Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

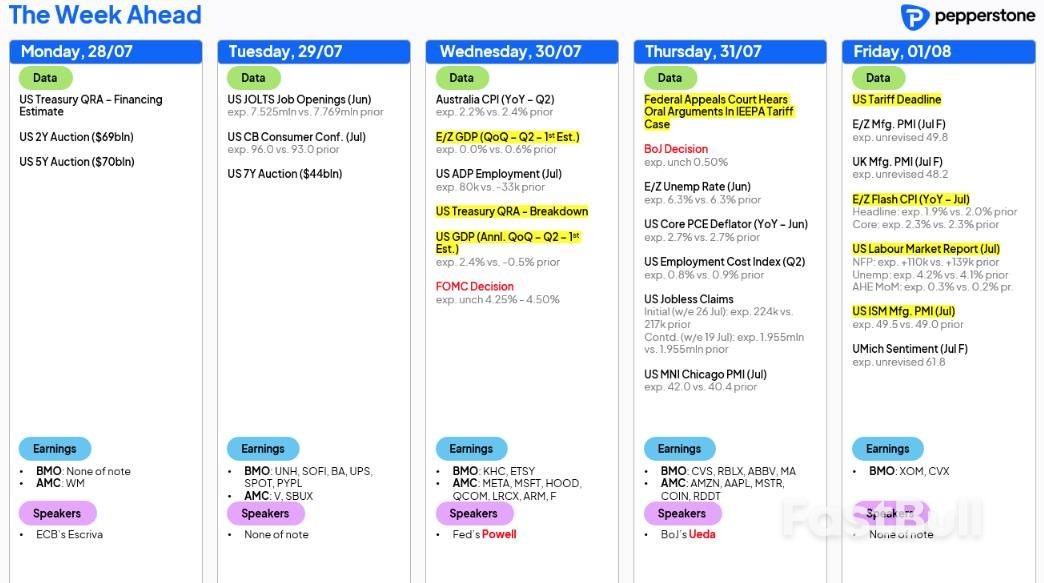

The event risk in the trading week ahead hits us from all angles – Tariff/trade headlines have already started to come in liberally, while market players also navigate tier 1 economic data, a deluge of US and EU corporate earnings, DM & EM central bank meetings and the US Treasury refunding announcement (QRA).

Tariff-related headlines seen through Sunday have been meaningful, with the US-China tariff pause being extended by a further 90 days, and the US-EU forging an agreement that follows a similar model to that of last week's US-Japan deal. EU exporters will now face a 15% tariff rate to its US buyers, a far more friendly rate than the 30% rate they were facing – in exchange, the EU has committed to purchasing $750b in US energy products and some $600b in other investments.

The news flow from both the extension with China and the agreement with the EU is clearly market-friendly, and should put further upside potential into the EUR, where the single currency is already finding the love from FX players, and should also put renewed upside into EU equities.

Importantly, for those nations still looking to achieve a last-minute floor tariff rate (on US exports) of 15%, it's all too clear from the case studies with Indonesia and Japan is that the most important factor is committing to massive levels of investment spend. Trump will now sell this hard to the US voters as a huge win for the US - so expect Trump to address the nation in a presser shortly.

A lasting US-China deal remains a more complex issue, and while trade imbalances remain a major consideration, at the heart of any potential full agreement, we're likely going to see a commitment from China to massive investment spending.

China/HK equity leading the gains through July

For the China market watchers, the 24-member Politburo will gather to formulate plans for the balance of 2025. Market expectations for any new impactful policy initiatives are low, and the Chinese authorities will be quietly content to maintain the status quo, perhaps massaging around the edges, with its growth metrics tracking above its policy objectives. China and HK equity markets have been the star performers in July, so perhaps policymakers will see that as the market voting on increased confidence in China's economic trajectory.

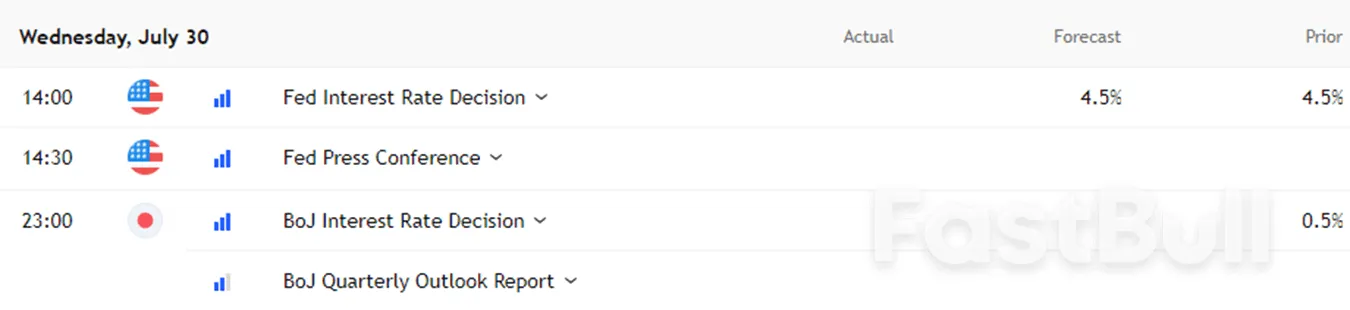

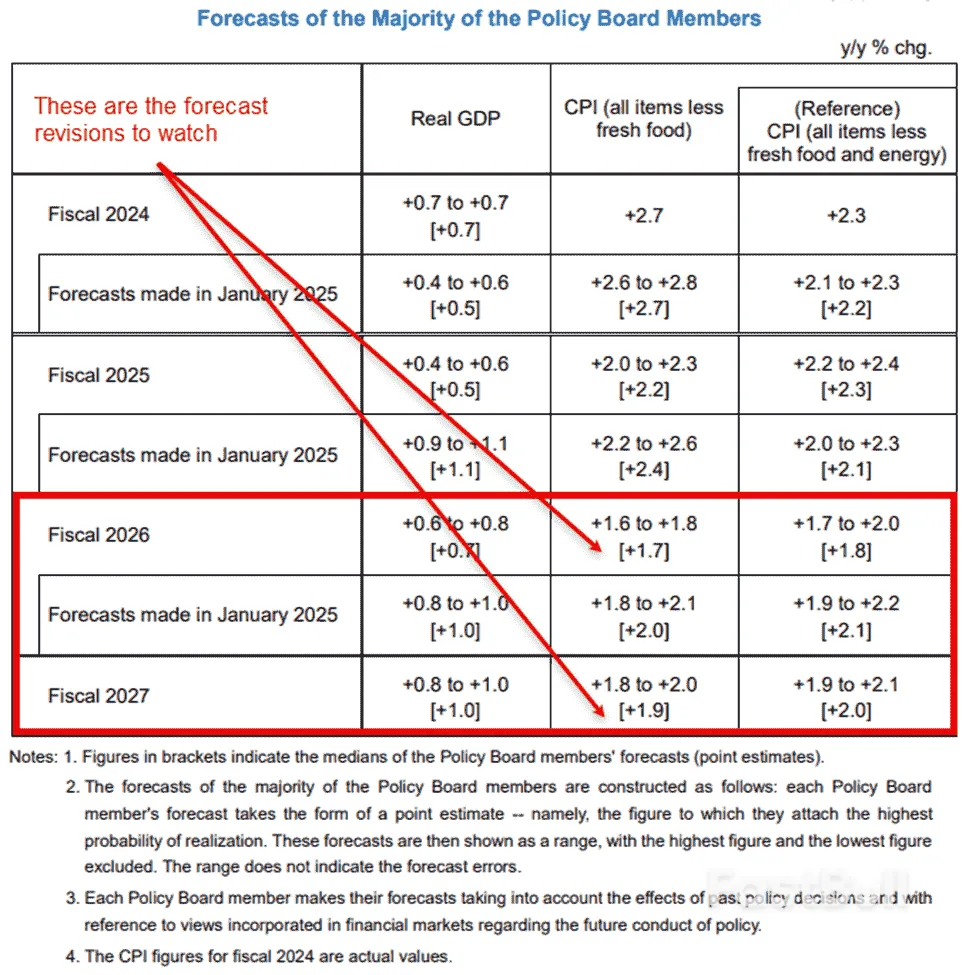

We navigate G10 central bank meetings in the US (hold), Canada (hold) and Japan (hold), as well as in the LATAM/EM space, with policy decisions in South Africa (25bp cut expected), Chile (25bp cut expected), Columbia (25bp cut expected), and Brazil (no change).

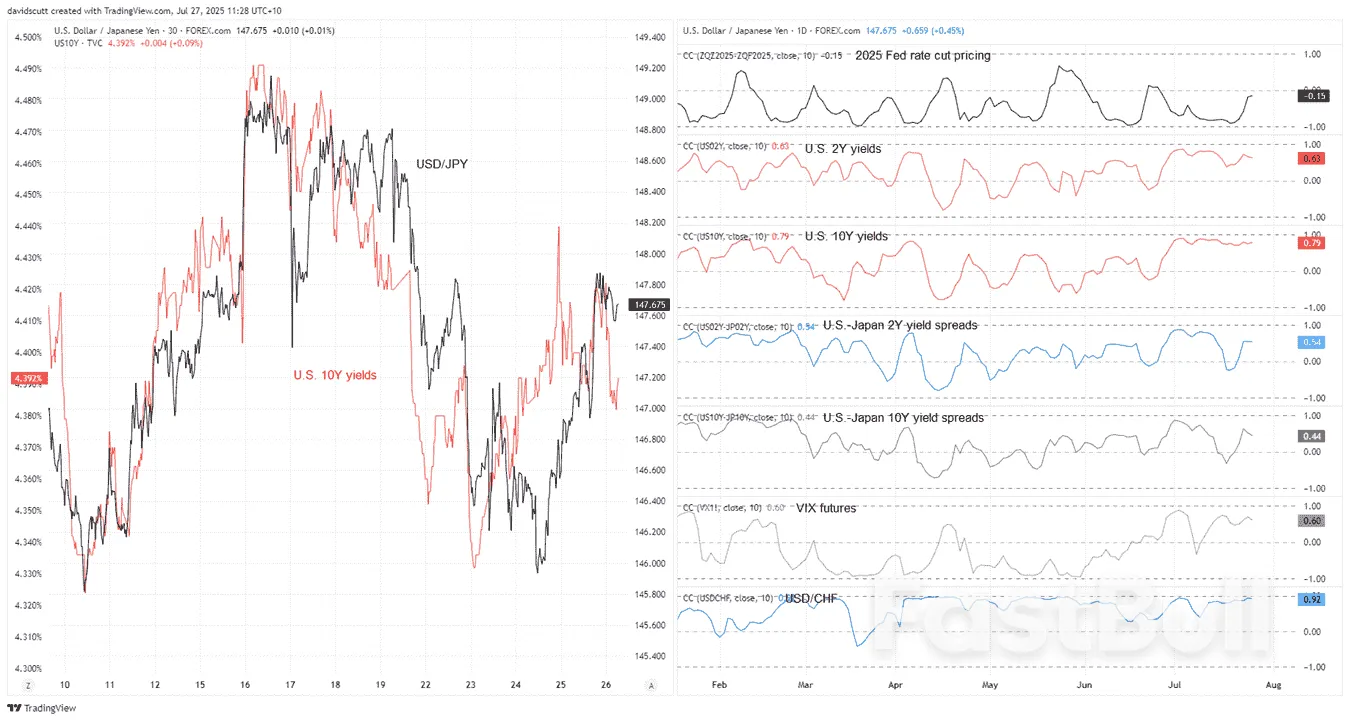

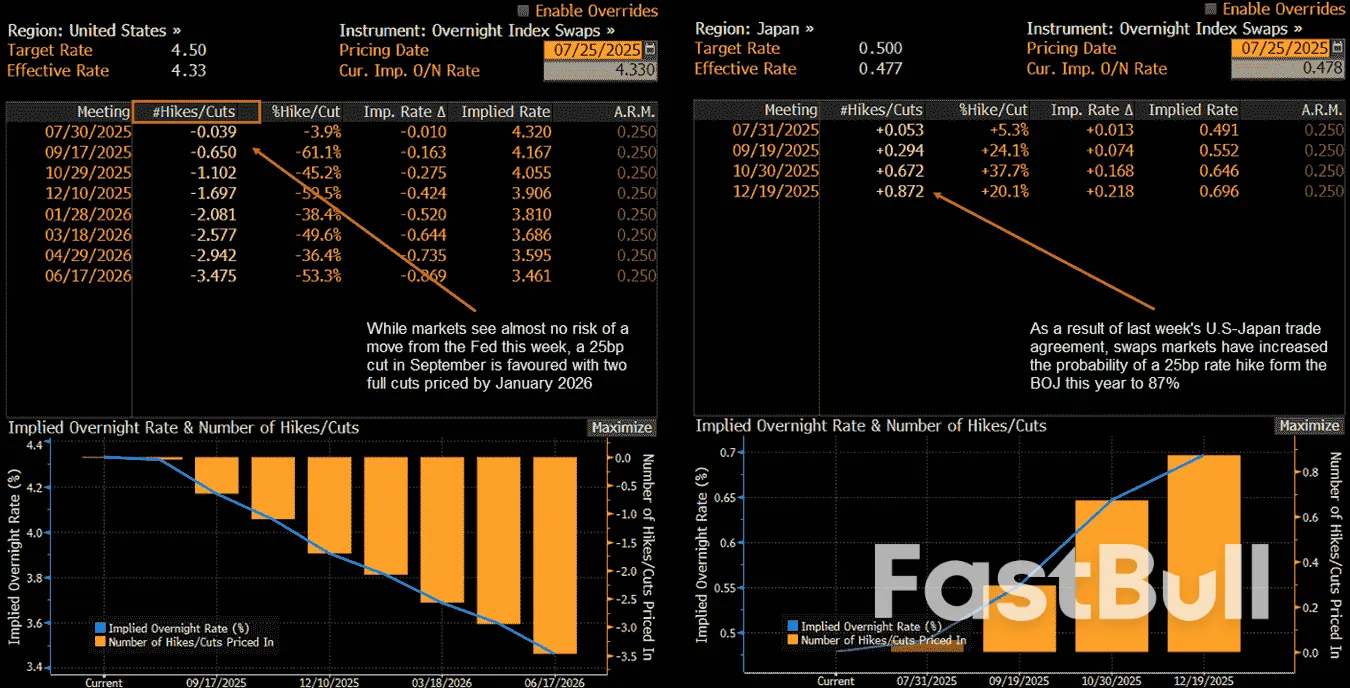

While the BoJ meeting could be quite informative for JPY & NKY225 traders, it will likely be the FOMC meeting on Wednesday that gets the headlines, even if this is shaping up to be a low-impact event for US markets. Expect dissent from Chris Waller and Michelle Bowman, who should both vote for a 25bp cut at this meeting - a symbolic development, as the once galvanised and cohesive committee appears increasingly fractured and almost… dare I say it, politicised…

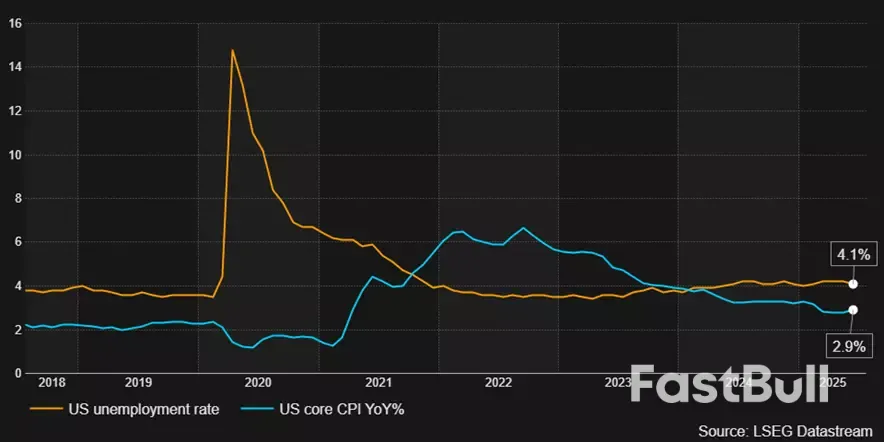

Dissent aside, Chair Powell will continue to guide that the board will take in the incoming data “over the summer” – with traders seeing a cut in the September FOMC meeting as more likely than not, the two nonfarm payrolls prints (31 July & 5 Sept) and two CPI prints (12 Aug & 11 Sept) that hit us in the lead up to the September FOMC meeting now take on additional significance.

It's the big week of the US corporate earnings season, with 38% of the S&P500 market cap set to report numbers for the quarter – the lineup includes Apple, Meta, Amazon and Microsoft, but we also hear from some of the retail trader favoured names, including Coinbase and Roblox. Traders look for these names to build on what has been a solid Q2 earnings season so far, a factor which has offered increasing tailwinds to the grind higher and consecutive ATHs in the S&P500 and NAS100 seen resulted in levels of cross asset volatility crushed.

Running the numbers, we see that a third of S&P500 companies have now reported earnings, with around 40% raising guidance, an outcome that is well above the levels seen in the Q1 reporting season. 83% of S&P 500 companies have beaten analysts' consensus expectations on EPS, with those beating doing so by an average of 6.9%.

It's also a big week on the European corporate earnings calendar, with c20% of the Euro Stoxx companies set to report.

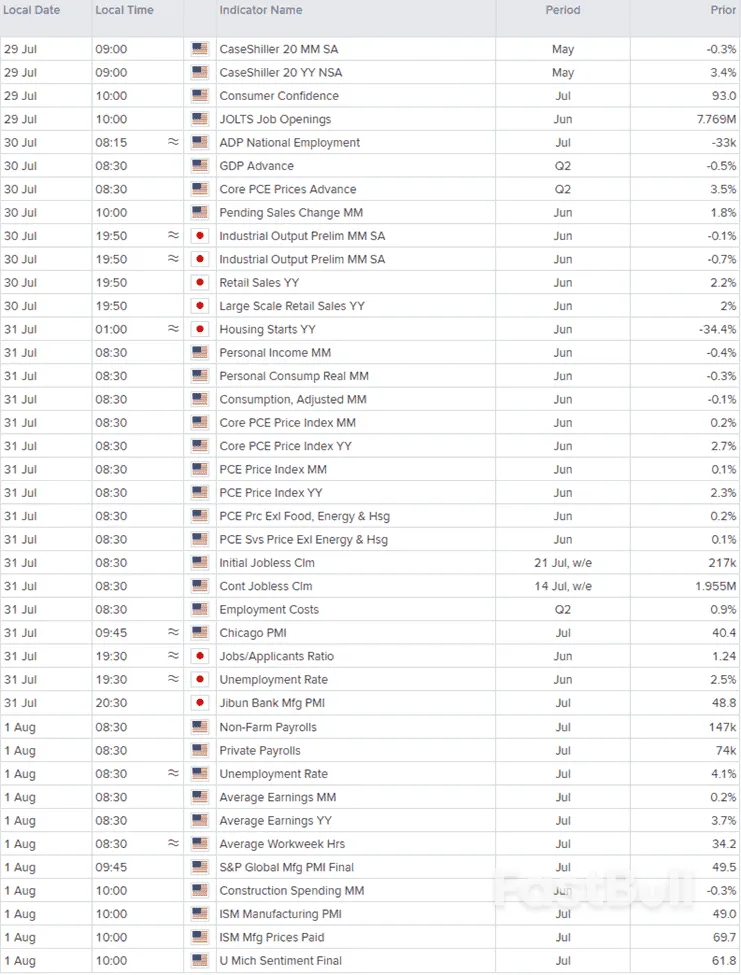

The flow of economic data also comes in hot, with the labour market getting close inspection. US nonfarm payrolls (NFP) is the main event risk of the week, with the market modelling a central case of 109k jobs created in July, with the range of estimates (from economists) seen between 170k and zero. The prospect of downward revisions to the prior two NFP prints is high, but likely a secondary consideration for rates and FX traders. The unemployment rate is expected to tick up to 4.2%, with the average hourly earnings metric eyed at 3.8% (from 3.7%).

US interest rate swaps imply a 25bp cut in the September FOMC meeting at 64% probability – a sub-100k NFP, with prior NFP prints revised lower and a 4.2% U/E would probably be enough to see swaps pricing move towards 70% implied for a cut in September. The USD will take its direction from the US 2-year Treasury yield, which is most impacted by changes in Fed rate cut expectations. The S&P500 and NAS100 will be content to see payrolls coming in around 100-120k, as the combination of reasonable job growth and increased Fed cut expectations would feed the goldilocks investment backdrop.

While the NFP report takes centre stage, staying Stateside, traders also navigate the US JOLTS (job openings) report, weekly jobless claims and the Q2 employment cost index. The US Q2 GDP print and ISM manufacturing report may also get some attention.

In Australia, Q2 trimmed mean CPI (due on Wednesday) is expected to come in at 0.7% q/q / 2.7%, which if realised would continue to portray a moderation in price pressures – however, that outcome would also be a touch above the RBA's own central forecast of 2.6% y/y, and while Aussie interest rate swaps once again price a 25bp cut on 12 August as a done deal, it feels as though we'd need to see a trimmed mean print at or above 3% to derail a cut in the markets eyes.

In Europe, the preliminary July CPI release (due on Friday) may be one to keep an eye on for those holding EUR exposures - after the ECB last week suggested the bar to cut rates again in the near-term has been sufficiently raised, we'd likely need to see a strong downside surprise to the consensus call of 1.9% y/y to see the September ECB as a live event in the markets thinking.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up