Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)A:--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Euro Zone M3 Money Supply YoY (Dec)

Euro Zone M3 Money Supply YoY (Dec)--

F: --

P: --

Euro Zone 3-Month M3 Money Supply YoY (Dec)

Euro Zone 3-Month M3 Money Supply YoY (Dec)--

F: --

P: --

South Africa PPI YoY (Dec)

South Africa PPI YoY (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

U.S. to hold air force readiness exercise in the Middle East; Iranian officials say they have real-time monitoring of the Strait of Hormuz......

The Federal Reserve is holding its benchmark interest rate steady, a move led by Chair Jerome Powell that directly challenges pressure from President Trump to implement cuts. This decision, announced at the FOMC meeting in Washington on January 28, prioritizes economic stability and has significant implications for risk assets, including cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH).

In a clear assertion of its independence, the Federal Reserve has opted to maintain current interest rates despite calls from the White House for monetary easing. The decision underscores the central bank's focus on managing inflation and fostering stable economic growth over responding to short-term political demands.

Jerome Powell's leadership is central to this policy, though the potential for dissent from figures like Governor Stephan Miran highlights the ongoing debate within the institution over the best path forward for the U.S. economy.

The Fed's decision to hold rates has a direct impact on the cryptocurrency market. Higher interest rates typically make holding non-yielding assets like BTC and ETH less attractive to investors, who can find safer returns elsewhere. This dynamic can place downward pressure on crypto valuations.

As a result, economists and market analysts are closely monitoring how the sustained rate environment will continue to influence investor behavior and the broader crypto ecosystem.

The current strategy is not without precedent. The Fed's decision to pause rate adjustments mirrors similar actions taken in 2023-2024, which successfully cooled inflation without tipping the economy into a recession. This historical context suggests the central bank is following a tested playbook aimed at achieving equilibrium.

Furthermore, a high-debt environment limits the government's ability to use fiscal policy to stimulate the economy. As noted by KPMG's Benjamin Shoesmith, this fiscal constraint places more weight on the Fed's monetary policy decisions to maintain stability.

Expert Outlook: A Cautious Path Forward

Market experts largely see the Fed's stance as a prudent measure designed to ensure a gradual and controlled approach to future policy. Analysts like Gregory Daco and Seema Shah suggest this rate stability is crucial for long-term monetary health amid fluctuating inflation.

Daco provides a specific forecast on the timeline for future adjustments, stating, "We anticipate 50 basis points of easing through 2026... first 2026 rate cut is unlikely... before June." This outlook indicates that investors should prepare for a prolonged period of steady rates before any significant easing begins.

India and the European Union have unveiled a landmark free trade agreement designed to eliminate or cut tariffs on over 90% of goods traded between them. The deal, which has been nearly two decades in the making, will see India lower import duties in the politically sensitive agriculture and auto sectors.

The agreement arrives as nations worldwide forge new bilateral deals, recalibrating supply chains and commercial relationships in response to Washington's aggressive use of tariffs. This global shift is already underway. Canadian Prime Minister Mark Carney recently visited China—the first such visit by a Canadian leader in 17 years—to strengthen economic ties. UK Prime Minister Keir Starmer is also scheduled for a three-day trip to China, the first by a British prime minister since 2018.

Despite its significance, the India-EU pact, dubbed the "mother of all deals" by European Commission President Ursula von der Leyen, now faces its most unpredictable challenge: U.S. President Donald Trump.

President Trump, known for imposing punitive tariffs on both allies and adversaries, has not yet commented on the India-EU agreement. His silence is conspicuous and hangs over the deal.

Last August, the U.S. hit Indian goods with higher levies over India's oil purchases from Russia, just days after applying a separate 25% duty on New Delhi. With Trump's increasingly sharp rhetoric aimed at the EU, including threats related to Greenland, his potential reaction casts a long shadow.

That shadow grew darker on Sunday when U.S. Treasury Secretary Scott Bessent criticized the EU for finalizing a trade agreement with India in an interview with ABC News.

However, there may be cause for optimism. India's Minister of Petroleum and Natural Gas, Hardeep Singh Puri, told CNBC on Tuesday that the U.S. and India are at "a very advanced stage" of completing their own highly anticipated trade deal.

Under the terms of the free trade agreement, India will reduce tariffs on European automobiles and agricultural products. In return, the EU will lower duties on Indian exports, including textiles, leather, marine products, and gems and jewelry.

While India is the EU's ninth-largest trading partner, making up 2.4% of the bloc's goods trade in 2024, the EU is one of India's top partners, alongside the U.S. and China. For comparison, the U.S. accounted for 17.3% of EU trade, China for 14.6%, and the U.K. for 10.1%.

Investors are also closely monitoring the U.S. Federal Reserve, which concludes its policy meeting on Wednesday. While interest rates are expected to hold steady, Chairman Jerome Powell's comments will be scrutinized amid rising political pressure on the central bank.

Here’s what else you need to know:

• S&P 500 Hits Record High: On Tuesday, the S&P 500 index reached a new all-time intraday high, driven by gains in Big Tech stocks ahead of their earnings reports. The Nasdaq Composite also advanced, though the Dow Jones Industrial Average declined. European markets closed higher following the EU-India deal announcement.

• Potential U.S. Government Shutdown: A partial U.S. government shutdown could begin early Saturday. The risk stems primarily from strong Senate Democratic opposition to funding for the Department of Homeland Security and other agencies following the recent killing of a U.S. citizen by federal agents in Minneapolis.

• Anthropic Secures Major Funding: The AI company closed a funding round totaling between $10 billion and $15 billion, exceeding its $10 billion target. According to sources, the round was led by Coatue and Singapore's sovereign wealth fund GIC.

The Australian dollar paused near three-year peaks on Wednesday as a selloff in the greenback turned into a rout, while a hot set of inflation figures at home ramped up the chance of a rate hike as soon as next week.

The Aussie was enjoying the view at $0.6994 , climbing 1.4% overnight to as high as $0.7016. That was the first visit to 70 cents since early 2023 and left the Aussie up more than 4% in just five sessions. The breach of the $0.69435 resistance triggered further momentum buying and targets $0.7158 next.

It got a further lift when Australian data showed a key trimmed mean measure of core inflation rose 0.9% in the December quarter, above forecasts of a 0.8% increase.

The annual pace quickened to 3.4%, up from 3.0% the previous quarter and the fastest in more than a year. It was also above the Reserve Bank of Australia's target range of 2% to 3%, setting the scene for a hike when it meets on February 3.

Markets now imply a 70% probability of a quarter-point rise in the 3.6% cash rate, up from 60% before the data. An increase to 3.85% is fully priced in by May, with 4.10% seen by September. (0#AUDIRPR)

Analysts at ANZ responded by changing their call to a hike next week, though they assumed it would be one and done, as inflation should moderate through this year.

Abhijit Surya, a senior APAC economist at Capital Economics, looks for rate rises in both February and May.

"Household spending has been growing strongly, business investment is rising in tandem, and the labour market is also tightening," he argued. "All of these factors will fuel the RBA's concerns that the economy is operating above potential."

Yields on 10-year bonds were left at 4.82%, after hitting their highest since late 2023 overnight at 4.901%. The spread over Treasuries stood at 58 basis points, offering an attractive premium to the out-of-favour U.S. dollar.

The New Zealand dollar was also firm at $0.6030 , after surging 1.2% overnight to clear $0.6007 resistance. The next targets are $0.6059 and $0.6120.

The Reserve Bank of New Zealand next meets on February 18 and is considered certain to hold rates at 2.25%, though again investors believe the next move will be up.

European Central Bank Executive Board member Piero Cipollone has declared that escalating geopolitical tensions are building a powerful case for Europe to establish its own fully controlled payment systems.

In an interview with Spanish newspaper El Pais, Cipollone highlighted the increasing "militarisation" of economic and technological tools, a trend he said exposes global vulnerabilities and reinforces the need for a payment infrastructure built exclusively on European technology.

"We need a system that is totally under our control," Cipollone stated. "This is what we are doing with the digital euro."

Currently, Europe lacks a homegrown cross-border payments giant to compete with the American duopoly of Visa and Mastercard, a gap that a digital euro could help address.

When asked about the potential impact of political pressure on U.S. Federal Reserve Chair Jerome Powell, Cipollone stressed that the ECB’s monetary policy decisions remain independent and centered on the euro-area economy.

"We are the central bank of the euro area, not of the United States," he affirmed.

Cipollone clarified the ECB's singular focus: "We set interest rates to ensure price stability — a 2% inflation target over the medium-term. What happens elsewhere matters only if it affects inflation in the euro zone."

Despite global uncertainty, Cipollone noted that the euro-area economy has demonstrated resilience and may deliver growth figures that exceed current forecasts. He attributed a recent upward revision in outlook primarily to investment, which boosts both immediate demand and long-term productive capacity, enabling faster growth without compromising price stability.

However, he issued a strong warning that rising geopolitical uncertainty could threaten this recovery.

"If uncertainty persists, it could undermine investment," Cipollone cautioned. "This would affect growth and, inevitably, inflation. If it persists, it will have an impact on the real economy."

The Federal Reserve is widely expected to pause its interest rate cuts at today's Federal Open Market Committee (FOMC) meeting, a move that defies sustained pressure from President Trump.

Led by Chair Jerome Powell, the central bank's decision to hold rates steady could have significant ripple effects across financial markets. For assets like Bitcoin (BTC) and Ethereum (ETH), which are highly sensitive to shifts in U.S. monetary policy, the outcome of the 2 p.m. ET meeting is a critical focal point. Powell's stance is seen as an effort to maintain the Fed's independence and promote economic stability.

Financial markets are signaling near-unanimous conviction that the Fed will not cut rates. Current pricing reflects a 97.2% probability that the central bank will keep its policy rate unchanged.

This consensus holds firm despite the visible tension between the Trump administration and the Federal Reserve. Investors appear confident that the institution will prioritize its mandate over political influence.

Benjamin Shoesmith, an economist at KPMG, highlighted this sentiment, stating, "Financial markets have not changed their pricing for rate cuts, despite an escalation of tension between the administration and Fed Chairman Jay Powell. Investors are betting the Fed keeps its independence from political influence."

The Federal Reserve's decisions on interest rates directly influence liquidity and borrowing costs across the economy. These changes often impact investor behavior toward higher-risk assets.

Historically, the market performance of cryptocurrencies like Bitcoin and Ethereum has been correlated with U.S. monetary policy. A pause in rate cuts could therefore alter trading dynamics and liquidity conditions for these digital assets.

Today's anticipated pause follows three consecutive rate reductions implemented by the Fed in 2025. This period of easing was set against a backdrop reminiscent of the high-inflation environment of 2022, underscoring the central bank's independent approach to managing the economy.

Looking ahead, market experts do not foresee an immediate return to rate cuts. According to Gregory Daco, Chief Economist at EY-Parthenon, any further easing is likely months away.

"We anticipate 50 basis points of easing through 2026," Daco noted, adding that "the first 2026 rate cut is unlikely to occur before June."

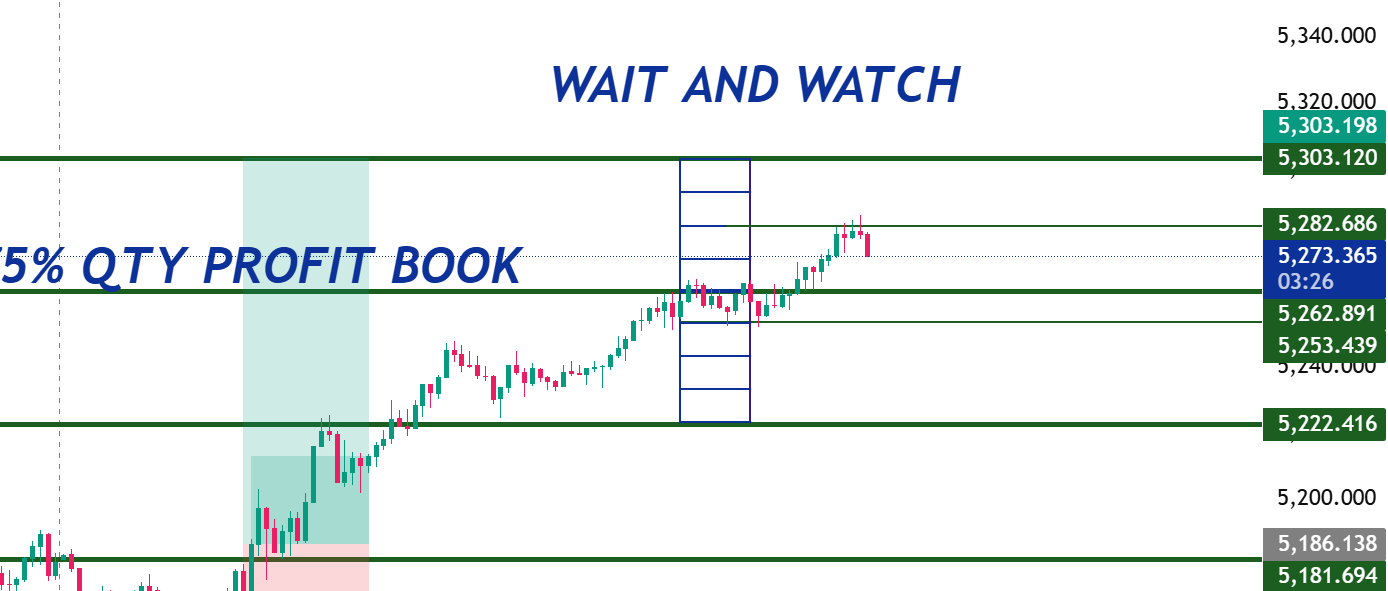

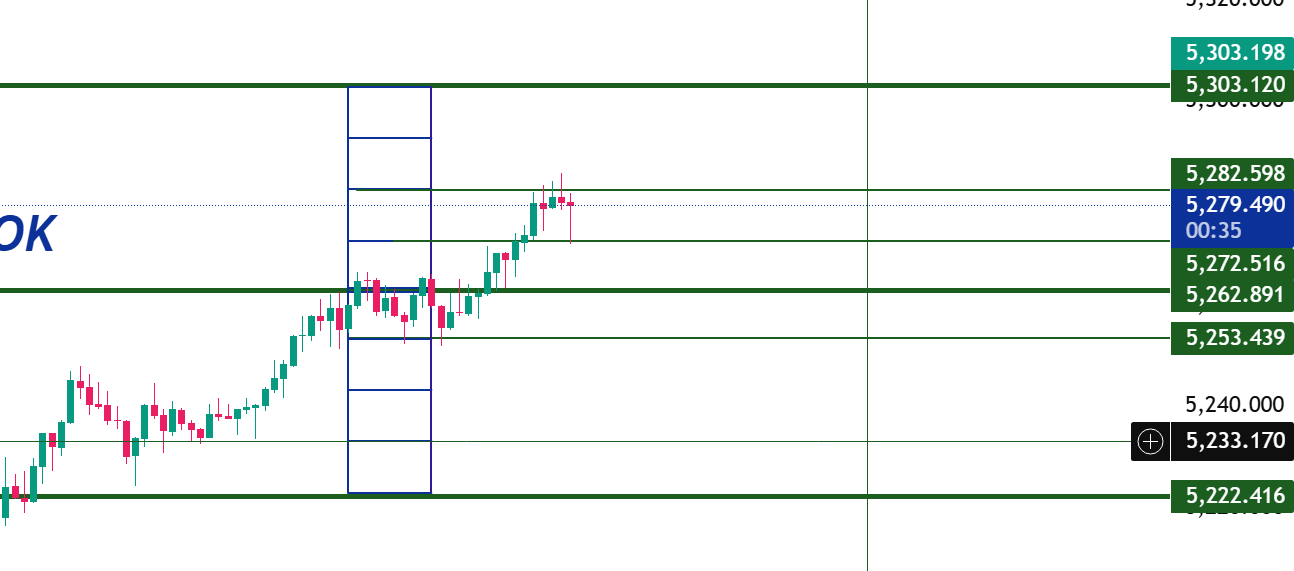

Gold prices saw a minor pullback in Asian trading on Wednesday, stabilizing after a powerful rally that pushed the precious metal to a record high near $5,200 per ounce. The market action reflects sustained investor demand for safe-haven assets amid rising geopolitical and economic uncertainty.

Spot gold was trading at $5,179.41 per ounce after touching an all-time high of $5,190.42 on Tuesday. Meanwhile, April gold futures jumped 1.8% to settle at $5,215.46 per ounce, signaling strong bullish sentiment.

The safe-haven bid for gold remains strong, largely fueled by global geopolitical tensions. Comments from U.S. President Donald Trump about a second armada heading toward Iran added to market uncertainty, helping gold trim earlier losses.

This follows a pattern of events this year that have consistently supported gold prices. An incursion in Venezuela and diplomatic friction over Greenland have also contributed to a risk-off environment, keeping investors on edge and increasing the metal's appeal.

A weakening U.S. dollar provided another significant tailwind for gold. The dollar fell to multi-year lows this week as investor concerns grew over U.S. fiscal spending and the future independence of the Federal Reserve.

President Trump's recent statements have amplified this uncertainty. On Tuesday, he announced he was close to selecting a new Fed chair to replace Jerome Powell, explicitly stating that a change in leadership would lead to lower interest rates. This has driven investors out of the dollar and into alternative assets like gold.

The rally was not confined to gold. Other precious metals have also seen strong performance, with both silver and platinum trading near their own recent record highs.

• Spot silver increased by 1.2% to $113.4325 per ounce.

• Spot platinum gained 0.6%, reaching $2,669.61 per ounce.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up