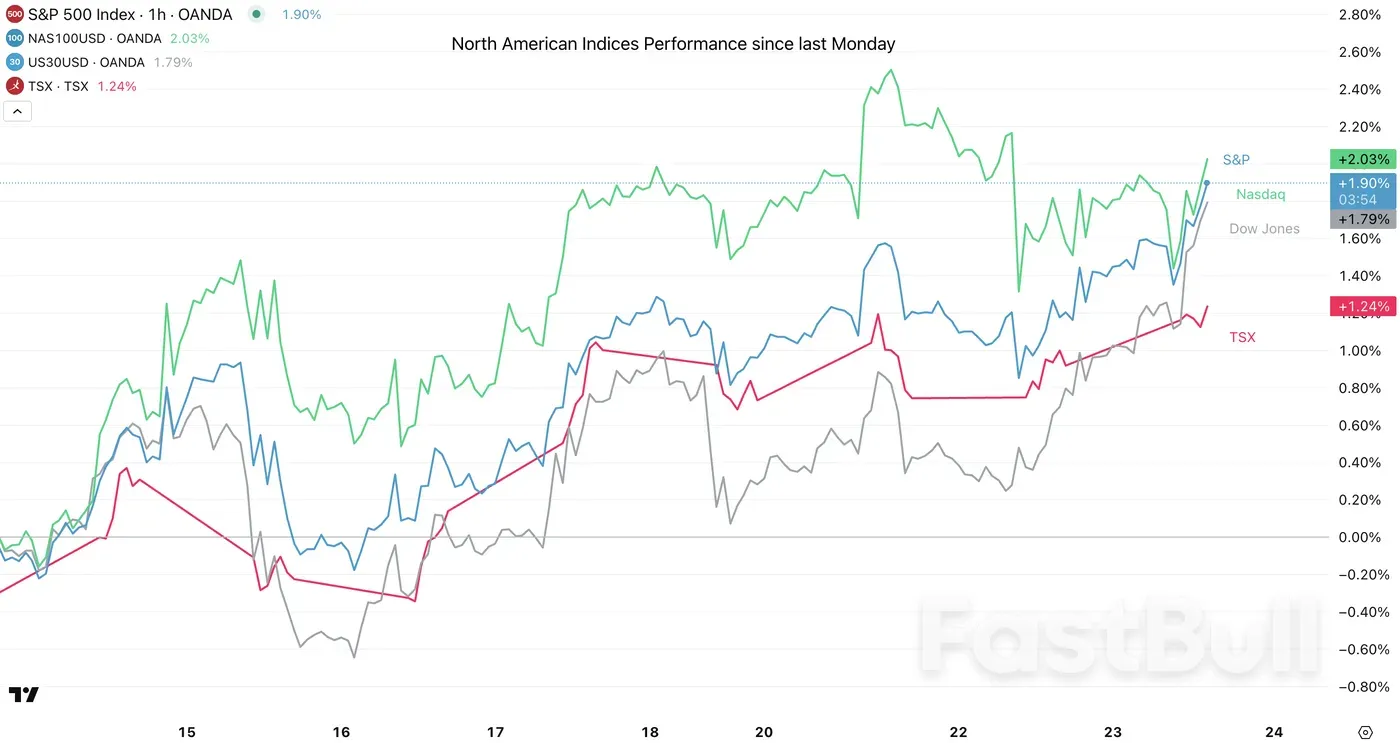

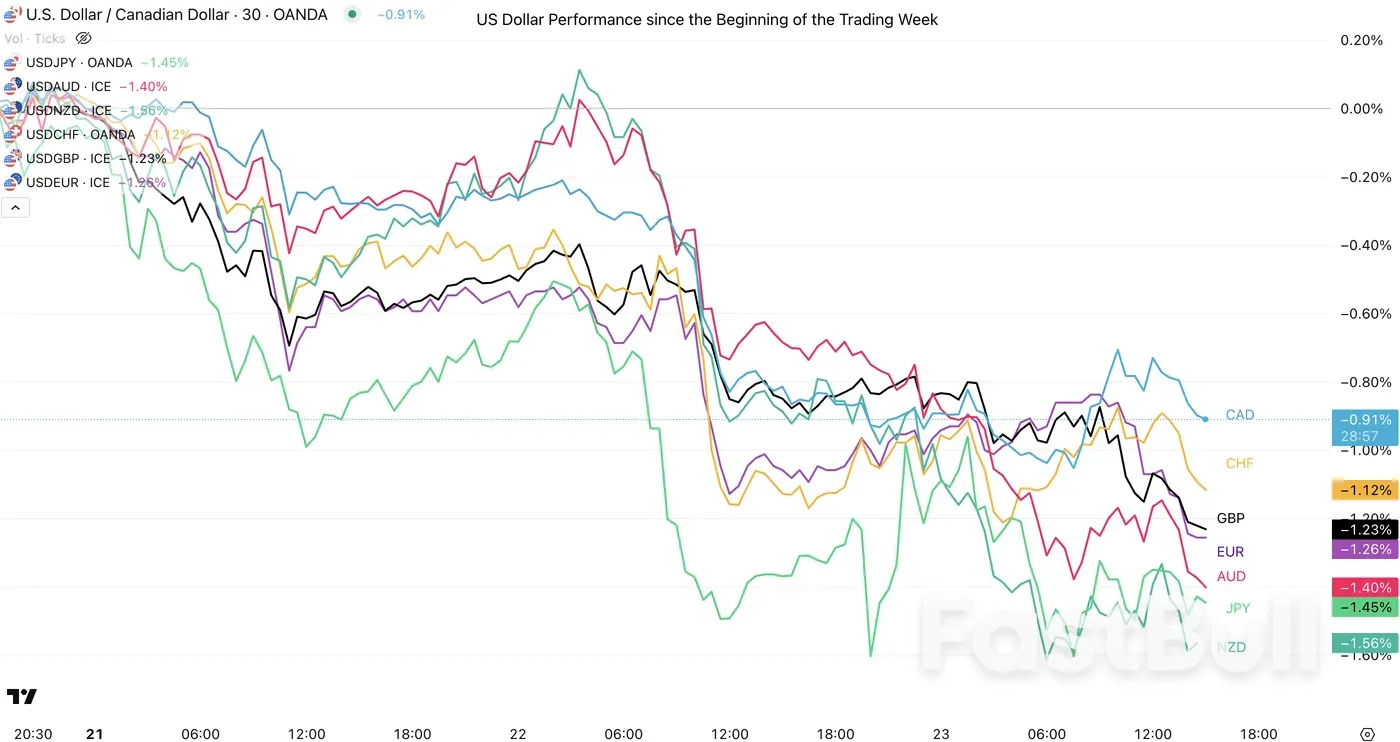

Wall Street indices reached record highs by Wednesday’s close on trade deal optimism. Trump’s announcement of a trade deal with Japan via Truth Social during Asian trade had sent the Nikkei 225 futures above 41k and within striking distance of its 2024 high. This then sparked expectations of a trade deal with the EU, with some reports suggesting 15% tariffs on most exports from the bloc.

The company posted a net profit of $1.2 billion, up sharply from just over $400 million in the previous quarter.

A significant portion of this turnaround came from a $284 million unrealized gain on Bitcoin, as the cryptocurrency rallied past $120,000 amid surging institutional demand and ETF inflows. New accounting rules now allow such gains to be included in earnings, further boosting Tesla’s bottom line.

While overall revenue dropped 12% year-over-year to $22.5 billion, Tesla is increasingly pivoting toward software and automation. The company recently launched its first driverless robotaxi service in Austin and delivered a vehicle to a customer using its upgraded Full Self-Driving system. Behind the scenes, Tesla has expanded its AI infrastructure by integrating 16,000 H200 GPUs for training.

Despite weaker vehicle sales, Tesla ended the quarter with $36.8 billion in liquidity and remains committed to its AI roadmap. Elon Musk emphasized a focus on cost efficiency and technology as Tesla shifts its long-term strategy.

Bitcoin’s contribution to Tesla’s earnings may also encourage other firms to follow suit. Corporate buyers acquired over $800 million in BTC last week, signaling that digital assets could play a growing role in corporate treasuries.

Oil steadied after a string of losses, with investors looking to US trade talk progress and low inventory levels.

West Texas Intermediate traded above $65 a barrel after four sessions of declines, while Brent crude closed below $69. US President Donald Trump said he would set tariffs of 15% to 50% ahead of an Aug. 1 deadline for trade talks. The 15% levy rate was set for Japan on Wednesday, while the European Union is progressing toward a similar agreement.

US nationwide crude inventories, meanwhile, fell by 3.2 million barrels last week, although levels at the oil storage hub of Cushing — the delivery point for WTI — rose for a third week. While diesel inventories were higher, they’re still at the lowest seasonal level since 1996.

Crude has been in a holding pattern this month, with tightness in global diesel markets over the summer months offset by expectations of a deluge of supply from OPEC+ as the group raises production quotas. Sanctions also remain in focus, with the EU’s latest curbs on Russia potentially affecting importers including India and US Treasury Secretary Scott Bessent reiterating that China’s purchases of oil from Russia and Iran may form part of trade negotiations next week.

During Donald Trump’s first presidency, Japan supported the liberal international order by playing a leading role in the conclusion of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership, after the United States’ withdrawal from the process and introducing the concept of the Free and Open Indo-Pacific.

Japan and the rest of the world now face a wave of populism and illiberalism from the second Trump administration which threatens civil society, human rights protections and democratic norms globally. Amid this upheaval and responding to calls to play a greater role in international security, Japanese Prime Minister Shigeru Ishiba and his administration are reconsidering Japan’s part in protecting democratic values and institutions on the international stage.

In an interview with the Nikkei Shimbun in March 2025, Jack McConnell of the British House of Lords expressed his expectation that Japan would participate in the coalition of the willing led by the United Kingdom and France in support of Ukraine. Japan’s major media continue to send messages that Japan should work with European countries for Ukraine and beyond. Underlying this proactive interest in the security sphere is a concern that the ceasefire between Ukraine and Russia brokered by the Trump administration may give too much ground to Russia’s claims, undermining relations between Europe and the United States and increasing the likelihood of China attempting to take Taiwan by force.

To prevent disruption of peace and stability, it is vital that Japan expand its security partnerships while making sure that the United States—its one and only alliance partner—maintains its security commitments in Asia. In this, Japan has had some rare success.

At a meeting with Japanese Minister of Defense Gen Nakatani in March 2025, US Secretary of Defense Pete Hegseth reaffirmed the importance of the US–Japan security alliance and declared US intentions to strengthen the military command in Japan. Although the United States called on Japan to increase its financial contribution to the alliance, this commitment was a stark contrast to the Trump administration’s hints of loosening its commitments with European allies.

Initially cautious, the Ishiba administration has begun actively strengthening its security partnerships. In addition to additional agreements with Ukraine in support of energy sector recovery and the country’s economic health, the Japanese government has continued to show its commitment to rules-based international order on occasions such as the NATO Foreign Ministers’ meeting and the Japan–UK 2+2 economic meeting.

Japan’s moves have been more proactive in the Indo-Pacific, where the stakes are high. Tokyo and Manila have committed to conclude a general agreement on security of information as soon as possible and to begin negotiation of an acquisition and cross-service agreement, leading Ishiba to state that Japan and the Philippines have become ‘partners close to an alliance’. An agreement in principle has been reached on the provision of Japanese defence equipment and official defence consultations with Vietnam, and Japan has also agreed to expand and deepen joint drills with India. Several members of the governing Liberal Democratic Party have also travelled to Taipei and reconfirmed bilateral cooperation on maritime security.

Japan is following the same pattern in the economic realm. When Trump introduced the idea of ‘reciprocal tariffs’, the Japanese government initially refrained from taking any action to defend the liberal international economic order despite expectations that Japan go beyond protecting its own economy by supporting free trade. Yoji Muto, Japan’s Minister of Economy, Trade and Industry, initially flew to Washington to get a tariff exemption rather than objecting to their imposition as an infringement of international trade law completely, but this stance changed in April 2025.

When Ryosei Akazawa, the Minister in charge of Economic Revitalization who took over Japan–US tariff negotiations, visited Washington on 3 May, he argued that the United States should also reduce existing tariffs on items such as automobiles, auto parts, steel and aluminium in addition to abolishing the newly imposed ‘reciprocal’ tariffs. As the first country to negotiate on Trump’s tariffs, Japan set the tone for the international community in not readily conceding the arbitrary measures taken by the United States.

Further afield, current and former Japanese prime ministers and cabinet members have been visiting countries across Asia, the Middle East, Europe and Africa to discuss the future of the free trade system and demonstrate commitment to free trade with these countries. In an unprecedented development, more than 70 per cent of Japan’s cabinet members travelled abroad for such talks during the long holiday week beginning in late April.

An even stronger voice for a free and open international order has been heard from Japanese media outlets which are closely analysing Trump’s moves. Shogo Akagawa, Editor-in-Chief of the Nikkei Shimbun, is even calling for Japan to be ready to carry the banner of democracy, rule of law and free trade in face of a potential US withdrawal from the G7.

An advantage that the media, has compared to the government, is its ability to analyse critically the Trump administration’s moves against the liberal international order. While the Japanese government is concerned about Trump’s actions in both the security and economic realms, its posture remains diplomatic. The sharper criticisms of the media add an important layer to the government’s messaging, as Japan works to buttress free and open international order.

This perspective needs to be heard clearly internationally. The Japanese government should support a network of pro-democracy journalists to deliver pro-democracy and pro-free trade narratives that appeal to the feelings of international audiences, no matter what the US administration does.

The momentum towards authoritarianism is real. It is time to move to fight it.

Gold held a decline as progress in talks between the US and key trading partners hurt demand for haven assets.

Bullion traded near $3,390 an ounce — following a 1.3% loss in the previous session — after Bloomberg News reported the European Union could be ready to accept a 15% tariff on most of its goods going to the US. That followed a similar agreement with Japan that included a $550 billion investment pledge by the Asian country.

That drove Treasury yields higher for the first time in six days. Higher yields tend to pose a headwind for gold, which doesn’t pay interest.

The positive sentiment was tempered by US President Donald Trump’s continued threats to impose between 15% and 50% duties on other countries, like South Korea and India, that are still trying to clinch agreements before the duties come into effect on Aug. 1. Traders were also seeking clarity on the progress of negotiations with China.

Elsewhere, money markets are betting the Federal Reserve will keep interest rates on hold next week when officials gather for their July meeting. However, traders expect at least one quarter-point reduction by October, with a roughly 60% chance of a cut at the September meeting. Lower borrowing costs tend to benefit non-yielding gold.

Gold has climbed about 30% this year, as uncertainty around Trump’s aggressive attempts to reshape global trade and conflicts in Ukraine and the Middle East sparked a flight to havens. The precious metal has been trading within a tight range over the past few months after hitting an all-time high above $3,500 an ounce in April.

Spot gold was up 0.1% to $3,389.77 an ounce at 8:24 a.m. in Singapore. The Bloomberg Dollar Spot Index was steady, though the gauge is down more than 1% so far this week. Platinum rose while palladium fell.

Silver, meanwhile, steadied after reaching the highest since 2011 on Wednesday before retreating slightly. Unlike its yellow cousin, silver is in high demand as an industrial metal used in clean-energy technologies like solar panels. The cost of borrowing it has jumped above historical norms, while growing exchange-trade fund holdings have further eroded the amount of metal freely available to buy.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up